Blank Michigan Promissory Note Form

The Michigan Promissory Note form serves as a crucial document in financial transactions, particularly when one party borrows money from another. This form outlines the borrower's promise to repay the loan amount, detailing the terms and conditions of the agreement. Key elements include the principal amount, interest rate, repayment schedule, and any late fees that may apply. Additionally, it specifies the consequences of defaulting on the loan, which can help protect the lender's interests. The form also includes spaces for both parties to sign, ensuring that the agreement is legally binding. Understanding these components is essential for anyone involved in lending or borrowing money in Michigan, as it provides clarity and security for both sides of the transaction.

Other Common Promissory Note State Templates

Illinois Promissory Note - It provides clarity and security for both parties involved in the loan agreement.

When engaging in the sale or acquisition of a trailer, it’s important to have a proper record. This is where a complete Trailer Bill of Sale document comes into play. You can explore more about the process and requirements by visiting this thorough guide on Trailer Bill of Sale forms.

California Promissory Note Requirements - The form is commonly used in personal loans and business transactions.

Similar forms

A Promissory Note is a vital financial document, but it shares similarities with several other important documents. Understanding these similarities can enhance your financial literacy and help you navigate various financial agreements. Here are six documents that resemble a Promissory Note:

- Loan Agreement: Like a Promissory Note, a loan agreement outlines the terms of borrowing money. Both documents specify the amount borrowed, interest rates, and repayment schedules, but a loan agreement often includes additional details regarding collateral and the rights of both parties.

- Mortgage: A mortgage is a specific type of loan agreement used to purchase real estate. Similar to a Promissory Note, it requires the borrower to repay the loan amount with interest. However, a mortgage also includes the property as collateral, meaning the lender can take possession of the property if the borrower defaults.

- Installment Agreement: An installment agreement allows a borrower to repay a debt in regular installments over time. This document, like a Promissory Note, details the repayment terms and the total amount owed, ensuring both parties understand their obligations.

- IOU (I Owe You): An IOU is a simple acknowledgment of a debt. While less formal than a Promissory Note, it serves a similar purpose by recognizing that one party owes money to another. Both documents establish a debtor-creditor relationship, although an IOU may lack detailed repayment terms.

- Divorce Settlement Agreement: The divorce settlement agreement is a pivotal document that encompasses the mutually agreed upon terms for asset division, debt responsibility, and child custody arrangements. It is essential for ensuring compliance with the established conditions during and after the divorce process, and can be obtained from Colorado PDF Forms.

- Security Agreement: A security agreement is used when a borrower pledges collateral to secure a loan. Similar to a Promissory Note, it outlines the loan amount and repayment terms, but it also details the collateral involved, providing the lender with additional security in case of default.

- Confession of Judgment: This document allows a borrower to admit liability for a debt and agree to a judgment against them if they fail to repay. While it functions differently than a Promissory Note, both documents establish a clear understanding of the debt and the borrower's obligations.

By recognizing these similarities, individuals can better understand their financial commitments and the importance of each document in the lending process.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a defined time. |

| Governing Law | The Michigan Promissory Note is governed by the Michigan Uniform Commercial Code (UCC), specifically under Article 3, which covers negotiable instruments. |

| Key Components | Essential elements include the principal amount, interest rate, payment schedule, and the signatures of the borrower and lender. |

| Enforceability | For a promissory note to be enforceable, it must be in writing, signed by the borrower, and include clear terms regarding repayment. |

| Use Cases | Commonly used in personal loans, business transactions, and real estate financing, providing a clear record of the debt agreement. |

Things You Should Know About This Form

-

What is a Michigan Promissory Note?

A Michigan Promissory Note is a legal document in which one party (the borrower) promises to pay a specified amount of money to another party (the lender) under agreed-upon terms. This document outlines the amount borrowed, the interest rate, repayment schedule, and any other relevant conditions.

-

Who can use a Promissory Note?

Any individual or business in Michigan can use a Promissory Note. It is commonly used in personal loans, business loans, or any situation where one party lends money to another. Both parties should be clear about the terms to ensure mutual understanding.

