Blank New York Articles of Incorporation Form

Starting a business in New York is an exciting venture, and one of the first steps in that journey involves completing the New York Articles of Incorporation form. This essential document lays the groundwork for your corporation, detailing key information that defines your business entity. It typically includes the corporation's name, which must be unique and distinguishable from existing entities, and the purpose of the corporation, which outlines what your business will do. Additionally, the form requires the designation of a registered agent, someone who will receive legal documents on behalf of the corporation. You’ll also need to provide the address of the corporation’s principal office and the number of shares the corporation is authorized to issue. Understanding these components is crucial, as they not only fulfill legal requirements but also help shape the identity and operational structure of your business. By carefully filling out the Articles of Incorporation, you take a significant step toward establishing a successful and compliant corporation in New York.

Other Common Articles of Incorporation State Templates

Sunbiz Llc Amendment - Different states have unique requirements for what must be included.

For those looking to establish renting conditions, the "standard lease agreement" is a crucial document that safeguards both parties involved. It delineates responsibilities and expectations, making the rental process smoother. To access the necessary form, click on the link for the standard lease agreement.

Bizfile Online California - Documents required to establish a corporation in the state.

Similar forms

The Articles of Incorporation serve as foundational documents for establishing a corporation. They share similarities with several other legal documents that facilitate the formation and operation of various entities. Below is a list of six documents that are comparable to the Articles of Incorporation, along with explanations of their similarities:

- Bylaws: Like the Articles of Incorporation, bylaws outline the governance structure of an organization. They detail the rules and procedures for managing the corporation, including how meetings are conducted and how decisions are made.

- Operating Agreement: This document is similar to the Articles of Incorporation for limited liability companies (LLCs). It establishes the management structure and operational guidelines for the LLC, providing clarity on ownership and responsibilities.

- Employment Verification Form: When confirming an individual's job status, the necessary Employment Verification documentation is essential for securing employment or loans.

- Partnership Agreement: Much like the Articles of Incorporation, a partnership agreement defines the roles, responsibilities, and profit-sharing arrangements among partners. It serves as a foundational document that governs the partnership's operations.

- Certificate of Formation: This document is used in some states as an alternative to the Articles of Incorporation for LLCs. It serves a similar purpose by formally establishing the entity and providing essential information about its structure.

- Business License: While not a formation document, a business license is required for legal operation. It shares the purpose of legitimizing a business entity, similar to how the Articles of Incorporation legally establish a corporation.

- Shareholder Agreement: This document outlines the rights and obligations of shareholders within a corporation. It complements the Articles of Incorporation by addressing issues related to ownership, voting rights, and transfer of shares.

Each of these documents plays a crucial role in defining the structure, governance, and operational guidelines of a business entity, much like the Articles of Incorporation do for corporations.

Document Properties

| Fact Name | Details |

|---|---|

| Governing Law | The New York Articles of Incorporation are governed by the New York Business Corporation Law. |

| Purpose | This form is used to officially create a corporation in the state of New York. |

| Filing Requirement | To be recognized as a corporation, the Articles of Incorporation must be filed with the New York Department of State. |

| Information Required | The form typically requires the corporation's name, address, purpose, and details about the registered agent. |

| Effective Date | The corporation may specify an effective date for the Articles, which can be immediate or a future date. |

| Filing Fee | A fee must be paid upon submission of the Articles of Incorporation, which varies based on the type of corporation. |

| Public Record | Once filed, the Articles of Incorporation become a public record, accessible by anyone interested. |

Things You Should Know About This Form

-

What is the Articles of Incorporation form in New York?

The Articles of Incorporation is a legal document that establishes a corporation in New York. It outlines essential information about the corporation, including its name, purpose, and registered agent. This document is filed with the New York Department of State to officially create the corporation.

-

Who needs to file Articles of Incorporation?

Anyone looking to start a corporation in New York must file Articles of Incorporation. This includes small business owners, entrepreneurs, and organizations that want to operate as a corporation rather than a sole proprietorship or partnership.

-

What information is required to complete the form?

