Blank New Jersey Quitclaim Deed Form

In New Jersey, the Quitclaim Deed form serves as a vital tool for transferring property rights between parties. This straightforward document allows one individual, known as the grantor, to convey their interest in a property to another, referred to as the grantee. Unlike other types of deeds, a quitclaim deed does not guarantee that the grantor holds clear title to the property; rather, it simply transfers whatever interest the grantor may have, if any. This makes it particularly useful in situations like divorce settlements, property transfers between family members, or clearing up title issues. The form requires essential information such as the names of the parties involved, a description of the property, and the signatures of the grantor and a witness. Additionally, while the deed itself does not require notarization to be valid, having it notarized can help ensure its acceptance in the future. Understanding the Quitclaim Deed form is crucial for anyone looking to navigate property transfers in New Jersey smoothly and effectively.

Other Common Quitclaim Deed State Templates

What Happens After a Quit Claim Deed Is Recorded - Provides a method for transferring title when selling to a friend.

Florida Quit Claim Deed Form Pdf - It can serve as an effective solution for correcting errors in titles.

Understanding the nuances of liability protection is essential, especially when drafting a legal document like the Hold Harmless Agreement, which plays a vital role in shielding parties from potential risks associated with various activities and transactions.

Kalamazoo Register of Deeds - This form is frequently utilized in estate planning to transfer property to heirs.

Similar forms

- Warranty Deed: This document guarantees that the seller has clear title to the property and will defend against any claims. Unlike a quitclaim deed, it provides more protection to the buyer.

- Grant Deed: Similar to a warranty deed, a grant deed transfers property ownership but does not offer as many guarantees. It assures that the property has not been sold to anyone else and is free of liens.

- Special Purpose Deed: This type of deed is used for specific situations, such as transferring property into a trust. Like a quitclaim deed, it does not guarantee a clear title.

- Life Estate Deed: This deed allows a person to use the property for their lifetime, after which it transfers to another party. It shares the non-guaranteeing nature of a quitclaim deed.

- Transfer on Death Deed: This document allows property to pass directly to a beneficiary upon the owner's death, without going through probate. It does not provide title guarantees, similar to a quitclaim deed.

- Deed of Trust: Often used in real estate financing, this document secures a loan by transferring the title to a trustee until the debt is paid. Like a quitclaim deed, it involves a transfer of interest.

- Transfer on Death Deed: This form allows an individual to transfer property upon death without going through probate. It is revocable and serves as an effective estate planning tool. For more information, visit https://transferondeathdeedform.com/north-carolina-transfer-on-death-deed.

- Tax Deed: This deed transfers property ownership due to unpaid taxes. It may not guarantee a clear title, similar to a quitclaim deed.

- Affidavit of Heirship: This document establishes the heirs of a deceased person and can help transfer property without a will. It shares the informal nature of a quitclaim deed.

- Bill of Sale: While typically used for personal property, this document transfers ownership without guarantees. It is similar in that it conveys interest without a warranty.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership interest in real property from one party to another without any warranties or guarantees. |

| Governing Law | In New Jersey, quitclaim deeds are governed by the New Jersey Statutes, Title 46, Chapter 3. |

| Use Case | This type of deed is commonly used among family members or in situations where the parties know each other well. |

| No Warranty | Unlike warranty deeds, a quitclaim deed does not guarantee that the grantor holds clear title to the property. |

| Filing Requirement | After execution, the deed must be filed with the county clerk's office in the county where the property is located. |

| Consideration | While consideration is not required, a nominal amount is often included to validate the transfer. |

| Tax Implications | Transfer tax may apply, and it is advisable to check local regulations regarding any potential tax obligations. |

| Notarization | The quitclaim deed must be signed by the grantor and typically requires notarization to be valid. |

Things You Should Know About This Form

-

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. It provides a way for the current owner, known as the grantor, to relinquish any claim to the property. However, it does not guarantee that the grantor holds clear title to the property. This means that if there are any liens or claims against the property, the new owner, or grantee, may inherit those issues.

