Valid Single-Member Operating Agreement Form

The Single-Member Operating Agreement is a crucial document for anyone looking to establish a single-member limited liability company (LLC). This form outlines the structure and operational guidelines for the business, ensuring clarity and legal protection for the owner. It typically includes essential details such as the name of the LLC, the purpose of the business, and the ownership percentage, which, in this case, is entirely held by the single member. Additionally, the agreement addresses management responsibilities, financial contributions, and procedures for profit distribution. By clearly defining the roles and expectations, this document helps prevent disputes and provides a framework for decision-making. Furthermore, it can also specify how the business will be dissolved if necessary, safeguarding the owner's interests. In summary, the Single-Member Operating Agreement serves as a foundational tool for managing a single-member LLC effectively and legally.

Different Types of Single-Member Operating Agreement Forms:

Multi Member Llc Operating Agreement - It allows members to tailor their operating procedures to fit their needs.

In addition to outlining ownership and operating procedures, the Illinois Operating Agreement form helps clarify the roles and responsibilities of each member in the company. For entrepreneurs eager to ensure their LLC operates smoothly, it is essential to have this agreement in place. To aid in this process, you can find necessary resources, such as the Illinois Forms, which provide templates and guidance for filling out your agreement effectively.

Similar forms

-

Articles of Organization: This document is essential for forming a limited liability company (LLC). It outlines basic information about the business, such as its name, address, and the registered agent. Like the Single-Member Operating Agreement, it serves as a foundational document for the LLC.

-

Bylaws: Typically used by corporations, bylaws govern the internal management of the company. They set rules for meetings, voting, and roles of officers. Similar to an Operating Agreement, they define how the business operates, though bylaws are more common in multi-member entities.

- Operating Agreement Template: This serves as a foundational document for LLCs, outlining their management structure and operational guidelines. For assistance in creating an effective agreement, you can refer to californiadocsonline.com/operating-agreement-form/.

-

Partnership Agreement: This document is crucial for partnerships. It outlines the roles, responsibilities, and profit-sharing among partners. While it differs in structure, it shares the purpose of clarifying expectations and responsibilities, much like an Operating Agreement does for a single-member LLC.

-

Shareholder Agreement: Used by corporations with multiple shareholders, this agreement details the rights and obligations of shareholders. It is similar to an Operating Agreement in that it governs relationships and expectations among members, ensuring clarity and reducing conflicts.

-

Business Plan: While not a legal document, a business plan outlines the goals and strategies of a business. Like an Operating Agreement, it helps define the direction and operations of the business, providing a roadmap for success.

-

Non-Disclosure Agreement (NDA): This document protects sensitive information shared between parties. While its focus is on confidentiality, it is similar to an Operating Agreement in that both documents aim to protect the interests of the parties involved and clarify expectations.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement is a document that outlines the management structure and operating procedures for a single-member limited liability company (LLC). |

| Purpose | This agreement serves to establish the rights and responsibilities of the sole member, ensuring clarity in operations and decision-making. |

| Legal Requirement | While not always legally required, having an operating agreement is highly recommended for single-member LLCs to protect personal liability and clarify business operations. |

| Governing Law | The governing laws for the operating agreement can vary by state. For example, in California, it is governed by the California Corporations Code. |

| Flexibility | The agreement allows the sole member to customize management and operational procedures according to personal preferences and business needs. |

| Tax Treatment | A single-member LLC is typically treated as a disregarded entity for tax purposes, meaning profits and losses are reported on the member's personal tax return. |

| Dispute Resolution | The agreement can include provisions for resolving disputes, helping to prevent misunderstandings and conflicts down the line. |

| Amendments | Single-member operating agreements can be amended as needed, allowing the member to adapt to changing circumstances or business needs. |

Things You Should Know About This Form

-

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document that outlines the ownership and operating procedures of a single-member limited liability company (LLC). It serves as an internal guideline for the owner, detailing how the business will be run and how decisions will be made.

-

Why do I need a Single-Member Operating Agreement?

Even if you are the only owner of your LLC, having an Operating Agreement is crucial. It helps establish your business as a separate entity from yourself, which can protect your personal assets. Additionally, it clarifies how the business will operate, making it easier to manage and lessening the chances of disputes in the future.

