Fill a Valid Stock Transfer Ledger Template

The Stock Transfer Ledger form plays a crucial role in the management of a corporation's equity and shareholder records. It serves as a detailed account of stock issuance and transfers, ensuring that all transactions are accurately documented. This form begins with the corporation's name, providing a clear identification of the entity involved. It captures essential information about stockholders, including their names and places of residence, which helps maintain an organized record of ownership. Each entry details the certificates issued, complete with certificate numbers, dates, and the number of shares involved. When shares are transferred, the form notes from whom they were transferred, ensuring clarity regarding the previous ownership. Additionally, it records the amount paid for the shares and the date of the transfer, providing a comprehensive timeline of transactions. The form also requires the surrender of certificates, if applicable, and concludes with a balance of shares held, giving a complete picture of the shareholder's current standing. By consolidating all these elements, the Stock Transfer Ledger form is an indispensable tool for corporations in tracking their stock activities and maintaining transparency with their shareholders.

Additional PDF Templates

What Do I Need to Get My Vehicle Inspected - The MV-427A supplemental form is necessary when applying for both safety and emissions stations.

The Arizona Board of Nursing License form serves as a crucial document for individuals seeking to obtain or renew a nursing license within the state of Arizona. This form outlines all necessary requirements and procedural steps, ensuring that applicants meet the state's professional standards. For those ready to take this important step in their nursing career, fill out the form by clicking the button below, or visit https://arizonaformpdf.com/ for more information.

Tattoo Contract - If there are any claims from the artist’s work, they must indemnify the shop.

Similar forms

The Stock Transfer Ledger form is an essential document for tracking stock ownership and transfers within a corporation. Several other documents share similarities with this form, each serving a unique purpose in the realm of stock management and corporate governance. Here are six such documents:

- Stock Certificate: This document represents ownership of shares in a corporation. Like the Stock Transfer Ledger, it contains details about the stockholder, the number of shares owned, and the corporation's name. Both documents are crucial for verifying stock ownership.

- Shareholder Agreement: This agreement outlines the rights and responsibilities of shareholders. Similar to the Stock Transfer Ledger, it tracks ownership and transfer of shares, ensuring that all parties are aware of their obligations and entitlements within the corporation.

- Stock Power: A Stock Power is a document used to transfer shares from one person to another. It complements the Stock Transfer Ledger by providing the necessary authorization for the transfer, thus ensuring a clear and legal transfer of ownership.

- Transfer-on-Death Deed: This form allows property owners to designate a beneficiary who will receive their property upon their death, streamlining the transfer process without probate, similar in purpose to the transferondeathdeedform.com/texas-transfer-on-death-deed.

- Corporate Bylaws: These rules govern the internal management of a corporation. While the Stock Transfer Ledger records specific transactions, the bylaws outline the procedures for issuing and transferring shares, ensuring that all actions align with corporate policies.

- Annual Report: This document provides a comprehensive overview of a corporation's performance over the past year. It often includes information about stock ownership and changes, similar to the Stock Transfer Ledger, which keeps track of who owns what and any changes that occur.

- Meeting Minutes: The minutes from shareholder meetings document decisions made regarding stock issuance and transfers. Like the Stock Transfer Ledger, they serve as an official record, providing transparency and accountability for stock-related actions taken by the corporation.

Document Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Stock Transfer Ledger is used to document the issuance and transfer of stock shares within a corporation. |

| Corporation Name | The form requires the name of the corporation for which the stock is being issued or transferred. |

| Stockholder Information | It includes the name and place of residence of the stockholder receiving the shares. |

| Certificates Issued | The ledger tracks the certificates issued, including certificate numbers and dates. |

| Transfer Details | Details about the transfer, including who the shares were transferred from and to, must be documented. |

| Payment Information | The amount paid for the shares must be recorded, ensuring transparency in transactions. |

| Balance Tracking | The form allows for tracking the number of shares held by the stockholder after transfers. |

| Governing Laws | In many states, the issuance and transfer of stock are governed by corporate laws, such as the Delaware General Corporation Law. |

Things You Should Know About This Form

-

What is the purpose of the Stock Transfer Ledger form?

The Stock Transfer Ledger form is designed to track the issuance and transfer of stock within a corporation. It helps maintain accurate records of stockholders, the shares they hold, and any changes in ownership. This form is essential for ensuring compliance with corporate governance and regulatory requirements.

-

What information do I need to fill out the Stock Transfer Ledger?

To complete the Stock Transfer Ledger, you will need the following information:

- The name of the corporation.

- The name of the stockholder.

- The place of residence of the stockholder.

- The certificates issued, including certificate numbers and dates.

- The number of shares issued.

- The name of the person or entity from whom shares were transferred.

- The amount paid for the shares.

- The date of transfer.

- The name of the person or entity to whom shares were transferred.