-

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in situations where the parties know each other, such as family transfers, divorce settlements, or when transferring property into a trust. They are typically not recommended for transactions involving strangers or where the title history is unclear, as they do not provide any warranty of title.

-

How do I complete a Quitclaim Deed in New Jersey?

To complete a Quitclaim Deed in New Jersey, you need to fill out the form with the following information:

- The names and addresses of the grantor and grantee.

- A legal description of the property being transferred.

- The consideration, or payment, for the transfer, even if it is a nominal amount.

Once completed, the deed must be signed by the grantor in the presence of a notary public. After notarization, the deed should be filed with the county clerk's office where the property is located.

-

Are there any fees associated with filing a Quitclaim Deed?

Yes, there are typically fees for filing a Quitclaim Deed with the county clerk’s office. These fees can vary by county, so it’s advisable to check with the local office for the exact amount. Additionally, if the property has a mortgage, there may be other costs associated with the transfer.

-

Do I need an attorney to create a Quitclaim Deed?

While you are not required to have an attorney to create a Quitclaim Deed, it can be beneficial to consult one, especially if you have questions about the property title or the implications of the transfer. An attorney can help ensure that the deed is completed correctly and that your interests are protected.

-

What happens after I file a Quitclaim Deed?

After you file a Quitclaim Deed, the property ownership officially transfers to the grantee. It is advisable for the grantee to keep a copy of the filed deed for their records. Additionally, the grantee should ensure that any necessary updates are made to property tax records and insurance policies.

-

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and filed, it cannot be revoked unilaterally. If the grantor wishes to regain ownership, they would typically need to execute another deed to transfer the property back. This process may require the consent of the grantee, depending on the circumstances.

Documents used along the form

When transferring property in New Jersey, the Quitclaim Deed is a common document used. However, several other forms and documents are often necessary to complete the process smoothly. Below is a list of these essential documents, each serving a specific purpose in the property transfer process.

- Property Transfer Tax Form: This form is required to report the transfer of property and calculate the applicable transfer taxes. It ensures that the state receives its due revenue from the transaction.

- Affidavit of Title: This document provides a sworn statement regarding the ownership of the property. It confirms that the seller has the right to transfer the property and discloses any liens or encumbrances.

- Title Search Report: A title search report is conducted to verify the legal ownership of the property and to check for any claims or liens against it. This helps ensure that the buyer receives clear title.

- Mortgage Satisfaction Document: If the property was previously mortgaged, this document proves that the mortgage has been paid off. It is essential for clearing the title before the transfer.

- Transfer-on-Death Deed: This form allows property owners to designate beneficiaries who will receive their property upon their death, bypassing the probate process. For more information, visit https://todform.com/blank-alabama-transfer-on-death-deed/.

- Settlement Statement: Also known as a HUD-1 statement, this document outlines the financial details of the transaction. It includes the purchase price, closing costs, and any other fees involved in the sale.

- Power of Attorney: In some cases, the seller may not be able to be present at the closing. A power of attorney allows someone else to act on their behalf in signing the necessary documents.

- Certificate of Occupancy: This document certifies that the property meets local building codes and is safe for occupancy. It is especially important for residential properties.

Understanding these documents can help ensure a smooth property transfer process. Each form plays a vital role in protecting the interests of both the buyer and the seller, making it essential to have them prepared and reviewed properly.

