Fill a Valid Netspend Dispute Template

When dealing with unauthorized transactions on your Netspend card, completing the Netspend Dispute Notification Form is a crucial step. This form serves as your official request to dispute any credit or debit transactions that you did not authorize. It is important to act quickly, as you must submit the form within 60 days of the transaction date in question. After you submit the completed form, Netspend will review your case and aim to make a decision about your funds within 10 business days. To strengthen your claim, providing supporting documents can significantly aid in the review process. If your card has been lost or stolen, you can also indicate this on the form, which allows you to block any further unauthorized activity. Remember, while you may be liable for some unauthorized transactions, this liability can be eliminated if you report the loss promptly. The form requires essential details such as your contact information, card number, and specifics about the disputed transactions, including the amount and merchant's name. There is also a section for you to explain what happened, which can be vital in resolving your dispute. By following these steps and providing comprehensive information, you can help ensure that your case is handled efficiently.

Additional PDF Templates

Acord 130 - It includes instructions for providing detailed operational descriptions of the business.

Cash Receipt Template Free - Can help identify revenue trends over time.

The Oregon Hold Harmless Agreement form is a legal document that protects one party from legal responsibility for any injuries or damages incurred by another party in the course of an activity. It is often used in situations where one party is using another’s property or services. This form plays a crucial role in managing risks and liabilities for individuals and businesses alike, making it essential to understand the implications of the Hold Harmless Agreement.

Royal Caribbean Cruise Single Parent - This consent form must be signed by all legal guardians.

Similar forms

- Fraud Report Form: This document allows individuals to report incidents of fraud, similar to how the Netspend Dispute form helps address unauthorized transactions. Both forms require detailed information about the incident and may request supporting documentation.

- Operating Agreement: To ensure clarity in business operations, utilize our detailed guide on Operating Agreement essentials for structuring your LLC effectively.

- Chargeback Request Form: A chargeback request is filed with a bank or credit card company to dispute a transaction. Like the Netspend Dispute form, it requires information about the transaction in question and often has a deadline for submission.

- Identity Theft Report: This form is used to report identity theft and can be similar in nature. It collects information about unauthorized use of personal information, paralleling the need for details about unauthorized transactions in the Netspend form.

- Bank Statement Dispute Form: Customers use this form to dispute charges listed on their bank statements. It shares similarities with the Netspend Dispute form in that both require transaction details and supporting evidence.

- Consumer Complaint Form: This document allows consumers to file complaints about various issues, including unauthorized charges. Both forms aim to resolve disputes and require specific details to assist in the investigation.

- Lost Card Report: When a card is lost or stolen, this form is filled out to report the incident. It is similar to the Netspend Dispute form as it also emphasizes the importance of reporting promptly to protect against unauthorized use.

- Service Cancellation Form: This form is used to cancel services that may have unauthorized charges. It requires information about the service and the reason for cancellation, akin to how the Netspend Dispute form gathers information about disputed transactions.

Document Specifics

| Fact Name | Description |

|---|---|

| Submission Deadline | The Dispute Notification Form must be submitted within 60 days of the transaction date in question. Timely submission is crucial to ensure your dispute is processed. |

| Processing Time | Netspend will review the form and make a decision regarding the disputed funds within 10 business days after receiving the completed form. |

| Liability for Unauthorized Use | If your card is lost or stolen, you may be liable for unauthorized transactions. However, you will not be liable for transactions after you report the card as compromised. |

| Supporting Documentation | Providing supporting documents, such as a police report or receipts, can strengthen your case and expedite the dispute resolution process. |

| State-Specific Laws | In some states, additional consumer protection laws may apply. It’s important to check local regulations to understand your rights regarding unauthorized transactions. |

Things You Should Know About This Form

-

What is the purpose of the Netspend Dispute Notification Form?

The Netspend Dispute Notification Form is designed for cardholders to report unauthorized credit or debit transactions. By completing this form, users can initiate a formal dispute process with Netspend regarding transactions that they did not authorize. It is crucial to submit the form as soon as possible, ideally within 60 days of the disputed transaction.

-

How long does it take for Netspend to respond to a dispute?

Once Netspend receives the completed Dispute Notification Form, they will review the information provided. A decision regarding the disputed funds will be made within 10 business days. This timeframe allows Netspend to investigate the claim and determine whether the funds should be credited back to the cardholder's account.

-

What should I do if my card was lost or stolen?

If your card is lost or stolen, it is important to notify Netspend immediately. You can indicate on the Dispute Notification Form that your card was compromised. Additionally, resetting your PIN and filing a police report are recommended steps to protect yourself from further unauthorized transactions.

-

What information do I need to provide on the Dispute Notification Form?

The form requires several key pieces of information. You must provide your cardholder name, contact details, card or account number, and details for each transaction you are disputing. This includes the disputed amount, date and time of the transaction, merchant’s name, and whether you have contacted the merchant regarding the issue. You should also include a detailed explanation of what occurred, along with any supporting documentation that may assist in your dispute.

Documents used along the form

When filing a dispute with Netspend, it is important to gather and submit various forms and documents to support your claim. These additional documents can help clarify the situation and expedite the resolution process. Below is a list of commonly used forms and documents that may accompany the Netspend Dispute form.

- Police Report: If your card was lost or stolen, a police report serves as official documentation of the incident. It can strengthen your case and is often required for disputes involving unauthorized transactions.

- Transaction Receipts: Providing copies of receipts for disputed transactions can help establish the legitimacy of your claim. These documents show the amounts charged and the merchants involved.

- Email Correspondence: Any emails exchanged with the merchant regarding the disputed transaction can be useful. They may include refund requests or responses from the merchant, which can clarify the situation.

- Transfer-on-Death Deed Form - For property owners in North Carolina wishing to pass on real estate without probate, the https://todform.com/blank-north-carolina-transfer-on-death-deed/ provides a clear solution to ensure properties are distributed according to their wishes.

- Shipping or Tracking Information: If the dispute involves a product that was never received, including shipping or tracking information can help prove that the item was not delivered as expected.

- Cancellation Information: If you canceled a service or order, providing documentation of the cancellation can support your claim. This may include confirmation emails or cancellation numbers.

- Identity Verification Documents: Sometimes, proof of identity may be required. This can include a copy of your driver’s license or another form of ID to verify that you are the cardholder.

- Authorization Letters: If someone else was authorized to use your card, a letter stating this can clarify any misunderstandings regarding the transactions in question.

- Additional Explanation Pages: If the space provided on the dispute form is insufficient, attaching additional pages with a detailed explanation of the dispute can be beneficial. Clear and thorough descriptions help in the decision-making process.

Collecting these documents and submitting them along with the Netspend Dispute form can significantly enhance your chances of a favorable outcome. Ensure that all information is accurate and complete to facilitate a smooth review process.

Netspend Dispute Preview

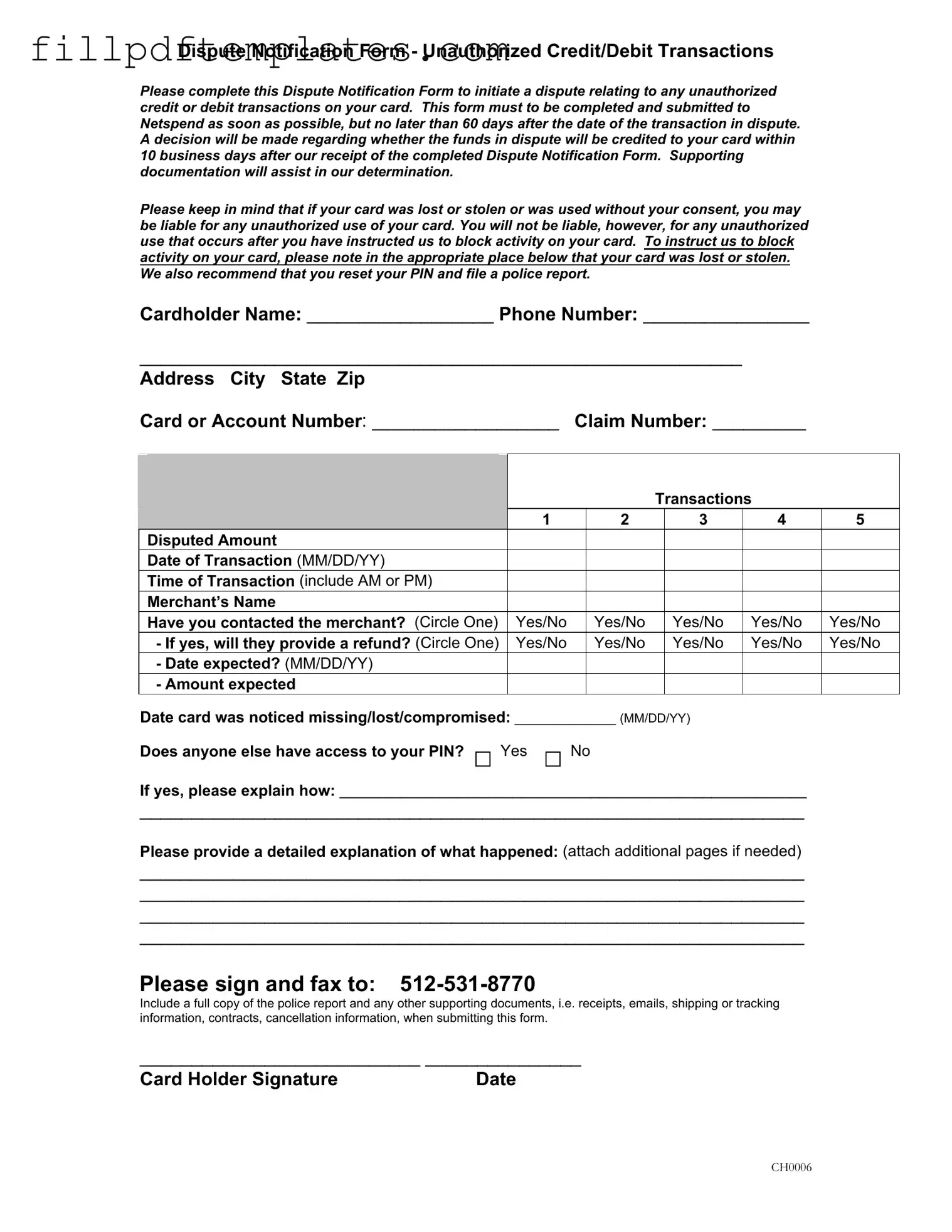

Dispute Notification Form - Unauthorized Credit/Debit Transactions

Please complete this Dispute Notification Form to initiate a dispute relating to any unauthorized credit or debit transactions on your card. This form must to be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the transaction in dispute. A decision will be made regarding whether the funds in dispute will be credited to your card within 10 business days after our receipt of the completed Dispute Notification Form. Supporting documentation will assist in our determination.

Please keep in mind that if your card was lost or stolen or was used without your consent, you may be liable for any unauthorized use of your card. You will not be liable, however, for any unauthorized use that occurs after you have instructed us to block activity on your card. To instruct us to block activity on your card, please note in the appropriate place below that your card was lost or stolen. We also recommend that you reset your PIN and file a police report.

Cardholder Name: __________________ Phone Number: ________________ |

|

||||||||

__________________________________________________________ |

|

|

|||||||

Address City State Zip |

|

|

|

|

|

|

|

||

Card or Account Number: __________________ |

Claim Number: _________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Please provide information for each |

|

|

|

|

|

|

|

|

|

transaction you are disputing (submit up to 5 |

|

|

|

|

|

|

|

|

|

on one form) |

|

|

|

|

Transactions |

|

||

|

|

|

1 |

|

2 |

|

3 |

4 |

5 |

Disputed Amount |

|

|

|

|

|

|

|

||

Date of Transaction (MM/DD/YY) |

|

|

|

|

|

|

|

||

Time of Transaction (include AM or PM) |

|

|

|

|

|

|

|

||

Merchant’s Name |

|

|

|

|

|

|

|

||

Have you contacted the merchant? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

||

|

- If yes, will they provide a refund? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

|

|

- Date expected? (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

- Amount expected |

|

|

|

|

|

|

|

|

Date card was noticed missing/lost/compromised: _____________ (MM/DD/YY)

Does anyone else have access to your PIN?

Yes

No

If yes, please explain how: ______________________________________________________

________________________________________________________________

Please provide a detailed explanation of what happened: (attach additional pages if needed)

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Please sign and fax to:

Include a full copy of the police report and any other supporting documents, i.e. receipts, emails, shipping or tracking information, contracts, cancellation information, when submitting this form.

___________________________ _______________

Card Holder Signature |

Date |

CH0006