Valid Quitclaim Deed Form

A Quitclaim Deed is a legal document commonly used in real estate transactions to transfer interest in a property from one party to another. Unlike other types of deeds, it does not guarantee that the grantor has clear title to the property being transferred. Instead, the Quitclaim Deed conveys whatever interest the grantor may have, if any, without any warranties. This form is often employed in situations such as transferring property between family members, clearing up title issues, or during divorce proceedings. It is essential to understand that while the Quitclaim Deed is a straightforward and efficient way to transfer property rights, it does not protect the grantee from potential claims or liens against the property. Therefore, parties involved should carefully consider the implications of using this form and may wish to seek legal advice to ensure their interests are adequately protected.

Quitclaim Deed - Customized for Each State

Different Types of Quitclaim Deed Forms:

What Is a Deed in Lieu of Foreclosure? - This option can be particularly advantageous for properties with little to no equity.

When engaging in the transfer of ownership for an all-terrain vehicle in Colorado, it's essential to utilize the appropriate documentation to ensure a smooth transaction. The Colorado ATV Bill of Sale form lays the groundwork for this process by clearly detailing the sale terms and protecting both parties' interests. For those looking for a reliable source to obtain this crucial form, Colorado PDF Forms provides easy access to the necessary paperwork, making the transaction straightforward and legally binding.

California Corrective Deed - Corrective Deeds come into play when changes need to be made to official records.

Title Companies and Transfer on Death Deeds - Inputting the correct names and relationship to the owner is vital for beneficiaries.

Similar forms

A Quitclaim Deed is a specific type of legal document used to transfer ownership of property. It is important to understand how it relates to other documents that serve similar purposes. Here are five documents that share similarities with a Quitclaim Deed:

- Warranty Deed: This document provides a guarantee that the seller holds clear title to the property and has the right to sell it. Unlike a Quitclaim Deed, it offers more protection to the buyer.

- Hold Harmless Agreement: The Maryland Hold Harmless Agreement form is a legal document where one party agrees not to hold the other party responsible for any injuries, damages, or losses. This agreement can be used in various contexts, making it a versatile tool for managing risk. Whether you're organizing an event or conducting a service, understanding this form ensures protection and peace of mind for all parties involved. Hold Harmless Agreement

- Grant Deed: A Grant Deed conveys property ownership and includes implied warranties that the property is free from encumbrances. Like a Quitclaim Deed, it transfers interest, but it offers additional assurances about the title.

- Deed of Trust: This document secures a loan by placing a lien on the property. While it does not transfer ownership in the same way a Quitclaim Deed does, it is also a legal instrument related to property rights and interests.

- Title Transfer Document: This is a general term for any document that facilitates the transfer of property title. A Quitclaim Deed is one specific type of title transfer document, but others may include additional warranties or protections.

- Affidavit of Title: This sworn statement confirms the seller's ownership and the absence of liens or claims against the property. While it does not transfer title, it is often used in conjunction with a Quitclaim Deed to provide reassurance about the seller's claims.

Understanding these documents can help clarify the process of property transfer and the level of protection each provides. Always consider consulting a professional when dealing with property transactions.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property without any guarantees about the title. |

| Usage | Commonly used among family members, in divorce settlements, or when property is transferred as a gift. |

| State-Specific Forms | Each state has its own version of the quitclaim deed. For example, in California, it is governed by California Civil Code Section 1092. |

| Limitations | This deed does not provide any warranties, meaning the grantor is not liable for any claims against the property. |

| Recording | To make the transfer official, the quitclaim deed should be recorded with the local county recorder's office. |

Things You Should Know About This Form

-

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another. Unlike other types of deeds, it does not guarantee that the title is clear or free of liens. Instead, it simply conveys whatever interest the grantor has in the property, if any.

-

When should I use a Quitclaim Deed?

This type of deed is commonly used in situations where the parties know each other well, such as transferring property between family members, divorcing spouses, or adding a partner to a property title. It is often chosen for its simplicity and speed.

-

What are the risks associated with a Quitclaim Deed?

Since a Quitclaim Deed offers no warranties, the grantee assumes the risk of any existing claims against the property. If there are liens or other encumbrances, the grantee may be responsible for resolving these issues. It is advisable to conduct a title search before proceeding.

