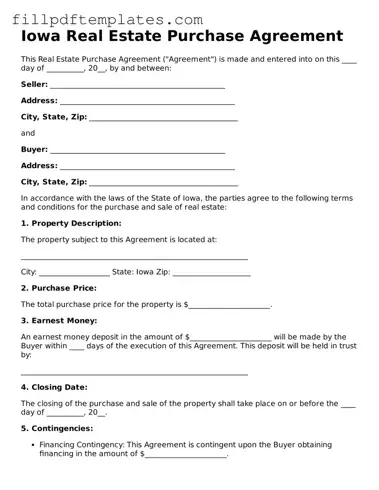

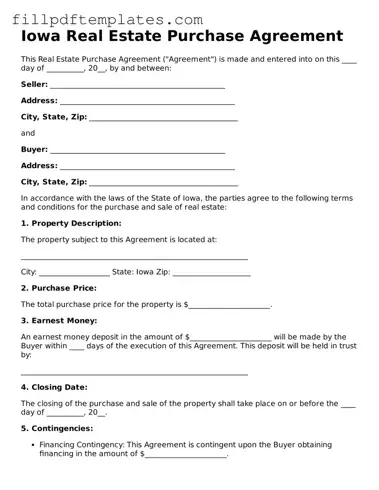

The Iowa Real Estate Purchase Agreement form is a legal document that outlines the terms and conditions for buying or selling real estate in Iowa. This agreement serves as a crucial tool for both buyers and sellers, ensuring clarity and...

The Iowa Rental Application form is a crucial document used by landlords to gather essential information about potential tenants. This form typically includes personal details, rental history, and financial information, helping landlords make informed decisions. Understanding how to complete this...

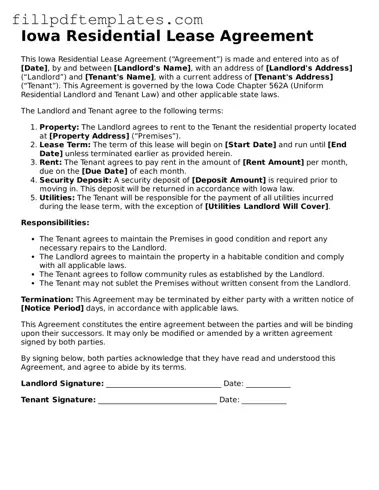

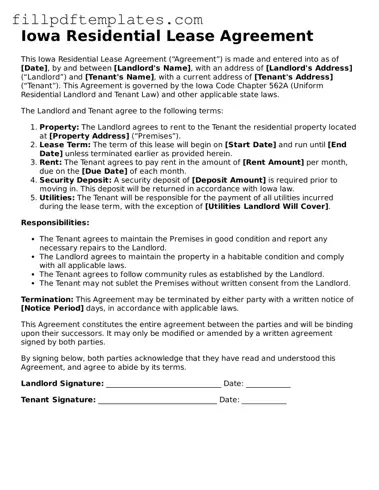

The Iowa Residential Lease Agreement is a legal document that outlines the terms and conditions between a landlord and tenant for renting residential property in Iowa. This form serves to protect the rights of both parties, ensuring clarity in the...

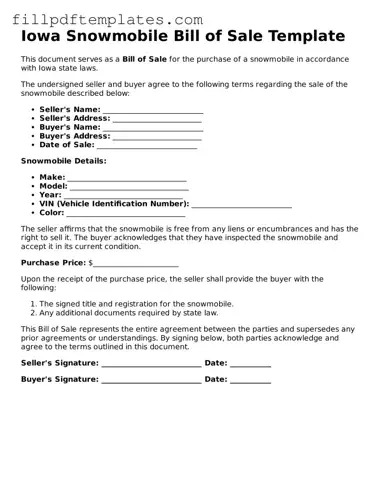

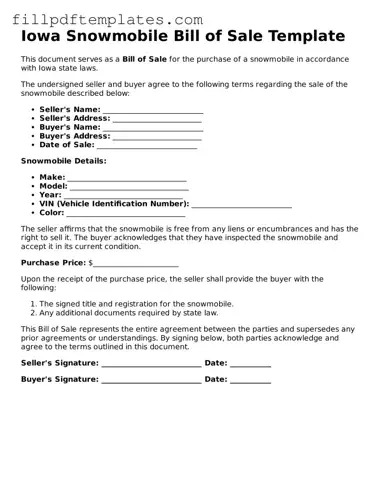

The Iowa Snowmobile Bill of Sale form is a crucial document that facilitates the legal transfer of ownership for snowmobiles in the state of Iowa. This form provides essential details about the transaction, including the seller's and buyer's information, as...