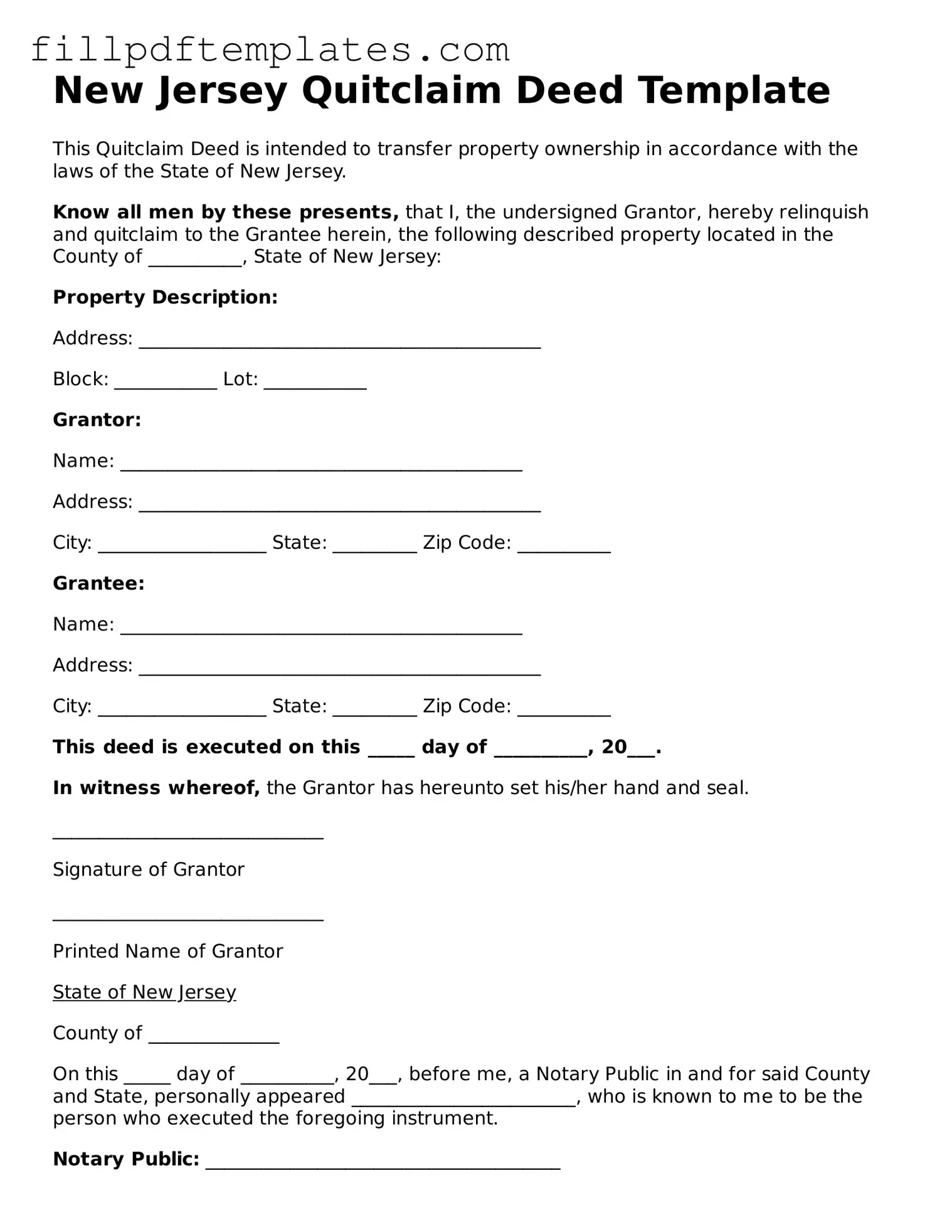

New Jersey Quitclaim Deed Preview

New Jersey Quitclaim Deed Template

This Quitclaim Deed is intended to transfer property ownership in accordance with the laws of the State of New Jersey.

Know all men by these presents, that I, the undersigned Grantor, hereby relinquish and quitclaim to the Grantee herein, the following described property located in the County of __________, State of New Jersey:

Property Description:

Address: ___________________________________________

Block: ___________ Lot: ___________

Grantor:

Name: ___________________________________________

Address: ___________________________________________

City: __________________ State: _________ Zip Code: __________

Grantee:

Name: ___________________________________________

Address: ___________________________________________

City: __________________ State: _________ Zip Code: __________

This deed is executed on this _____ day of __________, 20___.

In witness whereof, the Grantor has hereunto set his/her hand and seal.

_____________________________

Signature of Grantor

_____________________________

Printed Name of Grantor

State of New Jersey

County of ______________

On this _____ day of __________, 20___, before me, a Notary Public in and for said County and State, personally appeared ________________________, who is known to me to be the person who executed the foregoing instrument.

Notary Public: ______________________________________

My Commission Expires: _____________________________