Blank New York Operating Agreement Form

When starting a Limited Liability Company (LLC) in New York, one essential document to consider is the Operating Agreement. This form serves as the backbone of your business, outlining the structure and management of the LLC. It details the roles and responsibilities of members, clarifies how profits and losses will be distributed, and establishes guidelines for decision-making processes. Additionally, the Operating Agreement addresses important matters such as member voting rights and procedures for adding or removing members. By having a comprehensive Operating Agreement in place, you not only protect your personal assets but also ensure that your business operates smoothly and in accordance with your vision. Understanding the nuances of this document is vital for any entrepreneur looking to navigate the complexities of LLC formation in New York.

Other Common Operating Agreement State Templates

Operating Agreement Llc California - This document is pivotal for ensuring the long-term success and stability of the LLC.

Filing the California Articles of Incorporation is the vital first step in establishing your business, and for a comprehensive guide on how to navigate this process, you can refer to resources like Top Document Templates, which offer valuable templates and insights to ensure you're on the right track.

How to Write an Operating Agreement - This agreement can include provisions for maintaining confidentiality.

Similar forms

- Bylaws: Similar to an Operating Agreement, bylaws outline the rules and procedures for managing a corporation. They detail how meetings are conducted, how officers are elected, and other governance matters.

- Partnership Agreement: This document governs the relationship between partners in a business. Like an Operating Agreement, it specifies roles, responsibilities, and how profits and losses are shared.

- Shareholder Agreement: This agreement is used by corporations to define the rights and obligations of shareholders. It addresses issues such as share transfers and voting rights, akin to how an Operating Agreement addresses member rights.

- LLC Membership Certificate: This document certifies a member's ownership in an LLC. While the Operating Agreement outlines management and operational procedures, the membership certificate serves as proof of ownership.

- Joint Venture Agreement: This agreement is formed between two or more parties to undertake a specific project. Similar to an Operating Agreement, it defines each party's contributions, responsibilities, and profit-sharing arrangements.

- Franchise Agreement: This document outlines the relationship between a franchisor and franchisee. It includes operational guidelines and rights, similar to how an Operating Agreement sets forth the operational framework for an LLC.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information shared between parties. While not directly related to management, it ensures that sensitive business information remains private, paralleling the confidentiality often included in Operating Agreements.

- Business Plan: A business plan outlines a company's goals, strategies, and financial forecasts. Like an Operating Agreement, it serves as a roadmap for the business, guiding decisions and operations.

- Lease Agreement: For those looking to rent, the essential Lease Agreement template provides a clear framework for outlining rental terms and responsibilities.

- Employment Agreement: This document details the terms of employment for an employee. It includes responsibilities and compensation, similar to how an Operating Agreement outlines member roles and contributions.

- Asset Purchase Agreement: This agreement is used when purchasing assets from a business. It outlines the terms of the sale and responsibilities of each party, similar to how an Operating Agreement details ownership and management structure.

Document Properties

| Fact Name | Description |

|---|---|

| Purpose | The New York Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by the New York Limited Liability Company Law. |

| Member Rights | It defines the rights and responsibilities of the LLC members, including profit distribution and decision-making processes. |

| Flexibility | The agreement allows members to customize their management structure and operational rules to fit their needs. |

| Legal Requirement | While not mandatory, having an Operating Agreement is highly recommended to clarify expectations and reduce disputes. |

| Amendments | Members can amend the agreement as needed, ensuring it remains relevant as the business evolves. |

Things You Should Know About This Form

-

What is a New York Operating Agreement?

A New York Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC). This agreement serves as a guide for how the LLC will be run, detailing the rights and responsibilities of its members.

-

Is an Operating Agreement required in New York?

While New York law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Having one in place can help prevent misunderstandings among members and provides a clear framework for operations.

-

What should be included in an Operating Agreement?

Typically, an Operating Agreement should include:

- The name and purpose of the LLC

- The names and addresses of the members

- The management structure (member-managed or manager-managed)

- Voting rights and procedures

- Profit and loss distribution

- Procedures for adding new members or handling member departures

- Dispute resolution methods

-

Can I create my own Operating Agreement?

Yes, you can create your own Operating Agreement. Many business owners choose to draft one themselves to ensure it reflects their specific needs. However, consulting with a legal professional can help ensure that all necessary elements are included and compliant with state laws.

