Blank New York Promissory Note Form

The New York Promissory Note form serves as a crucial financial instrument for individuals and businesses alike, facilitating the borrowing and lending of money with clear terms. This document outlines the borrower's promise to repay a specified amount of money to the lender, typically including details such as the principal amount, interest rate, and repayment schedule. Additionally, it may specify the consequences of default, ensuring both parties understand their rights and obligations. The form can be tailored to fit various lending situations, whether for personal loans or business financing. By clearly documenting the terms of the loan, the New York Promissory Note helps to prevent misunderstandings and disputes, providing a solid foundation for the financial relationship between the lender and borrower. Understanding its components is essential for anyone involved in a loan transaction in New York, as it not only protects the interests of both parties but also ensures compliance with applicable state laws.

Other Common Promissory Note State Templates

Illinois Promissory Note - Offering favorable interest rates can facilitate quicker agreement on a promissory note.

Promissory Note Template Florida Pdf - Before signing a promissory note, it’s wise to read it carefully and ask questions if anything is unclear.

The Indiana Transfer-on-Death Deed form allows property owners to transfer their real estate to beneficiaries upon their death, avoiding the lengthy probate process. This deed provides a simple way to ensure that your property goes directly to your loved ones without the complications of a will. For more information and to access the form, visit https://todform.com/blank-indiana-transfer-on-death-deed/ today.

Promissory Note Template Georgia - Serves as a critical record in case of legal disputes.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of a loan. It specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement is typically more detailed and may include additional clauses regarding default and collateral.

- Security Agreement: A security agreement can accompany a promissory note when the loan is secured by collateral. It defines the collateral and the rights of the lender in case of default. Both documents work together to protect the lender's interests.

- Mortgage: A mortgage is a specific type of promissory note used in real estate transactions. It secures the loan with the property itself. The mortgage document includes details about the property and the obligations of the borrower, similar to a promissory note.

- Employment Verification: For those needing to confirm their job status, the quick Employment Verification form process provides necessary documentation for verification purposes.

- Installment Agreement: An installment agreement is similar to a promissory note in that it outlines the terms of repayment over time. It typically involves smaller payments made at regular intervals, making it easier for borrowers to manage their finances.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or bearer at a specified time. |

| Governing Law | The New York Uniform Commercial Code (UCC) governs promissory notes in New York. |

| Parties Involved | There are typically two parties: the maker (who promises to pay) and the payee (to whom the payment is owed). |

| Interest Rate | The note can specify an interest rate, which must comply with state usury laws to avoid legal issues. |

| Payment Terms | Payment terms, including the due date and installment amounts, should be clearly outlined in the note. |

| Signature Requirement | The maker must sign the promissory note for it to be enforceable. |

| Transferability | Promissory notes are generally negotiable instruments, meaning they can be transferred to others. |

| Default Consequences | If the maker defaults, the payee has the right to seek legal remedies, including the recovery of the owed amount. |

| Record Keeping | It is advisable for both parties to keep copies of the signed note for their records. |

Things You Should Know About This Form

-

What is a New York Promissory Note?

A New York Promissory Note is a legal document in which one party (the borrower) agrees to pay a specific amount of money to another party (the lender) at a designated time or on demand. This document outlines the terms of the loan, including interest rates, payment schedules, and any consequences for default.

-

Who can use a Promissory Note?

Any individual or business in New York can use a Promissory Note. It is commonly used in personal loans, business loans, and real estate transactions. Both the lender and borrower must agree to the terms outlined in the note.

-

What information should be included in a Promissory Note?

A comprehensive Promissory Note should include:

- The names and addresses of both the borrower and lender.

- The principal amount of the loan.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any late fees or penalties for missed payments.

- Signatures of both parties.

-

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding contract. Once signed, both parties are obligated to adhere to the terms outlined in the document. If either party fails to comply, the other party may pursue legal action to enforce the terms.

-

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised note to ensure clarity and enforceability.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or seeking a judgment against the borrower. The specific consequences should be outlined in the Promissory Note.

-

Do I need a lawyer to create a Promissory Note?

While it is not required to have a lawyer, consulting one can help ensure that the note is legally sound and that all necessary terms are included. This can prevent potential disputes in the future.

-

How is a Promissory Note different from a loan agreement?

A Promissory Note is generally simpler and focuses solely on the borrower's promise to repay the loan. A loan agreement, on the other hand, is more comprehensive and may include additional terms such as collateral, warranties, and representations.

-

Where can I obtain a New York Promissory Note form?

New York Promissory Note forms can be obtained from various online legal form providers, office supply stores, or legal stationery shops. Ensure that the form complies with New York state laws and is appropriate for your specific situation.

Documents used along the form

A New York Promissory Note is a crucial document used in lending agreements, outlining the borrower's promise to repay a loan under specified terms. However, it often accompanies several other forms and documents that help clarify the agreement and protect the interests of both parties involved. Below is a list of commonly used documents alongside the Promissory Note.

- Loan Agreement: This document details the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive outline of the agreement between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets pledged by the borrower. It provides the lender with rights to the collateral in case of default.

- Personal Guarantee: In some cases, a personal guarantee may be required from an individual, often a business owner. This document holds the individual personally responsible for repaying the loan if the borrowing entity defaults.

- Disclosure Statement: This statement outlines the terms of the loan, including any fees, penalties, and the total cost of borrowing. It ensures that the borrower is fully informed before signing the agreement.

- Hold Harmless Agreement: This crucial document, as outlined in the Hold Harmless Agreement, protects one party from legal claims and liabilities, ensuring that in case of any incidents, the other party will not be held accountable.

