Blank New Jersey Transfer-on-Death Deed Form

The New Jersey Transfer-on-Death Deed form serves as a valuable tool for property owners seeking to streamline the transfer of real estate to their beneficiaries upon their passing. This legal instrument allows individuals to designate one or more beneficiaries who will automatically receive ownership of the property, thereby avoiding the often lengthy and costly probate process. By completing this form, property owners can retain full control of their assets during their lifetime, ensuring that their wishes are honored without the complications that can arise from traditional wills. The form must be properly executed and recorded with the county clerk to be effective, making attention to detail essential. Furthermore, it is important to understand that the Transfer-on-Death Deed does not impose any immediate tax consequences or affect the property owner's ability to sell or mortgage the property while they are alive. This approach not only simplifies estate planning but also provides peace of mind, knowing that loved ones will inherit property seamlessly and efficiently. As the landscape of estate planning continues to evolve, the Transfer-on-Death Deed stands out as a modern solution for many New Jersey residents looking to ensure their real estate is passed on according to their wishes.

Other Common Transfer-on-Death Deed State Templates

Transfer on Death Deed California Common Questions - Ownership rights stay with the original owner until death; no interim ownership exists for beneficiaries.

In Montana, understanding the significance of a Hold Harmless Agreement form is essential, as it serves to protect individuals and organizations from unforeseen liabilities. By establishing clear terms, parties can engage in activities with reduced risk, knowing that responsibilities for any damages or losses may be transferred under the agreement. For further details, you can explore a comprehensive resource on the Hold Harmless Agreement specific to the state.

Free Printable Transfer on Death Deed Form Florida - It is recommended to consult with a legal professional to ensure the deed meets all requirements.

Transfer on Death Deed Form Georgia - An attorney can provide guidance on the implications of using this deed for property owners.

Similar forms

- Will: A will outlines how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property but requires probate to be effective.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they will be distributed upon death. This document avoids probate, similar to a Transfer-on-Death Deed.

- Beneficiary Designation: This is commonly used for accounts like life insurance or retirement plans. It designates who will receive the assets upon death, functioning similarly to a Transfer-on-Death Deed by allowing direct transfer without probate.

- Employment Verification Form: To confirm your employment status, use the essential Employment Verification document to provide proof of your current job and details related to your position.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows two or more individuals to hold title jointly. Upon the death of one owner, the surviving owner automatically receives full ownership, paralleling the intent of a Transfer-on-Death Deed.

- Payable-on-Death Account: This is a bank account that allows the account holder to designate a beneficiary who will receive the funds upon the account holder's death. It operates similarly by ensuring a direct transfer of assets without going through probate.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by the New Jersey Statutes, specifically N.J.S.A. 46:3B-1 et seq. |

| Eligibility | Any individual who owns real property in New Jersey can create a Transfer-on-Death Deed. |

| Execution Requirements | The deed must be signed by the property owner and witnessed by two individuals or notarized. |

| Revocation | The property owner can revoke the deed at any time before their death by executing a new deed or a written revocation. |

| Tax Implications | Property transferred via a Transfer-on-Death Deed is not subject to inheritance tax until the owner passes away. |

| Limitations | The deed cannot be used for transferring property subject to a mortgage or for certain types of property like commercial real estate. |

Things You Should Know About This Form

-

What is a Transfer-on-Death (TOD) Deed in New Jersey?

A Transfer-on-Death Deed allows property owners in New Jersey to transfer their real estate to a designated beneficiary upon their death. This deed is recorded during the owner's lifetime but takes effect only after their passing, avoiding the probate process.

-

Who can be a beneficiary of a TOD Deed?

Any individual or entity can be named as a beneficiary. This includes family members, friends, or organizations. However, it’s important to ensure that the beneficiary is legally capable of receiving the property.

-

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, you must fill out the appropriate form, which can be obtained from the New Jersey Division of Taxation or local county offices. The deed must include the property description, the beneficiary's information, and be signed by the property owner in front of a notary public.

-

Is there a cost associated with filing a TOD Deed?

Yes, there may be a filing fee when you record the TOD Deed with your county clerk’s office. Additionally, there may be other costs related to notarization or legal advice if you choose to seek assistance.

-

Can I revoke or change a TOD Deed after it has been created?

Yes, a TOD Deed can be revoked or changed at any time before the owner's death. This is done by executing a new TOD Deed or a formal revocation document and filing it with the county clerk's office.

-

What happens if the beneficiary dies before the property owner?

If the designated beneficiary passes away before the property owner, the TOD Deed becomes void. The property owner should consider naming an alternate beneficiary to avoid complications.

-

Do I need to notify the beneficiary after creating a TOD Deed?

While it is not legally required to notify the beneficiary, it is highly recommended. Informing them can prevent confusion and ensure they are aware of their future interest in the property.

-

Are there any tax implications associated with a TOD Deed?

Generally, a TOD Deed does not trigger gift taxes while the owner is alive. However, the property may be subject to estate taxes after the owner's death. It is advisable to consult a tax professional for personalized guidance.

Documents used along the form

The New Jersey Transfer-on-Death Deed form allows property owners to designate beneficiaries who will receive the property upon the owner's death, bypassing probate. When utilizing this form, several other documents may also be necessary or beneficial to ensure a smooth transfer process and to address related legal considerations.

- Last Will and Testament: This document outlines how a person's assets should be distributed upon their death. It can complement a Transfer-on-Death Deed by addressing assets not included in the deed.

- Living Trust: A living trust holds assets during a person's lifetime and can provide instructions for distribution after death. It may help avoid probate for assets not covered by the Transfer-on-Death Deed.

- Beneficiary Designation Forms: These forms apply to accounts like life insurance policies or retirement accounts, allowing owners to name beneficiaries directly, similar to the Transfer-on-Death Deed for real property.

- Divorce Settlement Agreement: The Colorado PDF Forms are essential for ensuring that all terms and conditions of asset division, child custody, and other arrangements are documented legally and clearly, thereby safeguarding the interests of both parties involved in a divorce.

- Property Deed: The original property deed provides legal proof of ownership. It is important to have this document on hand to ensure the Transfer-on-Death Deed is valid.

- Affidavit of Death: This document may be required to officially declare the death of the property owner, facilitating the transfer of property to the designated beneficiaries.

- Certificate of Trust: If a living trust is used, this certificate can verify the existence of the trust and the authority of the trustee, streamlining the transfer process.

- Real Estate Tax Records: Keeping track of property tax records is essential. These documents can clarify ownership and ensure that taxes are paid up to date, which can affect the transfer.

- Power of Attorney: This document allows someone to act on behalf of the property owner in financial matters. It can be useful if the owner becomes incapacitated before their death.

- Notice of Death: In some cases, filing a notice of death with the local government may be necessary to inform relevant parties of the property owner's passing.

- Estate Inventory: This document lists all assets owned by the deceased, including real estate, which can assist in the administration of the estate and clarify what is to be transferred.

Each of these documents plays a crucial role in ensuring that property transfers are handled effectively and in accordance with the owner's wishes. Proper preparation and organization can help avoid complications during the transfer process.

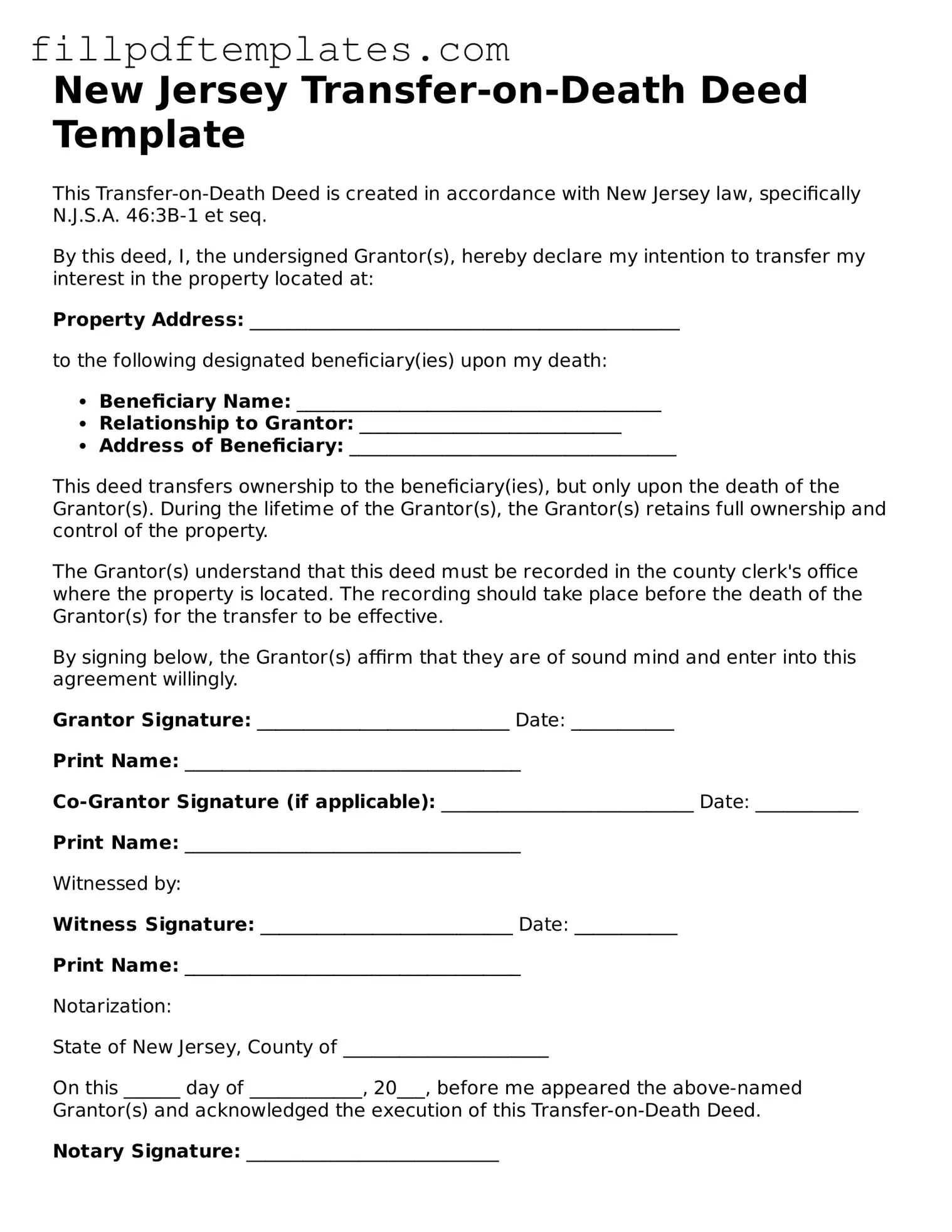

New Jersey Transfer-on-Death Deed Preview

New Jersey Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created in accordance with New Jersey law, specifically N.J.S.A. 46:3B-1 et seq.

By this deed, I, the undersigned Grantor(s), hereby declare my intention to transfer my interest in the property located at:

Property Address: ______________________________________________

to the following designated beneficiary(ies) upon my death:

- Beneficiary Name: _______________________________________

- Relationship to Grantor: ____________________________

- Address of Beneficiary: ___________________________________

This deed transfers ownership to the beneficiary(ies), but only upon the death of the Grantor(s). During the lifetime of the Grantor(s), the Grantor(s) retains full ownership and control of the property.

The Grantor(s) understand that this deed must be recorded in the county clerk's office where the property is located. The recording should take place before the death of the Grantor(s) for the transfer to be effective.

By signing below, the Grantor(s) affirm that they are of sound mind and enter into this agreement willingly.

Grantor Signature: ___________________________ Date: ___________

Print Name: ____________________________________

Co-Grantor Signature (if applicable): ___________________________ Date: ___________

Print Name: ____________________________________

Witnessed by:

Witness Signature: ___________________________ Date: ___________

Print Name: ____________________________________

Notarization:

State of New Jersey, County of ______________________

On this ______ day of ____________, 20___, before me appeared the above-named Grantor(s) and acknowledged the execution of this Transfer-on-Death Deed.

Notary Signature: ___________________________

My Commission Expires: ___________________