Valid Transfer-on-Death Deed Form

The Transfer-on-Death Deed (TOD) form is a valuable estate planning tool that allows property owners to designate beneficiaries who will automatically inherit their real estate upon the owner's death, bypassing the often lengthy and costly probate process. This form provides a straightforward way for individuals to ensure that their property is transferred directly to their chosen heirs without the need for a will or court intervention. By filling out and recording a TOD deed, property owners can maintain full control of their assets during their lifetime while also providing clarity and ease for their beneficiaries after their passing. It's important to note that the TOD deed can be revoked or modified at any time, offering flexibility as personal circumstances change. Additionally, the form must be properly executed and recorded in accordance with state laws to be legally effective. Understanding the nuances of this deed can empower individuals to make informed decisions about their estate planning, ultimately leading to smoother transitions for their loved ones in the future.

Transfer-on-Death Deed - Customized for Each State

Different Types of Transfer-on-Death Deed Forms:

California Corrective Deed - Real estate professionals often recommend using a Corrective Deed for clarity.

Deed of Gift Form - Gift Deeds are a simple tool to encourage generosity within families.

A Hold Harmless Agreement form in Connecticut is a legal document where one party agrees not to hold the other legally responsible for any risks, liabilities, or losses. This agreement is commonly used in scenarios where services are provided or during property use, to protect parties from legal actions stemming from unforeseen incidents. For further guidance on this important document, you can refer to the Hold Harmless Agreement. Understanding and properly executing this form is crucial to safeguarding the interests of all involved parties.

Free Lady Bird Deed Form - Residents can utilize this deed to ensure their home is transferred directly, reducing family tensions.

Similar forms

- Will: A will specifies how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property, but it requires probate, whereas the Transfer-on-Death Deed does not.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they will be managed and distributed after death. Both documents facilitate the transfer of property outside of probate, but a living trust requires more management and formalities.

- Beneficiary Designation: This document allows individuals to name beneficiaries for certain assets, such as life insurance policies or retirement accounts. Similar to a Transfer-on-Death Deed, it allows for direct transfer of assets upon death without going through probate.

- Quitclaim Deed: A Quitclaim Deed, particularly the https://quitclaimdeedtemplate.com/colorado-quitclaim-deed-template, is beneficial for transferring property while addressing potential title concerns without warranties, making it a popular choice in family or amicable transfers.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows co-owners to inherit the property automatically upon the death of one owner. Like a Transfer-on-Death Deed, it bypasses probate, but it requires joint ownership during the lifetime of the owners.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries upon their death, avoiding probate. |

| Governing Law | The Transfer-on-Death Deed is governed by state law, with specific provisions outlined in the Uniform Real Property Transfer on Death Act (URPTDA) adopted by many states. |

| Revocation | Property owners can revoke a Transfer-on-Death Deed at any time before their death, ensuring they retain control over their property. |

| Requirements | The deed must be signed, notarized, and recorded in the county where the property is located to be valid. |

Things You Should Know About This Form

-

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner to designate a beneficiary who will automatically receive the property upon the owner's death. This deed avoids the probate process, making the transfer simpler and more efficient.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate can use a Transfer-on-Death Deed. This includes homeowners and property owners. However, the specific rules may vary by state, so it’s important to check local laws.

-

What types of property can be transferred using a TOD Deed?

A TOD Deed can be used for various types of real estate, such as single-family homes, condominiums, and vacant land. However, it typically cannot be used for personal property like vehicles or bank accounts.

-

How does a Transfer-on-Death Deed work?

To create a TOD Deed, the property owner fills out the form, naming one or more beneficiaries. Once the deed is signed and recorded with the local government, it takes effect. Upon the owner's death, the property automatically transfers to the named beneficiaries without going through probate.

-

Do I need to notify my beneficiaries about the Transfer-on-Death Deed?