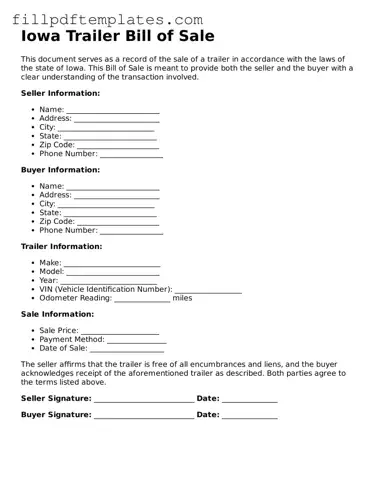

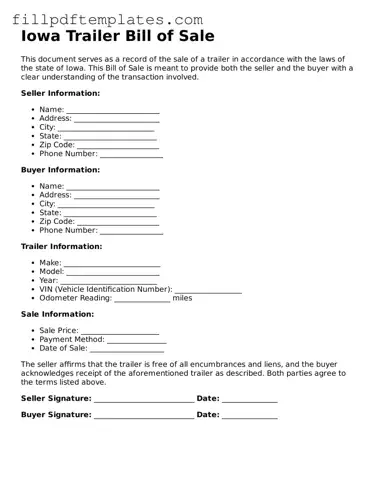

The Iowa Trailer Bill of Sale form is a legal document that records the sale and transfer of ownership of a trailer in the state of Iowa. This form serves as proof of the transaction, detailing essential information about the...

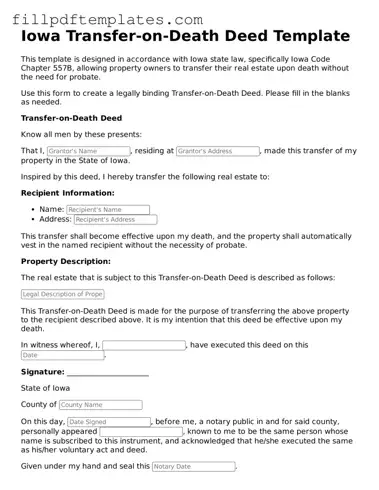

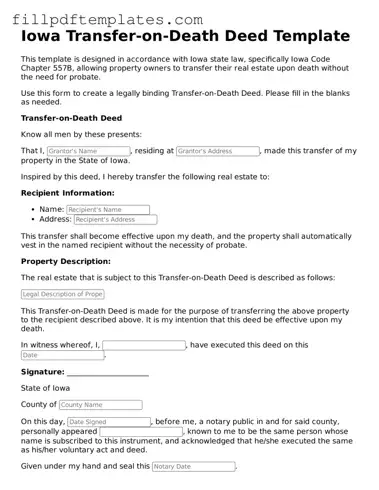

The Iowa Transfer-on-Death Deed form allows property owners to designate a beneficiary who will receive their property upon their passing, without the need for probate. This simple yet effective tool can provide peace of mind and streamline the transfer process...

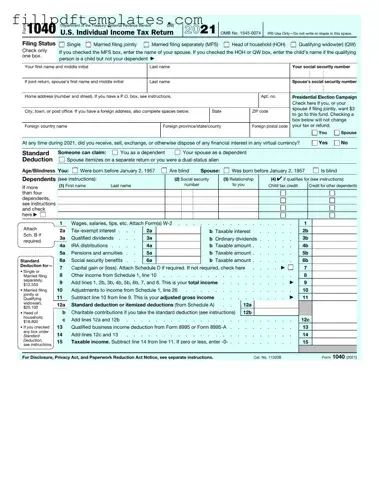

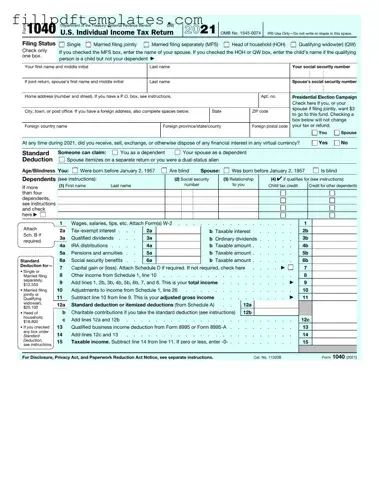

The IRS 1040 form is the standard federal income tax form used by individuals to report their income, claim tax deductions, and calculate their tax liability. Completing this form accurately is crucial for ensuring compliance with tax laws and maximizing...

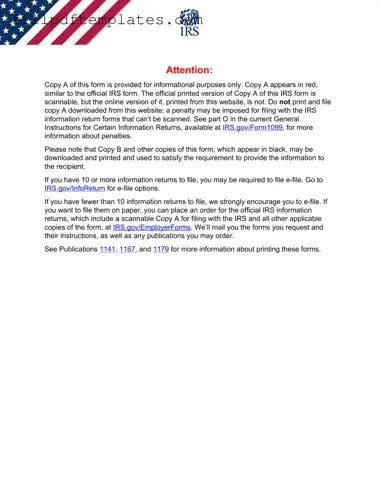

The IRS 1099-MISC form is used to report various types of income received by individuals who are not employees. This form is essential for freelancers, independent contractors, and other non-employee workers to accurately report their earnings to the IRS. Ready...