- Amortization Schedule: This document breaks down each payment over the life of the loan, showing how much goes toward principal and interest. It helps borrowers understand their repayment obligations over time.

- UCC Financing Statement: If the loan is secured by collateral, this form is filed with the state to publicly declare the lender's interest in the collateral. It protects the lender’s rights in case of the borrower’s bankruptcy.

- Default Notice: This document is issued if the borrower fails to meet the repayment terms. It formally notifies the borrower of the default and outlines the lender's rights and potential actions moving forward.

These documents work together to create a clear and enforceable agreement between the lender and borrower. Understanding each form's purpose can help both parties navigate their rights and obligations effectively.

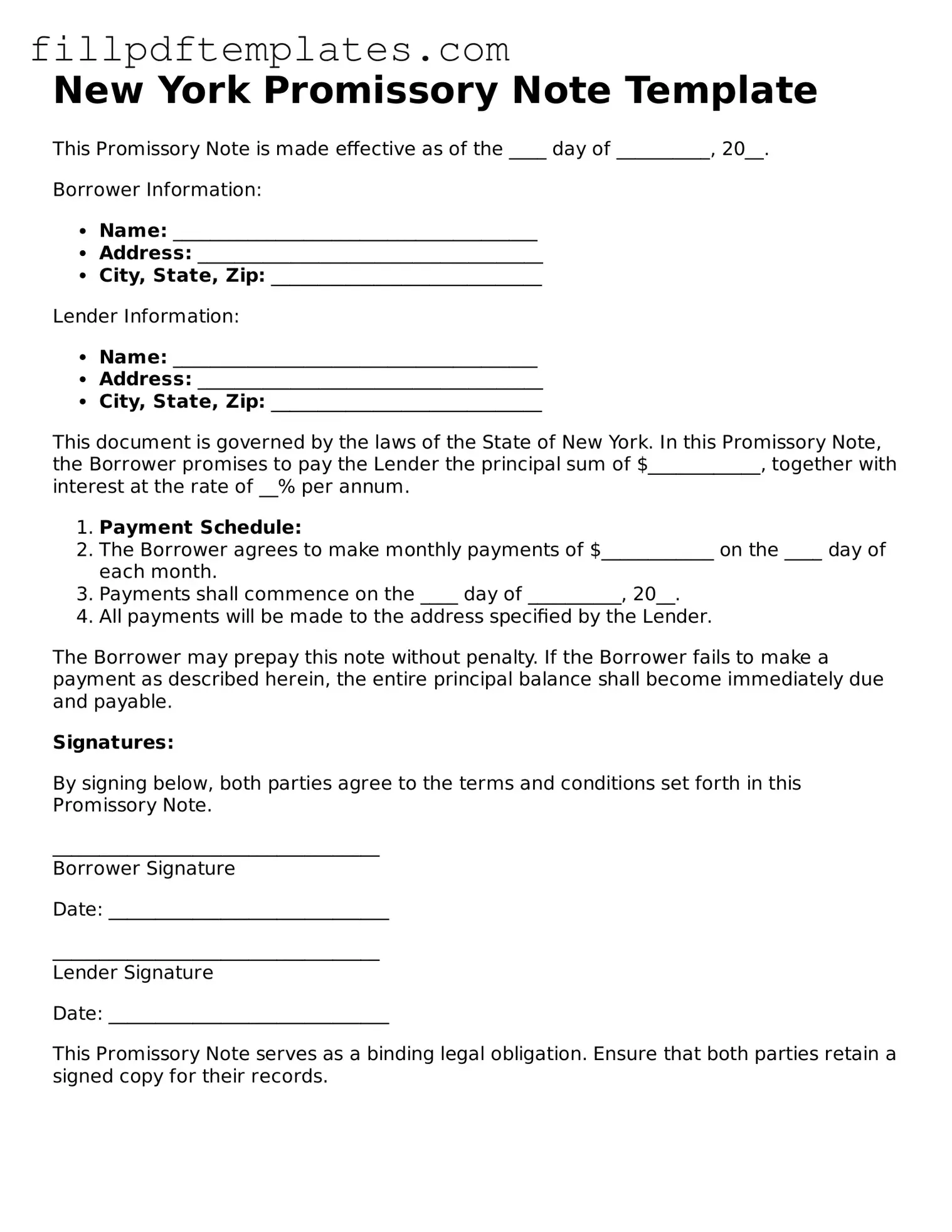

New York Promissory Note Preview

New York Promissory Note Template

This Promissory Note is made effective as of the ____ day of __________, 20__.

Borrower Information:

- Name: _______________________________________

- Address: _____________________________________

- City, State, Zip: _____________________________

Lender Information:

- Name: _______________________________________

- Address: _____________________________________

- City, State, Zip: _____________________________

This document is governed by the laws of the State of New York. In this Promissory Note, the Borrower promises to pay the Lender the principal sum of $____________, together with interest at the rate of __% per annum.

- Payment Schedule:

- The Borrower agrees to make monthly payments of $____________ on the ____ day of each month.

- Payments shall commence on the ____ day of __________, 20__.

- All payments will be made to the address specified by the Lender.

The Borrower may prepay this note without penalty. If the Borrower fails to make a payment as described herein, the entire principal balance shall become immediately due and payable.

Signatures:

By signing below, both parties agree to the terms and conditions set forth in this Promissory Note.

___________________________________

Borrower Signature

Date: ______________________________

___________________________________

Lender Signature

Date: ______________________________

This Promissory Note serves as a binding legal obligation. Ensure that both parties retain a signed copy for their records.