Valid Promissory Note for a Car Form

Purchasing a car often involves significant financial commitments, and a Promissory Note for a Car serves as a crucial document in this process. This form outlines the borrower's promise to repay a specified amount of money to the lender, typically the dealership or a financial institution, over a set period. It includes essential details such as the total loan amount, interest rate, payment schedule, and any applicable fees. Additionally, the note may specify consequences for late payments or default, ensuring that both parties understand their rights and obligations. By clearly documenting these terms, the Promissory Note provides protection for both the borrower and the lender, fostering transparency and accountability in the transaction. Understanding this form is vital for anyone considering financing a vehicle, as it lays the groundwork for a responsible and informed borrowing experience.

Different Types of Promissory Note for a Car Forms:

Release of Promissory Note - Often required for credit purposes to show debt resolution.

A promissory note in Alabama is a written promise to pay a specified amount of money to a designated party at a defined time. This legal document outlines the terms of the loan, including interest rates and repayment schedules. To get started on your own promissory note, visit promissorynotepdf.com/printable-alabama-promissory-note/ and fill out the form by clicking the button below.

Similar forms

-

Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of a loan between a borrower and a lender. It includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Both documents serve to formalize the borrowing arrangement and protect the interests of the lender.

-

Installment Sale Agreement: This document is used when a buyer purchases a vehicle and agrees to pay for it in installments. Like a promissory note, it specifies payment terms and conditions. However, an installment sale agreement typically transfers ownership of the vehicle to the buyer immediately, while a promissory note is focused on the promise to repay the loan.

-

Security Agreement: A security agreement is a legal document that grants a lender a security interest in the vehicle being financed. This document complements a promissory note by ensuring that if the borrower defaults, the lender has the right to repossess the vehicle. Both documents work together to protect the lender's investment.

- Promissory Note Template: For those looking to draft a promissory note in Pennsylvania, utilizing a template can ensure that all necessary terms and legalities are covered. You can find a useful template at patemplates.com.

-

Lease Agreement: In a lease agreement, one party allows another to use a vehicle for a specified period in exchange for payments. While a promissory note represents a promise to repay a loan, a lease agreement does not transfer ownership of the vehicle. Instead, it outlines the terms of use and payment for the duration of the lease.

-

Title Transfer Document: This document is crucial when ownership of a vehicle changes hands. While a promissory note is focused on repayment, a title transfer document ensures that the legal ownership of the vehicle is officially recorded. Both documents are essential in the context of vehicle financing and ownership transfer.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount for the purchase of a vehicle. |

| Parties Involved | The document involves two parties: the borrower (buyer) and the lender (seller or financial institution). |

| Governing Law | In the United States, the Uniform Commercial Code (UCC) governs promissory notes, though state-specific laws may apply. |

| Payment Terms | The note outlines the payment amount, frequency, and duration, ensuring clarity for both parties. |

| Interest Rate | The interest rate, if applicable, must be clearly stated, affecting the total amount to be repaid. |

| Default Clause | The note typically includes a default clause, detailing the consequences if the borrower fails to make payments. |

| Security Interest | Often, the vehicle itself serves as collateral, giving the lender rights to the car if payments are not made. |

| Signatures Required | Both parties must sign the document for it to be legally binding, affirming their agreement to the terms. |

Things You Should Know About This Form

-

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines the agreement between a borrower and a lender regarding the financing of a vehicle. This document serves as a written promise from the borrower to repay the loan amount, including interest, by a specified date. It typically includes details about the vehicle, the loan amount, the interest rate, and the repayment schedule.

-

Who needs a Promissory Note for a Car?

Anyone who is borrowing money to purchase a vehicle may need a Promissory Note. This includes individuals buying a car from a dealership or a private seller. If the seller is financing the purchase, a Promissory Note ensures that both parties understand the terms of the loan and their obligations.

-

What information is included in a Promissory Note for a Car?

The Promissory Note generally includes the following information:

- The names and addresses of both the borrower and lender.

- A description of the vehicle, including the make, model, year, and Vehicle Identification Number (VIN).

- The total loan amount and the interest rate.

- The repayment schedule, including the due dates and amounts of each payment.

- Any late fees or penalties for missed payments.

- Signatures of both parties to validate the agreement.

