Blank New York Deed in Lieu of Foreclosure Form

In the challenging landscape of real estate, homeowners facing financial difficulties often seek alternatives to foreclosure to protect their interests and preserve their dignity. One such alternative is the Deed in Lieu of Foreclosure, a legal mechanism that allows a homeowner to voluntarily transfer their property to the lender in exchange for relief from the mortgage obligation. This process can provide a more amicable solution than a traditional foreclosure, helping homeowners avoid the lengthy and often stressful court proceedings. The New York Deed in Lieu of Foreclosure form is a crucial document in this process, outlining the terms and conditions under which the property is transferred. It typically includes information about the parties involved, a description of the property, and any relevant financial details. By completing this form, homeowners can potentially mitigate the negative impacts on their credit scores and move forward with their lives more quickly. Understanding the intricacies of this form and the implications of signing it is essential for anyone considering this route as a means of navigating their financial challenges.

Other Common Deed in Lieu of Foreclosure State Templates

Foreclosure Process in Georgia - This option can be a more dignified way for a homeowner to address their financial struggles.

The North Carolina Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, avoiding the probate process. This simple yet effective tool provides peace of mind for property owners who wish to ensure their assets are passed on smoothly. Understanding how to properly execute this form can help families navigate property transfer without unnecessary complications. For more information, visit https://transferondeathdeedform.com/north-carolina-transfer-on-death-deed.

California Property Surrender Deed - A Deed in Lieu is often faster and less expensive than traditional foreclosure proceedings.

Similar forms

The Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer the title of their property to the lender to avoid foreclosure. Several other documents serve similar purposes in real estate and lending contexts. Here are six such documents:

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage. Like a Deed in Lieu, it helps avoid foreclosure, but it involves selling the home rather than transferring ownership directly to the lender.

- Loan Modification Agreement: This document modifies the terms of an existing loan to make it more manageable for the borrower. While it doesn’t involve transferring ownership, it serves a similar purpose by helping the homeowner avoid foreclosure through revised payment terms.

- Forbearance Agreement: This agreement allows the lender to temporarily reduce or suspend mortgage payments. It offers the homeowner relief from financial strain, similar to how a Deed in Lieu provides a way out of foreclosure.

- Mortgage Release or Satisfaction: This document indicates that a mortgage has been fully paid off. While it signifies a positive outcome, it shares the goal of clearing the homeowner's debt, akin to the resolution provided by a Deed in Lieu.

- Hold Harmless Agreement: This document is crucial for protecting parties involved in transactions in Arizona. It ensures that one party is not held liable for certain damages or legal actions taken by another party, thereby reducing potential disputes and risks. For more information on this important form, visit Hold Harmless Agreement.

- Quitclaim Deed: This document transfers whatever interest the owner has in the property without guaranteeing that the title is clear. It can be used to transfer property ownership quickly, similar to a Deed in Lieu, but often without the lender’s involvement.

- Repayment Plan: This is an agreement between the lender and borrower to repay overdue amounts over time. Like a Deed in Lieu, it aims to prevent foreclosure but focuses on catching up on missed payments rather than relinquishing the property.

Each of these documents serves to address financial difficulties and prevent foreclosure, but they do so in different ways, offering homeowners various options based on their unique situations.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal process where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | New York Real Property Actions and Proceedings Law (RPAPL) governs the process. |

| Eligibility | Homeowners facing financial difficulties may qualify, but they must have the lender's agreement. |

| Benefits | This process can be less damaging to credit than a foreclosure and may help the borrower avoid a lengthy legal process. |

| Tax Implications | Borrowers may face tax consequences, as forgiven debt could be considered taxable income. |

| Negotiation | Borrowers should negotiate terms with the lender to ensure a clear understanding of the process and any potential liabilities. |

| Documentation | Proper documentation, including a written agreement and the deed itself, is essential for a valid transaction. |

| Timeframe | The process can be quicker than foreclosure, but timelines vary based on lender policies and negotiations. |

| Legal Advice | Consulting with a legal professional is advisable to understand rights and obligations before proceeding. |

Things You Should Know About This Form

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers the title of their property to the lender in exchange for the cancellation of the mortgage debt. This option is often pursued when homeowners are unable to keep up with mortgage payments and want to avoid the lengthy and costly foreclosure process.

-

Who is eligible for a Deed in Lieu of Foreclosure in New York?

Eligibility typically includes homeowners who are facing financial hardship and can no longer afford their mortgage payments. Lenders will also consider the homeowner's overall financial situation, including income, expenses, and the value of the property. It is essential to communicate openly with the lender to determine if this option is viable for your circumstances.

