Blank New Jersey Promissory Note Form

When entering into a loan agreement in New Jersey, a Promissory Note serves as a crucial document that outlines the terms of repayment between the borrower and the lender. This form typically includes essential details such as the principal amount borrowed, the interest rate, and the repayment schedule. Additionally, it may specify the consequences of default, including late fees or legal action. By clearly stating the obligations of both parties, the Promissory Note helps to prevent misunderstandings and provides a framework for resolving disputes should they arise. Understanding the components of this form is vital for anyone involved in lending or borrowing money in New Jersey, as it not only protects the lender's interests but also provides the borrower with clarity on their financial commitments.

Other Common Promissory Note State Templates

Promissory Note Template Georgia - Includes provisions for late fees if payments are missed.

The use of a Hold Harmless Agreement is essential for parties involved in contracts, especially in North Carolina, to ensure both protection and clarity in their legal responsibilities. By utilizing a Hold Harmless Agreement, individuals and businesses can effectively minimize their risk of incurring liabilities and provide assurance that all parties are aware of their obligations, thereby fostering a more secure and compliant operating environment.

California Promissory Note Requirements - Including a provision for a grace period can benefit borrowers facing temporary financial hardship.

Promissory Notes for Personal Loans - May require witnesses or notarization for added validity.

Similar forms

The Promissory Note is a crucial financial document, but it shares similarities with several other important forms. Below is a list of eight documents that resemble a Promissory Note, along with a brief explanation of how they are alike.

- Loan Agreement: Like a Promissory Note, a loan agreement outlines the terms of borrowing money, including the amount, interest rate, and repayment schedule. Both documents establish a borrower-lender relationship.

- Mortgage: A mortgage is a specific type of loan secured by real property. Similar to a Promissory Note, it includes terms for repayment and may involve the same parties. Both documents create obligations for the borrower.

- Installment Agreement: This document sets out the terms for paying off a debt in installments. Like a Promissory Note, it details the amount owed, payment schedule, and any applicable interest.

- Secured Note: A secured note is a Promissory Note backed by collateral. Both documents require the borrower to repay the loan, but the secured note offers additional protection to the lender.

- Personal Guarantee: This document involves a third party agreeing to repay a debt if the primary borrower defaults. While it is not a loan document itself, it complements a Promissory Note by providing added security for the lender.

- Credit Agreement: A credit agreement outlines the terms under which a borrower can access credit. Like a Promissory Note, it specifies repayment terms and conditions, creating a binding obligation.

- Transfer-on-Death Deed: This legal document enables property owners to ensure their real estate is transferred to beneficiaries upon death, avoiding probate complications. For more information, visit https://todform.com/blank-new-jersey-transfer-on-death-deed/.

- Letter of Credit: This document guarantees payment to a seller from a buyer's bank. Similar to a Promissory Note, it involves financial commitments and outlines terms for payment.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. Like a Promissory Note, it formalizes an agreement between parties regarding financial obligations.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a certain time. |

| Governing Law | New Jersey's promissory notes are governed by the New Jersey Uniform Commercial Code (UCC), specifically N.J.S.A. 12A:3-104. |

| Parties Involved | The document involves two main parties: the maker (the person who promises to pay) and the payee (the person who receives the payment). |

| Amount | The note must clearly state the amount of money to be paid, which can be a fixed sum or a variable amount. |

| Interest Rate | If applicable, the interest rate should be specified in the note. This can be a fixed rate or a variable rate. |

| Payment Terms | Payment terms must be included, detailing when and how payments will be made, such as installments or a lump sum. |

| Signatures | The note must be signed by the maker to be legally binding. A signature can be handwritten or electronic, depending on the context. |

| Default Provisions | It is advisable to include terms regarding what happens in the event of a default, such as late fees or acceleration of payment. |

| State-Specific Requirements | While New Jersey does not have unique formatting requirements, it is important to ensure that the note complies with general legal standards. |

Things You Should Know About This Form

-

What is a promissory note?

A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a defined time or on demand. It is a legally binding document that outlines the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payment.

-

Why would I need a promissory note in New Jersey?

