Fill a Valid Payroll Check Template

The Payroll Check form plays a crucial role in the financial operations of any business, serving as a key document for employee compensation. This form typically includes essential information such as the employee's name, identification number, and the pay period for which the wages are being issued. Additionally, it outlines the gross pay, deductions for taxes and benefits, and the net pay that the employee will receive. Employers must ensure that the form is accurate and complies with relevant labor laws to avoid potential disputes. Furthermore, the Payroll Check form may also include details about overtime, bonuses, and any other additional compensation that may apply. By maintaining clear and precise records through this form, businesses can promote transparency and accountability in their payroll processes.

Additional PDF Templates

T-47 Description of Property - The T-47 is often requested by title companies and lenders to facilitate closing.

The New Jersey Transfer-on-Death Deed form is an essential tool for property owners looking to simplify the inheritance process. By using this legal document, individuals can designate beneficiaries who will automatically receive ownership of the real estate upon their passing, thus avoiding the complexities and delays associated with probate. This not only provides peace of mind but also ensures that your loved ones can inherit property seamlessly. For more information and to access the form, visit todform.com/blank-new-jersey-transfer-on-death-deed.

Acord 130 - The Acord 130 form is crucial for obtaining adequate workers compensation coverage.

Irs 2553 Form - Shareholders must have equal voting rights to qualify for S corporation status.

Similar forms

The Payroll Check form is an essential document for managing employee compensation. It shares similarities with several other important documents in the payroll and financial landscape. Here’s a look at nine documents that are akin to the Payroll Check form:

- Pay Stub: This document provides a detailed breakdown of an employee's earnings, deductions, and net pay for a specific pay period, similar to the Payroll Check form, which also outlines payment details.

- W-2 Form: Issued annually, the W-2 form summarizes an employee's total earnings and tax withholdings for the year. Like the Payroll Check, it reflects compensation but on a yearly basis.

- Direct Deposit Authorization Form: This form allows employees to authorize their employer to deposit their pay directly into their bank account. It relates to the Payroll Check by facilitating the payment process.

- Payroll Register: A payroll register is a comprehensive record of all payroll transactions for a specific period. It includes information similar to what is found on a Payroll Check, such as gross pay and deductions.

- Time Sheet: Employees use time sheets to record hours worked. This document is crucial for calculating the amount reflected in the Payroll Check.

- Employment Contract: This agreement outlines the terms of employment, including salary. It serves as a foundation for the payments made on the Payroll Check.

- Rental Application Form: Before securing a lease, it’s essential to complete the thorough Rental Application process to ensure all necessary information is collected for landlord review.

- Expense Reimbursement Form: Employees use this form to request reimbursement for work-related expenses. While it’s not a direct payment like a Payroll Check, it still involves the disbursement of funds from the employer.

- Tax Withholding Certificate (W-4): This form helps employers determine the amount of federal income tax to withhold from an employee's paycheck. It directly influences the net amount shown on the Payroll Check.

- Bonus or Commission Agreement: This document outlines additional compensation outside of regular pay, similar to how a Payroll Check may include bonuses or commissions as part of the overall payment.

Understanding these documents can help ensure a smoother payroll process and better financial management for both employers and employees.

Document Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Payroll Check form is used to document payments made to employees for their work, ensuring proper record-keeping and compliance with tax laws. |

| Components | Typically includes employee name, payment amount, date, hours worked, and pay period. |

| Frequency of Use | Commonly issued on a bi-weekly or monthly basis, depending on the employer's payroll schedule. |

| State-Specific Requirements | Some states may have additional requirements, such as itemized deductions or specific formatting guidelines. |

| Governing Laws | Payroll checks are governed by the Fair Labor Standards Act (FLSA) at the federal level, along with state-specific labor laws. |

| Tax Implications | Employers must withhold federal, state, and sometimes local taxes from payroll checks, impacting the net amount received by employees. |

| Record Keeping | Employers are required to keep payroll records for a minimum of three years, including copies of payroll checks issued. |

| Digital vs. Paper | Many employers are transitioning to digital payroll systems, allowing for electronic checks and easier tracking of payments. |

Things You Should Know About This Form

-

What is a Payroll Check form?

A Payroll Check form is a document used by employers to issue payments to employees for their work. It typically includes details such as the employee's name, payment amount, pay period, and any deductions. This form serves as an official record of payment and is essential for both accounting and tax purposes.

-

Why is the Payroll Check form important?

The Payroll Check form is crucial for ensuring that employees are paid accurately and on time. It also helps maintain compliance with labor laws and tax regulations. By documenting each payment, employers can keep clear records that are necessary for audits and financial reporting.

-

What information is typically included in a Payroll Check form?

Commonly included information in a Payroll Check form consists of:

- Employee's name

- Employee's identification number

- Payment amount

- Pay period dates

- Deductions (taxes, benefits, etc.)

- Employer's information

- Signature of the authorized person

-

How often should Payroll Check forms be issued?

Payroll Check forms are typically issued on a regular schedule, such as weekly, bi-weekly, or monthly, depending on the employer's payroll policy. Consistency in issuing these forms helps employees manage their finances and ensures that payroll records are up-to-date.

-

Can Payroll Check forms be issued electronically?

Yes, Payroll Check forms can be issued electronically. Many employers use payroll software that allows for electronic payments and digital records. However, it is essential to ensure that electronic forms comply with relevant regulations and that employees have access to their payment information.

-

What should I do if there is an error on my Payroll Check form?

If an error is found on a Payroll Check form, it is important to notify the employer or payroll department immediately. Corrections can often be made quickly, and the employee should receive a corrected check or a proper adjustment in the next payroll cycle.

-

How are Payroll Check forms related to taxes?

Payroll Check forms are closely tied to tax reporting. They include necessary information about wages and deductions, which are reported to tax authorities. Employers must ensure that the information on these forms is accurate to avoid penalties and ensure compliance with tax laws.

-

What happens if a Payroll Check form is lost?

If a Payroll Check form is lost, the employee should report it to their employer or payroll department as soon as possible. Employers can often issue a stop payment on the lost check and reissue a new one. It is advisable to act quickly to prevent any potential issues with payment.

-

Are Payroll Check forms the same for all employees?

While the basic structure of Payroll Check forms may be similar, the details will vary based on individual employee circumstances. Factors such as pay rates, deductions, and hours worked will differ, leading to unique forms for each employee.

-

How long should Payroll Check forms be kept?

Employers should retain Payroll Check forms for a minimum of three to seven years, depending on federal and state regulations. Keeping these records helps in case of audits or disputes regarding payments. Employees may also want to keep copies for their personal records.

Documents used along the form

In addition to the Payroll Check form, several other documents are commonly utilized to ensure accurate and efficient payroll processing. Each of these forms serves a specific purpose in the payroll system and helps maintain proper records for both the employer and employee.

- W-4 Form: This form is completed by employees to indicate their tax withholding preferences. It provides information on filing status and allowances, which helps employers calculate the correct amount of federal income tax to withhold from each paycheck.

- Time Sheet: A time sheet records the hours worked by an employee during a specific pay period. It can be used to track regular hours, overtime, and any leave taken, ensuring accurate payment for hours worked.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their paychecks directly into their bank accounts. It streamlines the payment process and enhances convenience for employees.

- Pay Stub: A pay stub accompanies the payroll check and provides a detailed breakdown of an employee's earnings, deductions, and net pay for the pay period. It serves as a record for employees to review their compensation and tax withholdings.

- Hold Harmless Agreement: This agreement is essential for protecting against potential liabilities related to payroll practices. Employers can safeguard their interests by utilizing a Hold Harmless Agreement to mitigate risks associated with employment-related claims.

- Payroll Summary Report: This report summarizes the payroll expenses for a specific period. It includes total wages, taxes withheld, and other deductions, providing an overview for accounting and financial planning purposes.

Understanding these documents is essential for both employers and employees. Each form plays a crucial role in ensuring compliance and accuracy in payroll management.

Payroll Check Preview

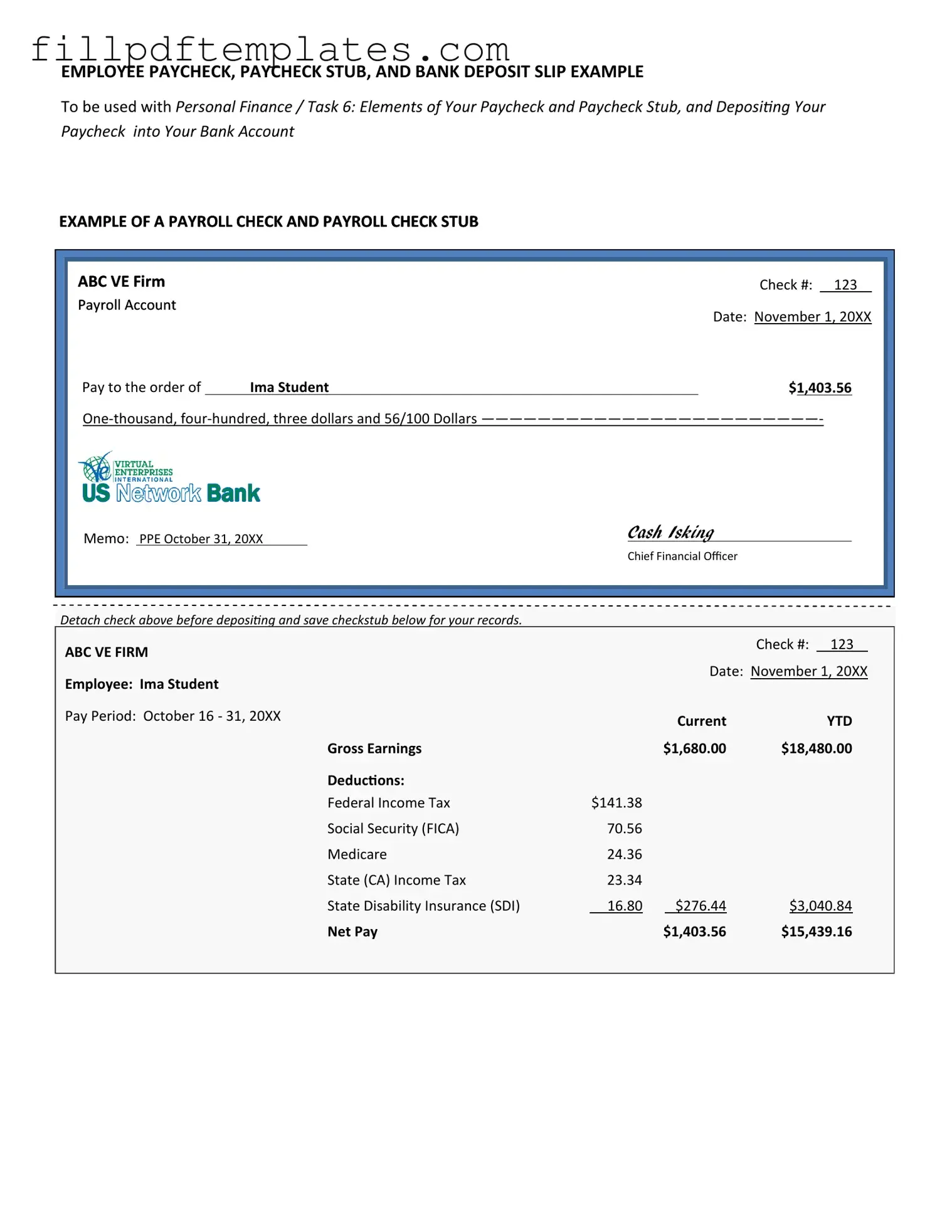

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

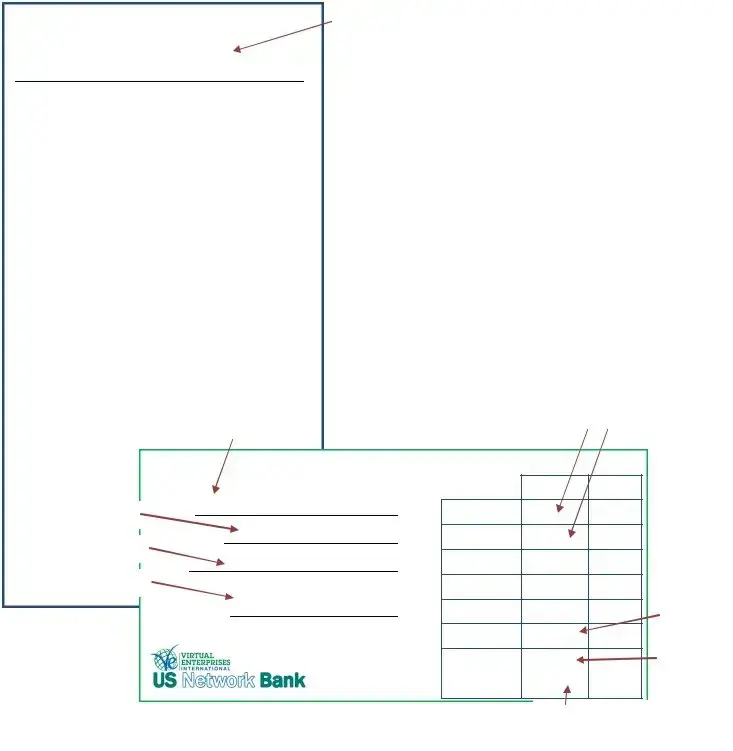

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account