Valid Owner Financing Contract Form

When navigating the complexities of real estate transactions, the Owner Financing Contract form emerges as a vital tool for both buyers and sellers. This agreement allows sellers to provide financing directly to buyers, bypassing traditional mortgage lenders. It outlines essential terms such as the purchase price, interest rate, payment schedule, and the duration of the loan. Additionally, it specifies the responsibilities of both parties, including property maintenance and insurance requirements. By utilizing this form, buyers can often secure a home even when they may face challenges obtaining conventional financing. Sellers, on the other hand, can benefit from a quicker sale and potentially earn interest on the financing they provide. Understanding the nuances of this contract is crucial for ensuring a smooth transaction and protecting the interests of both parties involved.

Different Types of Owner Financing Contract Forms:

How to Fire a Realtor Example Letter - This form is straightforward but crucial for real estate processes.

In addition to the important aspects already mentioned, individuals looking to utilize the Colorado Real Estate Purchase Agreement form can find helpful resources and templates online, such as those available at https://coloradoformpdf.com, which can facilitate a better understanding of the document's requirements and ensure that all necessary information is accurately captured.

Purchase Agreement Addendum - Establishes a record of all modifications for future reference.

Similar forms

- Purchase Agreement: Similar to an Owner Financing Contract, this document outlines the terms of a real estate sale, including price and contingencies. Both serve to protect the interests of the buyer and seller.

- Lease Option Agreement: This document allows a tenant to lease a property with the option to purchase it later. Like owner financing, it provides flexibility in financing arrangements.

- Promissory Note: A promissory note is a written promise to pay a specified amount of money at a future date. It is often part of owner financing, detailing the buyer's commitment to repay the seller.

- Deed of Trust: This document secures the loan by transferring the property title to a trustee until the loan is paid off. It is often used in conjunction with owner financing to protect the seller's interests.

- Real Estate Purchase Agreement Form: To initiate the transaction smoothly, it is essential to print and complete the form that outlines all terms and conditions associated with the sale.

- Mortgage Agreement: Similar to a deed of trust, this document outlines the terms of the loan and secures the property as collateral. Both agreements ensure the lender can reclaim the property if the borrower defaults.

- Real Estate Option Agreement: This gives a buyer the right, but not the obligation, to purchase a property at a later date. It shares similarities with owner financing in terms of flexibility and future purchase potential.

- Seller Financing Addendum: This is an addition to a standard purchase agreement that specifies the seller will finance part of the purchase price. It complements owner financing by detailing specific terms.

- Contract for Deed: Also known as a land contract, this document allows the buyer to take possession of the property while making payments directly to the seller. It resembles owner financing in structure and purpose.

- Equity Sharing Agreement: This document allows two parties to share ownership and financial responsibilities of a property. It offers an alternative financing structure similar to owner financing.

- Financing Contingency Clause: This clause in a purchase agreement allows the buyer to back out if they cannot secure financing. It is related to owner financing as it addresses the financing aspect of a real estate transaction.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | An owner financing contract is an agreement where the seller provides financing to the buyer, allowing them to purchase the property without traditional bank financing. |

| Parties Involved | The contract involves two primary parties: the seller (or owner) and the buyer. Each party has specific rights and obligations under the agreement. |

| Payment Terms | Payment terms, including the interest rate, payment schedule, and duration of the loan, are clearly outlined in the contract. |

| Governing Law | The governing law for owner financing contracts varies by state. For example, in California, it is governed by the California Civil Code. |

| Down Payment | Typically, a down payment is required, which can vary depending on the agreement between the buyer and seller. |

| Default Provisions | The contract includes provisions detailing the consequences of default, including potential foreclosure processes. |

| Title Transfer | Title to the property may transfer to the buyer upon signing the contract, but the seller retains a security interest until the loan is paid in full. |

| Legal Requirements | Some states require specific disclosures or documentation to be included in owner financing contracts to protect both parties. |

| Advantages | Owner financing can provide benefits such as quicker sales, flexibility in negotiations, and access for buyers who may not qualify for traditional loans. |

Things You Should Know About This Form

-

What is an Owner Financing Contract?

An Owner Financing Contract is an agreement between a seller and a buyer where the seller provides financing to the buyer for the purchase of property. Instead of obtaining a traditional mortgage from a bank, the buyer makes payments directly to the seller. This arrangement can benefit both parties by facilitating a sale when traditional financing is not available.