-

Is a Single-Member Operating Agreement required by law?

While many states do not legally require a Single-Member Operating Agreement, it is highly recommended. Having one can provide clarity and structure to your business operations, and it may be required by banks or other financial institutions if you seek funding.

-

What should be included in a Single-Member Operating Agreement?

Your agreement should cover several key areas, including:

- The name and purpose of the LLC

- The ownership structure

- Management and decision-making processes

- How profits and losses will be distributed

- Procedures for adding or removing members (if applicable)

- How the agreement can be amended

-

Can I change my Single-Member Operating Agreement later?

Yes, you can modify your Operating Agreement as your business needs change. It’s a good practice to review and update the agreement periodically, especially if you decide to expand your business or bring in additional members.

-

How do I create a Single-Member Operating Agreement?

You can create a Single-Member Operating Agreement by drafting it yourself or using templates available online. However, consulting with a legal professional can ensure that your agreement meets all necessary requirements and addresses your specific business needs.

-

Do I need to file my Single-Member Operating Agreement with the state?

No, you typically do not need to file your Operating Agreement with the state. It is an internal document that should be kept with your business records. However, you may want to keep a copy accessible for reference or if you need to show it to banks or investors.

-

What happens if I don’t have a Single-Member Operating Agreement?

If you don’t have an Operating Agreement, your LLC will be governed by your state’s default rules. These rules may not align with your intentions for the business, which could lead to confusion or disputes. Without a clear agreement, you may also lose some of the protections that come with having a formal structure.

Documents used along the form

A Single-Member Operating Agreement is an essential document for a single-member LLC, outlining the management structure and operational guidelines. However, several other forms and documents are often used in conjunction with it to ensure proper legal compliance and business functionality. Below is a list of these documents, along with a brief description of each.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information about the business, such as its name, address, and the name of the registered agent.

- Operating Agreement Form: This essential document outlines the ownership and member duties of an LLC, helping to define the operational framework for the business. For more information, visit usalawdocs.com/.

- Employer Identification Number (EIN): This is a unique number assigned by the IRS to identify the business for tax purposes. It is necessary for opening a business bank account and filing taxes.

- Initial Resolutions: These are formal decisions made by the member at the beginning of the LLC’s operation. They often include the approval of the operating agreement and the appointment of officers.

- Membership Certificates: Although not always required, these certificates can be issued to signify ownership in the LLC. They serve as proof of the member’s stake in the business.

- Bank Resolution: This document authorizes specific individuals to open and manage bank accounts on behalf of the LLC. It helps clarify who has the authority to handle financial matters.

- Bylaws: While not mandatory for single-member LLCs, bylaws can outline the rules and procedures for managing the business. They may cover topics like meetings and decision-making processes.

- Annual Report: Many states require LLCs to file an annual report to maintain good standing. This report typically updates the state on the business’s contact information and management structure.

- Tax Documents: Depending on the LLC’s structure, various tax forms may need to be filed, including income tax returns and any applicable state tax documents. These ensure compliance with tax obligations.

Each of these documents plays a vital role in the formation and operation of a single-member LLC. Properly managing these forms can help ensure the business runs smoothly and remains compliant with legal requirements.

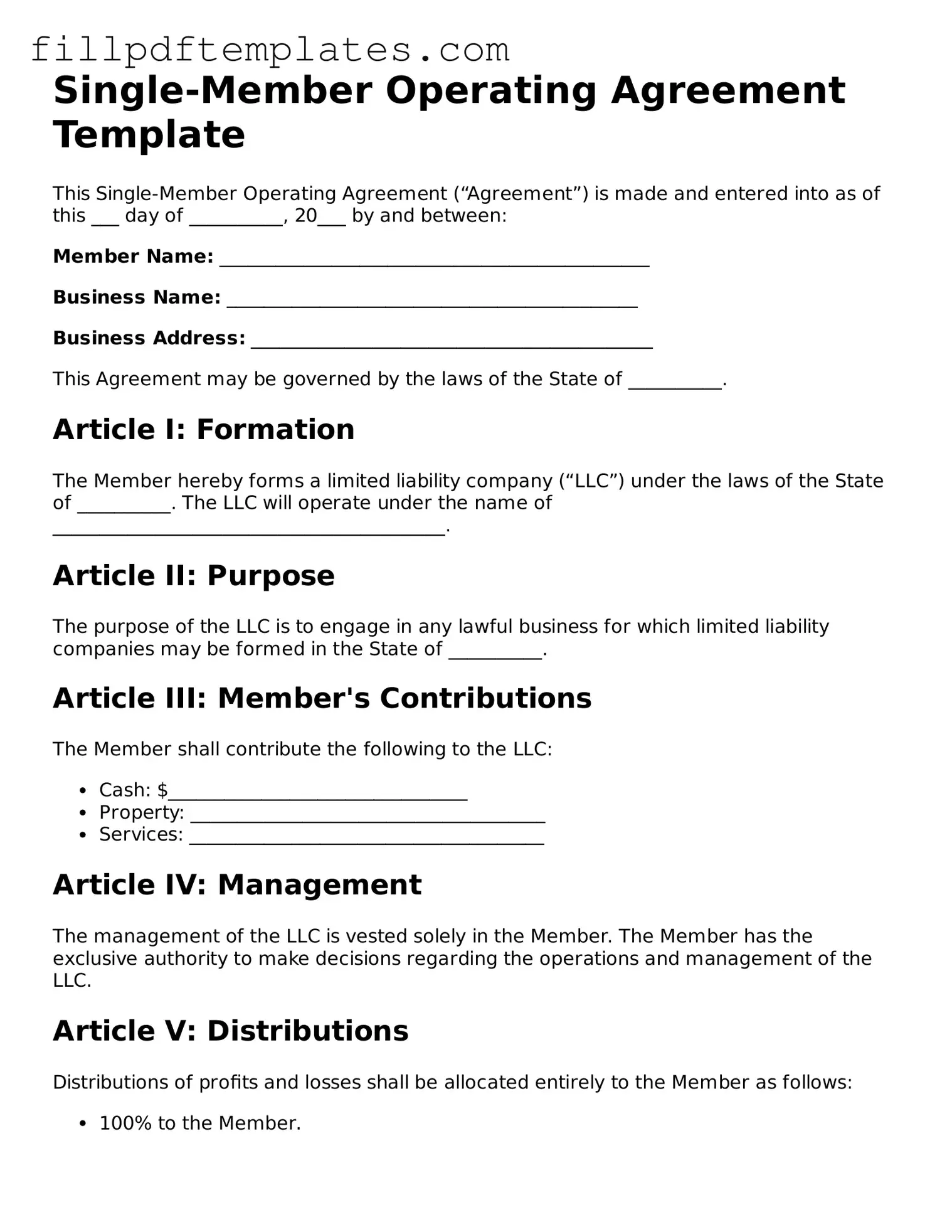

Single-Member Operating Agreement Preview

Single-Member Operating Agreement Template

This Single-Member Operating Agreement (“Agreement”) is made and entered into as of this ___ day of __________, 20___ by and between:

Member Name: ______________________________________________

Business Name: ____________________________________________

Business Address: ___________________________________________

This Agreement may be governed by the laws of the State of __________.

Article I: Formation

The Member hereby forms a limited liability company (“LLC”) under the laws of the State of __________. The LLC will operate under the name of __________________________________________.

Article II: Purpose

The purpose of the LLC is to engage in any lawful business for which limited liability companies may be formed in the State of __________.

Article III: Member's Contributions

The Member shall contribute the following to the LLC:

- Cash: $________________________________

- Property: ______________________________________

- Services: ______________________________________

Article IV: Management

The management of the LLC is vested solely in the Member. The Member has the exclusive authority to make decisions regarding the operations and management of the LLC.

Article V: Distributions

Distributions of profits and losses shall be allocated entirely to the Member as follows:

- 100% to the Member.

Article VI: Indemnification

The LLC shall indemnify the Member against any and all expenses and liabilities incurred in connection with the LLC to the fullest extent allowed by the laws of the State of __________.

Article VII: Amendments

This Agreement may be amended only by a written agreement executed by the Member.

Article VIII: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of __________.

In witness whereof, the Member has executed this Agreement as of the date first above written.

Member Signature: ________________________________

Date: ______________________________________