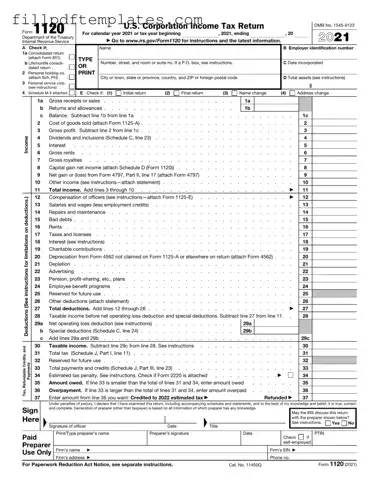

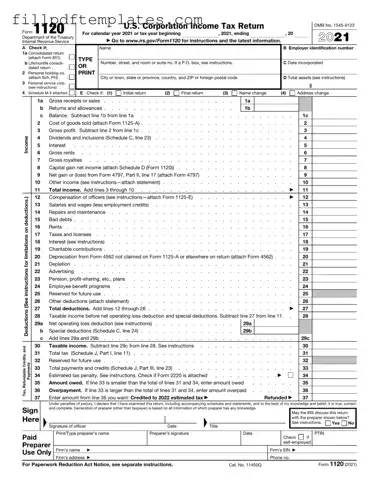

The IRS Form 1120 is a tax return used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for ensuring compliance with federal tax regulations and calculating the corporation's tax liability. For detailed guidance...

The IRS Form 2553 is a crucial document that allows eligible small businesses to elect S corporation status for tax purposes. By making this election, businesses can potentially benefit from pass-through taxation, which may lead to significant tax savings. Understanding...

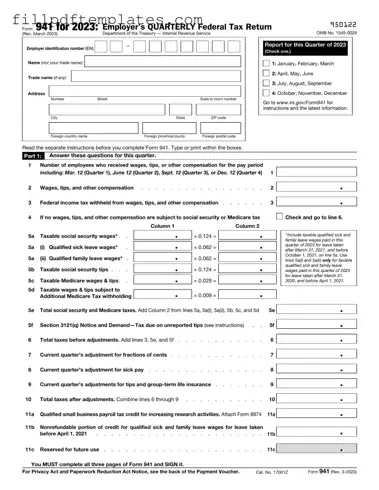

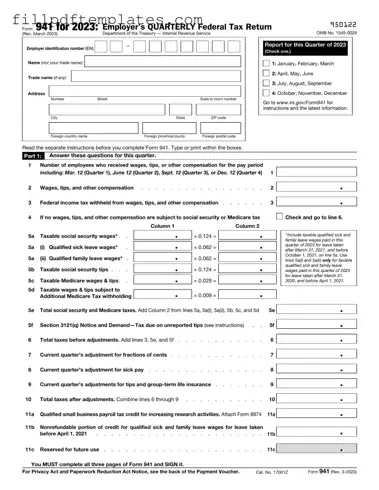

The IRS 941 form is a quarterly tax return that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form helps the IRS track payroll taxes and ensures that businesses comply with...

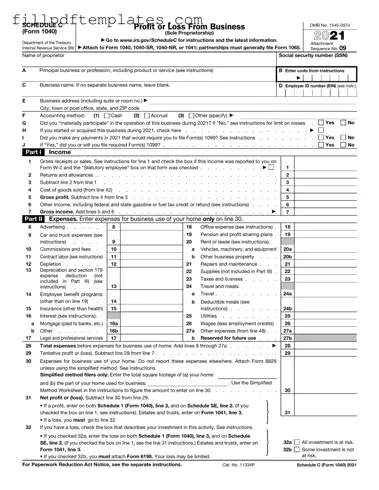

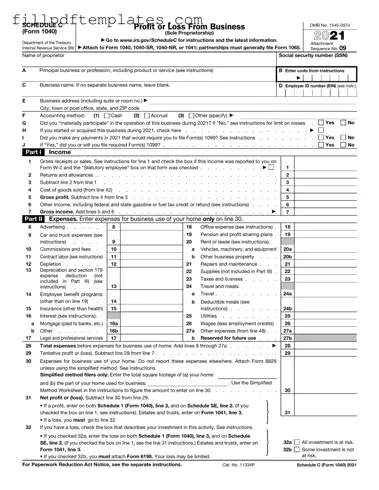

The IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business. This form helps individuals detail their earnings and expenses, allowing for accurate tax calculations. To learn more about...