Blank New York Durable Power of Attorney Form

A Durable Power of Attorney (DPOA) in New York is a vital legal document that allows individuals to appoint someone they trust to manage their financial and legal affairs when they are unable to do so themselves. This form remains effective even if the person who created it becomes incapacitated, ensuring that their chosen agent can make decisions on their behalf. The DPOA covers a wide range of powers, from handling bank transactions and paying bills to managing real estate and making investment decisions. It is essential for individuals to understand the responsibilities they are granting to their agent, as well as the limitations they may wish to impose. Additionally, the form must be signed in the presence of a notary public to be valid. By taking the time to complete a Durable Power of Attorney, individuals can gain peace of mind knowing that their affairs will be managed according to their wishes, even in challenging times.

Other Common Durable Power of Attorney State Templates

Power of Attorney Michigan Requirements - It’s essential to discuss your wishes with the person you choose as your agent beforehand.

To streamline your application process, consider utilizing this comprehensive Recommendation Letter template that can help you present a strong case for your qualifications and abilities.

California Durable Power of Attorney Form 2023 Pdf - The agent, often a trusted family member or friend, must act in the best interest of the principal.

Similar forms

The Durable Power of Attorney (DPOA) is a powerful legal document that grants someone the authority to make decisions on your behalf. While it serves a unique purpose, it shares similarities with several other legal documents. Here are four documents that are comparable to a Durable Power of Attorney:

- Health Care Proxy: This document allows you to appoint someone to make medical decisions for you if you become unable to do so. Like a DPOA, it empowers an agent to act on your behalf, but it specifically focuses on health-related matters.

- Living Will: A Living Will outlines your wishes regarding medical treatment and end-of-life care. While it does not appoint someone to make decisions for you, it complements a DPOA by providing guidance to your agent on your preferences.

- Financial Power of Attorney: Similar to a DPOA, this document specifically grants authority to handle financial matters. It can be limited to certain transactions or broad in scope, allowing your agent to manage your finances just like a DPOA would.

- Bill of Sale: When engaging in a sale, it’s crucial to utilize a Bill of Sale form to ensure all transaction details are documented and legally recognized, facilitating a clear transfer of ownership between the buyer and seller.

- Revocable Trust: A Revocable Trust allows you to place your assets in a trust while retaining control over them during your lifetime. While it serves a different function, it can work alongside a DPOA by managing your assets in case you become incapacitated.

Understanding these documents and their similarities can help you make informed decisions about your legal needs. Each document plays a vital role in ensuring your wishes are respected and your interests are protected.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney in New York allows an individual (the principal) to appoint someone else (the agent) to make financial decisions on their behalf, even if the principal becomes incapacitated. |

| Governing Law | The New York Durable Power of Attorney is governed by New York General Obligations Law, specifically Article 5, Title 15. |

| Durability | This form remains effective even after the principal is no longer able to make decisions due to illness or disability, which is what makes it "durable." |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

Things You Should Know About This Form

-

What is a Durable Power of Attorney in New York?

A Durable Power of Attorney is a legal document that allows one person, known as the "principal," to appoint another person, called the "agent," to make decisions on their behalf. This authority remains effective even if the principal becomes incapacitated. It is particularly useful for managing financial matters, healthcare decisions, and other important affairs when the principal is unable to do so.

-

How does a Durable Power of Attorney differ from a regular Power of Attorney?

The key difference lies in the durability of the authority granted. A regular Power of Attorney becomes invalid if the principal becomes incapacitated. In contrast, a Durable Power of Attorney remains in effect, allowing the agent to continue acting on behalf of the principal during periods of incapacity. This ensures that the principal's affairs are managed without interruption.

-

What powers can be granted to the agent?

The principal can grant a wide range of powers to the agent, including:

- Managing bank accounts

- Paying bills

- Buying or selling property

- Making investment decisions

- Handling tax matters

It is important for the principal to specify which powers are included in the document to ensure clarity and prevent misunderstandings.