To complete the Articles of Incorporation, you need to provide:

- The name of the corporation

- The purpose of the corporation

- The address of the corporation's principal office

- The name and address of the registered agent

- The number of shares the corporation is authorized to issue

-

How much does it cost to file the Articles of Incorporation?

The filing fee for the Articles of Incorporation in New York is typically around $125. However, additional fees may apply depending on the specific requirements of your corporation. Always check the latest fee schedule on the New York Department of State's website.

-

How long does it take to process the Articles of Incorporation?

Processing times can vary. Generally, it takes about 5 to 10 business days for the New York Department of State to process your Articles of Incorporation. If you need expedited service, you may request it for an additional fee.

-

Do I need a lawyer to file the Articles of Incorporation?

While it is not required to have a lawyer, consulting with one can be beneficial. A legal professional can help ensure that your form is filled out correctly and that you comply with all necessary regulations.

-

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are approved, you will receive a Certificate of Incorporation. This document serves as proof that your corporation is officially recognized by the state. You can then proceed with other steps, such as obtaining an Employer Identification Number (EIN) and setting up your corporate bylaws.

-

Can I amend the Articles of Incorporation later?

Yes, you can amend your Articles of Incorporation if necessary. To do this, you must file a Certificate of Amendment with the New York Department of State. This allows you to make changes such as altering the corporation's name or adjusting the number of authorized shares.

-

Are there ongoing requirements after filing the Articles of Incorporation?

Yes, after incorporating, your corporation must comply with ongoing requirements. This includes filing biennial statements and maintaining accurate records. You must also adhere to any local, state, and federal regulations that apply to your business.

-

What if I want to dissolve my corporation?

If you decide to dissolve your corporation, you must file a Certificate of Dissolution with the New York Department of State. It’s important to follow the proper procedures to ensure that all debts are settled and that you meet any remaining obligations before dissolution.

Documents used along the form

Incorporating a business in New York requires several important documents in addition to the Articles of Incorporation. Each document serves a specific purpose and is essential for ensuring compliance with state regulations. Below is a list of commonly used forms and documents that accompany the Articles of Incorporation.

- Bylaws: This document outlines the internal rules and regulations governing the management of the corporation. Bylaws typically cover the roles of directors and officers, meeting procedures, and voting rights.

- Certificate of Incorporation: Often used interchangeably with the Articles of Incorporation, this certificate is filed with the state to formally establish the corporation's existence. It includes basic information about the corporation, such as its name and purpose.

- Bill of Sale: To secure the transfer of ownership and ensure a smooth transaction, consider using a Bill of Sale form for documentation.

- Organizational Meeting Minutes: These minutes document the initial meeting of the board of directors, where important decisions are made, including the appointment of officers and the adoption of bylaws.

- Employer Identification Number (EIN): This number, issued by the IRS, is necessary for tax purposes. It identifies the corporation for federal tax obligations and is required for opening a business bank account.

- State Tax Registration: Depending on the nature of the business, registration with the New York State Department of Taxation and Finance may be necessary. This ensures compliance with state tax laws.

- Business Licenses and Permits: Certain businesses may require specific licenses or permits to operate legally. These vary by industry and location, so it is crucial to check local regulations.

- Shareholder Agreements: This document outlines the rights and obligations of shareholders. It can address issues such as transfer of shares, voting rights, and dispute resolution among shareholders.

- Annual Report: Corporations in New York must file an annual report with the state. This report updates the state on the corporation's activities and confirms its compliance with state laws.

Each of these documents plays a critical role in the successful formation and operation of a corporation in New York. Ensuring that all necessary paperwork is completed accurately and submitted on time is essential for legal compliance and the long-term viability of the business.