-

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding contract. Once both parties sign the document, they are obligated to adhere to its terms. If either party fails to comply, the other party may have legal recourse to enforce the agreement, which may include pursuing payment through the courts.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make payments as agreed, the lender has the right to take action. This may include charging late fees, demanding immediate payment of the remaining balance, or taking legal steps to recover the owed amount. In some cases, the lender may also have the right to repossess the vehicle.

-

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is essential to document any modifications in writing and have both parties sign the amended agreement. This ensures that the new terms are clear and legally enforceable.

-

Do I need a lawyer to create a Promissory Note for a Car?

While it is not legally required to have a lawyer draft a Promissory Note, consulting with one can be beneficial. A legal professional can help ensure that the document meets all legal requirements and adequately protects the interests of both parties. If you choose to create the note independently, ensure that it is clear and detailed.

-

How do I enforce a Promissory Note if the borrower does not pay?

If the borrower fails to make payments, the lender can begin by sending a formal demand for payment. If this does not resolve the issue, the lender may need to consider legal action. This typically involves filing a lawsuit in the appropriate court. Legal advice is recommended to navigate this process effectively.

-

Are there any tax implications related to a Promissory Note?

Yes, there can be tax implications for both the borrower and the lender. The lender may need to report the interest income received, while the borrower may be able to deduct the interest paid if the loan is secured by a vehicle used for business purposes. It is advisable to consult a tax professional for specific guidance related to individual circumstances.

-

Can a Promissory Note be used for other types of loans?

Absolutely. While this FAQ focuses on car loans, a Promissory Note can be used for various types of loans, including personal loans, business loans, and mortgages. The essential elements of the note remain similar, but the details will vary based on the nature of the loan.

Documents used along the form

When entering into a financing agreement for a car, several important documents accompany the Promissory Note for a Car. These forms help clarify the terms of the transaction and protect both parties involved. Below is a list of commonly used documents that you may encounter.

- Purchase Agreement: This document outlines the terms of the sale, including the purchase price, vehicle details, and any warranties or guarantees provided by the seller.

- Promissory Note: A Promissory Note is essential for documenting the terms of the loan agreement when financing a car. It includes specifics such as the repayment schedule and interest rate. For more information, you can review All New Jersey Forms.

- Bill of Sale: A legal document that serves as proof of the transfer of ownership from the seller to the buyer. It includes details about the vehicle and the parties involved.

- Title Transfer Form: Required to officially transfer the title of the vehicle from the seller to the buyer. This form must be filed with the state’s Department of Motor Vehicles (DMV).

- Loan Agreement: If financing is involved, this document details the terms of the loan, including interest rates, payment schedules, and penalties for late payments.

- Disclosure Statement: This form provides important information about the vehicle’s history, including any previous accidents, repairs, and odometer readings, ensuring transparency in the transaction.

- Insurance Verification: Proof of insurance coverage is often required before completing the sale. This document confirms that the buyer has obtained adequate insurance for the vehicle.

- Power of Attorney: In some cases, the buyer may grant power of attorney to the seller or a third party to facilitate the title transfer and other necessary paperwork.

- Registration Application: This form is used to register the vehicle in the buyer's name with the DMV, ensuring that the vehicle is legally recognized and can be driven on public roads.

- Affidavit of Identity: A sworn statement that verifies the identity of the buyer or seller, often required to prevent fraud during the transaction.

Understanding these documents is crucial for a smooth car purchase process. Each form serves a specific purpose and contributes to the overall security of the transaction. Be sure to gather and review all necessary paperwork before finalizing your agreement.

