Blank Michigan Transfer-on-Death Deed Form

In Michigan, the Transfer-on-Death Deed (TODD) form provides a straightforward way for property owners to transfer their real estate to designated beneficiaries upon their death, bypassing the often lengthy and costly probate process. This legal tool allows individuals to maintain full control of their property during their lifetime while ensuring a smooth transition to heirs without the need for court intervention. The form must be executed with specific requirements, including proper signatures and notarization, to be valid. Additionally, property owners can designate multiple beneficiaries and specify how the property will be divided among them. It's important to note that a Transfer-on-Death Deed can be revoked or changed at any time before the owner's death, offering flexibility in estate planning. By understanding the nuances of this deed, property owners can make informed decisions that align with their wishes and provide peace of mind for their loved ones.

Other Common Transfer-on-Death Deed State Templates

Problems With Transfer on Death Deeds - Each state may have different rules regarding how Transfer-on-Death Deeds operate; property owners should be informed.

The Indiana Transfer-on-Death Deed form allows property owners to transfer their real estate to beneficiaries upon their death, avoiding the lengthy probate process. This deed provides a simple way to ensure that your property goes directly to your loved ones without the complications of a will. For further details and to access the form, visit todform.com/blank-indiana-transfer-on-death-deed/ as you prepare to complete your documentation.

Free Printable Transfer on Death Deed Form Florida - This tool can enhance your overall estate planning strategy by clearly outlining your wishes.

Similar forms

- Will: A will outlines how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to designate beneficiaries, but it requires probate to be executed.

- Employment Verification Form: For individuals needing proof of employment, our comprehensive Employment Verification process provides necessary documentation for various purposes.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they should be distributed after death. Both documents avoid probate, but a living trust is more comprehensive and can manage assets while the person is still alive.

- Beneficiary Designation Forms: These forms are used for financial accounts and insurance policies to specify who receives the assets upon the account holder's death. Similar to a Transfer-on-Death Deed, they allow for direct transfer to beneficiaries without going through probate.

- Payable-on-Death (POD) Accounts: A POD account allows individuals to name beneficiaries who will receive funds in the account upon their death. Like a Transfer-on-Death Deed, it facilitates a direct transfer of assets without probate.

- Joint Tenancy with Right of Survivorship: This ownership arrangement allows co-owners to automatically inherit each other's share upon death. Both methods bypass probate, but joint tenancy involves shared ownership during the owner's lifetime.

- Life Estate Deed: A life estate deed allows a person to retain the right to use a property during their lifetime while designating a beneficiary to receive it afterward. Similar to a Transfer-on-Death Deed, it enables a transfer of property outside of probate.

- Transfer-on-Death Registration for Securities: This registration allows individuals to name beneficiaries for stocks and bonds, ensuring they transfer directly upon death. Like a Transfer-on-Death Deed, it streamlines the transfer process and avoids probate.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The Michigan Transfer-on-Death Deed is governed by the Michigan Compiled Laws, specifically MCL 565.101 to 565.107. |

| Eligibility | Any individual who owns real property in Michigan can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Multiple beneficiaries can be designated, and the property can be divided among them. |

| Revocation | The Transfer-on-Death Deed can be revoked at any time by the property owner before their death. |

| Execution Requirements | The deed must be signed by the property owner and witnessed by two individuals or notarized. |

| Filing Requirements | The deed must be recorded with the county register of deeds in the county where the property is located. |

| Tax Implications | Property transferred via a Transfer-on-Death Deed may be subject to estate taxes, depending on the value of the estate. |

Things You Should Know About This Form

-

What is a Transfer-on-Death Deed in Michigan?

A Transfer-on-Death Deed (TOD) is a legal document that allows property owners in Michigan to designate a beneficiary who will receive their property upon their death. This deed avoids the probate process, simplifying the transfer of property to heirs.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Michigan can use a Transfer-on-Death Deed. This includes single owners, joint owners, and those who hold property in trust. However, it is essential to ensure that the property is not subject to other legal claims or restrictions.

-

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must complete the appropriate form, which includes details about the property and the designated beneficiary. After filling out the form, it must be signed in the presence of a notary public and recorded with the local register of deeds.

-

Is there a deadline for recording the Transfer-on-Death Deed?

The Transfer-on-Death Deed must be recorded before the property owner’s death to be valid. It is advisable to record it as soon as it is executed to avoid any complications later.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must execute a new deed or a formal revocation document and ensure it is recorded with the local register of deeds.

-

What happens if the beneficiary predeceases me?

If the designated beneficiary dies before you, the Transfer-on-Death Deed will not be effective. You can choose to name a new beneficiary or allow the property to pass according to your will or Michigan’s intestacy laws if you do not have a will.

-

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger gift taxes while the property owner is alive. However, it is advisable to consult with a tax professional to understand any potential estate tax implications for your specific situation.

-

Can a Transfer-on-Death Deed be contested?

Yes, like any other legal document, a Transfer-on-Death Deed can be contested. Common grounds for contesting may include claims of undue influence, lack of capacity, or improper execution of the deed. It is essential to ensure that the deed is properly prepared to minimize the risk of disputes.

-

Where can I find the Transfer-on-Death Deed form?

The Transfer-on-Death Deed form can typically be obtained from the Michigan Department of Licensing and Regulatory Affairs or your local county register of deeds office. Many legal websites also provide templates for this deed.

Documents used along the form

The Michigan Transfer-on-Death Deed is a useful tool for property owners who wish to transfer their real estate to beneficiaries without going through probate. To ensure a smooth process, several other forms and documents are often used in conjunction with this deed. Below is a list of these documents, each serving a specific purpose.

- Beneficiary Designation Form: This document allows the property owner to specify who will receive the property upon their passing. It clearly outlines the beneficiaries and their respective shares.

- Hold Harmless Agreement: This document provides protection by ensuring that one party will not hold the other liable for any potential risks, aligning with arrangements needed during property transfers, such as the Hold Harmless Agreement.

- Affidavit of Heirship: This form is used to confirm the identity of heirs and their relationship to the deceased. It helps establish the rightful heirs when the property owner dies without a will.

- Will: A will outlines how a person's assets should be distributed after their death. Although not required for a Transfer-on-Death Deed, it can provide additional clarity regarding the owner’s intentions.

- Property Deed: The original property deed is essential for establishing ownership. It should be referenced or attached to the Transfer-on-Death Deed to confirm the property being transferred.

- Notice of Death: This document formally notifies relevant parties, such as the county clerk, of the property owner's death. It may be necessary for updating public records.

- Tax Clearance Certificate: This certificate confirms that all property taxes have been paid up to the date of the owner's death. It is often required to ensure a smooth transfer of property.

- Transfer Tax Form: This form may be required by the state to assess any transfer taxes due upon the transfer of property. It helps ensure compliance with state tax laws.

These documents work together to facilitate the transfer of property and protect the rights of beneficiaries. Proper preparation and understanding of each form can help streamline the process and avoid potential complications.

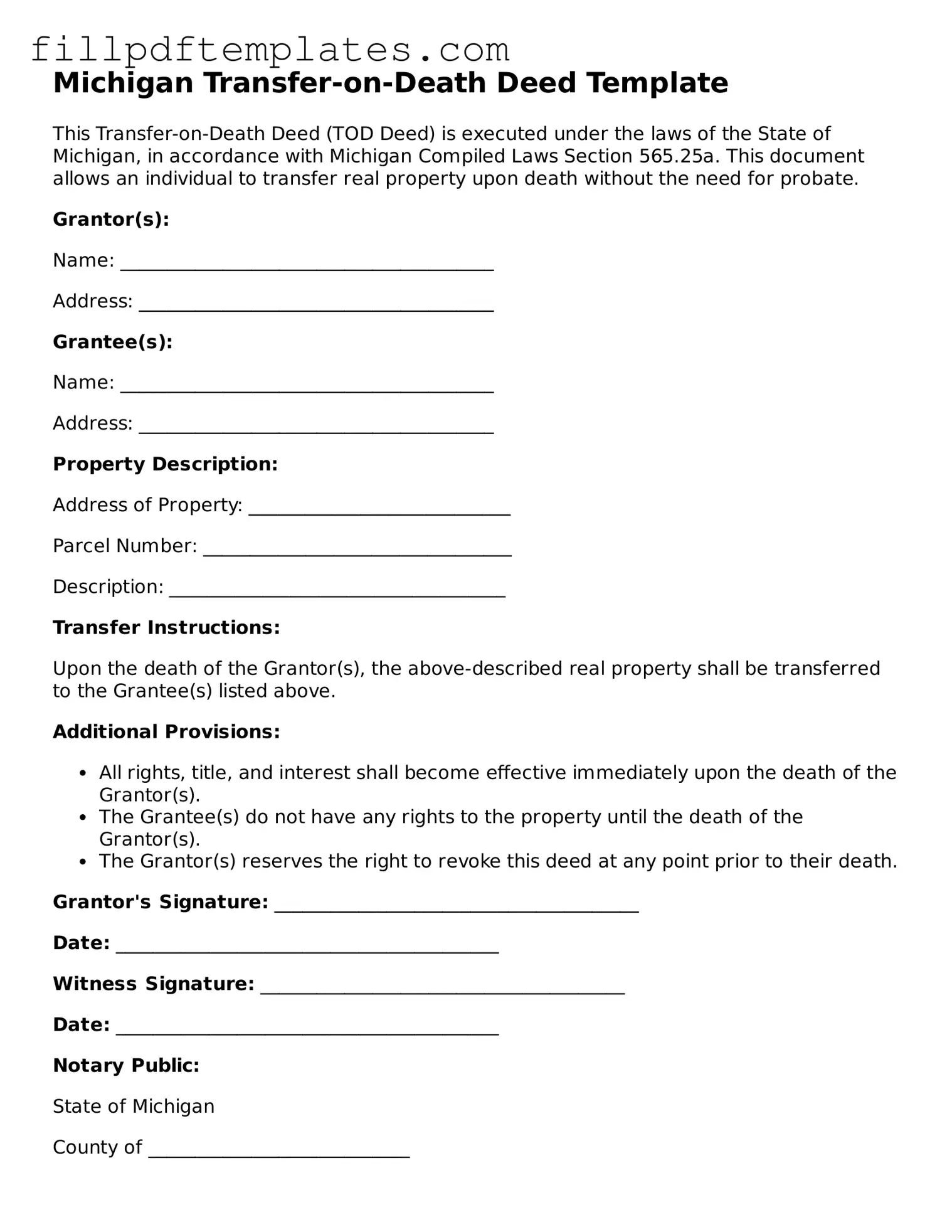

Michigan Transfer-on-Death Deed Preview

Michigan Transfer-on-Death Deed Template

This Transfer-on-Death Deed (TOD Deed) is executed under the laws of the State of Michigan, in accordance with Michigan Compiled Laws Section 565.25a. This document allows an individual to transfer real property upon death without the need for probate.

Grantor(s):

Name: ________________________________________

Address: ______________________________________

Grantee(s):

Name: ________________________________________

Address: ______________________________________

Property Description:

Address of Property: ____________________________

Parcel Number: _________________________________

Description: ____________________________________

Transfer Instructions:

Upon the death of the Grantor(s), the above-described real property shall be transferred to the Grantee(s) listed above.

Additional Provisions:

- All rights, title, and interest shall become effective immediately upon the death of the Grantor(s).

- The Grantee(s) do not have any rights to the property until the death of the Grantor(s).

- The Grantor(s) reserves the right to revoke this deed at any point prior to their death.

Grantor's Signature: _______________________________________

Date: _________________________________________

Witness Signature: _______________________________________

Date: _________________________________________

Notary Public:

State of Michigan

County of ____________________________

Subscribed and sworn before me this ____ day of __________, 20__.

Notary Signature: __________________________

My Commission Expires: ____________________