A promissory note serves as proof of a loan agreement. It protects both the lender and the borrower by clearly stating the terms of the loan. In New Jersey, having a written note can help avoid misunderstandings and disputes in the future.

-

What information should be included in a New Jersey promissory note?

A typical promissory note should include:

- The names and addresses of the borrower and lender.

- The principal amount of the loan.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any late fees or penalties for missed payments.

- Conditions for default and remedies available to the lender.

-

Is it necessary to have the promissory note notarized?

While it is not legally required to notarize a promissory note in New Jersey, having it notarized can add an extra layer of protection. A notarized document can serve as evidence in court if disputes arise.

-

Can I modify the terms of a promissory note after it has been signed?

Yes, modifications can be made to a promissory note, but they must be agreed upon by both parties. It is advisable to document any changes in writing and have both parties sign the revised agreement to ensure clarity and enforceability.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options. These may include charging late fees, accelerating the loan (demanding full payment immediately), or pursuing legal action to recover the owed amount. The specific remedies available will depend on the terms outlined in the promissory note.

-

How long is a promissory note valid in New Jersey?

The validity of a promissory note in New Jersey generally depends on the statute of limitations for written contracts, which is typically six years. After this period, the lender may lose the right to enforce the note in court.

-

Can a promissory note be transferred to another party?

Yes, a promissory note can be transferred, or assigned, to another party. The new holder of the note will assume the rights to collect the debt. However, it is important to inform the borrower of the transfer to avoid confusion regarding payment obligations.

-

Where can I find a New Jersey promissory note template?

Promissory note templates can be found online through legal websites, or you may consult with an attorney to draft a customized note that meets your specific needs. It is crucial to ensure that any template complies with New Jersey laws.

Documents used along the form

When engaging in a lending arrangement in New Jersey, a Promissory Note is often accompanied by several other important documents. These documents help clarify the terms of the loan and protect the interests of both the lender and the borrower. Here’s a brief overview of seven common forms used alongside a New Jersey Promissory Note.

- Loan Agreement: This document outlines the specific terms of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide to the obligations of both parties.

- Security Agreement: If the loan is secured by collateral, this document details what assets are pledged to guarantee the loan. It specifies the rights of the lender in case of default.

- Personal Guarantee: In cases where the borrower is a business entity, a personal guarantee may be required. This document holds an individual personally liable for the loan if the business fails to repay.

- Divorce Settlement Agreement: This form ensures that both parties agree on the division of assets and responsibilities, and for further details, you can refer to Colorado PDF Forms.

- Disclosure Statement: This statement provides essential information about the loan, including the total cost, interest rates, and any fees. It ensures transparency and helps borrowers understand their financial commitments.

- Amortization Schedule: This document breaks down each payment over the life of the loan, detailing how much of each payment goes toward principal and interest. It helps borrowers plan their finances accordingly.

- Default Notice: If the borrower fails to make payments, a default notice may be issued. This document formally alerts the borrower of the default and outlines the potential consequences.

- Release of Liability: Once the loan is fully repaid, this document confirms that the borrower is no longer obligated to the lender. It provides peace of mind and legal protection for the borrower.

Each of these documents plays a vital role in the lending process, ensuring that both parties have a clear understanding of their rights and responsibilities. By utilizing these forms, lenders and borrowers can navigate their financial agreements with greater confidence and clarity.

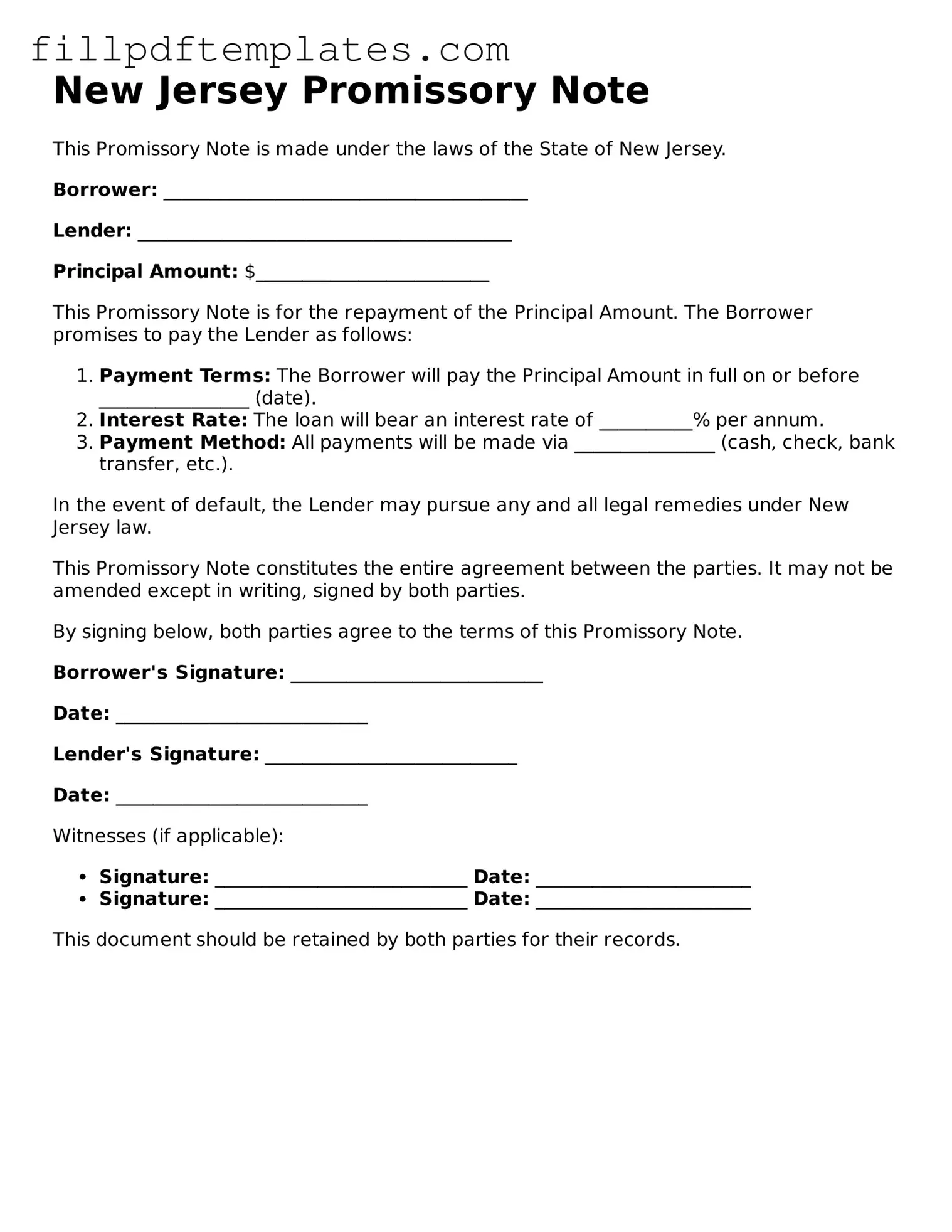

New Jersey Promissory Note Preview

New Jersey Promissory Note

This Promissory Note is made under the laws of the State of New Jersey.

Borrower: _______________________________________

Lender: ________________________________________

Principal Amount: $_________________________

This Promissory Note is for the repayment of the Principal Amount. The Borrower promises to pay the Lender as follows:

- Payment Terms: The Borrower will pay the Principal Amount in full on or before ________________ (date).

- Interest Rate: The loan will bear an interest rate of __________% per annum.

- Payment Method: All payments will be made via _______________ (cash, check, bank transfer, etc.).

In the event of default, the Lender may pursue any and all legal remedies under New Jersey law.

This Promissory Note constitutes the entire agreement between the parties. It may not be amended except in writing, signed by both parties.

By signing below, both parties agree to the terms of this Promissory Note.

Borrower's Signature: ___________________________

Date: ___________________________

Lender's Signature: ___________________________

Date: ___________________________

Witnesses (if applicable):

- Signature: ___________________________ Date: _______________________

- Signature: ___________________________ Date: _______________________

This document should be retained by both parties for their records.