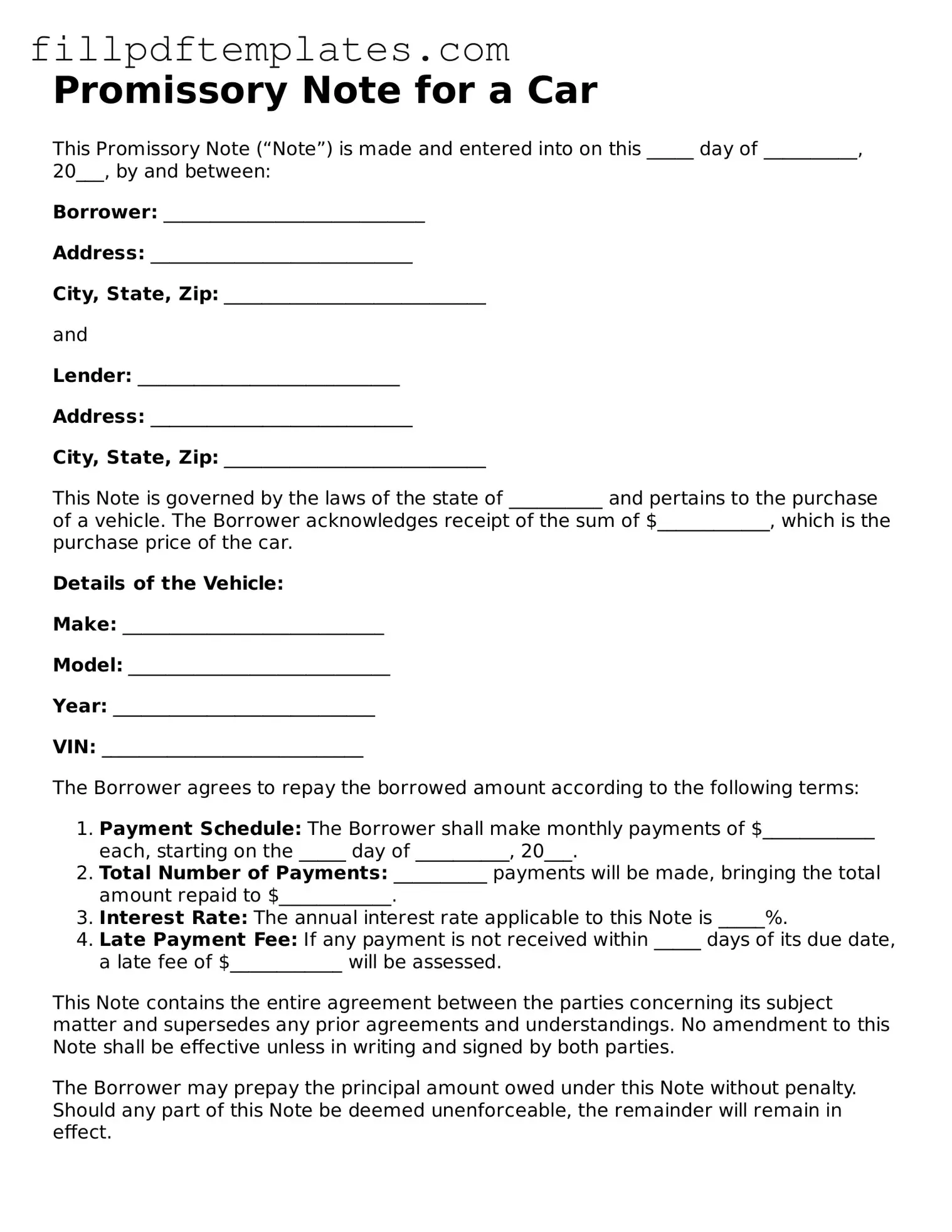

Promissory Note for a Car Preview

Promissory Note for a Car

This Promissory Note (“Note”) is made and entered into on this _____ day of __________, 20___, by and between:

Borrower: ____________________________

Address: ____________________________

City, State, Zip: ____________________________

and

Lender: ____________________________

Address: ____________________________

City, State, Zip: ____________________________

This Note is governed by the laws of the state of __________ and pertains to the purchase of a vehicle. The Borrower acknowledges receipt of the sum of $____________, which is the purchase price of the car.

Details of the Vehicle:

Make: ____________________________

Model: ____________________________

Year: ____________________________

VIN: ____________________________

The Borrower agrees to repay the borrowed amount according to the following terms:

- Payment Schedule: The Borrower shall make monthly payments of $____________ each, starting on the _____ day of __________, 20___.

- Total Number of Payments: __________ payments will be made, bringing the total amount repaid to $____________.

- Interest Rate: The annual interest rate applicable to this Note is _____%.

- Late Payment Fee: If any payment is not received within _____ days of its due date, a late fee of $____________ will be assessed.

This Note contains the entire agreement between the parties concerning its subject matter and supersedes any prior agreements and understandings. No amendment to this Note shall be effective unless in writing and signed by both parties.

The Borrower may prepay the principal amount owed under this Note without penalty. Should any part of this Note be deemed unenforceable, the remainder will remain in effect.

Both parties agree by signing below to adhere to the terms laid out in this Promissory Note.

Borrower's Signature: ____________________________ Date: _____________

Lender's Signature: ____________________________ Date: _____________

This document is intended for use as a Promissory Note in the state of __________. Please consult a legal expert in your state to ensure compliance with local laws and regulations.