-

How do I create a Durable Power of Attorney in New York?

To create a Durable Power of Attorney in New York, the principal must fill out the appropriate form, which includes their name, the name of the agent, and the specific powers granted. The form must be signed by the principal in the presence of a notary public. Additionally, it is advisable to have witnesses present during the signing to further validate the document.

-

Can I revoke a Durable Power of Attorney?

Yes, a principal can revoke a Durable Power of Attorney at any time, as long as they are mentally competent. To revoke the document, the principal must create a written notice of revocation and provide copies to the agent and any institutions or individuals that were relying on the original Power of Attorney. This ensures that the agent's authority is officially terminated.

-

What happens if I do not have a Durable Power of Attorney?

If a person becomes incapacitated without a Durable Power of Attorney in place, their family may need to go through a court process to appoint a guardian or conservator to manage their affairs. This can be a lengthy and costly process, often leading to disputes among family members. Having a Durable Power of Attorney in place can help avoid these complications and ensure that the principal's wishes are respected.

Documents used along the form

A Durable Power of Attorney (DPOA) is a crucial document that allows an individual to appoint someone to manage their financial and legal matters. However, several other forms and documents may complement or support the DPOA. Below is a list of commonly used documents that individuals may consider alongside a New York Durable Power of Attorney.

- Health Care Proxy: This document designates an individual to make medical decisions on behalf of someone if they become incapacitated.

- Living Will: A living will outlines an individual's preferences regarding medical treatment and end-of-life care.

- Last Will and Testament: This legal document specifies how a person's assets should be distributed after their death.

- Revocable Living Trust: A trust that allows a person to maintain control of their assets during their lifetime while designating beneficiaries for after their death.

- Advance Directive: This document provides instructions regarding a person's medical treatment preferences in case they cannot communicate their wishes.

- Financial Power of Attorney: Similar to a DPOA, this document specifically grants authority to manage financial matters, but may not be durable.

- Beneficiary Designation Forms: These forms allow individuals to designate beneficiaries for accounts such as life insurance policies and retirement plans.

- Property Deed: A legal document that transfers ownership of real estate from one party to another, often used in estate planning.

- Guardianship Documents: These documents establish a legal guardian for minor children or incapacitated adults, ensuring their care and protection.

- South Dakota Hold Harmless Agreement: This document protects one party from legal liability by transferring risk to another party, and it is essential for various situations such as construction projects or special events. It is advisable to consult the Hold Harmless Agreement for specific terms and conditions to include.

- Tax Documents: Various forms that may be needed for tax purposes, including estate tax returns and gift tax returns, particularly relevant in estate planning.

Each of these documents serves a specific purpose and can play a vital role in comprehensive planning. It is advisable to consult with a legal professional to determine which documents are necessary based on individual circumstances.