-

Who benefits from an Owner Financing Contract?

Both buyers and sellers can benefit from this type of contract. Buyers may find it easier to qualify for financing, especially if they have less-than-perfect credit. Sellers can attract more potential buyers and may receive a higher sale price. Additionally, sellers can earn interest on the financing, providing them with a steady income stream.

-

What terms should be included in an Owner Financing Contract?

Key terms to include are the purchase price, down payment amount, interest rate, payment schedule, and duration of the loan. Additionally, specify any contingencies, such as the buyer's right to prepay the loan or the consequences of default. Clear terms help prevent misunderstandings and protect both parties.

-

Is an Owner Financing Contract legally binding?

Yes, an Owner Financing Contract is a legally binding agreement. Both parties must adhere to the terms outlined in the contract. It is advisable to have the contract reviewed by a legal professional to ensure compliance with local laws and regulations.

-

What happens if the buyer defaults on the contract?

If the buyer defaults, the seller typically has the right to initiate foreclosure proceedings, similar to a bank. The specific remedies available depend on the terms of the contract and state laws. It is crucial to outline the consequences of default in the contract to avoid disputes later.

-

Can an Owner Financing Contract be refinanced?

Yes, a buyer can refinance an Owner Financing Contract. This process involves obtaining a traditional mortgage to pay off the seller. The buyer should discuss this option with the seller and ensure that any necessary provisions are included in the original contract.

-

Are there any risks associated with Owner Financing Contracts?

Yes, there are risks for both buyers and sellers. Buyers may face higher interest rates than traditional loans, and sellers may risk buyer default. It is essential for both parties to conduct due diligence, including assessing the buyer's financial situation and the property's value.

-

How can I ensure my Owner Financing Contract is fair?

To ensure fairness, both parties should engage in open communication and negotiate terms that meet their needs. Consulting with a real estate attorney or a qualified real estate professional can provide valuable insights and help draft a balanced contract.

Documents used along the form

When entering into an owner financing arrangement, several additional documents may be necessary to ensure clarity and protect the interests of all parties involved. Each of these documents serves a specific purpose in the transaction.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount to the seller. It includes details such as the loan amount, interest rate, and repayment schedule.

- Deed of Trust: This document secures the loan by transferring an interest in the property to a trustee until the borrower repays the loan. It provides the seller with a legal claim to the property if the borrower defaults.

- Disclosure Statement: This document provides important information about the financing terms and any potential risks. It ensures that the borrower understands their obligations and the implications of the agreement.

- Real Estate Purchase Agreement: This essential document outlines the terms and conditions of a real estate transaction, ensuring both parties' rights and obligations are clearly defined. For more information and to access the form, visit https://texasdocuments.net/printable-real-estate-purchase-agreement-form.

- Purchase Agreement: This document outlines the terms of the sale, including the purchase price and any contingencies. It establishes the framework for the transaction prior to finalizing the financing details.

- Title Insurance Policy: This insurance protects the buyer and lender against any claims or disputes regarding the property's title. It ensures that the seller has the right to sell the property free of liens or other encumbrances.

- Property Inspection Report: This document details the condition of the property at the time of sale. It can help identify any issues that may affect the value or safety of the property.

- Closing Statement: This document summarizes the financial details of the transaction, including all costs and fees associated with the sale. It is provided at the closing of the transaction for transparency.

- Amortization Schedule: This document breaks down the repayment of the loan over time, showing how much of each payment goes toward interest and principal. It helps the borrower understand their payment obligations.

These documents work together to create a comprehensive framework for the owner financing transaction. Each plays a critical role in ensuring that both parties are informed and protected throughout the process.

