Valid Power of Attorney Form

The Power of Attorney form serves as a crucial legal document that empowers an individual, known as the principal, to designate another person, referred to as the agent or attorney-in-fact, to act on their behalf. This arrangement can cover a wide range of responsibilities, from managing financial affairs and making healthcare decisions to handling real estate transactions. The form can be tailored to grant specific powers or can be comprehensive, allowing the agent to make decisions across various domains. Importantly, the Power of Attorney can be durable, meaning it remains effective even if the principal becomes incapacitated, or it can be limited to a specific timeframe or purpose. Understanding the implications of this document is essential, as it not only facilitates decision-making in times of need but also requires careful consideration of trust and responsibility between the principal and the agent. Various state laws govern the execution and validity of the Power of Attorney, making it imperative for individuals to be aware of their local regulations when creating this important legal instrument.

Power of Attorney - Customized for Each State

Power of Attorney Form Subtypes

Fill out More Documents

What Should Be Included in a Photo Release Form - The form outlines that employees will not receive compensation for the use of their images.

The ADP Pay Stub form is an important document that provides employees with a detailed breakdown of their earnings and deductions for each pay period. Understanding this form can help individuals stay on top of their finances and ensure they are being compensated accurately. If you're ready to manage your payroll information, you can fill out the Adp Pay Stub form by clicking the button below.

How to Run a Criminal Background Check on Yourself - List your full name and Social Security number for identification purposes.

Similar forms

-

Living Will: A living will allows individuals to express their wishes regarding medical treatment in case they become unable to communicate. Like a Power of Attorney, it grants authority over personal decisions, specifically in healthcare situations.

-

Health Care Proxy: This document designates someone to make medical decisions on behalf of another person. Similar to a Power of Attorney, it ensures that someone trusted can act in accordance with the individual's healthcare preferences.

-

Durable Power of Attorney: This form is a specific type of Power of Attorney that remains effective even if the individual becomes incapacitated. It serves a similar purpose by allowing another person to manage financial or legal matters.

-

Trust Document: A trust document outlines how assets will be managed and distributed. Like a Power of Attorney, it involves appointing someone to act on behalf of the individual, ensuring their wishes are followed regarding asset management.

- Bill of Sale: This document serves as proof of the transfer of ownership of personal property, detailing information such as the item sold, the sale price, and the parties involved. For templates to guide you through this process, visit Top Document Templates.

-

Financial Power of Attorney: This document specifically grants authority to manage financial affairs. It is a focused version of the general Power of Attorney, emphasizing financial decisions and transactions.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| Types | There are several types of POAs, including general, limited, durable, and medical. Each serves a different purpose. |

| Durable POA | A durable POA remains effective even if the principal becomes incapacitated. This is crucial for long-term planning. |

| State-Specific Forms | Each state has its own specific requirements and forms for POAs. It's important to use the correct form for your state. |

| Governing Laws | The Uniform Power of Attorney Act provides a framework, but states may have additional laws governing POAs. |

| Revocation | A principal can revoke a POA at any time, as long as they are competent. This revocation should be documented. |

| Agent's Duties | The agent must act in the best interest of the principal and follow their wishes as outlined in the POA. |

| Execution Requirements | Most states require the POA to be signed by the principal and witnessed or notarized to be valid. |

| Financial Authority | A POA can grant broad financial powers, including managing bank accounts, paying bills, and making investments. |

| Medical Decisions | A medical POA specifically allows the agent to make healthcare decisions on behalf of the principal if they are unable to do so. |

Things You Should Know About This Form

-

What is a Power of Attorney (POA)?

A Power of Attorney is a legal document that allows one person, known as the "principal," to grant another person, called the "agent" or "attorney-in-fact," the authority to act on their behalf. This can include making financial decisions, managing property, or handling legal matters. The principal can specify the extent of the agent's authority, which can be broad or limited to specific tasks.

-

Why might I need a Power of Attorney?

Having a Power of Attorney can be crucial for various reasons. It ensures that someone you trust can make decisions for you if you become unable to do so yourself due to illness, injury, or absence. This document can help avoid delays and complications in managing your affairs during challenging times.

-

What types of Power of Attorney are there?

There are several types of Power of Attorney, including:

- General Power of Attorney: Grants broad powers to the agent to act on behalf of the principal in various matters.

- Limited Power of Attorney: Restricts the agent's authority to specific tasks or for a limited time.

- Durable Power of Attorney: Remains in effect even if the principal becomes incapacitated.

- Springing Power of Attorney: Becomes effective only under certain conditions, typically when the principal becomes incapacitated.

-

How do I choose an agent for my Power of Attorney?

Selecting an agent is a significant decision. Choose someone you trust, such as a family member, close friend, or a professional advisor. This person should be responsible, reliable, and willing to take on the duties outlined in the Power of Attorney. It is also wise to discuss your wishes and expectations with them beforehand.

-

Can I revoke or change my Power of Attorney?

Yes, you can revoke or change your Power of Attorney at any time, as long as you are mentally competent. To do so, you must create a new document or formally revoke the existing one, notifying your agent and any relevant institutions of the change. It is essential to follow the proper legal procedures to ensure that your revocation is valid.

-

Do I need a lawyer to create a Power of Attorney?

While it is not strictly necessary to hire a lawyer to create a Power of Attorney, consulting with one can be beneficial. A legal professional can help ensure that the document complies with state laws and accurately reflects your wishes. If your situation is complex, legal advice may be particularly valuable.

-

How do I ensure my Power of Attorney is valid?

To ensure that your Power of Attorney is valid, you must follow your state’s specific requirements. This often includes signing the document in the presence of a notary public or witnesses. It is crucial to check local laws, as requirements can vary significantly from state to state.

-

What happens if I do not have a Power of Attorney?

If you do not have a Power of Attorney and become incapacitated, a court may need to appoint a guardian or conservator to manage your affairs. This process can be lengthy and may not align with your preferences. Having a Power of Attorney in place can help ensure that your wishes are honored and that decisions are made by someone you trust.

Documents used along the form

When establishing a Power of Attorney, several additional forms and documents may be necessary to ensure comprehensive legal authority and clarity. Below is a list of commonly used documents that complement the Power of Attorney.

- Advance Healthcare Directive: This document outlines an individual's preferences regarding medical treatment and interventions in case they become unable to communicate their wishes.

- Lease Agreement Form: To streamline your rental process, make sure to utilize our comprehensive Lease Agreement preparation guide for accurate documentation.

- Living Will: A living will specifies the types of medical care an individual wishes to receive or avoid, particularly in end-of-life situations.

- Durable Power of Attorney: Similar to a standard Power of Attorney, this document remains effective even if the individual becomes incapacitated.

- Financial Power of Attorney: This form grants authority specifically for financial matters, allowing the agent to manage the principal's financial affairs.

- Trust Document: A trust document establishes a legal entity that holds assets for the benefit of designated beneficiaries, often used for estate planning.

- Will: A will outlines how an individual's assets will be distributed after their death and can also appoint guardians for minor children.

These documents can work together to provide a more complete legal framework for managing personal and financial affairs. It is advisable to consult with a legal professional to determine which documents are appropriate for your specific situation.

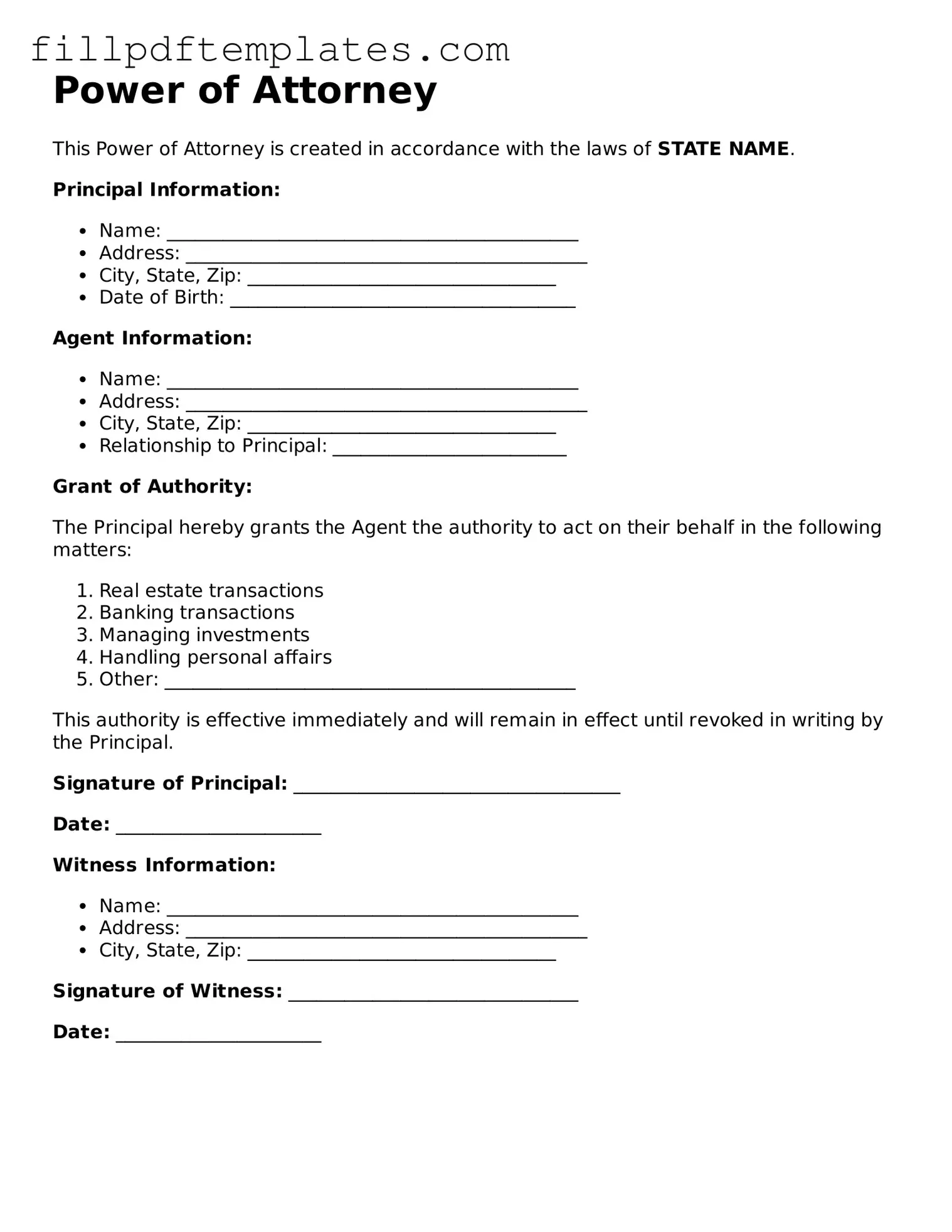

Power of Attorney Preview

Power of Attorney

This Power of Attorney is created in accordance with the laws of STATE NAME.

Principal Information:

- Name: ____________________________________________

- Address: ___________________________________________

- City, State, Zip: _________________________________

- Date of Birth: _____________________________________

Agent Information:

- Name: ____________________________________________

- Address: ___________________________________________

- City, State, Zip: _________________________________

- Relationship to Principal: _________________________

Grant of Authority:

The Principal hereby grants the Agent the authority to act on their behalf in the following matters:

- Real estate transactions

- Banking transactions

- Managing investments

- Handling personal affairs

- Other: ____________________________________________

This authority is effective immediately and will remain in effect until revoked in writing by the Principal.

Signature of Principal: ___________________________________

Date: ______________________

Witness Information:

- Name: ____________________________________________

- Address: ___________________________________________

- City, State, Zip: _________________________________

Signature of Witness: _______________________________

Date: ______________________