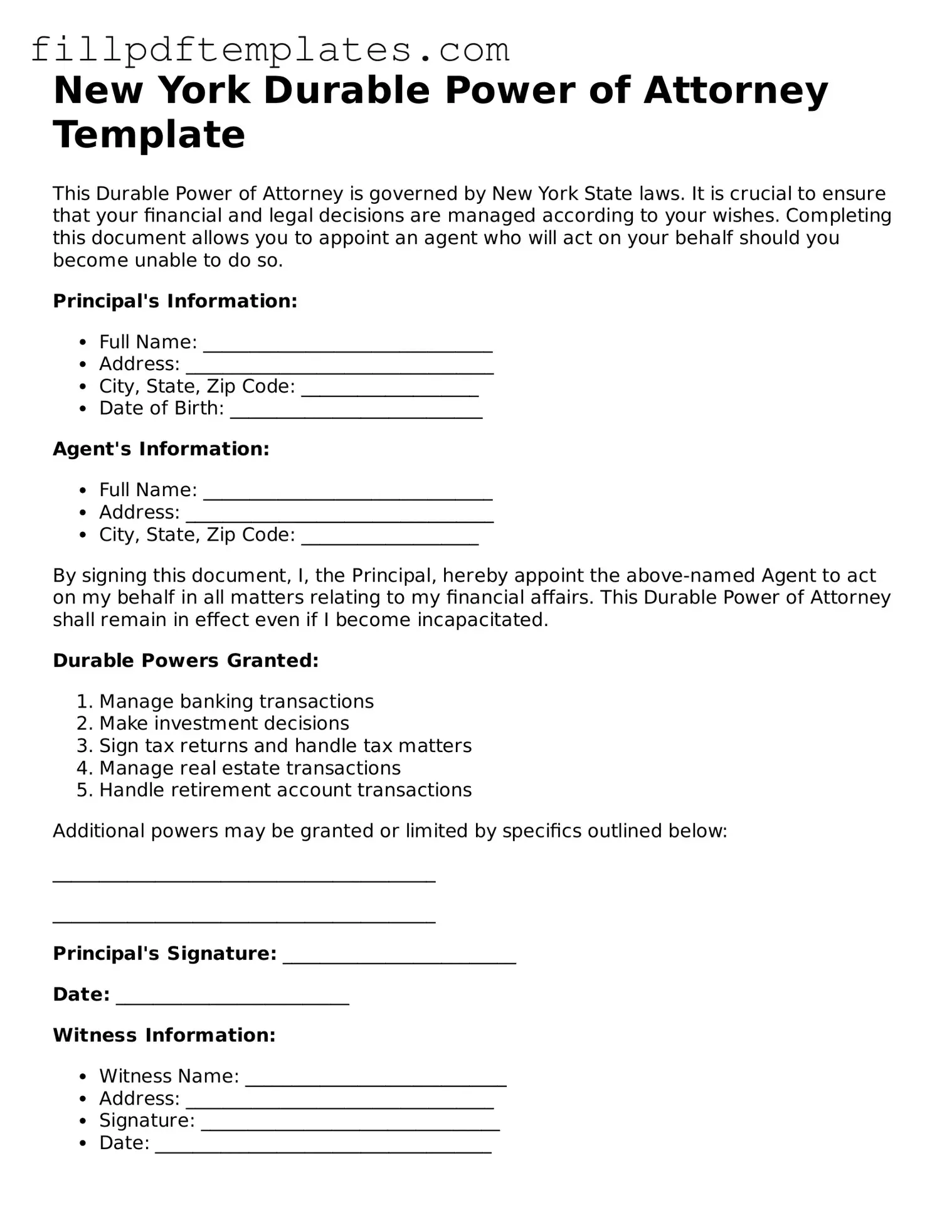

New York Durable Power of Attorney Preview

New York Durable Power of Attorney Template

This Durable Power of Attorney is governed by New York State laws. It is crucial to ensure that your financial and legal decisions are managed according to your wishes. Completing this document allows you to appoint an agent who will act on your behalf should you become unable to do so.

Principal's Information:

- Full Name: _______________________________

- Address: _________________________________

- City, State, Zip Code: ___________________

- Date of Birth: ___________________________

Agent's Information:

- Full Name: _______________________________

- Address: _________________________________

- City, State, Zip Code: ___________________

By signing this document, I, the Principal, hereby appoint the above-named Agent to act on my behalf in all matters relating to my financial affairs. This Durable Power of Attorney shall remain in effect even if I become incapacitated.

Durable Powers Granted:

- Manage banking transactions

- Make investment decisions

- Sign tax returns and handle tax matters

- Manage real estate transactions

- Handle retirement account transactions

Additional powers may be granted or limited by specifics outlined below:

_________________________________________

_________________________________________

Principal's Signature: _________________________

Date: _________________________

Witness Information:

- Witness Name: ____________________________

- Address: _________________________________

- Signature: ________________________________

- Date: ____________________________________

It is recommended to have this document notarized for additional validation. Consult with an attorney to ensure that it meets all personal requirements and state laws.