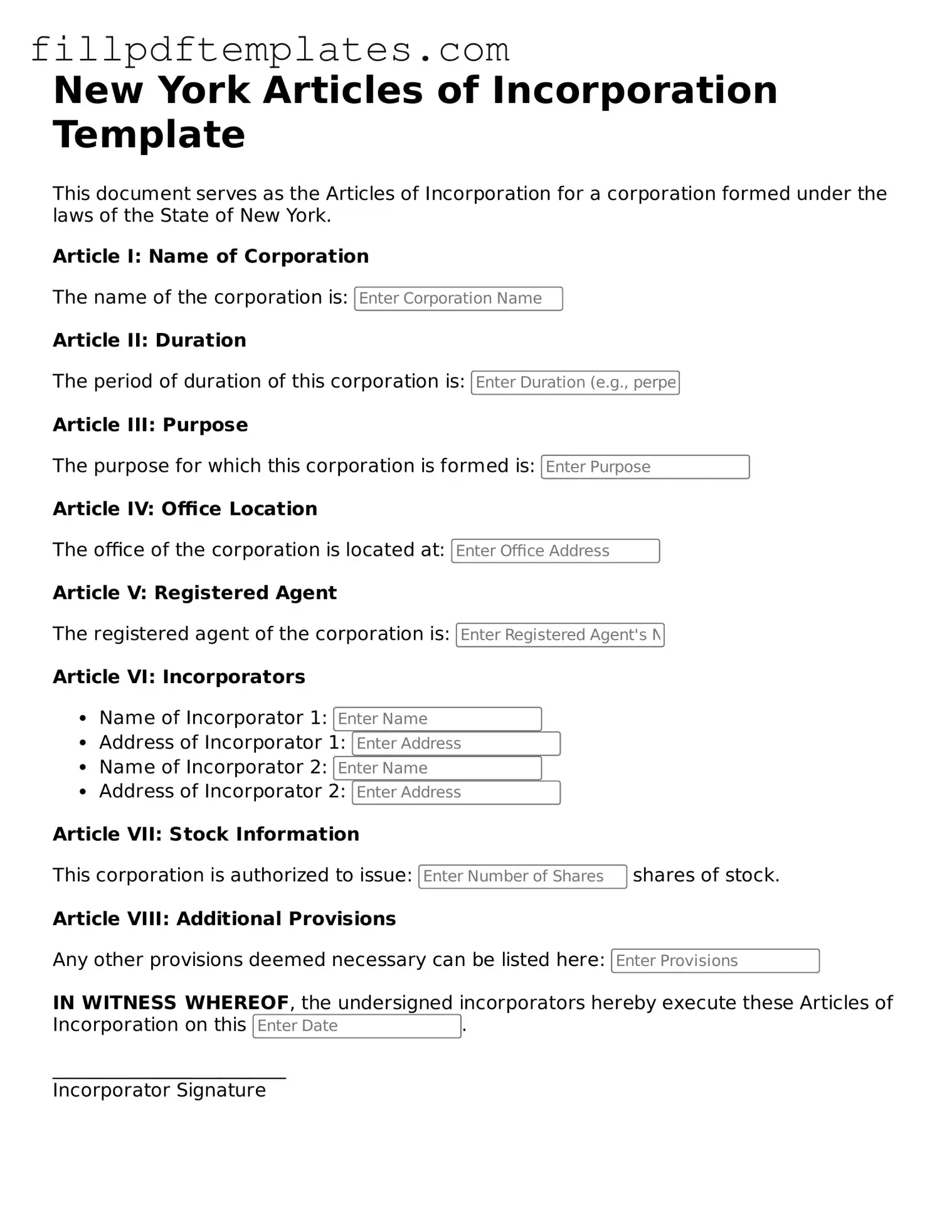

New York Articles of Incorporation Preview

New York Articles of Incorporation Template

This document serves as the Articles of Incorporation for a corporation formed under the laws of the State of New York.

Article I: Name of Corporation

The name of the corporation is:

Article II: Duration

The period of duration of this corporation is:

Article III: Purpose

The purpose for which this corporation is formed is:

Article IV: Office Location

The office of the corporation is located at:

Article V: Registered Agent

The registered agent of the corporation is:

Article VI: Incorporators

- Name of Incorporator 1:

- Address of Incorporator 1:

- Name of Incorporator 2:

- Address of Incorporator 2:

Article VII: Stock Information

This corporation is authorized to issue: shares of stock.

Article VIII: Additional Provisions

Any other provisions deemed necessary can be listed here:

IN WITNESS WHEREOF, the undersigned incorporators hereby execute these Articles of Incorporation on this .

_________________________

Incorporator Signature