Blank New York Quitclaim Deed Form

In the realm of real estate transactions, understanding the New York Quitclaim Deed form is essential for anyone looking to transfer property rights smoothly and efficiently. This legal document serves as a tool for transferring ownership without guaranteeing that the title is free from claims or defects. It is particularly useful in situations such as transferring property between family members, clearing up title issues, or facilitating a divorce settlement. Unlike other types of deeds, the Quitclaim Deed does not require a title search, making it a quicker option for those who trust the other party's claim to the property. However, it’s crucial to recognize that while it simplifies the transfer process, it also places the burden of due diligence on the recipient. Understanding the nuances of this form can empower individuals to make informed decisions, ensuring that their property dealings are both secure and straightforward.

Other Common Quitclaim Deed State Templates

How to Get a Quit Claim Deed - Every party involved should understand the implications of using a quitclaim deed.

Quick Deed - In some cases, notarization may be necessary to validate the document's authenticity.

The District of Columbia Transfer-on-Death Deed form allows property owners to designate beneficiaries who will receive their real estate upon their passing, without the need for probate. This form provides a straightforward way to transfer property, ensuring that the owner's wishes are honored while simplifying the process for heirs. To get more information and access the form, visit https://todform.com/blank-district-of-columbia-transfer-on-death-deed/ and start securing your property transfer.

Cost for Quit Claim Deed - Quitclaim Deeds do not protect buyers from hidden claims against the property.

Similar forms

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, a warranty deed provides more protection to the buyer.

- Grant Deed: A grant deed transfers ownership of property and includes assurances that the property has not been sold to anyone else. Similar to a quitclaim deed, it conveys ownership but offers additional guarantees.

- Special Purpose Deed: This type of deed is used for specific situations, such as transferring property to a trust. Like a quitclaim deed, it may not provide extensive warranties but serves a unique purpose.

- Deed of Trust: This document secures a loan with real estate as collateral. It functions differently than a quitclaim deed but is involved in property transactions and financing.

- Lease Agreement: A lease allows one party to use property owned by another for a specified time in exchange for payment. While it does not transfer ownership, it shares the aspect of property rights.

- Medical Power of Attorney: This essential form allows you to appoint someone to make healthcare decisions for you if you are unable to, ensuring your medical preferences are honored. Ready to fill out your form? Click the button below! More information can be found here: https://arizonaformpdf.com/

- Bill of Sale: This document transfers ownership of personal property, such as vehicles or equipment. It is similar in that it conveys ownership but is used for movable property rather than real estate.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal matters, including property transactions. It can facilitate the execution of a quitclaim deed.

- Affidavit of Title: This sworn statement confirms the seller's ownership and the absence of liens or claims against the property. It complements a quitclaim deed by providing additional assurance about the title.

- Real Estate Purchase Agreement: This contract outlines the terms of a property sale. While it does not transfer ownership directly, it often leads to the execution of a quitclaim deed or other transfer documents.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without guaranteeing the title. |

| Governing Law | The New York Quitclaim Deed is governed by the New York Real Property Law. |

| Parties Involved | It involves two parties: the grantor (the person transferring the property) and the grantee (the person receiving the property). |

| Title Transfer | With a quitclaim deed, the grantor transfers whatever interest they have in the property, if any. |

| Use Cases | Commonly used among family members, in divorce settlements, or to clear up title issues. |

| Recording | To ensure the transfer is legally recognized, the deed should be recorded with the county clerk’s office. |

| No Warranty | The grantor makes no guarantees about the property’s title, meaning the grantee assumes all risks. |

Things You Should Know About This Form

-

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. Unlike other types of deeds, a quitclaim deed does not guarantee that the person transferring the property has clear title. Instead, it simply conveys whatever interest the grantor has in the property, if any.

-

When should I use a Quitclaim Deed?

This type of deed is often used in situations where property is transferred between family members, such as during a divorce or inheritance. It’s also useful for clearing up title issues or when the parties involved trust each other and do not require the protections that a warranty deed provides.

-

How do I fill out a Quitclaim Deed in New York?

To fill out a Quitclaim Deed in New York, you’ll need to include the names of the grantor (the person transferring the property) and the grantee (the person receiving the property). You must also describe the property being transferred, including its address and any relevant legal descriptions. Finally, both parties should sign the document in front of a notary public.

-

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed offers more protection to the grantee, as it guarantees that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed provides no such guarantees.

-

Do I need to file the Quitclaim Deed with the county?

Yes, after completing the Quitclaim Deed, it must be filed with the county clerk’s office in the county where the property is located. This ensures that the transfer of ownership is officially recorded and protects the rights of the new owner.

-

Are there any fees associated with filing a Quitclaim Deed in New York?

Yes, there are typically fees associated with filing a Quitclaim Deed. These fees vary by county, so it’s important to check with your local county clerk’s office for the exact amount. Additionally, there may be other costs involved, such as notary fees.

-

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and filed, it cannot be revoked unilaterally. However, the parties involved can agree to rescind the deed through a mutual agreement, or the grantor can create a new deed to transfer the property back, if applicable.

-

What are the risks of using a Quitclaim Deed?

The primary risk of using a Quitclaim Deed is the lack of guarantees regarding the property title. If the grantor does not actually own the property or if there are existing liens, the grantee may face legal issues later on. It’s advisable to conduct a title search before accepting a Quitclaim Deed to understand any potential risks involved.

Documents used along the form

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. While it serves a specific purpose, several other forms and documents often accompany it to ensure a smooth transaction and protect the interests of all parties involved. Here are some commonly used documents alongside the New York Quitclaim Deed:

- Title Search Report: This document provides a detailed history of the property’s ownership. It reveals any liens, encumbrances, or claims against the property, ensuring the buyer is fully informed before the transfer takes place.

- Hold Harmless Agreement: This document ensures that one party does not hold the other liable for any injuries or damages that may arise. A well-defined Hold Harmless Agreement is essential for protecting all parties involved in various transactions.

- Property Transfer Tax Form: In New York, a property transfer tax is often applicable. This form is necessary to report the transaction to the state and calculate any taxes owed based on the sale price or value of the property.

- Affidavit of Title: This sworn statement assures the buyer that the seller has the legal right to transfer the property. It also confirms that there are no undisclosed liens or claims against the property, providing additional security for the buyer.

- Closing Statement: This document outlines the financial aspects of the transaction, including the purchase price, closing costs, and any adjustments. It serves as a summary of the final financial obligations of both the buyer and seller.

- Bill of Sale: If personal property is included in the transaction, a Bill of Sale documents the transfer of ownership of these items. This is particularly relevant when real estate includes fixtures, appliances, or other tangible assets.

- Power of Attorney: If the seller cannot be present at the closing, a Power of Attorney allows another person to act on their behalf. This document grants the designated individual the authority to sign the Quitclaim Deed and other necessary documents.

Each of these documents plays a vital role in the property transfer process. Understanding their purpose can help ensure that the transaction is completed efficiently and legally, safeguarding the interests of both the buyer and the seller.