-

How do I complete a Quitclaim Deed?

To complete a Quitclaim Deed, you will need to include the names of the grantor and grantee, a legal description of the property, and the date of the transfer. Both parties must sign the document in the presence of a notary public. Once signed, the deed should be filed with the appropriate county office.

-

Is a Quitclaim Deed the same as a Warranty Deed?

No, they are not the same. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed does not offer such guarantees and simply transfers the interest the grantor may have.

-

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. However, if both parties agree, they can execute a new deed to reverse the transaction. Legal advice may be beneficial in such cases.

-

Do I need an attorney to create a Quitclaim Deed?

While it is not legally required to have an attorney draft a Quitclaim Deed, consulting with one can provide peace of mind. An attorney can ensure that the deed is properly completed and compliant with state laws.

-

Are there any fees associated with a Quitclaim Deed?

There may be fees for preparing the deed, notarizing it, and recording it with the county. These fees vary by location. It is important to check with local authorities for specific costs.

-

What happens after a Quitclaim Deed is filed?

Once the Quitclaim Deed is filed with the county, the property ownership is officially transferred. The new owner should keep a copy of the deed for their records. It is also advisable to update any relevant property tax records.

-

Can a Quitclaim Deed be used for properties with mortgages?

Yes, a Quitclaim Deed can be used to transfer a property with an existing mortgage. However, the lender must be notified, as the mortgage remains with the property. The new owner may need to assume the mortgage or refinance to remove the original borrower from the obligation.

Documents used along the form

A Quitclaim Deed is often used in real estate transactions to transfer ownership of property. However, it is usually accompanied by several other important forms and documents to ensure a smooth transfer and proper documentation. Here’s a list of other forms that are frequently used alongside a Quitclaim Deed.

- Warranty Deed: This document guarantees that the seller has clear title to the property and has the right to sell it. It offers more protection to the buyer than a quitclaim deed.

- Grant Deed: Similar to a warranty deed, this form provides some assurances about the title but is less comprehensive. It confirms that the property has not been sold to anyone else.

- Property Transfer Tax Declaration: This form is often required by local governments to assess any transfer taxes due upon the sale of the property.

- Transfer-on-Death Deed: This form allows for the seamless transfer of property upon death without probate, ensuring your wishes are fulfilled. For more information, visit todform.com/blank-arkansas-transfer-on-death-deed/.

- Title Insurance Policy: This policy protects the buyer against any future claims to the property that may arise due to defects in the title.

- Affidavit of Title: A sworn statement by the seller affirming that they hold clear title to the property and disclosing any liens or encumbrances.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale, including the purchase price and any conditions that must be met before closing.

- Closing Statement: Also known as a settlement statement, this document summarizes the financial aspects of the transaction, including fees and adjustments.

- Homestead Declaration: This form can protect a portion of the property from creditors, depending on state laws. It may be filed after the quitclaim deed is executed.

- Power of Attorney: If someone is signing on behalf of the property owner, this document grants them the authority to act in legal matters related to the property transfer.

Each of these forms plays a crucial role in the property transfer process. Having the right documents in place can help avoid complications and ensure that the transaction proceeds smoothly.