- The certificate numbers of surrendered certificates.

- The number of shares held after the transfer.

-

How do I record a stock transfer using this form?

To record a stock transfer, start by entering the corporation's name at the top of the form. Next, fill in the stockholder's name and residence. Document the certificates issued and their corresponding certificate numbers along with the date. Indicate the number of shares being transferred and the name of the transferor. After that, note the amount paid and the date of the transfer. Finally, record the name of the transferee, any certificates that were surrendered, and the balance of shares held by the stockholder.

-

Why is it important to keep an accurate Stock Transfer Ledger?

Maintaining an accurate Stock Transfer Ledger is crucial for several reasons. First, it ensures that the corporation has a clear record of ownership, which is essential for voting rights and dividend distribution. Second, it aids in compliance with legal and regulatory requirements. Lastly, it helps prevent disputes over ownership and provides transparency for all stakeholders involved.

Documents used along the form

The Stock Transfer Ledger form is an essential document used by corporations to track the issuance and transfer of shares among stockholders. It provides a detailed record of ownership changes, ensuring transparency and compliance with corporate governance. Alongside this form, several other documents are commonly utilized to facilitate the process of stock transfers and maintain accurate corporate records.

- Stock Certificate: This document serves as proof of ownership for a specific number of shares in a corporation. It typically includes the stockholder's name, the number of shares owned, and the corporation's name.

- Transfer Agreement: This is a legal document that outlines the terms and conditions under which shares are transferred from one party to another. It may specify the purchase price and any representations made by the seller.

- Board Resolution: A formal statement by a corporation's board of directors authorizing the transfer of shares. This document is crucial for ensuring that the transfer complies with corporate bylaws and governance procedures.

- Stock Power: This is a document that allows a stockholder to transfer ownership of shares to another party. It typically requires the signature of the stockholder and may need to be notarized.

- Form 4: This is a filing required by the Securities and Exchange Commission (SEC) for corporate insiders who buy or sell shares. It provides transparency regarding insider trading activities and is essential for regulatory compliance.

- Hold Harmless Agreement: This essential document safeguards all parties involved during stock transfers, ensuring that one party does not hold the other liable for potential risks. It is crucial to consider including a Hold Harmless Agreement to enhance protection for all stakeholders.

- Shareholder Agreement: This document outlines the rights and obligations of shareholders within a corporation. It may address issues such as voting rights, transfer restrictions, and dispute resolution mechanisms.

- Annual Report: This comprehensive report provides shareholders with information about the corporation's financial performance and activities over the past year. It often includes details relevant to stock ownership and transfers.

Understanding these accompanying documents is vital for anyone involved in the process of stock transfers. Each document plays a unique role in ensuring that ownership records are accurate and that all legal requirements are met, thereby fostering trust and stability within the corporate structure.

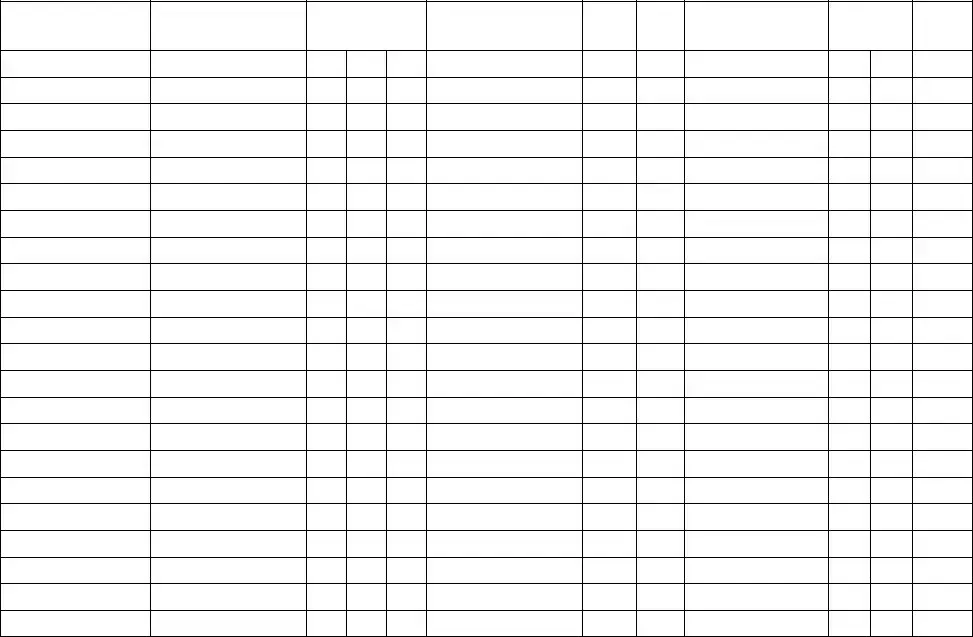

Stock Transfer Ledger Preview

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)