Blank New York Deed Form

When engaging in real estate transactions in New York, understanding the New York Deed form is essential for ensuring a smooth transfer of property ownership. This document serves as a legal instrument that conveys title from the seller to the buyer, outlining key details such as the names of the parties involved, a description of the property, and the terms of the transfer. Additionally, the form must be executed with specific formalities, including notarization, to ensure its validity. Various types of deeds exist, such as warranty deeds and quitclaim deeds, each serving different purposes and offering varying levels of protection for the parties. Furthermore, the deed must be filed with the appropriate county clerk's office to provide public notice of the ownership change. Failing to properly complete or file this form can lead to disputes or complications in property rights, making it crucial for both buyers and sellers to familiarize themselves with its components and requirements.

Other Common Deed State Templates

Quit Claim Deed Georgia - The language in a Deed can be straightforward or complex, depending on its purpose.

Understanding the Texas Real Estate Purchase Agreement is vital for both buyers and sellers, as it helps to clarify the specifics of the transaction and avoids potential disputes. For those interested in acquiring the necessary documentation, you can find a suitable template at https://legalpdfdocs.com/, which will assist in preparing for a successful property transaction.

How Do I Find the Deed to My House - Powers of Attorney may allow someone to sign a deed on behalf of another.

Similar forms

The Deed form is an important legal document, but it shares similarities with several other documents in the realm of property and legal transactions. Here are seven documents that are similar to the Deed form, along with explanations of how they relate:

- Bill of Sale: This document transfers ownership of personal property from one party to another, much like a Deed does for real property. Both documents serve as proof of ownership and detail the terms of the transfer.

- Rental Application: To accurately evaluate potential tenants, utilize the thorough Rental Application process that collects necessary information for landlords assessing new applicants.

- Lease Agreement: A lease outlines the terms under which one party can use another party's property. Similar to a Deed, it establishes rights and responsibilities regarding the property, though it typically does not transfer ownership.

- Title Certificate: This document proves ownership of a property. Like a Deed, it is crucial in real estate transactions, as it provides evidence that the seller has the right to transfer the property.

- Mortgage Agreement: This document secures a loan with the property as collateral. While a Deed transfers ownership, a mortgage establishes a lender's interest in the property until the loan is paid off.

- Quitclaim Deed: This is a specific type of Deed that transfers whatever interest the grantor has in the property without guaranteeing that the title is clear. It is similar to a standard Deed but offers less protection for the buyer.

- Trust Agreement: This document establishes a trust, which can hold property on behalf of beneficiaries. Both a Trust Agreement and a Deed involve the management and transfer of property, but a Trust Agreement typically includes more complex terms regarding the property’s use and distribution.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. While a Deed transfers property rights, a Power of Attorney enables someone to sign a Deed or other documents on behalf of another person.

Understanding these documents can help clarify the various ways in which property rights and responsibilities can be established and transferred.

Document Properties

| Fact Name | Description |

|---|---|

| Purpose | The New York Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | New York recognizes several types of deeds, including warranty deeds, quitclaim deeds, and bargain and sale deeds. |

| Governing Law | The New York Real Property Law governs the use and requirements of deeds in the state. |

| Signing Requirements | All parties involved must sign the deed in front of a notary public to ensure its validity. |

| Recording | To protect the buyer's interests, the deed should be recorded with the county clerk's office where the property is located. |

| Consideration | The deed must state the consideration, or the amount paid for the property, even if it is a nominal fee. |

| Property Description | A complete and accurate description of the property must be included in the deed to avoid confusion. |

| Tax Implications | Transfer taxes may apply when a property changes hands, and these should be calculated prior to the transaction. |

| Legal Advice | Consulting with a real estate attorney is recommended to ensure compliance with all local laws and regulations. |

| Common Errors | Common mistakes include incomplete information or failure to notarize, which can invalidate the deed. |

Things You Should Know About This Form

-

What is a New York Deed form?

A New York Deed form is a legal document used to transfer ownership of real property from one party to another within the state of New York. This document outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions related to the transfer.

-

What types of deeds are available in New York?

New York recognizes several types of deeds, including:

- Warranty Deed: Offers the highest level of protection to the buyer, guaranteeing that the seller holds clear title to the property.

- Quitclaim Deed: Transfers whatever interest the seller has in the property without any warranties.

- Executor's Deed: Used by an executor to transfer property from a deceased person's estate.

- Referee's Deed: Typically used in foreclosure proceedings to transfer property after a sale.

-

How do I fill out a New York Deed form?

To fill out a New York Deed form, you will need to provide specific information, including:

- The names and addresses of the grantor (seller) and grantee (buyer).

- A legal description of the property being transferred.

- The consideration amount (the price paid for the property).

- The date of the transaction.

Ensure that all information is accurate to avoid complications during the transfer process.

-

Do I need to notarize the Deed?

Yes, in New York, a Deed must be signed in the presence of a notary public. The notary will verify the identity of the signers and witness the signing of the document. This step is crucial to ensure the Deed is legally valid.

-

Where do I file the New York Deed?

The completed Deed must be filed with the County Clerk's office in the county where the property is located. Filing the Deed provides public notice of the ownership transfer and protects the buyer's rights.

-

Are there any fees associated with filing a Deed?

Yes, there are typically fees associated with filing a Deed in New York. These fees can vary by county, so it is advisable to check with the local County Clerk's office for the specific amounts. Additionally, there may be transfer taxes applicable to the transaction.

-

What happens if I do not file the Deed?

If you do not file the Deed, the transfer of ownership may not be recognized legally. This can lead to complications regarding property rights, potential disputes, and difficulties in selling or mortgaging the property in the future. Filing is essential for protecting your ownership rights.

-

Can I revoke a Deed once it is filed?

Generally, a Deed cannot be revoked once it has been filed and recorded. However, in certain circumstances, such as fraud or mutual mistake, it may be possible to challenge the validity of the Deed in court. Consulting with a legal professional is recommended for specific guidance.

-

Is it necessary to hire a lawyer for a Deed transfer?

While it is not legally required to hire a lawyer for a Deed transfer in New York, doing so can be beneficial. A legal professional can help ensure that all paperwork is completed correctly, provide guidance on local laws, and assist in resolving any potential issues that may arise during the process.

Documents used along the form

When preparing a New York Deed, several other forms and documents may be necessary to ensure a smooth transfer of property. Each document serves a specific purpose and helps clarify the details of the transaction.

- Affidavit of Title: This document confirms that the seller has clear ownership of the property and has the right to sell it. It protects the buyer from future claims against the title.

- Real Property Transfer Report: Required by New York State, this report provides information about the property and the transaction. It helps local governments assess property taxes accurately.

- Property Tax Identification Number (PTID): This number is essential for tax purposes. It identifies the property in the local tax system and ensures that taxes are correctly attributed to the new owner.

- Notice of Sale: This document informs the public about the sale of the property. It is often required to be published in local newspapers to provide transparency in the transaction.

- Hold Harmless Agreement: This document releases one party from potential legal liabilities at the hands of another, often used to protect against lawsuits or claims during a transaction. It's crucial for parties in Arizona to consider a Hold Harmless Agreement when engaging in various agreements to minimize risks associated.

- Closing Statement: Also known as a HUD-1, this document outlines all the financial details of the transaction, including costs, fees, and any adjustments. It is crucial for both parties to understand their financial obligations.

These documents work together with the New York Deed to facilitate a clear and lawful transfer of property. Ensuring all necessary paperwork is completed accurately will help protect both the buyer and the seller throughout the process.

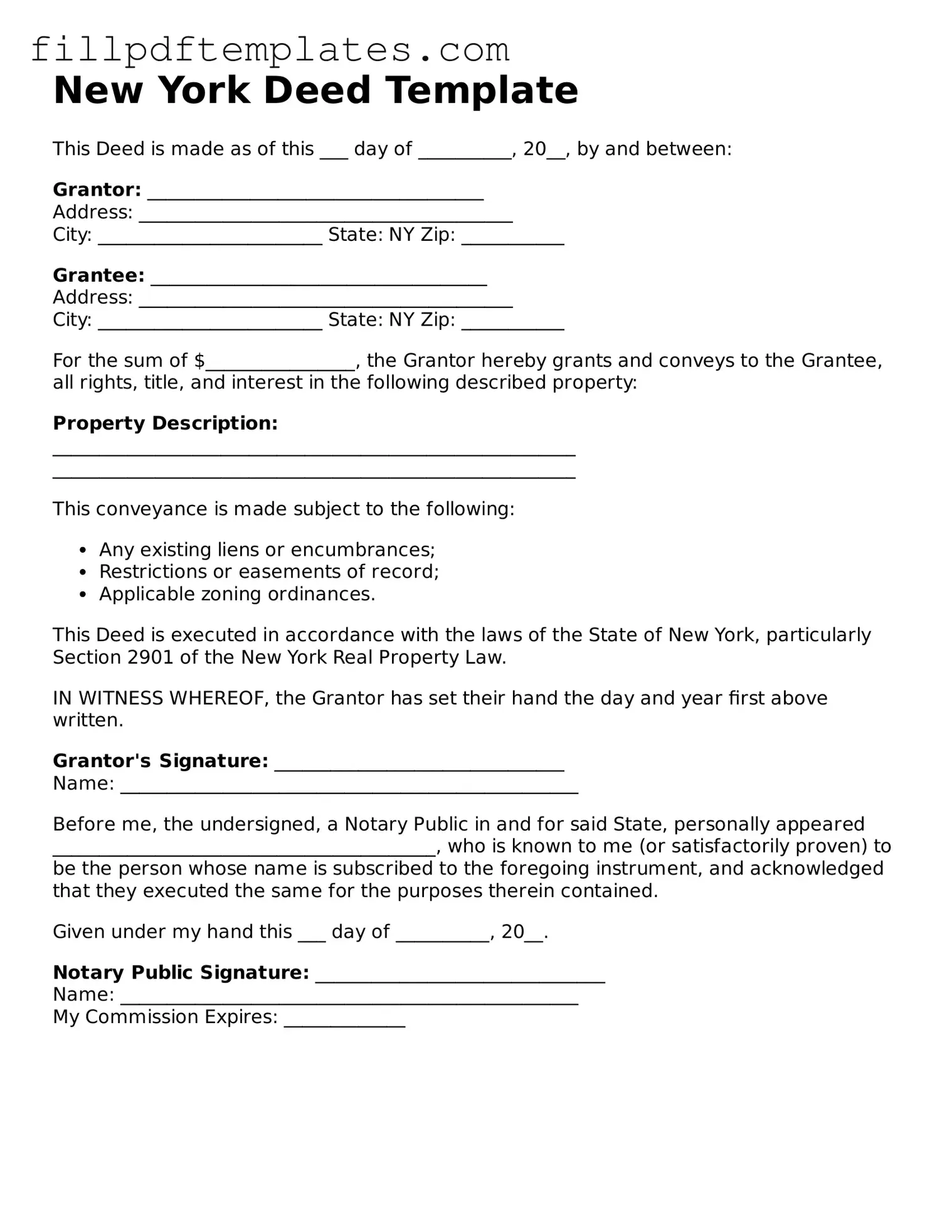

New York Deed Preview

New York Deed Template

This Deed is made as of this ___ day of __________, 20__, by and between:

Grantor: ____________________________________

Address: ________________________________________

City: ________________________ State: NY Zip: ___________

Grantee: ____________________________________

Address: ________________________________________

City: ________________________ State: NY Zip: ___________

For the sum of $________________, the Grantor hereby grants and conveys to the Grantee, all rights, title, and interest in the following described property:

Property Description:

________________________________________________________

________________________________________________________

This conveyance is made subject to the following:

- Any existing liens or encumbrances;

- Restrictions or easements of record;

- Applicable zoning ordinances.

This Deed is executed in accordance with the laws of the State of New York, particularly Section 2901 of the New York Real Property Law.

IN WITNESS WHEREOF, the Grantor has set their hand the day and year first above written.

Grantor's Signature: _______________________________

Name: _________________________________________________

Before me, the undersigned, a Notary Public in and for said State, personally appeared _________________________________________, who is known to me (or satisfactorily proven) to be the person whose name is subscribed to the foregoing instrument, and acknowledged that they executed the same for the purposes therein contained.

Given under my hand this ___ day of __________, 20__.

Notary Public Signature: _______________________________

Name: _________________________________________________

My Commission Expires: _____________