While it is not legally required to inform beneficiaries, it is highly advisable. Doing so can prevent confusion and ensure that beneficiaries are aware of their future interest in the property.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, a property owner can change or revoke a TOD Deed at any time while they are alive. This is typically done by executing a new TOD Deed or a formal revocation document, which should also be recorded with the local government.

-

What happens if a beneficiary dies before the property owner?

If a beneficiary named in the TOD Deed dies before the property owner, the property will typically transfer to the remaining beneficiaries. If there are no remaining beneficiaries, the property may become part of the owner's estate and go through probate.

-

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, transferring property through a TOD Deed does not trigger immediate tax consequences. However, beneficiaries may be responsible for property taxes and capital gains taxes when they sell the property. Consulting a tax advisor is recommended for specific guidance.

-

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, you can obtain the appropriate form from your state’s government website or a legal document provider. Fill it out with the required information, sign it, and then record it with the local county recorder’s office. Ensure that you follow your state’s specific requirements.

-

Is legal assistance necessary to create a Transfer-on-Death Deed?

While it is possible to create a TOD Deed without legal assistance, consulting an attorney is recommended. An attorney can ensure that the deed is correctly drafted, executed, and recorded, helping to avoid potential issues in the future.

Documents used along the form

A Transfer-on-Death Deed allows an individual to transfer real estate to beneficiaries upon their death without going through probate. While this deed is a crucial document, several other forms and documents often accompany it to ensure a smooth transfer process. Below is a list of these commonly used documents.

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death. It can complement a Transfer-on-Death Deed by addressing other assets not covered by the deed.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, such as bank accounts or retirement plans, upon the owner's death. They ensure that these assets pass directly to the named beneficiaries.

- Arizona Annual Report Form: Essential for utility companies to provide vital information to the Arizona Corporation Commission, the arizonaformpdf.com/ offers the necessary template for completing this form accurately, ensuring compliance and good standing.

- Power of Attorney: This document grants someone the authority to act on another person's behalf in legal or financial matters. It can be useful for managing property or financial decisions before the owner’s death.

- Living Trust: A legal entity that holds ownership of an individual's assets during their lifetime and specifies how those assets will be distributed after death. This can help avoid probate and provide privacy.

- Notice of Transfer: This document may be filed with the local recorder’s office to inform interested parties about the Transfer-on-Death Deed. It serves as public notice of the intended transfer.

- Affidavit of Heirship: This sworn statement establishes the heirs of a deceased person, which can be necessary if there is no will or if the will is contested.

- Deed of Distribution: This document is used to formally transfer property from the estate to the beneficiaries as outlined in the will or trust. It provides legal documentation of the transfer.

- Property Tax Exemption Forms: These forms may be required to ensure that the property remains eligible for certain tax exemptions after the transfer, depending on local laws.

Each of these documents plays a vital role in estate planning and property transfer. Together, they help ensure that an individual's wishes are honored and that the transfer process is as efficient as possible.

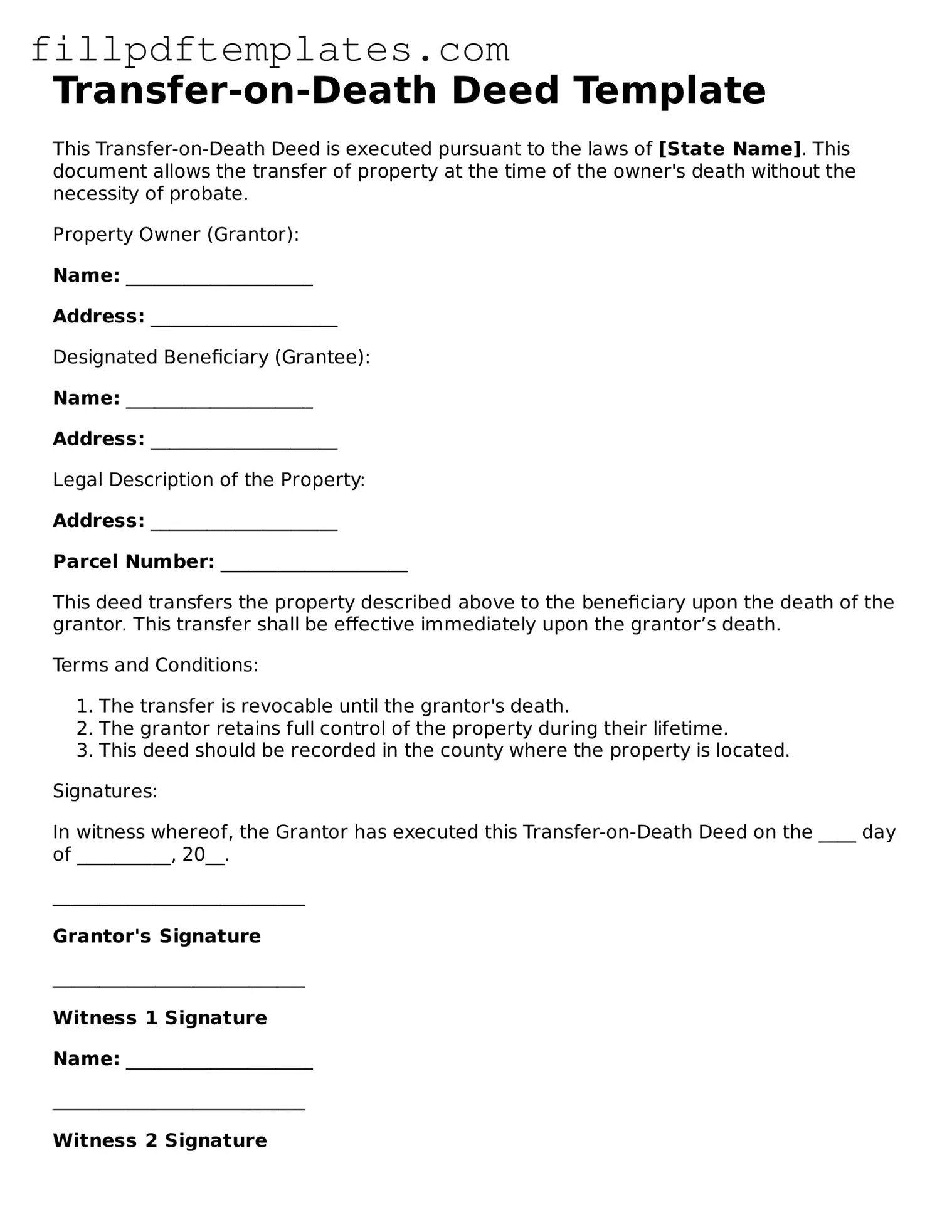

Transfer-on-Death Deed Preview

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed pursuant to the laws of [State Name]. This document allows the transfer of property at the time of the owner's death without the necessity of probate.

Property Owner (Grantor):

Name: ____________________

Address: ____________________

Designated Beneficiary (Grantee):

Name: ____________________

Address: ____________________

Legal Description of the Property:

Address: ____________________

Parcel Number: ____________________

This deed transfers the property described above to the beneficiary upon the death of the grantor. This transfer shall be effective immediately upon the grantor’s death.

Terms and Conditions:

- The transfer is revocable until the grantor's death.

- The grantor retains full control of the property during their lifetime.

- This deed should be recorded in the county where the property is located.

Signatures:

In witness whereof, the Grantor has executed this Transfer-on-Death Deed on the ____ day of __________, 20__.

___________________________

Grantor's Signature

___________________________

Witness 1 Signature

Name: ____________________

___________________________

Witness 2 Signature

Name: ____________________

State of [State Name]

County of ____________________

On this ____ day of __________, 20__, before me, a notary public, personally appeared ____________________ (Grantor's Name) and acknowledged the execution of this Transfer-on-Death Deed.

___________________________

Notary Public Signature

My commission expires: ____________________