Blank New York Loan Agreement Form

When engaging in a financial transaction, clarity and structure are paramount, especially in the context of a loan. The New York Loan Agreement form serves as a crucial document that outlines the terms and conditions of borrowing money. It typically includes essential details such as the loan amount, interest rate, repayment schedule, and the duration of the loan. Additionally, the form addresses the responsibilities of both the lender and the borrower, ensuring that each party understands their obligations. Security interests, if applicable, are also detailed, providing a layer of protection for the lender. Furthermore, provisions regarding default and remedies are included to safeguard both parties in case of unforeseen circumstances. By laying out these aspects clearly, the New York Loan Agreement form not only facilitates trust but also helps prevent misunderstandings that could arise during the loan period.

Other Common Loan Agreement State Templates

Promissory Note Template Georgia - This form can include provisions for collateral if required.

California Promissory Note Template - A Loan Agreement may describe the loan's repayment method, like monthly payments.

To effectively evaluate potential tenants, a thorough Rental Application process is critical for landlords. This form collects necessary details that help in making informed decisions regarding tenancy and property leasing.

Promissory Note Florida Pdf - It provides clarity on the loan purpose, if applicable.

Illinois Promissory Note - It can be used for personal, business, or real estate loans.

Similar forms

-

Promissory Note: This document outlines a borrower's promise to repay a loan, detailing the amount borrowed, interest rate, and repayment schedule. Like a Loan Agreement, it serves as a formal acknowledgment of debt.

-

Mortgage Agreement: This document secures a loan with real property. Similar to a Loan Agreement, it specifies the terms of the loan and the consequences of default, ensuring both parties understand their obligations.

-

Credit Agreement: This outlines the terms under which credit is extended to a borrower. Like a Loan Agreement, it includes the loan amount, interest rates, and repayment terms, but may also cover revolving credit lines.

-

Quitclaim Deed: A Texas Quitclaim Deed allows the transfer of property ownership without warranties about the title. It is particularly useful for family transactions or clearing property titles. For more information, visit https://legalpdfdocs.com/.

-

Loan Modification Agreement: This document modifies the terms of an existing loan. It shares similarities with a Loan Agreement by detailing changes in repayment terms, interest rates, or loan duration.

-

Security Agreement: This document secures a loan with collateral. Similar to a Loan Agreement, it defines the obligations of the borrower and the rights of the lender in case of default.

-

Personal Loan Agreement: This is a specific type of Loan Agreement for personal loans. It outlines the terms of borrowing between individuals, including repayment schedules and interest rates.

-

Business Loan Agreement: This document is similar to a Loan Agreement but is tailored for business loans. It includes terms specific to business operations and may involve additional requirements such as financial statements.

-

Lease Agreement: While primarily for renting property, a lease agreement can resemble a Loan Agreement in that it outlines payment terms and obligations. Both documents create a binding agreement between parties.

-

Debt Settlement Agreement: This document outlines the terms under which a borrower agrees to settle a debt for less than the full amount owed. It shares the goal of resolving financial obligations, similar to a Loan Agreement.

-

Installment Agreement: This document allows for the repayment of a debt in installments. Like a Loan Agreement, it specifies the amount owed and the repayment schedule, ensuring clarity for both parties.

Document Properties

| Fact Name | Details |

|---|---|

| Purpose | The New York Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of New York. |

| Key Components | It typically includes the loan amount, interest rate, repayment schedule, and any collateral. |

| Signature Requirement | Both parties must sign the agreement to make it legally binding. |

Things You Should Know About This Form

-

What is a New York Loan Agreement form?

A New York Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This agreement specifies the amount borrowed, the interest rate, repayment schedule, and any collateral involved. It serves to protect both parties by clearly defining their rights and obligations.

-

Who needs a Loan Agreement?

Any individual or business seeking to borrow money should consider using a Loan Agreement. This includes personal loans between friends or family members, as well as formal loans from banks or private lenders. Having a written agreement minimizes misunderstandings and establishes clear expectations for repayment.

-

What key elements should be included in the agreement?

A comprehensive Loan Agreement should contain the following key elements:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The percentage charged on the borrowed amount.

- Repayment Terms: A detailed schedule indicating when payments are due and the total duration of the loan.

- Collateral: Any assets pledged to secure the loan, if applicable.

- Default Conditions: Terms outlining what happens if the borrower fails to repay the loan.

-

Is it necessary to have the Loan Agreement notarized?

While notarization is not strictly required for a Loan Agreement in New York, it is highly recommended. Notarizing the document adds an extra layer of authenticity and can help prevent disputes regarding the validity of the agreement. It serves as a safeguard for both parties involved.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender may take several actions depending on the terms outlined in the Loan Agreement. This could include charging late fees, initiating collection procedures, or taking legal action to recover the owed amount. The specific consequences should be clearly detailed in the agreement to avoid confusion.

Documents used along the form

When entering into a loan agreement in New York, several other documents may accompany the main agreement to ensure clarity and legal compliance. Each of these forms plays a crucial role in the overall transaction, helping to protect the interests of all parties involved. Below is a list of common documents often used alongside the New York Loan Agreement.

- Promissory Note: This document outlines the borrower's promise to repay the loan, detailing the loan amount, interest rate, and repayment schedule.

- Loan Disclosure Statement: This statement provides borrowers with essential information about the loan terms, including fees and annual percentage rates (APRs).

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets pledged to protect the lender's interests in case of default.

- Boat Bill of Sale: To finalize a boat transaction in New York, having a click here to download is essential. This document serves as legal proof of the sale, detailing the specifics of the boat and safeguarding the interests of both parties involved.