-

What information is needed to complete the form?

To complete a Michigan Promissory Note, you will need the following information:

- The full names and addresses of both the borrower and the lender.

- The principal amount being borrowed.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any late fees or penalties for missed payments.

- Signatures of both parties and the date of signing.

-

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. It creates an obligation for the borrower to repay the loan according to the terms outlined in the document. If the borrower fails to repay, the lender may take legal action to recover the owed amount.

-

Can I modify a Promissory Note after it is signed?

Modifications to a Promissory Note can be made, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note to avoid confusion in the future.

-

What happens if the borrower defaults?

If the borrower defaults, meaning they fail to make payments as agreed, the lender has the right to take legal action. This may include filing a lawsuit to recover the owed amount. The specific actions taken will depend on the terms of the Promissory Note and applicable state laws.

-

Do I need a witness or notary for a Promissory Note?

While a witness or notary is not required for a Promissory Note to be valid in Michigan, having one can provide additional legal protection. A notary public can verify the identities of the parties and the authenticity of the signatures, which may be beneficial in case of disputes.

-

Can a Promissory Note be used for business loans?

Yes, a Promissory Note is commonly used for business loans. It serves as a formal agreement between the lender and the business, detailing the loan amount, repayment terms, and any interest. Both parties should ensure the terms are clear and agreed upon to avoid future disputes.

-

Where can I obtain a Michigan Promissory Note form?

You can obtain a Michigan Promissory Note form from various sources, including online legal document services, local office supply stores, or legal professionals. Ensure that the form complies with Michigan laws and meets your specific needs.

Documents used along the form

When entering into a loan agreement in Michigan, a Promissory Note is often accompanied by several other important documents. Each of these forms serves a specific purpose and helps clarify the terms of the loan. Here’s a list of commonly used documents that you may encounter alongside the Michigan Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and any collateral involved. It provides a comprehensive overview of the obligations of both the lender and the borrower.

- Security Agreement: If the loan is secured by collateral, this agreement specifies what assets are being used as security for the loan. It details the rights of the lender in case of default.

- Disclosure Statement: This document provides important information about the loan, including fees, interest rates, and other costs. It ensures that borrowers understand the financial implications of the loan.

- Guaranty Agreement: In some cases, a third party may agree to guarantee the loan. This document outlines the guarantor's responsibilities and obligations if the borrower defaults.

- Payment Schedule: This form details the specific dates and amounts of each payment due under the loan agreement. It helps both parties keep track of payments and manage their finances.

- Default Notice: Should the borrower fail to meet their obligations, this document serves as a formal notification of default. It outlines the consequences and the next steps the lender may take.

- Amendment Agreement: If any terms of the original loan agreement need to be changed, this document officially modifies those terms. It ensures that all parties are in agreement about the new conditions.

- Hold Harmless Agreement: This document is designed to protect one party from any legal liabilities associated with the activities outlined in the agreement. It provides essential safeguards in various agreements or activities by ensuring that one party does not hold the other accountable for any potential losses or harms. For more information, refer to the Hold Harmless Agreement.

- Release of Liability: Once the loan is fully repaid, this document releases the borrower from any further obligations under the Promissory Note and confirms that the lender has no claims against the borrower.

Understanding these documents can help both lenders and borrowers navigate the loan process more effectively. Each form plays a crucial role in ensuring clarity and protection for all parties involved.

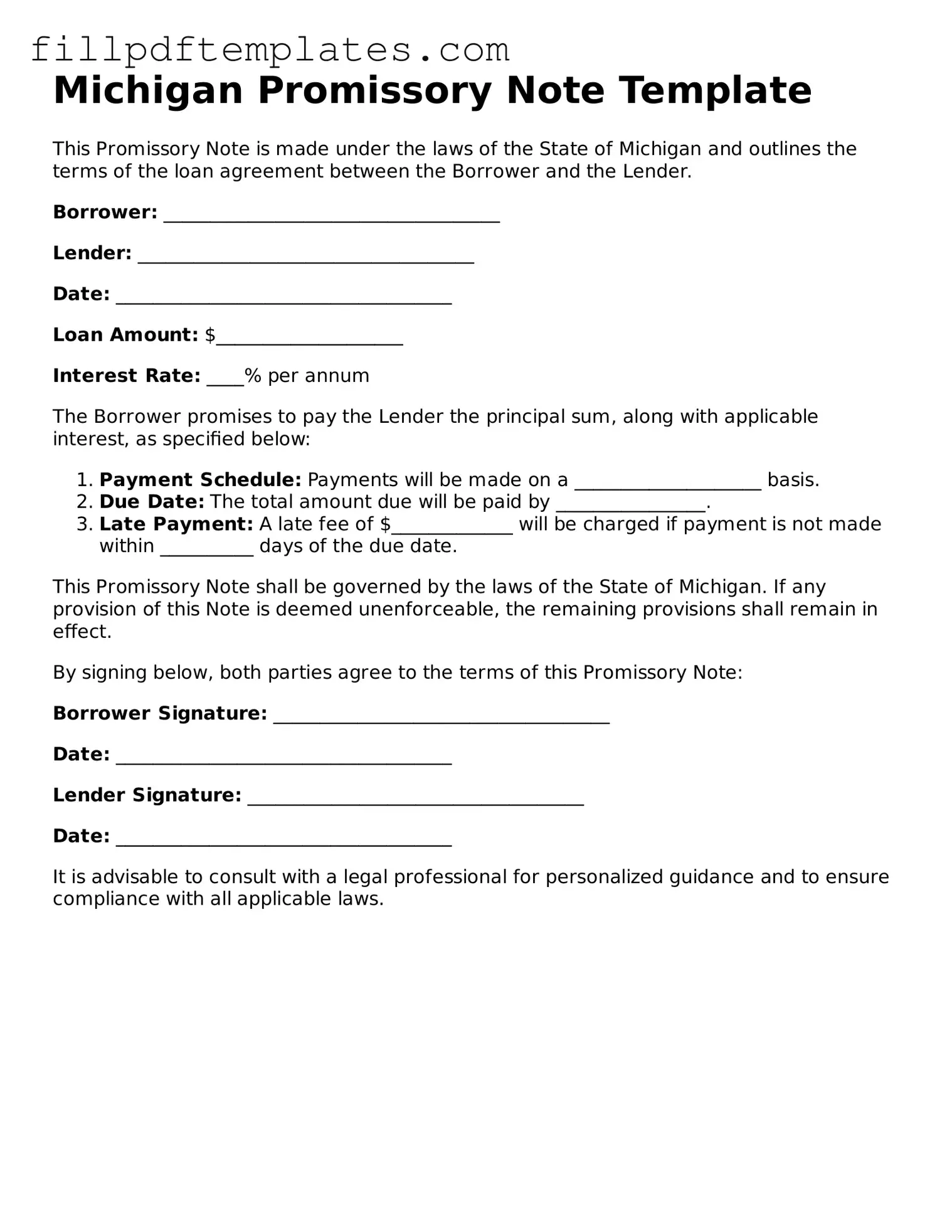

Michigan Promissory Note Preview

Michigan Promissory Note Template

This Promissory Note is made under the laws of the State of Michigan and outlines the terms of the loan agreement between the Borrower and the Lender.

Borrower: ____________________________________

Lender: ____________________________________

Date: ____________________________________

Loan Amount: $____________________

Interest Rate: ____% per annum

The Borrower promises to pay the Lender the principal sum, along with applicable interest, as specified below:

- Payment Schedule: Payments will be made on a ____________________ basis.

- Due Date: The total amount due will be paid by ________________.

- Late Payment: A late fee of $_____________ will be charged if payment is not made within __________ days of the due date.

This Promissory Note shall be governed by the laws of the State of Michigan. If any provision of this Note is deemed unenforceable, the remaining provisions shall remain in effect.

By signing below, both parties agree to the terms of this Promissory Note:

Borrower Signature: ____________________________________

Date: ____________________________________

Lender Signature: ____________________________________

Date: ____________________________________

It is advisable to consult with a legal professional for personalized guidance and to ensure compliance with all applicable laws.