Valid Release of Promissory Note Form

The Release of Promissory Note form serves as a crucial document in financial transactions, particularly when a borrower has fulfilled their obligation to repay a loan. This form not only signifies the lender's formal acknowledgment that the debt has been satisfied, but it also provides peace of mind to the borrower by eliminating any lingering claims related to the note. Key components of the form typically include the names and addresses of both parties, details about the original promissory note, and a clear statement confirming that the debt has been paid in full. Additionally, it often requires signatures from both the lender and borrower, ensuring that both parties agree to the release. This document is essential for protecting the interests of both sides and helps maintain clear records, which can be invaluable in the event of future disputes. Understanding the importance of this form can empower individuals to navigate their financial responsibilities more confidently.

Different Types of Release of Promissory Note Forms:

Basic Promissory Note - This document typically includes information about the car, such as make, model, and VIN.

Understanding the importance of a well-structured New Jersey Promissory Note form is essential for anyone involved in lending or borrowing money in the state. For those seeking to create a comprehensive document that protects both parties, resources such as njtemplates.com/ provide valuable templates and guidance, ensuring that all critical terms and conditions are clearly defined and legally enforceable.

Similar forms

-

Release of Lien: This document releases a claim against a property. Just like the Release of Promissory Note, it signifies that a debt has been satisfied, allowing the borrower to move forward without encumbrances on their property.

-

Debt Settlement Agreement: This agreement outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. Similar to the Release of Promissory Note, it marks the end of the financial obligation once the agreed amount is paid.

-

Loan Satisfaction Letter: This letter confirms that a loan has been paid off. Like the Release of Promissory Note, it provides evidence that the borrower has fulfilled their obligations and is no longer liable for the loan.

-

Certificate of Satisfaction: This document certifies that a debt has been fully paid. It serves a similar purpose to the Release of Promissory Note by providing proof that the borrower is free from further obligations.

-

Money Promissory Note: A crucial document for lending arrangements, the Money Promissory Note clearly defines the terms and conditions of a loan. It is essential to ensure that both the lender and borrower understand their financial responsibilities, providing a structured framework for repayment.

-

Quitclaim Deed: This deed transfers any interest a person may have in a property without guaranteeing that the title is clear. It is similar to the Release of Promissory Note in that it can remove claims or interests, allowing for a fresh start.

-

Settlement Statement: This document details the financial transactions involved in settling a debt. It shares similarities with the Release of Promissory Note as it outlines what has been paid and confirms the settlement of obligations.

-

Termination Agreement: This agreement ends a contract or obligation. Just like the Release of Promissory Note, it signifies that all parties have agreed to terminate their responsibilities under the contract.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | A Release of Promissory Note is a legal document that signifies the cancellation of a promissory note obligation. |

| Purpose | This form is used to formally release a borrower from their obligation to repay a loan as outlined in the promissory note. |

| Governing Law | The laws governing the release of promissory notes vary by state; typically, state contract laws apply. |

| Parties Involved | The document usually involves the lender (creditor) and the borrower (debtor). |

| Signature Requirement | Both parties must sign the release for it to be legally binding. |

| Filing | In some states, it may be necessary to file the release with a local government office or court. |

| Effect on Credit | Releasing a promissory note can positively affect the borrower’s credit score, as it indicates the debt has been settled. |

| State-Specific Forms | Some states may have specific forms or requirements for the release; always check local regulations. |

Things You Should Know About This Form

-

What is a Release of Promissory Note form?

The Release of Promissory Note form is a document that formally indicates that a borrower has fulfilled their obligation to repay a loan. Once this form is executed, it releases the borrower from any further obligations related to the promissory note.

-

Why do I need a Release of Promissory Note?

This form is important because it provides legal evidence that the debt has been paid in full. Having this document can prevent any future claims from the lender regarding the same debt, offering peace of mind to the borrower.

-

Who should sign the Release of Promissory Note?

Typically, the lender or the person who originally issued the promissory note must sign the release. If there are multiple lenders, all parties involved may need to sign to ensure that the release is valid and comprehensive.

-

When should I use this form?

You should use the Release of Promissory Note form after you have made the final payment on your loan. It is advisable to complete this form as soon as the payment is made to avoid any confusion or disputes in the future.

-

What happens if I don’t obtain a Release of Promissory Note?

If you do not obtain this release, you may still be considered liable for the debt. This could lead to potential issues if the lender tries to claim that you owe more money or if there are disputes regarding the payment status.

-

Is there a specific format for the Release of Promissory Note?

While there is no universally mandated format, the document should clearly state the names of the parties involved, details of the original promissory note, and a statement confirming that the debt has been paid in full. It is often beneficial to consult a legal professional to ensure the document meets all necessary requirements.

-

Can I create my own Release of Promissory Note form?

Yes, you can create your own form, but it is crucial to ensure that it contains all the necessary information and complies with local laws. It is often recommended to use a template or consult with a legal advisor to avoid any omissions that could lead to complications later.

-

How do I store the Release of Promissory Note once it is signed?

After the form is signed, it is wise to keep it in a safe place, such as a locked file cabinet or a secure digital storage system. This ensures that you have access to the document if any questions arise in the future regarding the debt.

Documents used along the form

The Release of Promissory Note form is an important document in financial transactions, particularly when a borrower has fulfilled their obligations. Alongside this form, several other documents may be necessary to ensure clarity and legal compliance. Below is a list of related forms and documents commonly used in conjunction with the Release of Promissory Note.

- Promissory Note: This is the original document where the borrower agrees to repay a specified amount to the lender, detailing the terms of the loan, including interest rates and repayment schedules.

- Loan Agreement: This comprehensive document outlines the terms and conditions of the loan, including rights and responsibilities of both parties, and may include provisions for default and remedies.

- Security Agreement: If the loan is secured by collateral, this document establishes the lender's rights to the collateral in case of default, detailing what assets are pledged as security.

- Release of Lien: When the borrower pays off the loan, this document formally releases the lender's claim on any collateral, ensuring that the borrower has clear ownership of the asset.

- Promissory Note Form: To ensure you have the proper documentation, click here to get the form that represents the terms of the loan.

- Payment Receipt: This document serves as proof that the borrower has made a payment towards the loan. It is essential for record-keeping and may be required for tax purposes.

Understanding these documents is crucial for both borrowers and lenders. Each plays a specific role in the loan process, ensuring that all parties are protected and that the transaction is legally sound.

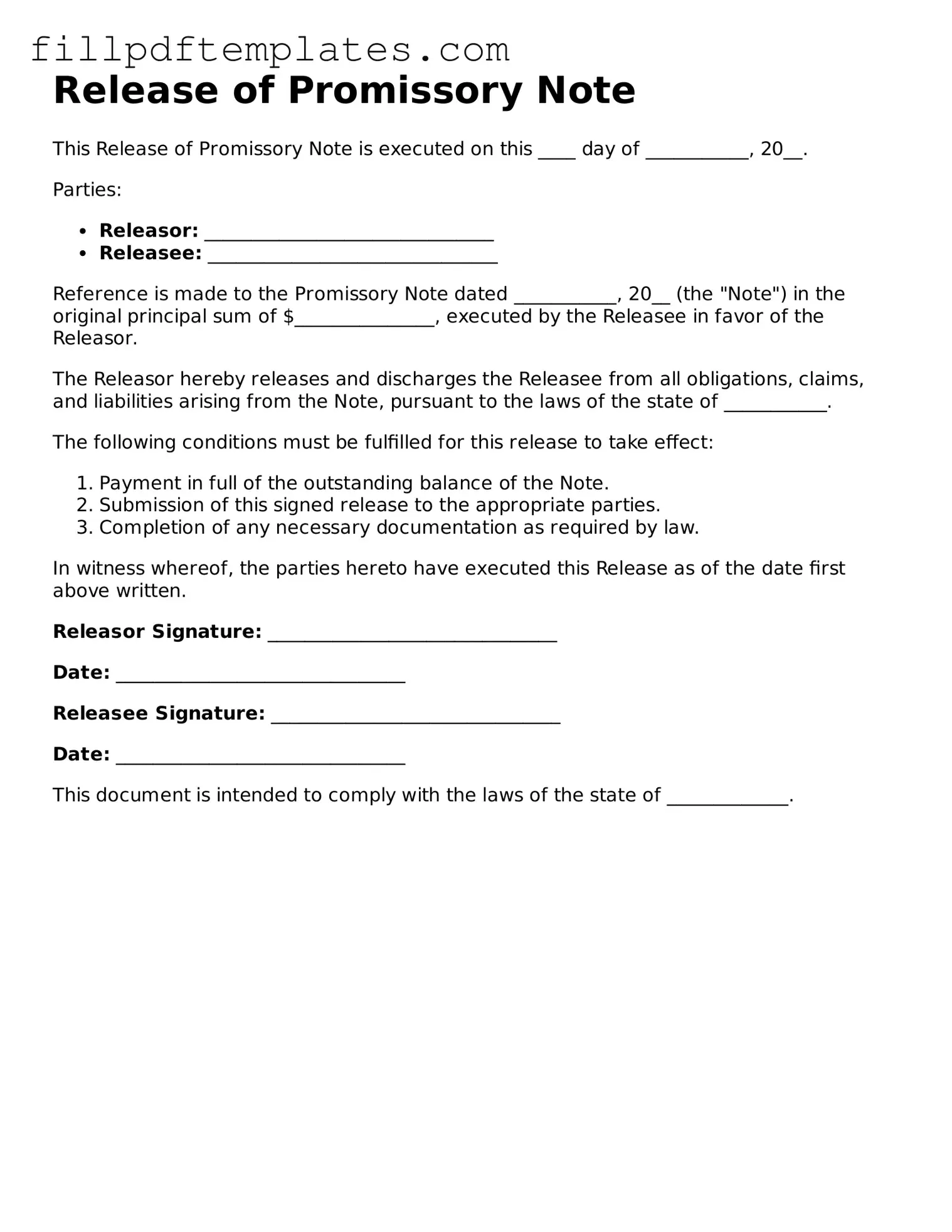

Release of Promissory Note Preview

Release of Promissory Note

This Release of Promissory Note is executed on this ____ day of ___________, 20__.

Parties:

- Releasor: _______________________________

- Releasee: _______________________________

Reference is made to the Promissory Note dated ___________, 20__ (the "Note") in the original principal sum of $_______________, executed by the Releasee in favor of the Releasor.

The Releasor hereby releases and discharges the Releasee from all obligations, claims, and liabilities arising from the Note, pursuant to the laws of the state of ___________.

The following conditions must be fulfilled for this release to take effect:

- Payment in full of the outstanding balance of the Note.

- Submission of this signed release to the appropriate parties.

- Completion of any necessary documentation as required by law.

In witness whereof, the parties hereto have executed this Release as of the date first above written.

Releasor Signature: _______________________________

Date: _______________________________

Releasee Signature: _______________________________

Date: _______________________________

This document is intended to comply with the laws of the state of _____________.