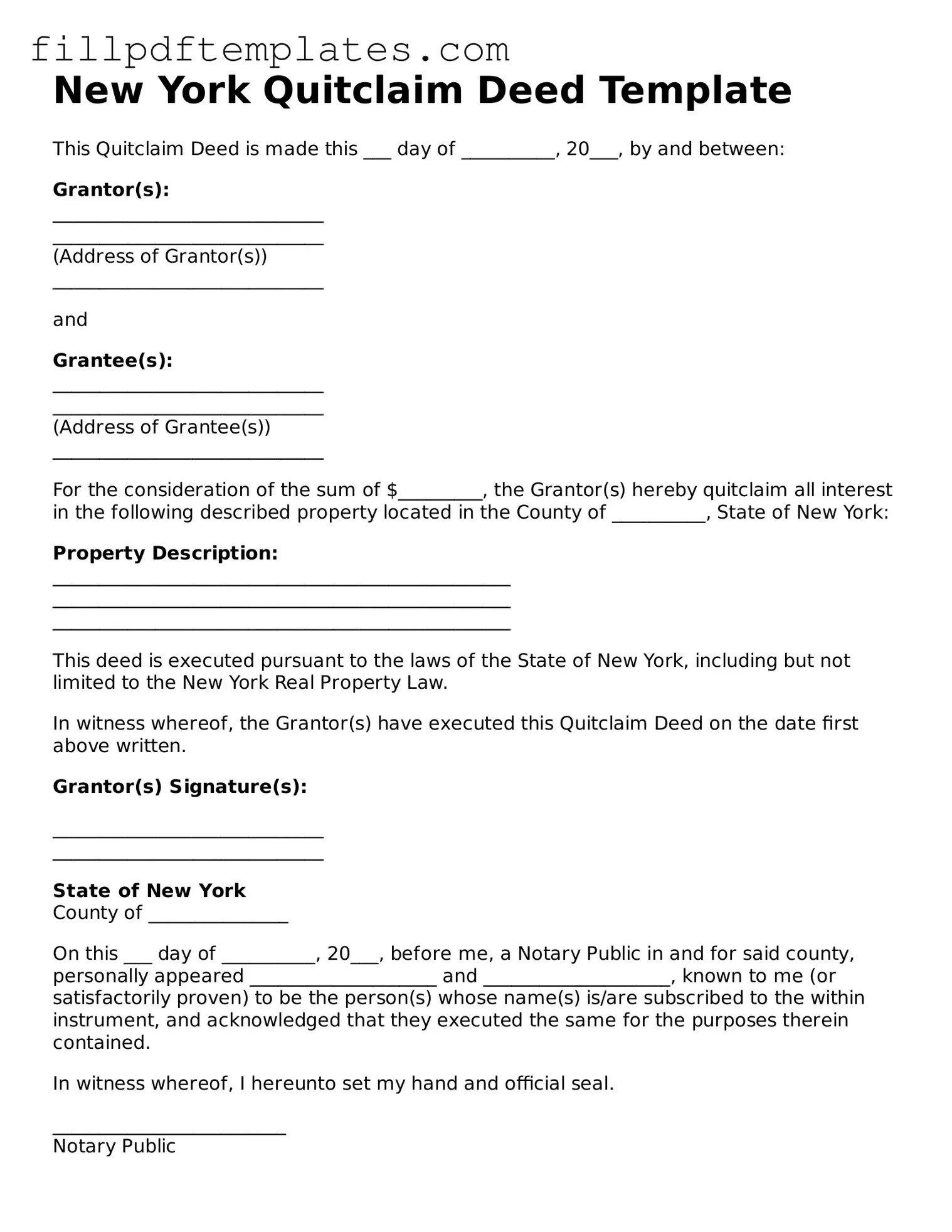

New York Quitclaim Deed Preview

New York Quitclaim Deed Template

This Quitclaim Deed is made this ___ day of __________, 20___, by and between:

Grantor(s):

_____________________________

_____________________________

(Address of Grantor(s))

_____________________________

and

Grantee(s):

_____________________________

_____________________________

(Address of Grantee(s))

_____________________________

For the consideration of the sum of $_________, the Grantor(s) hereby quitclaim all interest in the following described property located in the County of __________, State of New York:

Property Description:

_________________________________________________

_________________________________________________

_________________________________________________

This deed is executed pursuant to the laws of the State of New York, including but not limited to the New York Real Property Law.

In witness whereof, the Grantor(s) have executed this Quitclaim Deed on the date first above written.

Grantor(s) Signature(s):

__________________________________________________________

State of New York

County of _______________

On this ___ day of __________, 20___, before me, a Notary Public in and for said county, personally appeared ____________________ and ____________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_________________________

Notary Public

My commission expires: _____________