Blank New Jersey Durable Power of Attorney Form

In New Jersey, a Durable Power of Attorney (DPOA) is an essential legal document that allows individuals to appoint someone they trust to make decisions on their behalf, especially in times when they may not be able to do so themselves. This form is particularly crucial for managing financial matters, healthcare decisions, and other important aspects of daily life. The DPOA remains effective even if the person who created it becomes incapacitated, providing peace of mind that their wishes will be honored. It is important to understand the various powers that can be granted, which may include handling bank transactions, signing checks, and making medical decisions. Additionally, the form requires specific language and signatures to ensure its validity, making it vital for individuals to follow the state's guidelines carefully. By establishing a Durable Power of Attorney, individuals can ensure that their affairs are managed according to their preferences, safeguarding their interests and easing the burden on loved ones during challenging times.

Other Common Durable Power of Attorney State Templates

How to Get Power of Attorney in Ny - A Durable Power of Attorney can grant your agent authority to handle tax-related matters.

Power of Attorney Florida - A Durable Power of Attorney provides a clear legal pathway for others to support your needs in a crisis.

The Indiana Transfer-on-Death Deed form allows property owners to transfer their real estate to beneficiaries upon their death, avoiding the lengthy probate process. This deed provides a simple way to ensure that your property goes directly to your loved ones without the complications of a will. For more information, you can visit https://todform.com/blank-indiana-transfer-on-death-deed and start the process today.

Power of Attorney Michigan Requirements - Your agent can handle tasks such as paying bills, managing real estate, and accessing bank accounts.

Similar forms

- General Power of Attorney: Like a Durable Power of Attorney, this document allows one person to act on behalf of another in financial matters. However, it typically becomes invalid if the principal becomes incapacitated.

- Hold Harmless Agreement: This legal document serves to protect one party from liability while transferring risks to another, similar to the functions of the DPOA. A Hold Harmless Agreement is essential in establishing clarity and responsibility in various transactions and activities.

- Healthcare Power of Attorney: This form designates someone to make medical decisions for another person if they are unable to do so. It focuses specifically on healthcare choices rather than financial matters.

- Living Will: A Living Will outlines a person's wishes regarding medical treatment in situations where they cannot communicate. While it does not appoint an agent, it complements the Healthcare Power of Attorney.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document grants authority to manage financial affairs. However, it may not remain effective if the principal becomes incapacitated unless specified as durable.

- Revocable Trust: A Revocable Trust allows a person to place their assets in a trust, which can be managed by a trustee. It provides a way to handle assets during incapacity, similar to the Durable Power of Attorney.

- Advance Directive: This document combines a Living Will and a Healthcare Power of Attorney. It outlines medical preferences and appoints an agent for healthcare decisions, ensuring comprehensive medical planning.

- Guardianship Documents: If someone becomes incapacitated and has not set up a Durable Power of Attorney, a court may appoint a guardian. This process can be lengthy and is often seen as a last resort.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to designate another person to make decisions on their behalf, even if they become incapacitated. |

| Governing Law | The New Jersey Durable Power of Attorney is governed by the New Jersey Statutes, specifically N.J.S.A. 46:2B-8. |

| Durability | This form remains effective even if the principal becomes mentally incapacitated, unlike a standard power of attorney. |

| Agent Authority | The agent can be granted broad or limited authority, depending on the principal's wishes outlined in the document. |

| Signing Requirements | The form must be signed by the principal and witnessed by at least one adult or notarized to be valid. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| Uses | This document is often used for financial matters, healthcare decisions, and managing assets in the event of incapacity. |

Things You Should Know About This Form

-

What is a Durable Power of Attorney in New Jersey?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to appoint someone else, called the agent or attorney-in-fact, to make decisions on their behalf. This authority remains in effect even if the principal becomes incapacitated. In New Jersey, a DPOA can cover a wide range of financial and legal matters, ensuring that the principal's affairs are managed according to their wishes.

-

How do I create a Durable Power of Attorney in New Jersey?

To create a Durable Power of Attorney in New Jersey, the principal must be at least 18 years old and mentally competent. The document must be in writing and clearly state that it is a durable power of attorney. It is advisable to specify the powers granted to the agent, which can include managing finances, handling real estate transactions, and making healthcare decisions. The document must be signed by the principal and witnessed by two individuals or acknowledged by a notary public to be valid.

-

Can I revoke a Durable Power of Attorney?

Yes, a Durable Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. To revoke the DPOA, the principal should create a written revocation notice and provide copies to the agent and any relevant institutions or parties that may rely on the DPOA. It is important to ensure that the revocation is clear and unambiguous to avoid any confusion regarding the authority of the agent.

-

What happens if I do not have a Durable Power of Attorney?

If an individual does not have a Durable Power of Attorney and becomes incapacitated, a court may need to appoint a guardian to manage their affairs. This process can be lengthy and costly, and the appointed guardian may not necessarily be the person the individual would have chosen. Having a DPOA in place allows individuals to maintain control over their decisions and choose someone they trust to act on their behalf.

Documents used along the form

When preparing a New Jersey Durable Power of Attorney, several other forms and documents may also be necessary to ensure comprehensive legal coverage. Below is a list of commonly used documents that often accompany the Durable Power of Attorney form, each serving a unique purpose.

- Advance Directive for Health Care: This document outlines an individual's healthcare preferences in case they become unable to communicate their wishes. It often includes instructions about medical treatment and appoints a healthcare representative.

- Living Will: A living will specifies what types of medical treatment a person does or does not want in end-of-life situations. It is crucial for guiding healthcare providers and family members when difficult decisions arise.

- HIPAA Authorization: This form allows individuals to grant permission for healthcare providers to share their medical information with designated persons. It ensures that loved ones can access necessary health records when needed.

- Will: A will outlines how a person's assets will be distributed upon their death. It designates beneficiaries and may appoint an executor to manage the estate, ensuring that the individual's wishes are honored.

- Trailer Bill of Sale Form: For those involved in trailer transactions, the simple Trailer Bill of Sale documentation is crucial for establishing ownership transfer and legal compliance.

- Revocable Living Trust: This legal arrangement allows an individual to place their assets into a trust during their lifetime. It can help avoid probate and manage assets if the individual becomes incapacitated.

- Declaration of Guardian: This document allows an individual to designate a guardian for themselves should they become incapacitated. It provides clarity on who will make decisions on their behalf.

- Property Power of Attorney: Similar to a Durable Power of Attorney, this form specifically grants authority to manage real estate and other property matters. It is often used for transactions involving real estate or significant assets.

- Financial Power of Attorney: This document allows an individual to appoint someone to handle their financial affairs. It can be broad or limited in scope, depending on the individual's preferences.

Understanding these documents can significantly enhance the effectiveness of a Durable Power of Attorney. Each serves to protect an individual's rights and preferences in various situations, ensuring that their wishes are respected and upheld.