-

What are the benefits of choosing a Deed in Lieu of Foreclosure?

There are several benefits to consider:

- It can help homeowners avoid the negative impact of a foreclosure on their credit score.

- The process is often quicker and less expensive than going through foreclosure.

- Homeowners may be able to negotiate a "cash for keys" agreement, receiving some financial assistance for moving expenses.

- It allows for a more dignified exit from homeownership.

-

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also drawbacks. Homeowners may still face a negative impact on their credit score, although it may be less severe than a foreclosure. Additionally, lenders may require the homeowner to prove financial hardship, which can be a lengthy process. Lastly, homeowners should be aware that they may still be liable for any deficiency if the property sells for less than the mortgage balance.

-

How do I initiate the process of a Deed in Lieu of Foreclosure?

To begin, contact your lender and express your interest in a Deed in Lieu of Foreclosure. They will provide you with the necessary forms and guidelines. It is advisable to gather all relevant financial documents, including your mortgage statement, proof of income, and any other documentation that demonstrates your financial situation. This information will help the lender assess your request more efficiently.

-

What happens after the Deed in Lieu of Foreclosure is executed?

Once the Deed in Lieu is executed, the lender will take possession of the property. Homeowners should ensure that they vacate the premises by the agreed-upon date. The lender will then typically initiate the process of selling the property. Homeowners may receive a settlement statement detailing any potential financial implications, including the cancellation of the mortgage debt.

-

Can I still pursue a Deed in Lieu of Foreclosure if I have a second mortgage?

Yes, it is possible to pursue a Deed in Lieu of Foreclosure even if you have a second mortgage. However, the process may be more complicated. The lender holding the first mortgage will need to agree to the deed transfer, and the second mortgage lender may still have a claim against the property. It is crucial to consult with both lenders to understand your options and any potential consequences.

Documents used along the form

When dealing with a Deed in Lieu of Foreclosure in New York, several other forms and documents may be necessary to ensure a smooth process. These documents help clarify the agreement between the borrower and lender, outline terms, and protect the interests of both parties. Below is a list of commonly used documents associated with this process.

- Mortgage Agreement: This document outlines the terms of the loan, including the interest rate, payment schedule, and obligations of both the borrower and lender.

- Texas Vehicle Purchase Agreement: This essential document outlines the specifics of buying or selling a vehicle in Texas, ensuring clarity and fairness in the transaction. For more information on this form, visit legalpdfdocs.com/.

- Notice of Default: This notice informs the borrower that they have failed to meet their mortgage obligations and may face foreclosure if the situation is not resolved.

- Loan Modification Agreement: This agreement modifies the original terms of the mortgage, often to make payments more manageable for the borrower.

- Release of Liability: This document releases the borrower from further liability for the mortgage debt after the deed is executed, protecting them from future claims related to the loan.

- Title Search Report: A title search is conducted to ensure there are no liens or claims against the property that could complicate the transfer of ownership.

- Property Condition Disclosure: This form provides information about the condition of the property, ensuring the lender is aware of any issues that may affect its value.

- Settlement Statement: This statement details all financial transactions related to the deed transfer, including any fees or costs that need to be settled at closing.

- Affidavit of Title: This affidavit certifies that the seller has clear title to the property and can legally transfer ownership to the lender.

Each of these documents plays a vital role in the Deed in Lieu of Foreclosure process. They help establish clear communication between the borrower and lender, ensuring that all parties understand their rights and responsibilities. Proper documentation can significantly reduce complications and facilitate a smoother transition.

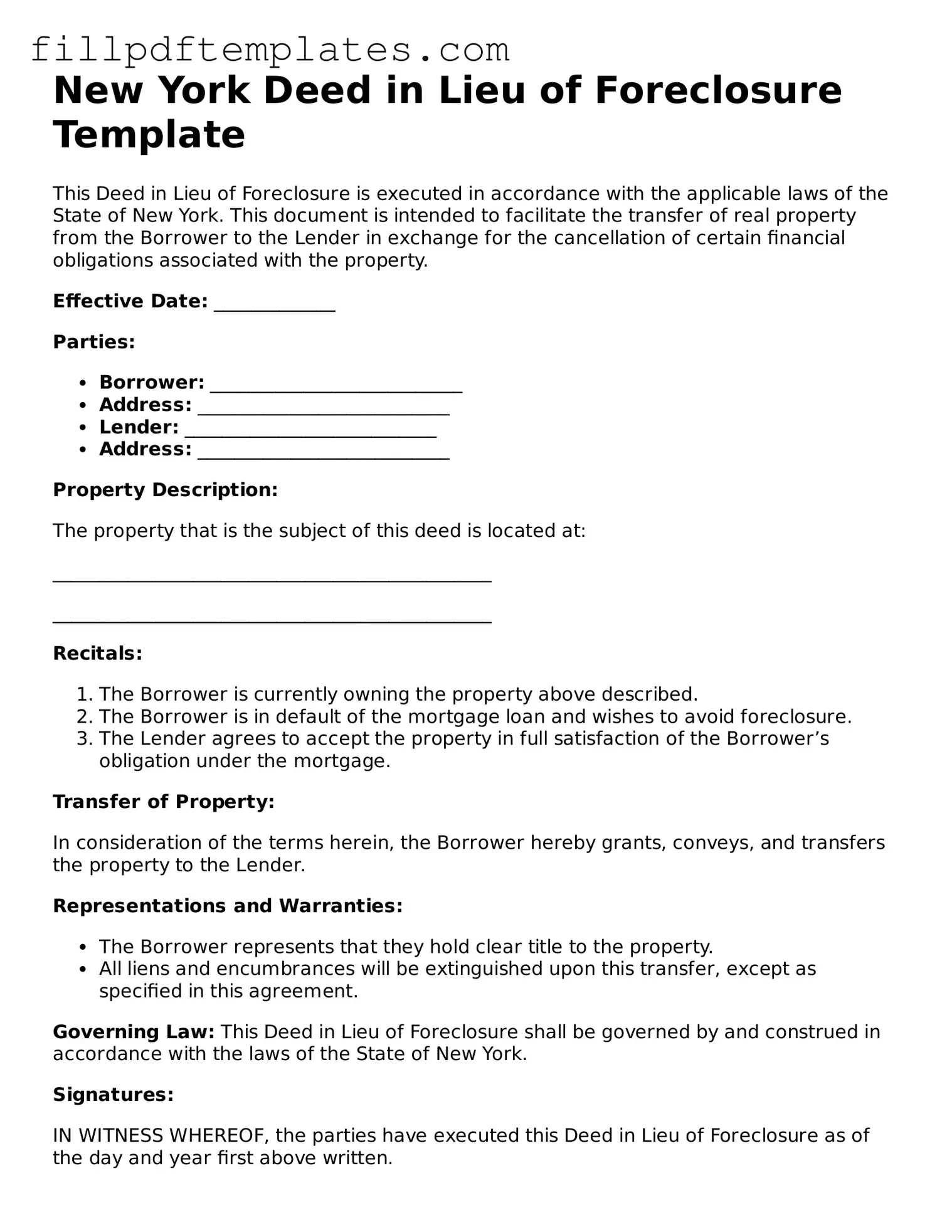

New York Deed in Lieu of Foreclosure Preview

New York Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed in accordance with the applicable laws of the State of New York. This document is intended to facilitate the transfer of real property from the Borrower to the Lender in exchange for the cancellation of certain financial obligations associated with the property.

Effective Date: _____________

Parties:

- Borrower: ___________________________

- Address: ___________________________

- Lender: ___________________________

- Address: ___________________________

Property Description:

The property that is the subject of this deed is located at:

_______________________________________________

_______________________________________________

Recitals:

- The Borrower is currently owning the property above described.

- The Borrower is in default of the mortgage loan and wishes to avoid foreclosure.

- The Lender agrees to accept the property in full satisfaction of the Borrower’s obligation under the mortgage.

Transfer of Property:

In consideration of the terms herein, the Borrower hereby grants, conveys, and transfers the property to the Lender.

Representations and Warranties:

- The Borrower represents that they hold clear title to the property.

- All liens and encumbrances will be extinguished upon this transfer, except as specified in this agreement.

Governing Law: This Deed in Lieu of Foreclosure shall be governed by and construed in accordance with the laws of the State of New York.

Signatures:

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Borrower: ___________________________________

Signature: ___________________________________

Date: _______________________________________

Lender: _____________________________________

Signature: ___________________________________

Date: _______________________________________

State of New York

County of ____________________ ss:

On this ____ day of __________, 20__, before me, a Notary Public in and for said State, personally appeared _______________________ to me known, and known to me to be the individual described in and who executed the foregoing instrument, and acknowledged that they executed the same.

Notary Public: _________________________________

My Commission Expires: _______________________