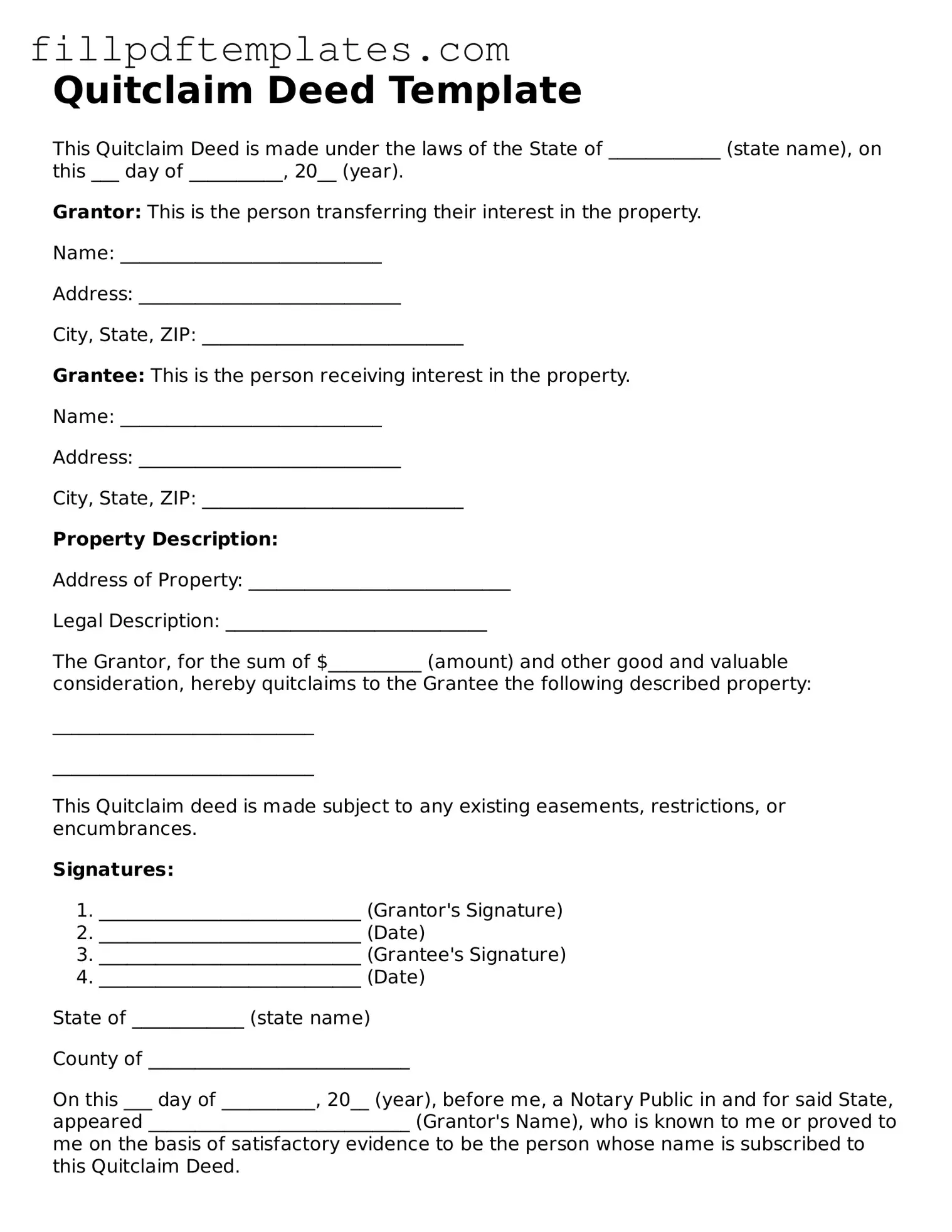

Quitclaim Deed Preview

Quitclaim Deed Template

This Quitclaim Deed is made under the laws of the State of ____________ (state name), on this ___ day of __________, 20__ (year).

Grantor: This is the person transferring their interest in the property.

Name: ____________________________

Address: ____________________________

City, State, ZIP: ____________________________

Grantee: This is the person receiving interest in the property.

Name: ____________________________

Address: ____________________________

City, State, ZIP: ____________________________

Property Description:

Address of Property: ____________________________

Legal Description: ____________________________

The Grantor, for the sum of $__________ (amount) and other good and valuable consideration, hereby quitclaims to the Grantee the following described property:

____________________________

____________________________

This Quitclaim deed is made subject to any existing easements, restrictions, or encumbrances.

Signatures:

- ____________________________ (Grantor's Signature)

- ____________________________ (Date)

- ____________________________ (Grantee's Signature)

- ____________________________ (Date)

State of ____________ (state name)

County of ____________________________

On this ___ day of __________, 20__ (year), before me, a Notary Public in and for said State, appeared ____________________________ (Grantor's Name), who is known to me or proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to this Quitclaim Deed.

In witness whereof, I have hereunto set my hand and official seal.

____________________________

(Notary Public Signature)

My commission expires: _________________