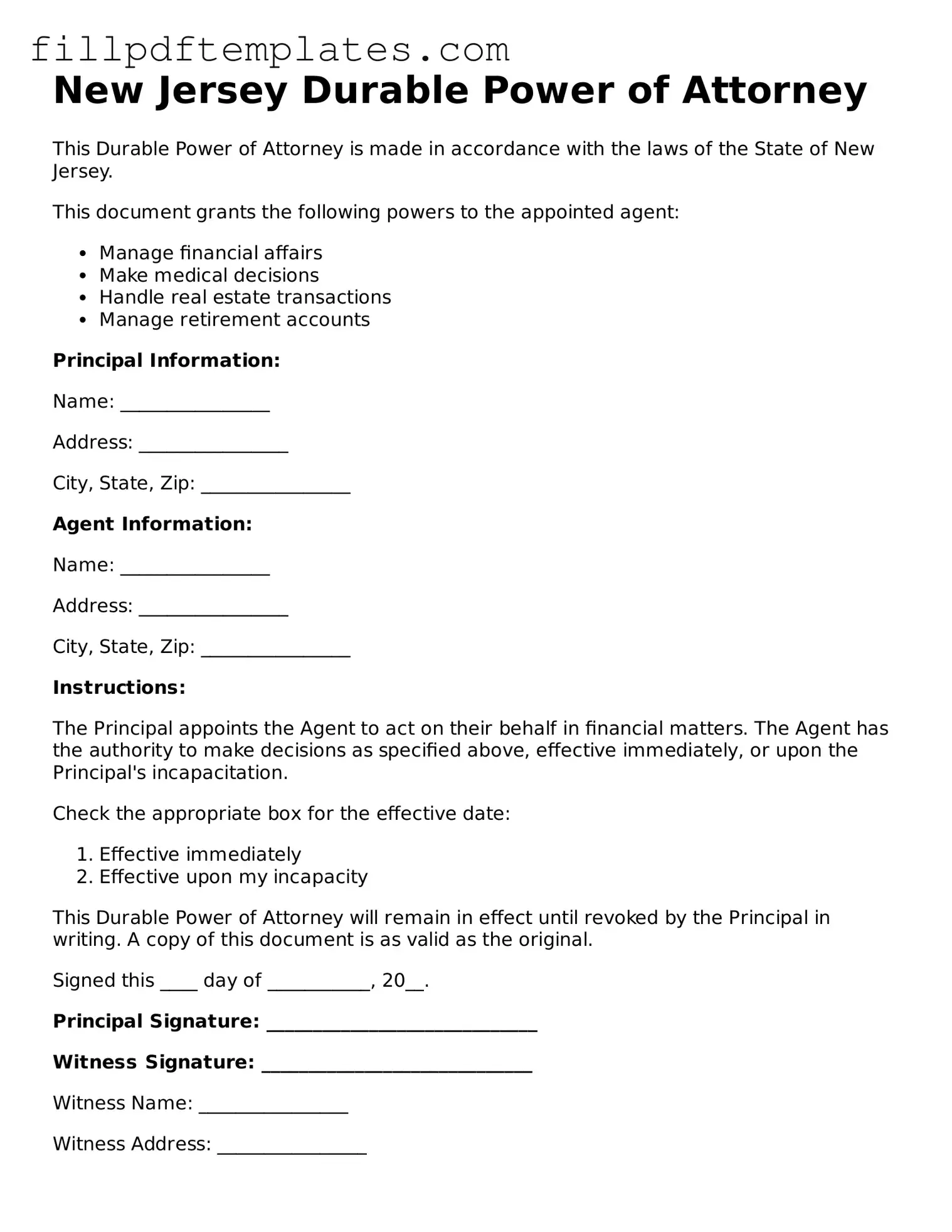

New Jersey Durable Power of Attorney Preview

New Jersey Durable Power of Attorney

This Durable Power of Attorney is made in accordance with the laws of the State of New Jersey.

This document grants the following powers to the appointed agent:

- Manage financial affairs

- Make medical decisions

- Handle real estate transactions

- Manage retirement accounts

Principal Information:

Name: ________________

Address: ________________

City, State, Zip: ________________

Agent Information:

Name: ________________

Address: ________________

City, State, Zip: ________________

Instructions:

The Principal appoints the Agent to act on their behalf in financial matters. The Agent has the authority to make decisions as specified above, effective immediately, or upon the Principal's incapacitation.

Check the appropriate box for the effective date:

- Effective immediately

- Effective upon my incapacity

This Durable Power of Attorney will remain in effect until revoked by the Principal in writing. A copy of this document is as valid as the original.

Signed this ____ day of ___________, 20__.

Principal Signature: _____________________________

Witness Signature: _____________________________

Witness Name: ________________

Witness Address: ________________

Notary Public:

State of New Jersey

County of ________________

On this ____ day of ___________, 20__, before me, a Notary Public, personally appeared the above-named Principal.

Notary Signature: _____________________________

My Commission Expires: ________________