Valid Promissory Note Form

When engaging in financial transactions, clarity and security are paramount. One essential tool that facilitates this is the Promissory Note form. This document serves as a written promise to pay a specified amount of money to a designated party at a future date or upon demand. It outlines critical elements such as the principal amount, interest rate, repayment schedule, and any applicable penalties for late payments. The Promissory Note not only protects the lender’s interests but also provides the borrower with a clear understanding of their obligations. Additionally, it often includes provisions regarding default and remedies, ensuring that both parties are aware of their rights and responsibilities. By encapsulating these vital details, the Promissory Note form plays a crucial role in fostering trust and accountability in financial agreements, making it an indispensable resource for individuals and businesses alike.

Promissory Note - Customized for Each State

Promissory Note Form Subtypes

Fill out More Documents

Short Term Rental Agreement Template - Outline procedures for terminating the rental agreement properly.

Miscellaneous Information - The form may need to be submitted alongside other tax forms, depending on the nature of the business taxes.

When engaging in the sale of an all-terrain vehicle, it is essential to utilize the appropriate documentation to ensure a smooth transfer of ownership. The Colorado ATV Bill of Sale is not only a vital requirement but can also be conveniently accessed through resources like Colorado PDF Forms, which provides printable versions of the necessary forms to facilitate the transaction.

Hiv Clia Test Normal Range - A section is dedicated to noting the initials of those involved in the testing process.

Similar forms

A Promissory Note is a financial document that outlines a borrower's promise to repay a loan under specific terms. Several other documents serve similar purposes or share characteristics with a Promissory Note. Here are eight documents that are comparable:

- Loan Agreement: This document details the terms of a loan, including the amount borrowed, interest rate, repayment schedule, and any penalties for late payments. Like a Promissory Note, it establishes the borrower's obligation to repay the loan.

- Mortgage: A mortgage is a specific type of loan agreement secured by real property. It outlines the borrower's promise to repay the loan while also detailing the lender's rights to the property if the borrower defaults, similar to the obligations in a Promissory Note.

- Installment Agreement: This document allows a borrower to pay off a debt in regular installments over time. It includes the total amount owed, the payment schedule, and interest rates, much like a Promissory Note.

- Secured Note: A secured note is a Promissory Note backed by collateral. It specifies the borrower's promise to repay while detailing the collateral involved, offering added security to the lender.

- Credit Agreement: This document outlines the terms under which credit is extended to a borrower. It includes details about repayment obligations, interest rates, and fees, resembling the structure of a Promissory Note.

- Transfer-on-Death Deed: This form allows property owners to designate beneficiaries who will receive their real estate after their death, thus bypassing probate. For more information and to access the form, visit https://todform.com/blank-arkansas-transfer-on-death-deed.

- Personal Guarantee: A personal guarantee is a promise made by an individual to be responsible for another party's debt. It shares similarities with a Promissory Note by establishing a clear obligation to repay a debt.

- Loan Modification Agreement: This document modifies the terms of an existing loan, including changes to interest rates or payment schedules. It serves to clarify the new obligations of the borrower, akin to the original Promissory Note.

- Debt Settlement Agreement: This document outlines an agreement between a debtor and creditor to settle a debt for less than the full amount owed. It specifies repayment terms, similar to how a Promissory Note delineates repayment obligations.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time or on demand. |

| Legal Framework | In the United States, promissory notes are governed by the Uniform Commercial Code (UCC), specifically Article 3, which deals with negotiable instruments. |

| Key Elements | Essential elements include the principal amount, interest rate, maturity date, and the signatures of the parties involved. |

| State-Specific Laws | While the UCC provides a uniform framework, individual states may have specific regulations or requirements for promissory notes, such as notarization or witness signatures. |

Things You Should Know About This Form

-

What is a Promissory Note?

A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It outlines the terms of the loan, including the interest rate, repayment schedule, and any consequences for late payments.

-

Who uses a Promissory Note?

Individuals and businesses often use promissory notes. They are common in personal loans, business loans, and real estate transactions. Anyone who lends or borrows money can benefit from this document.

-

What are the key components of a Promissory Note?

A promissory note typically includes:

- The names and addresses of the borrower and lender.

- The principal amount being borrowed.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any late fees or penalties for missed payments.

- Signatures of both parties.

-

Is a Promissory Note legally binding?

Yes, a promissory note is a legally binding document. Once signed, it obligates the borrower to repay the loan under the agreed-upon terms. If the borrower fails to repay, the lender can take legal action to recover the owed amount.

-

Can a Promissory Note be modified?

Yes, a promissory note can be modified if both the borrower and lender agree to the changes. This may involve altering the payment schedule, interest rate, or other terms. It is advisable to document any changes in writing and have both parties sign the updated agreement.

-

What happens if the borrower defaults?

If the borrower defaults, meaning they fail to make payments as agreed, the lender has several options. They may charge late fees, demand immediate repayment of the full amount, or take legal action to recover the debt. Defaulting can also negatively affect the borrower's credit score.

-

Do I need a lawyer to create a Promissory Note?

While it is not required to have a lawyer to create a promissory note, consulting one can be beneficial. A lawyer can ensure that the note complies with state laws and includes all necessary terms to protect both parties. However, many templates are available for those who prefer to create one independently.

Documents used along the form

A Promissory Note is a crucial document that outlines the terms of a loan between a borrower and a lender. Along with this form, there are several other documents that are commonly utilized to ensure clarity and security in the lending process. Below are four key forms often used in conjunction with a Promissory Note.

- Loan Agreement: This document details the specific terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive contract that both parties must adhere to.

- Security Agreement: If the loan is secured by collateral, this document outlines the specific assets pledged by the borrower. It provides the lender with rights to the collateral in case of default, ensuring protection for the lender's investment.

