Valid Vehicle Repayment Agreement Form

When it comes to financing a vehicle, understanding the terms and conditions of a Vehicle Repayment Agreement is essential for both buyers and lenders. This form serves as a crucial document that outlines the obligations of both parties involved in the transaction. It details the total amount financed, the interest rate, and the repayment schedule, ensuring that borrowers are fully aware of their financial commitments. Additionally, it includes provisions for late payments and potential penalties, which are important for maintaining transparency throughout the loan period. By clearly delineating the responsibilities of the borrower, such as the obligation to maintain insurance and the consequences of defaulting on the loan, the agreement aims to protect the interests of all parties. Furthermore, it often includes sections that address the possibility of early repayment, allowing borrowers to pay off their loans sooner if they choose. Understanding these aspects can empower individuals to make informed decisions and foster a positive relationship with their lenders.

Fill out More Documents

Bill of Sale Template for Boat - Carefully documenting the sale protects both parties involved.

For those seeking to ensure their transactions are protected, a well-prepared Vehicle Release of Liability form is indispensable. This document serves as a safeguard for both parties involved, confirming that the seller is no longer accountable for any incidents related to the vehicle post-transfer. To learn more, visit the critical Vehicle Release of Liability documentation.

Wedding Venue Contract Example - Outline rental hours and any overtime fees applicable.

Similar forms

Loan Agreement: Similar to the Vehicle Repayment Agreement, a loan agreement outlines the terms under which money is borrowed. It specifies the amount borrowed, interest rates, repayment schedules, and consequences for defaulting. Both documents aim to ensure clear communication between lender and borrower.

- Hold Harmless Agreement: This agreement, similar to other legal documents, is designed to protect one party from liability in the event of disputes or damages. Often utilized in various transactions, the Hold Harmless Agreement provides clarity and assurance between the parties involved, ensuring that responsibilities are well-defined.

Lease Agreement: A lease agreement, much like the Vehicle Repayment Agreement, details the terms of use for an asset—in this case, a vehicle. It includes payment amounts, duration, and responsibilities for maintenance. Both agreements protect the interests of the involved parties and define their obligations.

Promissory Note: This document serves as a written promise to pay a specified amount to a lender. Similar to the Vehicle Repayment Agreement, it includes details about the repayment terms and conditions. Both documents establish legal obligations and can be used in court if necessary.

Sales Contract: A sales contract outlines the terms of a transaction for the purchase of a vehicle. Like the Vehicle Repayment Agreement, it specifies payment terms, delivery conditions, and warranties. Both documents are crucial for ensuring that both parties understand their rights and responsibilities.

Document Properties

| Fact Name | Details |

|---|---|

| Purpose | The Vehicle Repayment Agreement form outlines the terms under which a borrower agrees to repay a loan for a vehicle. |

| Parties Involved | The form typically involves two parties: the borrower (the individual taking the loan) and the lender (the financial institution or individual providing the loan). |

| Governing Law | The governing law for the agreement may vary by state. For example, in California, the relevant laws include the California Civil Code. |

| Payment Terms | The form specifies payment terms, including the amount, frequency, and duration of payments. |

| Default Clause | It includes a clause that outlines the consequences of defaulting on the loan, such as repossession of the vehicle. |

| Signatures Required | Both parties must sign the form to indicate their agreement to the terms outlined within it. |

| State-Specific Variations | Some states may have specific requirements or additional disclosures that must be included in the agreement. |

Things You Should Know About This Form

-

What is a Vehicle Repayment Agreement form?

A Vehicle Repayment Agreement form is a document that outlines the terms and conditions under which a borrower agrees to repay a loan taken out for the purchase of a vehicle. This form typically includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments.

-

Who needs to fill out the Vehicle Repayment Agreement form?

This form is generally required for individuals or businesses that are financing a vehicle purchase. Both the borrower and the lender need to complete and sign the agreement to ensure that both parties are aware of their rights and responsibilities.

-

What information is typically included in the form?

- Borrower’s name and contact information

- Lender’s name and contact information

- Vehicle details, including make, model, and VIN

- Loan amount and interest rate

- Repayment schedule and due dates

- Consequences of defaulting on the loan

-

How is the repayment schedule structured?

The repayment schedule outlines how often payments are due—such as weekly, bi-weekly, or monthly—and specifies the amount of each payment. It may also indicate the total duration of the loan, which can vary based on the lender’s terms and the amount financed.

-

What happens if a borrower misses a payment?

If a borrower misses a payment, the consequences can vary based on the terms outlined in the Vehicle Repayment Agreement. Common repercussions may include late fees, a negative impact on credit scores, or even repossession of the vehicle in severe cases. It is crucial for borrowers to communicate with their lender if they anticipate difficulties in making a payment.

-

Can the terms of the agreement be modified?

Yes, the terms of the Vehicle Repayment Agreement can often be modified, but this typically requires mutual consent from both the borrower and the lender. Any changes should be documented in writing and signed by both parties to ensure clarity and enforceability.

-

Where can I obtain a Vehicle Repayment Agreement form?

Vehicle Repayment Agreement forms can usually be obtained from financial institutions, auto dealerships, or online legal resources. It’s important to ensure that the form you use complies with state laws and meets the specific requirements of your lender.

Documents used along the form

The Vehicle Repayment Agreement form is an essential document for outlining the terms of repayment for a vehicle loan. However, it is often accompanied by other important forms and documents that help clarify the transaction and protect the interests of all parties involved. Below is a list of five commonly used documents in conjunction with the Vehicle Repayment Agreement.

- Loan Application Form: This document collects personal and financial information from the borrower. It helps the lender assess the borrower's creditworthiness and ability to repay the loan.

- Promissory Note: A legally binding document in which the borrower agrees to repay the loan amount under specified terms. It outlines the interest rate, repayment schedule, and consequences of default.

- Title Transfer Document: This form facilitates the transfer of ownership of the vehicle from the seller to the buyer. It is crucial for ensuring that the new owner has legal rights to the vehicle.

- Divorce Settlement Agreement: A vital document that outlines the terms related to asset division and other crucial matters in a divorce, similar to how the Colorado PDF Forms provides necessary legal templates for various agreements.

- Bill of Sale: A document that serves as proof of the transaction between the buyer and seller. It details the sale price, vehicle description, and both parties' signatures.

- Insurance Verification Form: This form confirms that the borrower has obtained the necessary insurance coverage for the vehicle. Lenders often require this as a condition of the loan to protect their investment.

Each of these documents plays a vital role in the vehicle financing process. Together, they create a comprehensive framework that ensures clarity and protection for both the borrower and the lender.

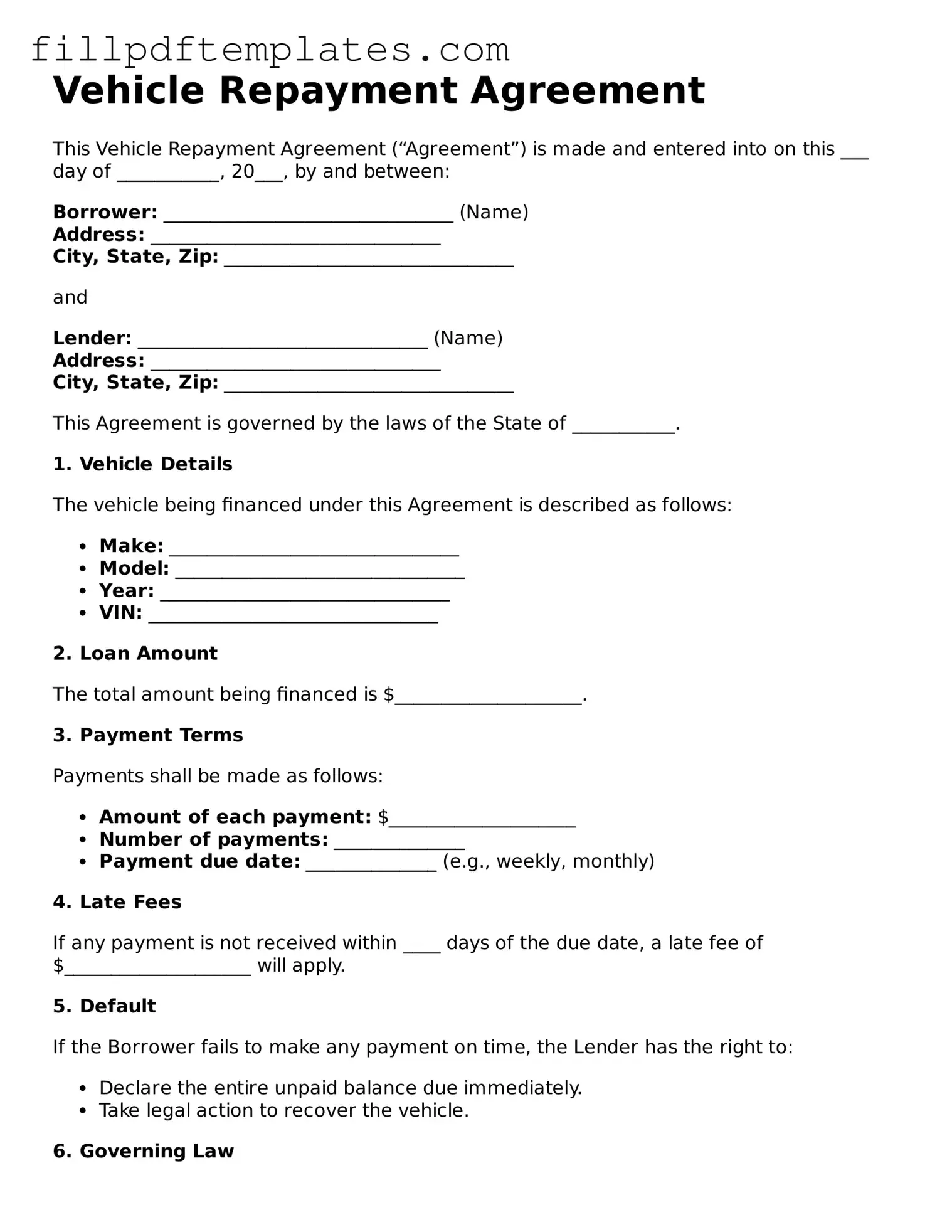

Vehicle Repayment Agreement Preview

Vehicle Repayment Agreement

This Vehicle Repayment Agreement (“Agreement”) is made and entered into on this ___ day of ___________, 20___, by and between:

Borrower: _______________________________ (Name)

Address: _______________________________

City, State, Zip: _______________________________

and

Lender: _______________________________ (Name)

Address: _______________________________

City, State, Zip: _______________________________

This Agreement is governed by the laws of the State of ___________.

1. Vehicle Details

The vehicle being financed under this Agreement is described as follows:

- Make: _______________________________

- Model: _______________________________

- Year: _______________________________

- VIN: _______________________________

2. Loan Amount

The total amount being financed is $____________________.

3. Payment Terms

Payments shall be made as follows:

- Amount of each payment: $____________________

- Number of payments: ______________

- Payment due date: ______________ (e.g., weekly, monthly)

4. Late Fees

If any payment is not received within ____ days of the due date, a late fee of $____________________ will apply.

5. Default

If the Borrower fails to make any payment on time, the Lender has the right to:

- Declare the entire unpaid balance due immediately.

- Take legal action to recover the vehicle.

6. Governing Law

This Agreement shall be governed by the laws of the State of ___________.

By signing below, both parties agree to the terms outlined in this Vehicle Repayment Agreement.

Borrower Signature: ___________________________

Date: ________________

Lender Signature: ___________________________

Date: ________________