Blank New York Transfer-on-Death Deed Form

In the realm of estate planning, the New York Transfer-on-Death Deed form offers a practical solution for property owners seeking to simplify the transfer of real estate upon their passing. This form allows individuals to designate a beneficiary who will automatically receive ownership of the property without the need for probate, streamlining the process and reducing potential delays and costs. By filling out this deed, property owners can maintain control over their assets during their lifetime while ensuring a smooth transition for their loved ones after they are gone. It’s important to note that the deed must be properly executed and recorded to be effective, and it can be revoked or modified at any time before the owner's death. Additionally, this form is particularly beneficial for those who wish to avoid the complexities of traditional wills, making it a popular choice among New Yorkers looking to safeguard their real estate interests for future generations.

Other Common Transfer-on-Death Deed State Templates

Transfer on Death Deed Iowa Form - Beneficiaries named in the Transfer-on-Death Deed have no claim to the property until your death.

Can a Transfer on Death Deed Be Contested - It helps ensure that the owner’s real estate goes where they intended without unnecessary delays.

To create a corporation in South Carolina, the founders must prepare and file the Articles of Incorporation with the Secretary of State, which outlines key information such as the corporation's name, purpose, and its initial directors and registered agent, thereby establishing its legal existence in the state.

Transfer on Death Deed California Common Questions - It ensures that the property is transferred directly to the named beneficiaries without court involvement.

Similar forms

The Transfer-on-Death Deed (TODD) form is a useful tool for individuals looking to pass on their property without the complications of probate. It shares similarities with several other legal documents that facilitate the transfer of assets or property. Here’s a breakdown of nine documents that are comparable to the Transfer-on-Death Deed:

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. Like a TODD, it allows individuals to specify beneficiaries, but it goes through probate.

- Living Trust: A living trust holds assets during a person's lifetime and allows for their distribution upon death. It avoids probate, similar to a TODD, but requires more management and paperwork.

- Beneficiary Designation Forms: Commonly used for financial accounts and insurance policies, these forms allow individuals to name beneficiaries directly, ensuring assets pass outside of probate, much like a TODD.

- Joint Tenancy with Right of Survivorship: This property ownership arrangement allows co-owners to automatically inherit each other’s share upon death. It provides a direct transfer, similar to how a TODD works.

- Hold Harmless Agreement: This legal document protects one party from liability for injuries or damages suffered by another party. It allows individuals to engage in activities without fear of legal repercussions, much like how a Transfer-on-Death Deed facilitates property transfer without probate. For more information, you can refer to the Hold Harmless Agreement.

- Transfer-on-Death Registration for Securities: This document enables the transfer of stocks or bonds upon death, bypassing probate, akin to the TODD for real estate.

- Payable-on-Death Accounts: These bank accounts allow the account holder to designate a beneficiary who will receive the funds upon death, avoiding probate, similar to the TODD's intent.

- Health Care Proxy: While primarily for medical decisions, this document can also include provisions for asset management upon incapacitation, reflecting the TODD's focus on asset transfer.

- Durable Power of Attorney: This allows someone to manage your affairs if you become incapacitated. While it doesn’t directly transfer property upon death, it can be part of a broader estate planning strategy.

- Family Limited Partnership: This arrangement allows family members to manage and control assets while providing a way to transfer wealth to heirs, similar to the intent behind a TODD.

Understanding these documents can empower individuals to make informed decisions about their estate planning. Each serves a unique purpose but shares the common goal of simplifying the transfer of assets.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | The New York Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by New York Estates, Powers and Trusts Law (EPTL) § 13-4.1. |

| Execution Requirements | The deed must be signed by the property owner in the presence of a notary public and recorded in the county where the property is located. |

| Revocation | The property owner can revoke the Transfer-on-Death Deed at any time before their death by executing a new deed or a revocation document. |

Things You Should Know About This Form

-

What is a Transfer-on-Death Deed in New York?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner in New York to transfer real estate to a designated beneficiary upon the owner’s death. This deed enables the property to bypass the probate process, allowing for a smoother and quicker transfer of ownership. It is important to note that the transfer only occurs upon the death of the owner, and the owner retains full control of the property during their lifetime.

-

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must fill out the appropriate form, which includes details such as the property description, the name of the beneficiary, and the owner's information. After completing the form, it must be signed in the presence of a notary public. Finally, the deed should be filed with the county clerk's office where the property is located. This filing is crucial for the deed to be valid and enforceable.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you will need to create a new deed that explicitly revokes the previous one or simply file a revocation form with the county clerk. It’s essential to ensure that the new deed is properly executed and recorded to avoid any confusion regarding the transfer of the property.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, transferring property via a Transfer-on-Death Deed does not trigger immediate tax consequences. The property is not considered a gift during the owner’s lifetime, so there are no gift taxes. However, the beneficiary may face capital gains taxes when they sell the property after inheriting it. It’s advisable to consult with a tax professional to understand any potential tax implications fully.

Documents used along the form

When planning for the transfer of property in New York, the Transfer-on-Death Deed form is a crucial document. However, it often works in conjunction with several other forms and documents that help ensure a smooth transition of property ownership. Below is a list of related documents that you may need to consider.

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death. It can complement a Transfer-on-Death Deed by addressing other assets not covered by the deed.

- Living Trust: A living trust allows a person to manage their assets during their lifetime and specify how those assets should be distributed upon death. This can provide additional benefits such as avoiding probate.

- Power of Attorney: This document grants someone else the authority to act on your behalf in financial or legal matters. It is useful if you become incapacitated and need someone to manage your property.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person. It may be necessary if there is no will and can clarify who is entitled to the property.

- Property Deed: The original property deed serves as proof of ownership. It is important to keep this document updated, especially when using a Transfer-on-Death Deed.

- Certificate of Death: This official document verifies the death of an individual. It is often required to complete the transfer of property after someone passes away.

- Notice of Death: This notice may need to be filed with the county clerk or other relevant authorities to formally announce the death and initiate the transfer process.

- Transfer-on-Death Deed Form: This crucial document allows for the seamless transfer of property to beneficiaries upon death, avoiding probate, as highlighted in detail here: https://transferondeathdeedform.com/indiana-transfer-on-death-deed.

- Tax Documents: Depending on the property and its value, tax documents may be necessary to address any estate or inheritance tax obligations that arise after death.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for specific assets like bank accounts or retirement plans, ensuring that these assets transfer outside of probate.

Understanding these documents can greatly assist in the planning and execution of property transfers in New York. Each plays a vital role in ensuring that your wishes are honored and that the process is as seamless as possible for your loved ones.