- Disclosure Statement: This form provides important information about the loan, including the total cost of borrowing, any fees associated with the loan, and the annual percentage rate (APR). It ensures that the borrower is fully informed before agreeing to the terms.

- Hold Harmless Agreement: To manage risks effectively, it is important to consider a Hold Harmless Agreement, which can protect parties from liability; for more details, refer to the Hold Harmless Agreement.

- Personal Guarantee: In some cases, a lender may require a personal guarantee from an individual, often the business owner or a partner. This document holds the individual personally liable for the loan, adding an extra layer of security for the lender.

These documents work together with the Promissory Note to create a clear framework for the loan agreement. Understanding each of these forms can help both borrowers and lenders navigate the lending process with confidence.

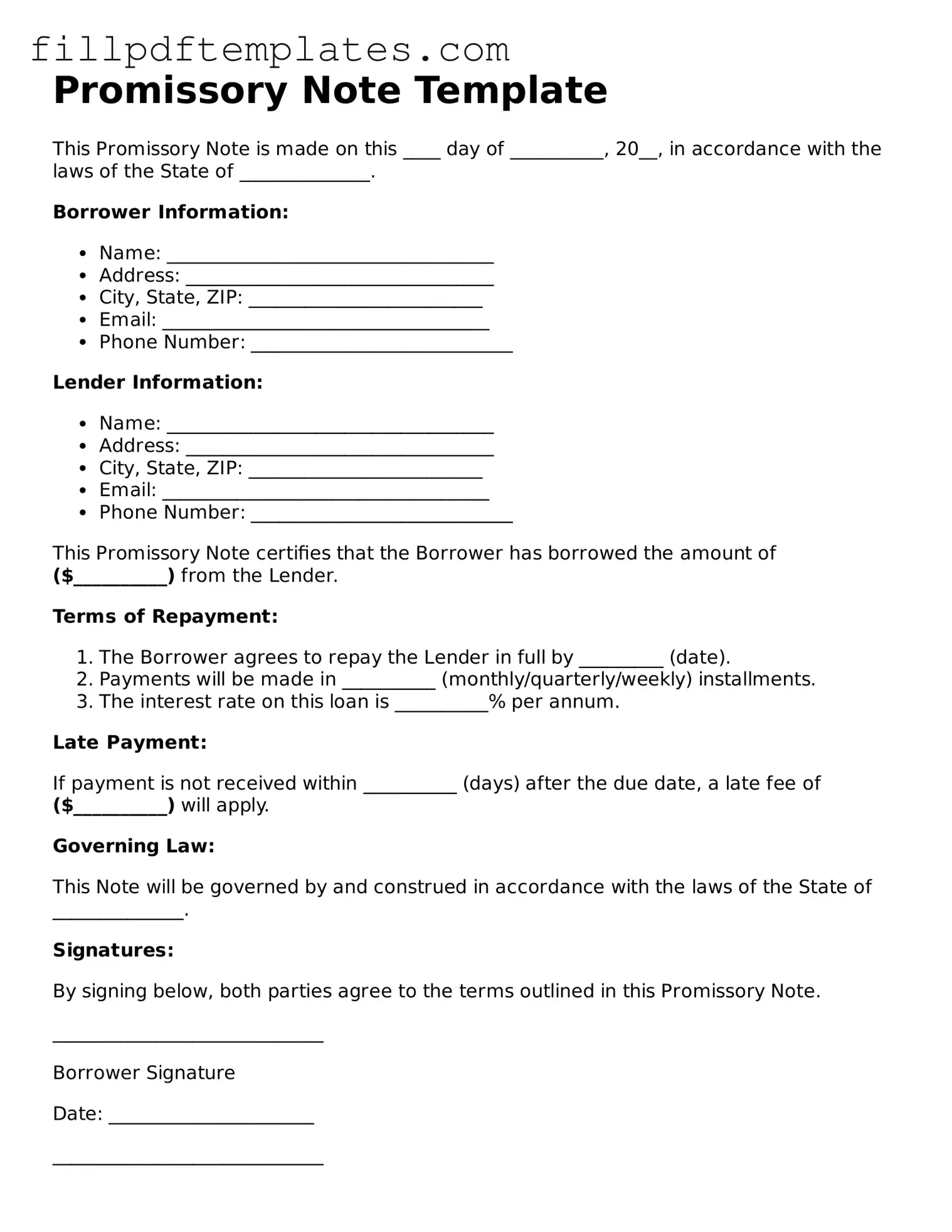

Promissory Note Preview

Promissory Note Template

This Promissory Note is made on this ____ day of __________, 20__, in accordance with the laws of the State of ______________.

Borrower Information:

- Name: ___________________________________

- Address: _________________________________

- City, State, ZIP: _________________________

- Email: ___________________________________

- Phone Number: ____________________________

Lender Information:

- Name: ___________________________________

- Address: _________________________________

- City, State, ZIP: _________________________

- Email: ___________________________________

- Phone Number: ____________________________

This Promissory Note certifies that the Borrower has borrowed the amount of ($__________) from the Lender.

Terms of Repayment:

- The Borrower agrees to repay the Lender in full by _________ (date).

- Payments will be made in __________ (monthly/quarterly/weekly) installments.

- The interest rate on this loan is __________% per annum.

Late Payment:

If payment is not received within __________ (days) after the due date, a late fee of ($__________) will apply.

Governing Law:

This Note will be governed by and construed in accordance with the laws of the State of ______________.

Signatures:

By signing below, both parties agree to the terms outlined in this Promissory Note.

_____________________________

Borrower Signature

Date: ______________________

_____________________________

Lender Signature

Date: ______________________