-

How does an Operating Agreement benefit my LLC?

An Operating Agreement provides clarity and structure. It helps define the roles of each member, establishes rules for decision-making, and outlines how profits and losses will be distributed. This can prevent conflicts and misunderstandings down the road.

-

Do I need to file the Operating Agreement with the state?

No, you do not need to file your Operating Agreement with the New York state. It is an internal document, which means it should be kept with your business records. However, having it readily available is important for reference and in case of any disputes.

-

Can I amend my Operating Agreement?

Absolutely! If circumstances change, you can amend your Operating Agreement. It's important to follow the procedures outlined in the agreement for making amendments to ensure that all members are in agreement.

-

What happens if we don’t have an Operating Agreement?

Without an Operating Agreement, your LLC will be governed by New York's default laws regarding LLCs. This may not align with your intentions and can lead to unexpected outcomes, especially in areas like profit sharing and decision-making.

-

How can I ensure my Operating Agreement is legally binding?

To ensure your Operating Agreement is legally binding, it should be in writing and signed by all members. While notarization is not required in New York, having a notary public witness the signatures can add an extra layer of legitimacy.

-

Where can I find a template for a New York Operating Agreement?

Templates for New York Operating Agreements can be found online through various legal document preparation services. Make sure to choose a reputable source that allows for customization to fit your specific business needs.

Documents used along the form

When establishing a business entity in New York, particularly a Limited Liability Company (LLC), several key documents complement the New York Operating Agreement. These documents help define the structure, governance, and operational procedures of the LLC. Below is a list of common forms and documents that are often used alongside the Operating Agreement.

- Articles of Organization: This document is filed with the New York Department of State to officially create the LLC. It includes essential information such as the LLC's name, address, and the name of the registered agent.

- Member Resolutions: These written records outline decisions made by the members of the LLC. They provide clarity on actions taken, such as the approval of new members or significant business decisions.

- Membership Certificates: These certificates serve as proof of ownership for members of the LLC. They typically detail the member's ownership percentage and can be important for both internal records and external validation.

- Operating Procedures: While the Operating Agreement outlines the overall governance of the LLC, operating procedures provide specific guidelines on day-to-day operations. This can include financial management, meeting protocols, and conflict resolution processes.

- Motor Vehicle Bill of Sale Form: For finalizing vehicle transactions, the comprehensive Motor Vehicle Bill of Sale form guide provides essential documentation to protect both buyer and seller.

- Tax Registration Forms: Depending on the nature of the business and its structure, various tax forms may be required. These documents ensure compliance with federal, state, and local tax obligations and may include forms for obtaining an Employer Identification Number (EIN).

In summary, these documents work in conjunction with the New York Operating Agreement to provide a comprehensive framework for the operation and management of an LLC. Ensuring that all necessary forms are properly completed and filed is crucial for the legal and operational integrity of the business.