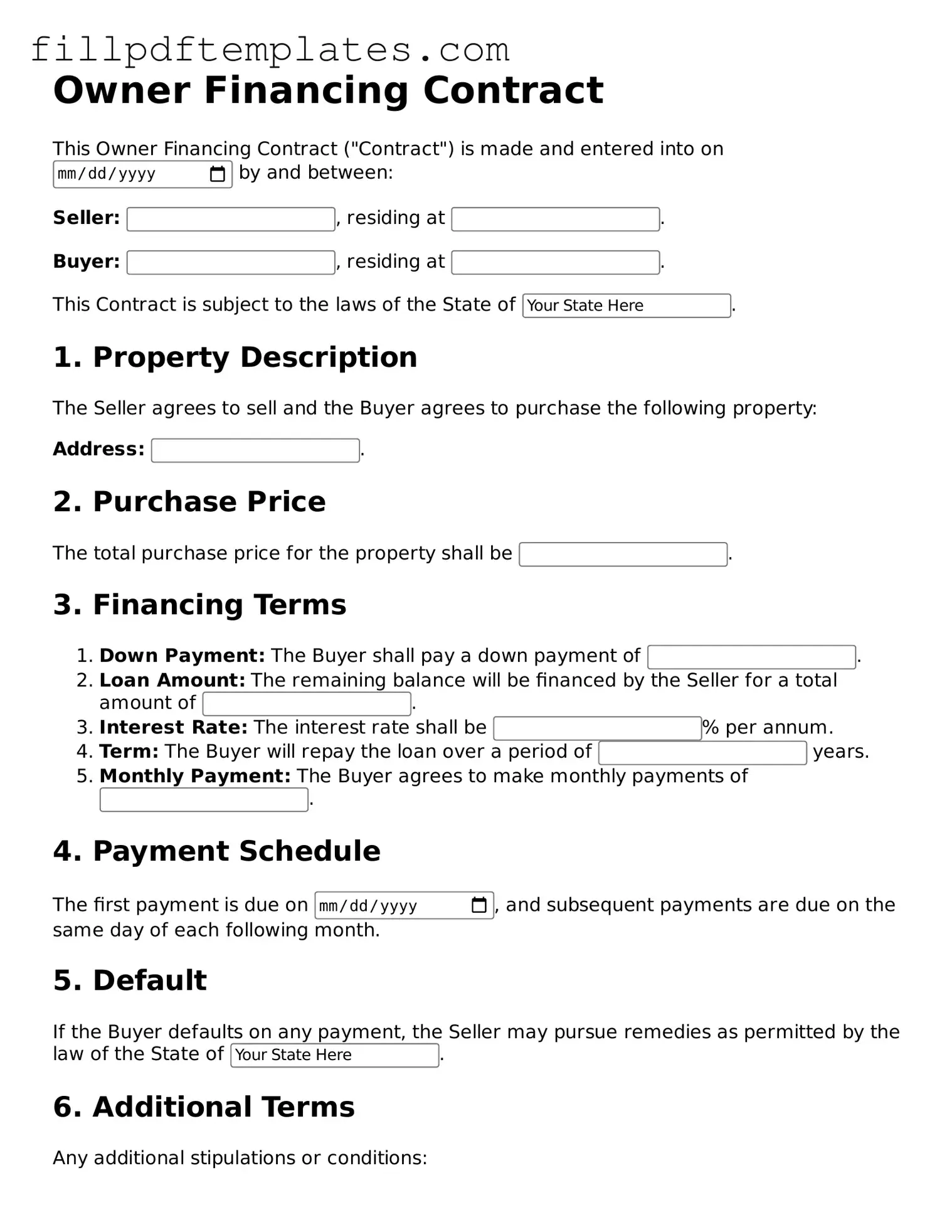

Owner Financing Contract Preview

Owner Financing Contract

This Owner Financing Contract ("Contract") is made and entered into on by and between:

Seller: , residing at .

Buyer: , residing at .

This Contract is subject to the laws of the State of .

1. Property Description

The Seller agrees to sell and the Buyer agrees to purchase the following property:

Address: .

2. Purchase Price

The total purchase price for the property shall be .

3. Financing Terms

- Down Payment: The Buyer shall pay a down payment of .

- Loan Amount: The remaining balance will be financed by the Seller for a total amount of .

- Interest Rate: The interest rate shall be % per annum.

- Term: The Buyer will repay the loan over a period of years.

- Monthly Payment: The Buyer agrees to make monthly payments of .

4. Payment Schedule

The first payment is due on , and subsequent payments are due on the same day of each following month.

5. Default

If the Buyer defaults on any payment, the Seller may pursue remedies as permitted by the law of the State of .

6. Additional Terms

Any additional stipulations or conditions:

7. Signatures

In witness whereof, the parties have executed this Owner Financing Contract as of the date above written.

Seller's Signature: _________________________ Date:

Buyer's Signature: _________________________ Date: