Fill a Valid Mortgage Statement Template

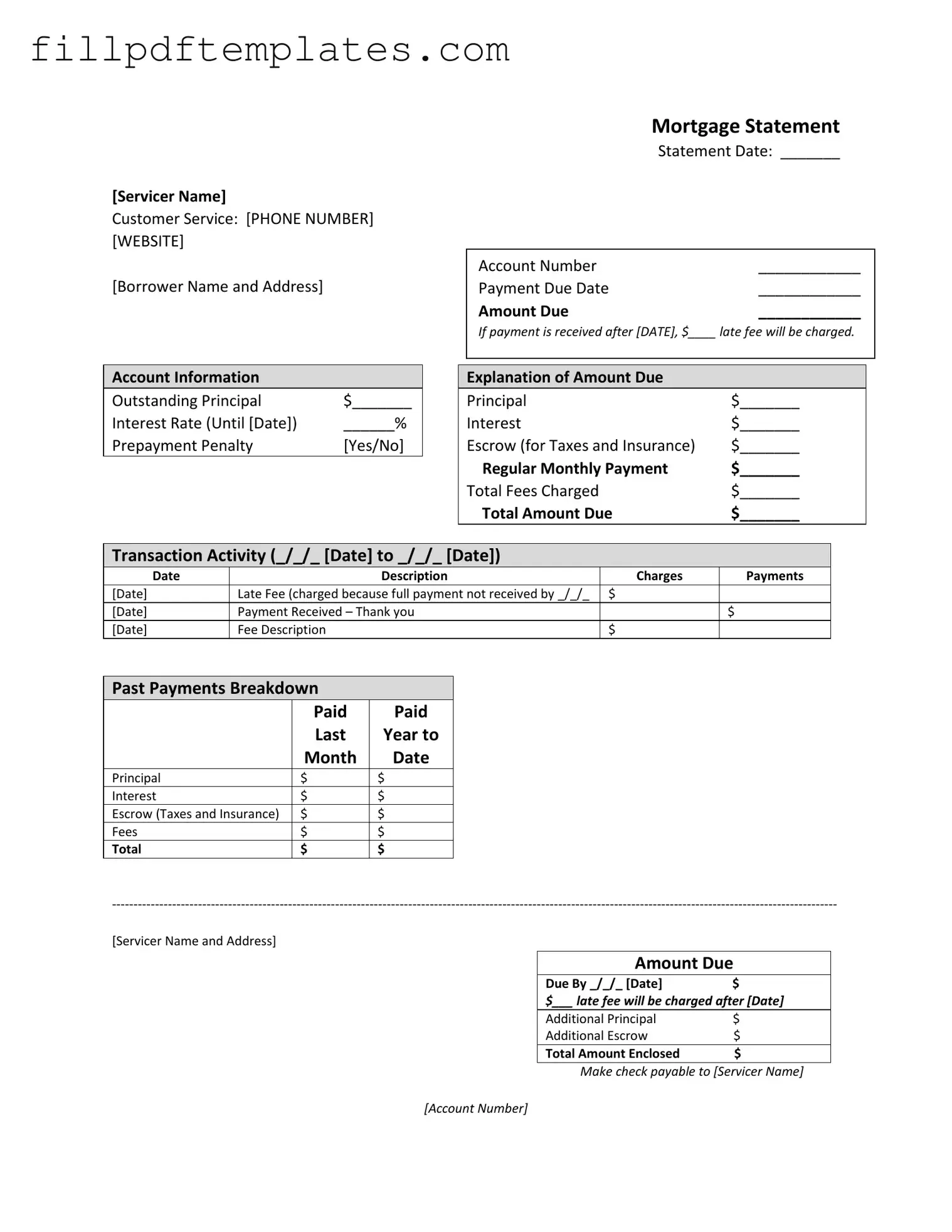

The Mortgage Statement form is a crucial document for homeowners, providing a comprehensive overview of their mortgage account. This statement includes essential information such as the servicer's name, customer service contact details, and the borrower's name and address. Key dates are highlighted, including the statement date, payment due date, and the amount due. Homeowners should pay particular attention to the outstanding principal balance, interest rate, and any potential prepayment penalties. The form also breaks down the total amount due into specific components, such as principal, interest, and escrow for taxes and insurance. Transaction activity is documented, showing recent charges and payments, which helps borrowers track their payment history. Important messages regarding partial payments and delinquency notices are included, alerting borrowers to the consequences of late payments and offering guidance for those experiencing financial difficulties. Understanding the Mortgage Statement form is vital for managing mortgage obligations effectively and ensuring timely payments.

Additional PDF Templates

Simple Boyfriend Application Form - Submit your application to join our exclusive boyfriend selection process.

For those seeking to ensure their legal interests are safeguarded, the process of completing a detailed Power of Attorney form can provide the necessary authority needed to manage another's affairs in their absence. This form is an important step in preparing for future uncertainties.

Accord Forms - This form is essential for any business with employees eligible for compensation coverage.

Similar forms

- Billing Statement: Similar to a mortgage statement, a billing statement outlines the amounts due for various services or products. It provides details on charges, payments, and any outstanding balances.

- Loan Statement: A loan statement offers a summary of a borrower’s loan account, including principal, interest, and any fees. It helps borrowers track their payments and outstanding balance, similar to how a mortgage statement functions.

- Credit Card Statement: This document summarizes the transactions made on a credit card account. It includes details such as the total amount due, payment due date, and any fees incurred, mirroring the structure of a mortgage statement.

- Utility Bill: A utility bill details the charges for services like water, electricity, or gas. It specifies the amount due and the payment due date, akin to the payment structure found in a mortgage statement.

- Property Tax Statement: This document outlines the amount of property taxes owed for a given period. It includes payment details and deadlines, similar to the information provided in a mortgage statement.

- Homeowners Association (HOA) Statement: An HOA statement lists fees owed to a homeowners association. It includes payment amounts and deadlines, paralleling the payment structure of a mortgage statement.

- Insurance Premium Statement: This statement details the premium amounts due for insurance policies. It provides payment due dates and any applicable fees, resembling the format of a mortgage statement.

- Legal Protection Documentation: Essential for mitigating liability, this documentation indicates the responsibilities and protections related to property usage or services. For instance, a Hold Harmless Agreement clearly outlines the terms under which one party is protected from legal claims made by another, thereby emphasizing risk management in various activities.

- Loan Payoff Statement: A loan payoff statement provides the total amount needed to pay off a loan, including any fees. It shares similarities with a mortgage statement by detailing amounts owed and payment deadlines.

- Student Loan Statement: This document summarizes the status of a student loan account, including the amount due and payment history. It serves a similar purpose to a mortgage statement in tracking payment obligations.

- Lease Statement: A lease statement outlines the rent due for a property, including payment dates and any additional charges. Its structure and purpose are comparable to those of a mortgage statement.

Document Specifics

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for easy access to assistance. |

| Payment Due Date | The statement specifies the payment due date, which is crucial for avoiding late fees. |

| Late Fees | If payment is received after the specified date, a late fee will be charged. This amount is clearly stated on the statement. |

| Account Information | Details about the outstanding principal, interest rate, and any prepayment penalties are included, helping borrowers understand their financial obligations. |

| Transaction Activity | The statement provides a record of recent transactions, including payments and any late fees charged, offering transparency in account management. |

| Delinquency Notice | A notice is included if the borrower is late on payments, warning that failure to pay may lead to foreclosure. |

| Financial Assistance | Information about mortgage counseling or assistance is provided for borrowers experiencing financial difficulty, promoting awareness of available resources. |

Things You Should Know About This Form

-

What is a Mortgage Statement?

A mortgage statement is a document provided by your mortgage servicer that outlines important information about your mortgage account. This includes details such as the outstanding principal balance, interest rate, payment due date, and any fees charged. It serves as a summary of your mortgage activity for a specific period.

-

How can I contact my mortgage servicer?

You can reach your mortgage servicer by calling the customer service number listed on your mortgage statement. Additionally, their website is also provided for further assistance and information.

-

What should I do if I notice an error on my mortgage statement?

If you find any discrepancies on your mortgage statement, it is important to contact your mortgage servicer immediately. They can help clarify any errors and provide guidance on how to resolve the issue.

-

What happens if I miss a payment?

If your payment is not received by the due date, a late fee will be charged. The amount of the late fee and the date it will be applied are specified on your mortgage statement. Continuous missed payments may lead to serious consequences, including foreclosure.

-

What is included in the "Amount Due" section?

The "Amount Due" section details the total payment required to keep your mortgage account current. This includes the principal, interest, escrow for taxes and insurance, and any fees that may have been charged.

-

What are partial payments and how are they handled?

Partial payments are amounts less than your total mortgage payment. These payments are not applied directly to your mortgage balance. Instead, they are held in a suspense account until the full payment is made. Once the balance is paid, the funds will then be applied to your mortgage.

-

What does the delinquency notice mean?

A delinquency notice indicates that you are behind on your mortgage payments. The statement will specify how many days you are delinquent. It is crucial to address this situation promptly to avoid additional fees or the risk of foreclosure.

-

How can I find help if I'm experiencing financial difficulty?

If you are facing financial challenges, your mortgage statement may provide information about mortgage counseling or assistance programs. It is advisable to seek help as soon as possible to explore options that may be available to you.

-

What is the significance of the transaction activity section?

The transaction activity section provides a detailed record of your mortgage payments and any fees charged over a specified period. This transparency helps you track your payment history and understand any outstanding balances.

-

How do I make a payment on my mortgage?

You can make a payment by mailing a check to the address provided on your mortgage statement. Ensure that you include your account number on the check. Some servicers may also offer online payment options through their website.

Documents used along the form

The Mortgage Statement form is an essential document for borrowers, providing a detailed overview of their mortgage account. Along with this form, several other documents are often used to ensure clarity and facilitate communication between the borrower and the lender. Below is a list of these documents, each serving a unique purpose in the mortgage process.

- Loan Agreement: This document outlines the terms and conditions of the mortgage loan. It includes details such as the loan amount, interest rate, repayment schedule, and any fees associated with the loan. Both the borrower and lender sign this agreement, making it a legally binding contract.

- Payment History Statement: This statement provides a record of all payments made by the borrower over a specified period. It details the dates of payments, amounts paid, and any late fees incurred. This document is useful for tracking payment patterns and understanding any outstanding balances.

- Escrow Account Statement: If the borrower has an escrow account for property taxes and insurance, this statement outlines the funds collected and disbursed from that account. It shows how much has been paid for taxes and insurance, as well as any remaining balance in the escrow account.

- Transfer-on-Death Deed: This form allows property owners in North Carolina to transfer real estate to beneficiaries automatically upon their death, thus avoiding probate. For more information, visit todform.com/blank-north-carolina-transfer-on-death-deed.

- Delinquency Notice: This notice is issued when the borrower falls behind on payments. It serves as a formal reminder of missed payments and outlines the consequences of continued delinquency, including potential fees and foreclosure. This document is critical for borrowers to understand their current standing and the urgency of addressing any outstanding payments.

Each of these documents plays a vital role in the management of a mortgage account. They provide essential information that helps borrowers stay informed about their obligations and financial status. Understanding these documents can empower borrowers to make informed decisions regarding their mortgage and financial health.

Mortgage Statement Preview

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.