- Personal Guarantee: A personal guarantee may be required, where an individual agrees to be personally responsible for the loan if the borrowing entity defaults.

- UCC Financing Statement: This document is filed to give public notice of the lender's security interest in the collateral, establishing priority over other creditors.

- Loan Application: The loan application collects information about the borrower’s financial history and creditworthiness, helping lenders assess risk.

- Closing Statement: This statement summarizes the final details of the loan transaction, including any fees, adjustments, and the distribution of funds.

- Amortization Schedule: This schedule outlines each payment over the life of the loan, showing how much goes toward principal and interest.

These documents are essential for a smooth loan process, ensuring that both the lender and borrower understand their rights and obligations. Having all necessary paperwork in order can help prevent misunderstandings and potential disputes down the line.

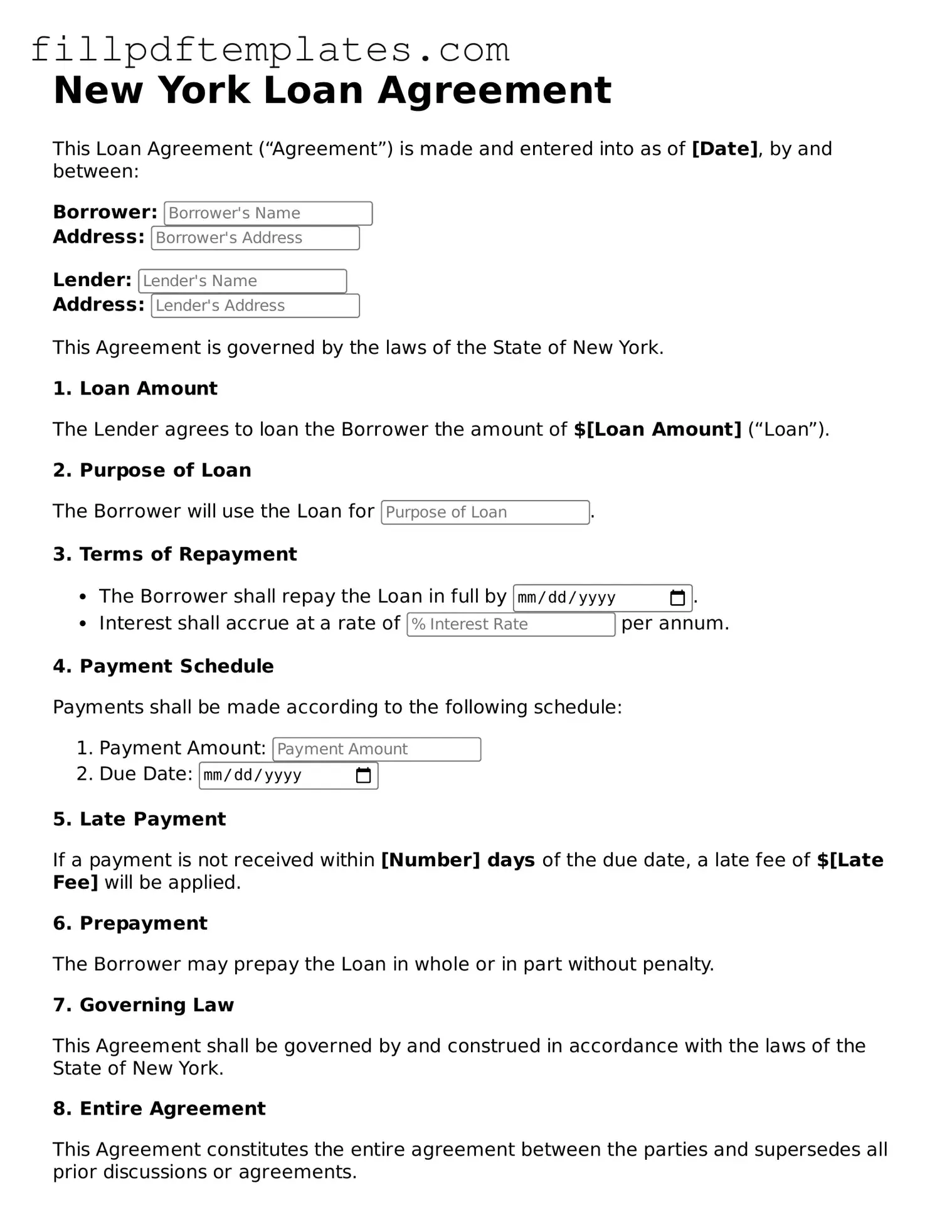

New York Loan Agreement Preview

New York Loan Agreement

This Loan Agreement (“Agreement”) is made and entered into as of [Date], by and between:

Borrower:

Address:

Lender:

Address:

This Agreement is governed by the laws of the State of New York.

1. Loan Amount

The Lender agrees to loan the Borrower the amount of $[Loan Amount] (“Loan”).

2. Purpose of Loan

The Borrower will use the Loan for .

3. Terms of Repayment

- The Borrower shall repay the Loan in full by .

- Interest shall accrue at a rate of per annum.

4. Payment Schedule

Payments shall be made according to the following schedule:

- Payment Amount:

- Due Date:

5. Late Payment

If a payment is not received within [Number] days of the due date, a late fee of $[Late Fee] will be applied.

6. Prepayment

The Borrower may prepay the Loan in whole or in part without penalty.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of New York.

8. Entire Agreement

This Agreement constitutes the entire agreement between the parties and supersedes all prior discussions or agreements.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first above written.

Borrower:

Date:

Lender:

Date: