Fill a Valid Profit And Loss Template

The Profit and Loss form is an essential tool for any business, providing a clear snapshot of financial performance over a specific period. This document typically includes key components such as total revenue, cost of goods sold, gross profit, operating expenses, and net income. By breaking down income and expenses, it helps business owners and stakeholders understand how well the company is performing financially. The form can highlight trends, identify areas for improvement, and assist in making informed decisions for future growth. Whether you're a small business owner or part of a larger corporation, understanding the Profit and Loss form is crucial for effective financial management and strategic planning.

Additional PDF Templates

Chick a Fil - Contribute to improving processes and enhancing the guest experience.

Army Awards Form - It is essential for maintaining proper award documentation in military files.

The process of divorce in Georgia requires the submission of specific documentation, and for those looking to file, the Georgia Divorce form is an essential starting point. This legal document not only provides crucial details regarding jurisdiction and venue but also captures important aspects of the marriage and any children involved, ensuring that all necessary information is presented accurately to the court.

Dd 214 - Service members should consider keeping multiple copies of their DD214 for various needs.

Similar forms

Balance Sheet: This document provides a snapshot of a company's financial position at a specific point in time. While the Profit and Loss form details income and expenses over a period, the Balance Sheet summarizes assets, liabilities, and equity.

Cash Flow Statement: Similar to the Profit and Loss form, the Cash Flow Statement tracks financial activity. However, it focuses specifically on cash inflows and outflows, rather than net income or expenses.

Income Statement: Often used interchangeably with the Profit and Loss form, the Income Statement presents revenues and expenses to show net profit or loss. Both documents serve the same fundamental purpose of assessing financial performance.

Trial Balance: This report lists all the balances of general ledger accounts. While the Profit and Loss form reflects performance over time, the Trial Balance is a tool for ensuring that debits and credits are balanced at a specific date.

Statement of Changes in Equity: This document outlines changes in a company’s equity over a specific period. It complements the Profit and Loss form by showing how profits or losses affect the overall equity of the business.

Budget Report: A Budget Report forecasts future income and expenses. While the Profit and Loss form reflects actual performance, the Budget Report serves as a plan against which actual results can be measured.

Sales Report: This document details sales performance over a specific period. Like the Profit and Loss form, it provides insights into revenue generation but focuses solely on sales figures.

Expense Report: An Expense Report tracks specific expenditures. While the Profit and Loss form categorizes expenses broadly, the Expense Report provides detailed information on individual costs incurred.

- Hold Harmless Agreement: This form is crucial in Pennsylvania for mitigating liability risks in various transactions. Implementing a Hold Harmless Agreement can protect parties from unforeseen legal actions, ensuring smoother business operations and interactions.

Financial Forecast: This document predicts future financial performance based on historical data and market trends. It shares similarities with the Profit and Loss form in its focus on income and expenses but is more forward-looking.

Document Specifics

| Fact Name | Description |

|---|---|

| Definition | A Profit and Loss form summarizes a company's revenues, costs, and expenses over a specific period, typically a fiscal quarter or year. |

| Purpose | This form helps businesses assess their financial performance and make informed decisions based on profitability. |

| Components | Key components include total revenue, cost of goods sold, gross profit, operating expenses, and net income. |

| Reporting Period | The form can be prepared for various reporting periods, such as monthly, quarterly, or annually, depending on business needs. |

| Tax Implications | Net income from the Profit and Loss form is often used to determine taxable income for federal and state taxes. |

| State-Specific Forms | Some states require specific Profit and Loss forms for tax reporting; for example, California follows the California Revenue and Taxation Code. |

| Standardization | While formats can vary, generally accepted accounting principles (GAAP) guide the preparation of these forms in the U.S. |

| Use in Financing | Lenders and investors often require Profit and Loss statements to evaluate a business's financial health before providing funding. |

| Comparison Tool | Businesses use these forms to compare performance across different periods, identifying trends and areas for improvement. |

| Importance of Accuracy | Accurate reporting on the Profit and Loss form is crucial, as discrepancies can lead to financial mismanagement and legal issues. |

Things You Should Know About This Form

-

What is a Profit and Loss form?

A Profit and Loss form, often referred to as an income statement, summarizes the revenues and expenses of a business over a specific period. It helps business owners understand their financial performance, showing whether they made a profit or incurred a loss during that time frame.

-

Why is the Profit and Loss form important?

This form is crucial for several reasons. It provides insight into a company's profitability, aids in budgeting and forecasting, and is often required for tax filings. Investors and lenders also use it to assess the financial health of a business before making decisions.

-

What information is included in a Profit and Loss form?

The form typically includes:

- Total revenue or sales

- Cost of goods sold (COGS)

- Gross profit

- Operating expenses (such as rent, utilities, and salaries)

- Net profit or loss

-

How often should a Profit and Loss form be completed?

Many businesses prepare this form on a monthly, quarterly, or annual basis. The frequency depends on the size of the business and its financial needs. Smaller businesses may find monthly reports beneficial for tracking performance, while larger companies often use quarterly or annual reports.

-

Can the Profit and Loss form be used for tax purposes?

Yes, the Profit and Loss form is an essential document for tax preparation. It provides the necessary information to report income and expenses accurately, ensuring compliance with tax regulations.

-

How do I calculate net profit or loss?

To calculate net profit or loss, subtract total expenses from total revenues. If the result is positive, you have a net profit. If it is negative, you have incurred a net loss.

-

What is the difference between gross profit and net profit?

Gross profit is the revenue remaining after deducting the cost of goods sold. In contrast, net profit accounts for all expenses, including operating expenses, taxes, and interest. Gross profit gives insight into production efficiency, while net profit reflects overall business profitability.

-

Can I use software to create a Profit and Loss form?

Yes, numerous accounting software options are available that can help you create a Profit and Loss form easily. These tools often automate calculations and provide templates, making the process more efficient and accurate.

-

What should I do if I notice discrepancies in my Profit and Loss form?

If discrepancies arise, review your entries carefully. Check for errors in data entry, ensure all transactions are accounted for, and verify that calculations are correct. If issues persist, consider consulting with a financial professional for assistance.

Documents used along the form

The Profit and Loss form is an essential document for assessing a business's financial performance over a specific period. However, it is often used in conjunction with several other forms and documents that provide a comprehensive view of the company's financial health. Below is a list of these related documents.

- Balance Sheet: This document provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It helps stakeholders understand what the business owns and owes.

- Cash Flow Statement: This statement tracks the flow of cash in and out of the business, detailing operating, investing, and financing activities. It is crucial for assessing liquidity and cash management.

- Statement of Retained Earnings: This statement outlines changes in retained earnings over a reporting period. It shows how much profit has been reinvested in the business versus distributed as dividends.

- Tax Returns: Annual tax returns provide a summary of income, deductions, and tax liabilities. They are important for compliance and can impact financial planning.

- Budget: A budget outlines expected revenues and expenditures for a future period. It serves as a financial roadmap for the business and aids in resource allocation.

- Sales Reports: These reports detail sales performance, including revenue generated from products or services. They help identify trends and inform strategic decisions.

- Accounts Receivable Aging Report: This report categorizes accounts receivable based on the length of time an invoice has been outstanding. It helps manage cash flow and collections.

- Recommendation Letter: To enhance your application process, consider utilizing our valuable recommendation letter insights to articulate your qualifications effectively.

- Accounts Payable Aging Report: Similar to the accounts receivable report, this document tracks outstanding obligations to suppliers and vendors. It assists in managing cash outflows and payment schedules.

Each of these documents plays a vital role in providing a complete picture of a business's financial situation. Together, they enable informed decision-making and strategic planning.

Profit And Loss Preview

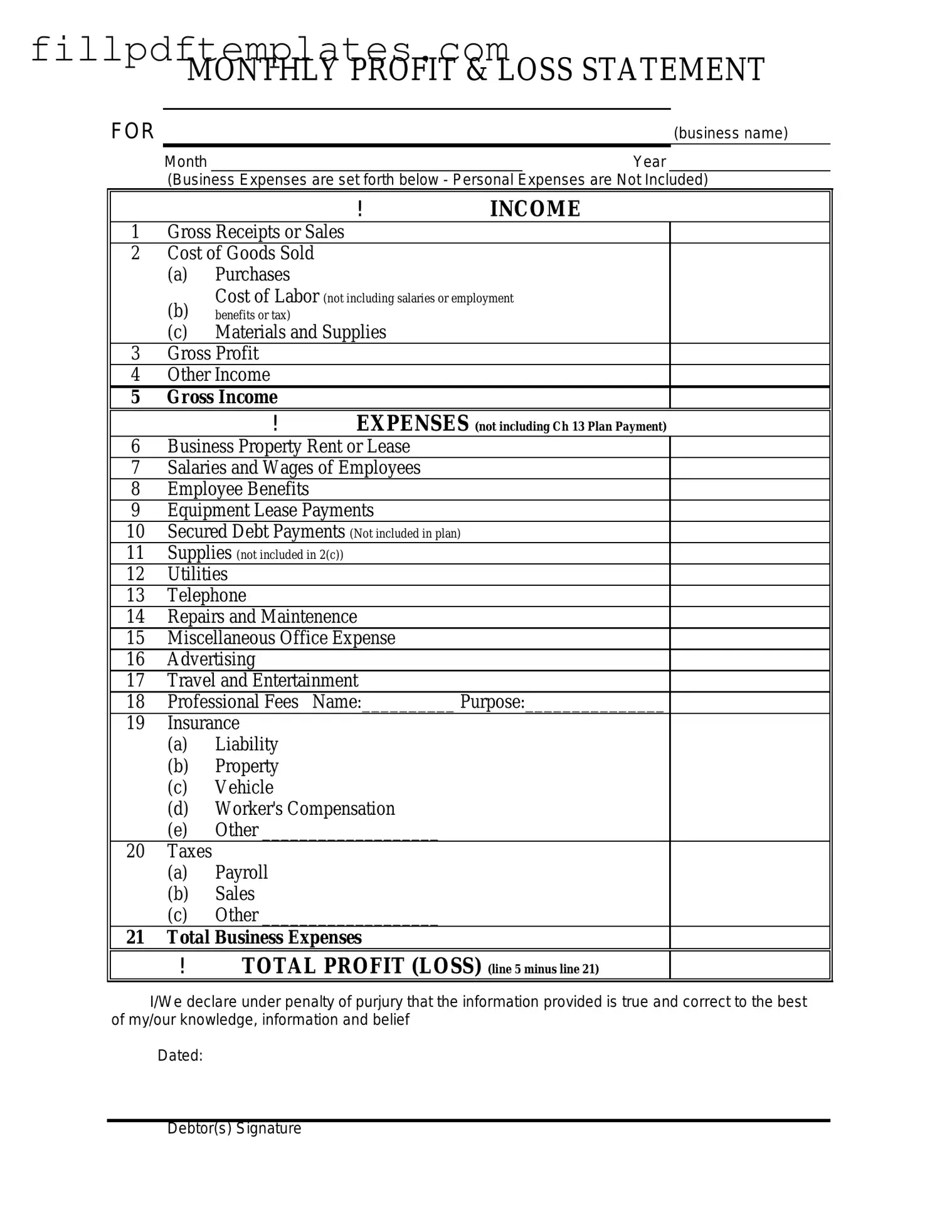

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature