Blank New Jersey Operating Agreement Form

The New Jersey Operating Agreement form is an essential document for any limited liability company (LLC) operating within the state. This form outlines the internal workings of the LLC, detailing the roles and responsibilities of its members. It serves as a roadmap for decision-making, profit distribution, and management structure, ensuring that all members are on the same page. By addressing key elements such as voting rights, capital contributions, and procedures for adding or removing members, the agreement provides clarity and stability for the business. Additionally, it can help prevent disputes among members by establishing clear guidelines and expectations. Whether you are starting a new LLC or updating an existing agreement, understanding the New Jersey Operating Agreement form is crucial for the smooth operation of your business.

Other Common Operating Agreement State Templates

Llc Operating Agreement Michigan Template - It may include provisions for employee compensation and benefits.

For a smooth leasing experience, it's vital to utilize a well-structured detailed Lease Agreement template that clearly defined the terms you and your tenant must adhere to.

Sample Operating Agreement Llc New York - An Operating Agreement can play a vital role during business audits.

Similar forms

- Bylaws: Bylaws outline the internal rules and procedures for a corporation. Like an Operating Agreement, they govern the management structure and decision-making processes within the organization.

- Partnership Agreement: This document details the terms of a partnership, including roles, responsibilities, and profit-sharing. Similar to an Operating Agreement, it establishes how the partners will work together and manage the business.

- Divorce Settlement Agreement: This document is essential for divorcing couples as it stipulates the terms of asset division, child custody, and support obligations, similar to the way the Colorado PDF Forms serve a specific legal purpose in Colorado.

- Shareholder Agreement: A Shareholder Agreement defines the rights and obligations of shareholders in a corporation. It is akin to an Operating Agreement in that it outlines governance and operational procedures for the entity.

- LLC Membership Agreement: This document is specific to Limited Liability Companies and serves a similar purpose as an Operating Agreement. It details the rights and responsibilities of members, including management and profit distribution.

- Joint Venture Agreement: A Joint Venture Agreement outlines the terms of a partnership between two or more parties for a specific project. It shares similarities with an Operating Agreement in terms of governance and operational guidelines.

- Franchise Agreement: This document governs the relationship between a franchisor and franchisee. Like an Operating Agreement, it includes operational guidelines, responsibilities, and rights of the parties involved.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information shared between parties. While it serves a different primary function, it can complement an Operating Agreement by ensuring that sensitive business information is kept private.

Document Properties

| Fact Name | Description |

|---|---|

| Purpose | The New Jersey Operating Agreement outlines the management structure and operational procedures of an LLC. |

| Governing Law | This agreement is governed by the New Jersey Limited Liability Company Act (N.J.S.A. 42:2B-1 et seq.). |

| Mandatory Requirement | While not required by law, having an Operating Agreement is highly recommended for LLCs in New Jersey. |

| Members' Rights | The agreement defines the rights and responsibilities of each member, including voting and profit-sharing. |

| Amendments | Members can amend the Operating Agreement as needed, provided all parties agree to the changes. |

| Dispute Resolution | The agreement often includes provisions for resolving disputes among members, which can help avoid litigation. |

| Confidentiality | Many Operating Agreements include confidentiality clauses to protect sensitive business information. |

Things You Should Know About This Form

-

What is a New Jersey Operating Agreement?

A New Jersey Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in New Jersey. It serves as an internal guideline for members, detailing their rights, responsibilities, and the distribution of profits and losses.

-

Is an Operating Agreement required in New Jersey?

While New Jersey does not legally require LLCs to have an Operating Agreement, it is highly recommended. Having this document helps prevent misunderstandings among members and provides clarity on how the company will operate. It also offers protection in case of disputes.

-

Who should draft the Operating Agreement?

The Operating Agreement can be drafted by any member of the LLC, but it is advisable to seek the assistance of a legal professional. An attorney can ensure that the agreement complies with state laws and adequately addresses the specific needs of the business.

-

What should be included in the Operating Agreement?

Key elements to include in the Operating Agreement are:

- The name and address of the LLC

- The purpose of the LLC

- The names and contributions of the members

- The management structure (member-managed or manager-managed)

- Voting rights and procedures

- Profit and loss distribution

- Procedures for adding or removing members

- Dispute resolution methods

-

How is the Operating Agreement adopted?

The Operating Agreement is typically adopted when all members agree to its terms and sign the document. It is essential that all members understand and consent to the provisions outlined in the agreement.

-

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. The process for making changes should be clearly outlined in the agreement itself. Generally, amendments require the consent of all members or a specified majority, depending on what the original agreement states.

-

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, it will be governed by New Jersey’s default LLC laws. These laws may not reflect the specific intentions of the members, potentially leading to disputes and misunderstandings. It is always better to have a customized agreement in place.

-

Is the Operating Agreement a public document?

No, the Operating Agreement is not filed with the state and is considered a private document. This means that its contents are not publicly accessible, allowing members to maintain confidentiality regarding their internal operations.

-

Can members of the LLC be individuals or entities?

Members of an LLC can be individuals, corporations, other LLCs, or even foreign entities. This flexibility allows for a diverse range of ownership structures, which can be beneficial depending on the business goals.

-

What are the benefits of having an Operating Agreement?

Having an Operating Agreement provides several advantages, including:

- Clarifying the roles and responsibilities of members

- Establishing a clear framework for decision-making

- Protecting personal assets from business liabilities

- Facilitating smoother operations and reducing conflicts

Documents used along the form

When forming a Limited Liability Company (LLC) in New Jersey, the Operating Agreement serves as a foundational document outlining the management structure and operational guidelines. However, several other forms and documents are typically utilized in conjunction with the Operating Agreement to ensure compliance with state regulations and to facilitate smooth business operations. Below is a list of such documents, each serving a unique purpose in the LLC formation process.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes essential details such as the LLC's name, address, and the names of its members.

- Employer Identification Number (EIN) Application: An EIN is necessary for tax purposes and is required if the LLC has employees or multiple members. This application is submitted to the IRS.

- Initial Resolutions: These are formal decisions made by the members of the LLC at its inception. They may cover the appointment of officers and the adoption of the Operating Agreement.

- Membership Certificates: These documents serve as proof of ownership for the members of the LLC. They outline the percentage of ownership each member holds.

- Bylaws: While not mandatory for LLCs, bylaws can be helpful in detailing the internal rules and procedures governing the LLC's operations and member interactions.

- Hold Harmless Agreement: This document is crucial for transferring risk and protecting parties from liability in various business scenarios, much like the Hold Harmless Agreement used in North Carolina.

- Business Licenses and Permits: Depending on the nature of the business, various licenses and permits may be required at the local, state, or federal level to operate legally.

- Operating Procedures: This document outlines the day-to-day operational processes of the LLC, including roles and responsibilities of members and management.

- Financial Agreements: These agreements detail the financial arrangements among members, including profit sharing, capital contributions, and expense reimbursements.

- Annual Reports: Many states, including New Jersey, require LLCs to file annual reports to maintain good standing. This document typically includes updated information about the business.

Each of these documents plays a crucial role in the establishment and maintenance of an LLC in New Jersey. By ensuring that all necessary forms are completed and filed correctly, members can create a solid foundation for their business operations while adhering to legal requirements.

New Jersey Operating Agreement Preview

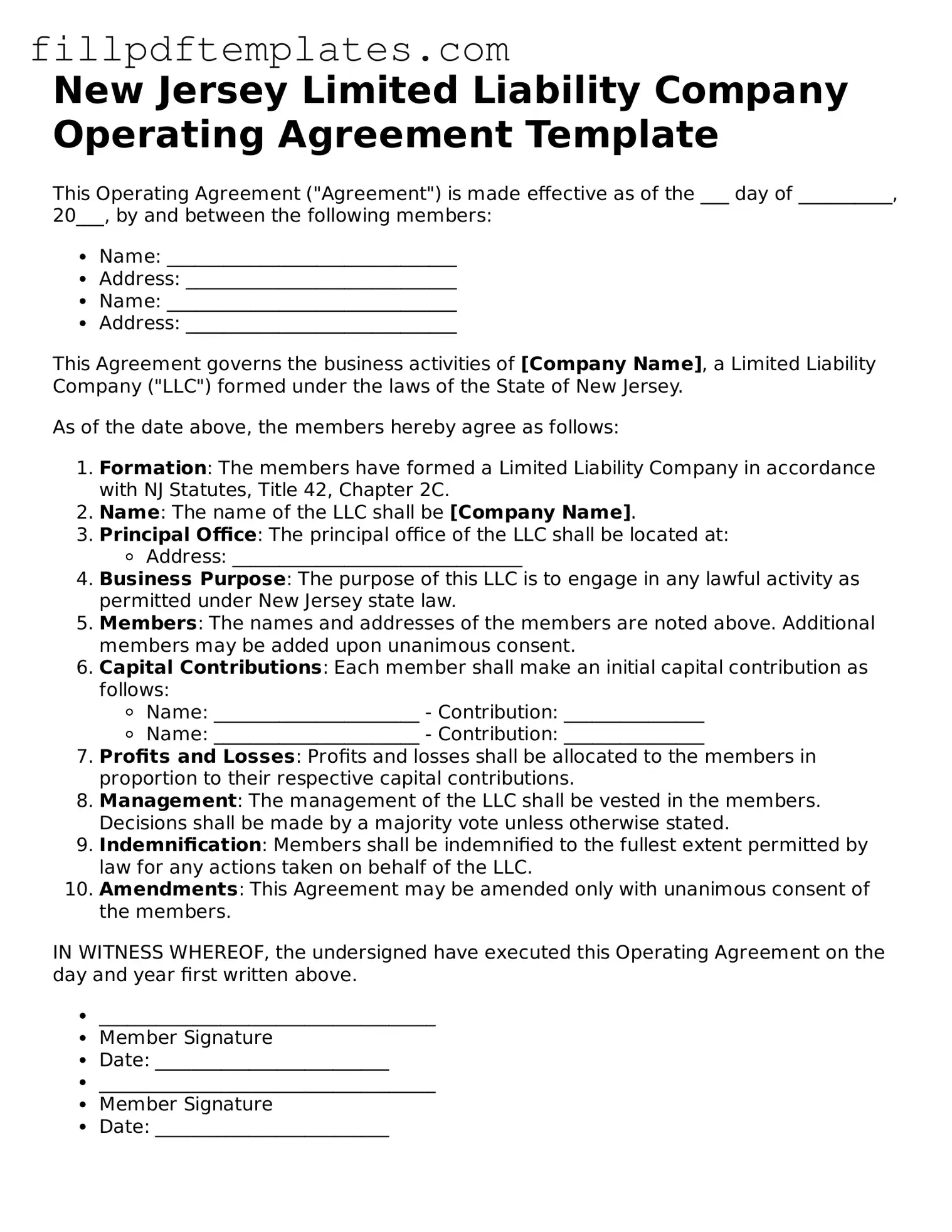

New Jersey Limited Liability Company Operating Agreement Template

This Operating Agreement ("Agreement") is made effective as of the ___ day of __________, 20___, by and between the following members:

- Name: _______________________________

- Address: _____________________________

- Name: _______________________________

- Address: _____________________________

This Agreement governs the business activities of [Company Name], a Limited Liability Company ("LLC") formed under the laws of the State of New Jersey.

As of the date above, the members hereby agree as follows:

- Formation: The members have formed a Limited Liability Company in accordance with NJ Statutes, Title 42, Chapter 2C.

- Name: The name of the LLC shall be [Company Name].

- Principal Office: The principal office of the LLC shall be located at:

- Address: _______________________________

- Business Purpose: The purpose of this LLC is to engage in any lawful activity as permitted under New Jersey state law.

- Members: The names and addresses of the members are noted above. Additional members may be added upon unanimous consent.

- Capital Contributions: Each member shall make an initial capital contribution as follows:

- Name: ______________________ - Contribution: _______________

- Name: ______________________ - Contribution: _______________

- Profits and Losses: Profits and losses shall be allocated to the members in proportion to their respective capital contributions.

- Management: The management of the LLC shall be vested in the members. Decisions shall be made by a majority vote unless otherwise stated.

- Indemnification: Members shall be indemnified to the fullest extent permitted by law for any actions taken on behalf of the LLC.

- Amendments: This Agreement may be amended only with unanimous consent of the members.

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement on the day and year first written above.

- ____________________________________

- Member Signature

- Date: _________________________

- ____________________________________

- Member Signature

- Date: _________________________