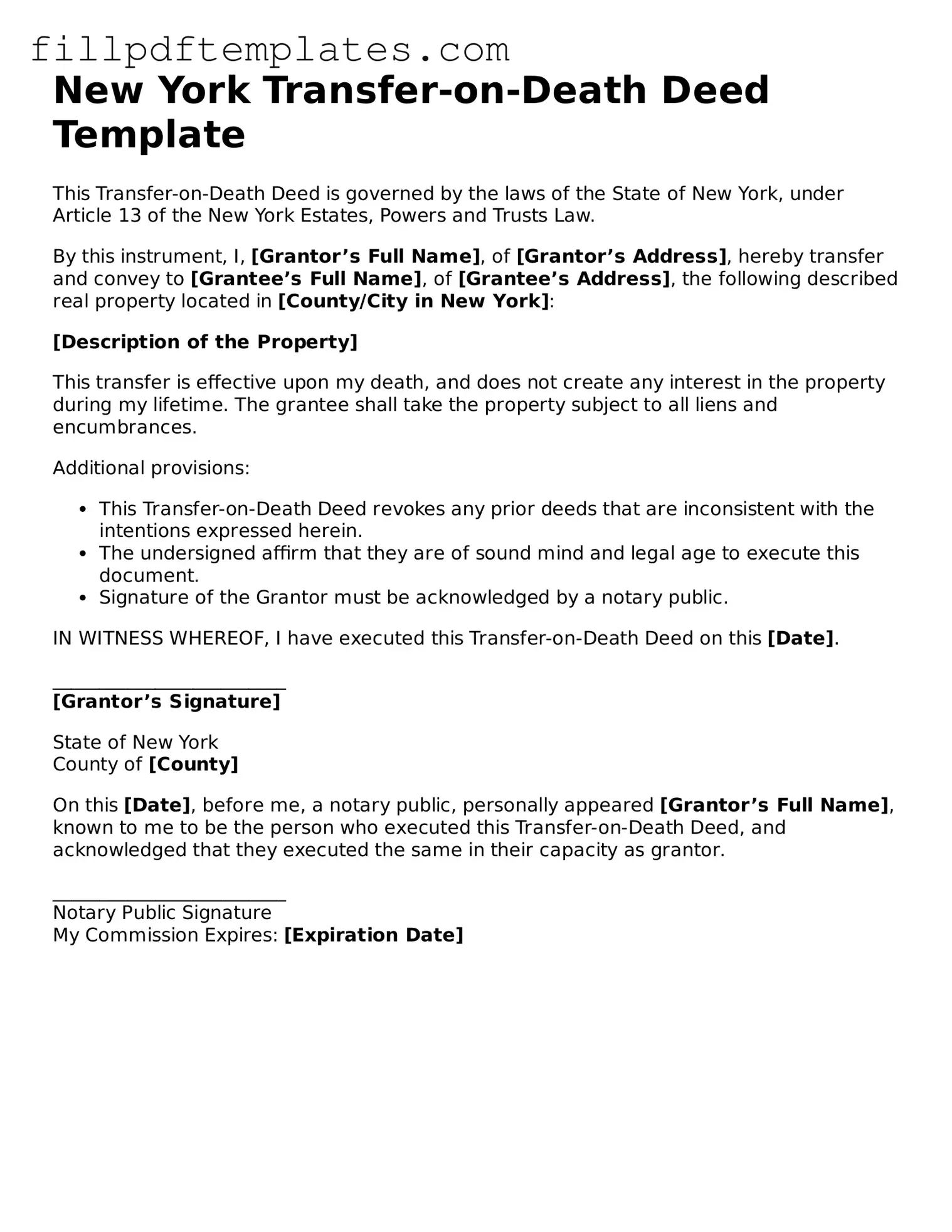

New York Transfer-on-Death Deed Preview

New York Transfer-on-Death Deed Template

This Transfer-on-Death Deed is governed by the laws of the State of New York, under Article 13 of the New York Estates, Powers and Trusts Law.

By this instrument, I, [Grantor’s Full Name], of [Grantor’s Address], hereby transfer and convey to [Grantee’s Full Name], of [Grantee’s Address], the following described real property located in [County/City in New York]:

[Description of the Property]

This transfer is effective upon my death, and does not create any interest in the property during my lifetime. The grantee shall take the property subject to all liens and encumbrances.

Additional provisions:

- This Transfer-on-Death Deed revokes any prior deeds that are inconsistent with the intentions expressed herein.

- The undersigned affirm that they are of sound mind and legal age to execute this document.

- Signature of the Grantor must be acknowledged by a notary public.

IN WITNESS WHEREOF, I have executed this Transfer-on-Death Deed on this [Date].

_________________________

[Grantor’s Signature]

State of New York

County of [County]

On this [Date], before me, a notary public, personally appeared [Grantor’s Full Name], known to me to be the person who executed this Transfer-on-Death Deed, and acknowledged that they executed the same in their capacity as grantor.

_________________________

Notary Public Signature

My Commission Expires: [Expiration Date]