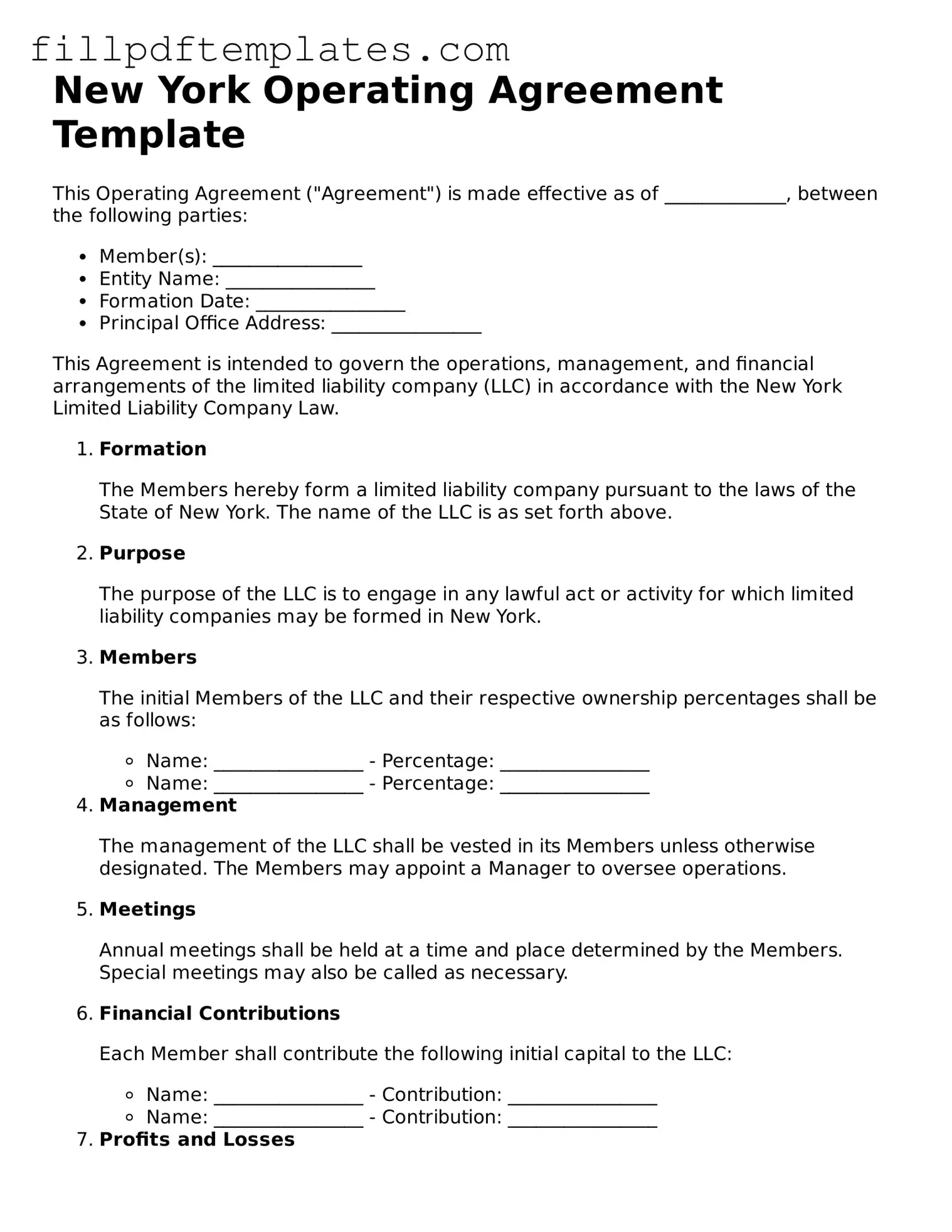

New York Operating Agreement Preview

New York Operating Agreement Template

This Operating Agreement ("Agreement") is made effective as of _____________, between the following parties:

- Member(s): ________________

- Entity Name: ________________

- Formation Date: ________________

- Principal Office Address: ________________

This Agreement is intended to govern the operations, management, and financial arrangements of the limited liability company (LLC) in accordance with the New York Limited Liability Company Law.

- Formation

- Purpose

- Members

- Name: ________________ - Percentage: ________________

- Name: ________________ - Percentage: ________________

- Management

- Meetings

- Financial Contributions

- Name: ________________ - Contribution: ________________

- Name: ________________ - Contribution: ________________

- Profits and Losses

- Distributions

- Amendments

- Governing Law

The Members hereby form a limited liability company pursuant to the laws of the State of New York. The name of the LLC is as set forth above.

The purpose of the LLC is to engage in any lawful act or activity for which limited liability companies may be formed in New York.

The initial Members of the LLC and their respective ownership percentages shall be as follows:

The management of the LLC shall be vested in its Members unless otherwise designated. The Members may appoint a Manager to oversee operations.

Annual meetings shall be held at a time and place determined by the Members. Special meetings may also be called as necessary.

Each Member shall contribute the following initial capital to the LLC:

Profits and losses of the LLC shall be allocated to the Members in proportion to their ownership percentages.

Distributions shall be made to the Members at such times and in such amounts as determined by the Members.

This Agreement may be amended only by a written agreement signed by all Members.

This Agreement shall be governed by and construed in accordance with the laws of the State of New York.

IN WITNESS WHEREOF, the parties hereto have executed this Operating Agreement as of the date first above written.

Member Signature(s): ________________________ Date: ________________

Member Signature(s): ________________________ Date: ________________