Blank Michigan Lady Bird Deed Form

The Michigan Lady Bird Deed is a powerful estate planning tool designed to facilitate the transfer of property while retaining certain rights for the current owner. This unique deed allows property owners to transfer their real estate to beneficiaries without going through probate, ensuring a smoother transition of assets upon death. One of its standout features is the ability for the original owner to maintain control over the property during their lifetime. They can sell, mortgage, or change their mind about the transfer at any time. Additionally, the Lady Bird Deed can help protect the property from being counted as an asset for Medicaid eligibility, offering a strategic advantage for those concerned about long-term care costs. Understanding the nuances of this form can empower property owners in Michigan to make informed decisions about their estate planning, ultimately safeguarding their legacy while simplifying the transfer process for their heirs.

Other Common Lady Bird Deed State Templates

How to File a Lady Bird Deed in Florida - The deed is a strategic option particularly for real estate investors managing multiple properties.

In the context of Indiana, utilizing a Hold Harmless Agreement form can be crucial for individuals and businesses looking to safeguard themselves against potential liabilities. This legal document ensures that one party assumes responsibility for any risks, effectively protecting the provider or owner from claims related to damages or injuries. For more detailed information, you can refer to the Hold Harmless Agreement, which outlines the usage and importance of this essential risk management tool.

Similar forms

- Quitclaim Deed: This document transfers ownership of property without any guarantees. Like a Lady Bird Deed, it allows for a straightforward transfer but lacks the same protections regarding future interests.

- Warranty Deed: A warranty deed provides a guarantee that the seller holds clear title to the property. While both documents transfer property, a warranty deed offers more protection to the buyer than a Lady Bird Deed.

- Transfer on Death Deed: This deed allows property to pass directly to a beneficiary upon the owner’s death. Similar to the Lady Bird Deed, it avoids probate, but it does not allow the owner to retain control during their lifetime.

- Durable Power of Attorney: For individuals seeking to designate someone to handle their affairs when they can no longer do so, the necessary Durable Power of Attorney documentation is crucial to ensure their wishes are respected.

- Life Estate Deed: This deed grants someone the right to use the property for their lifetime, after which it passes to another person. Like a Lady Bird Deed, it allows for continued control, but it does not allow for changes in ownership during the life of the life tenant.

- Revocable Trust: A revocable trust holds property for the benefit of the trust creator during their lifetime. It shares the benefit of avoiding probate with the Lady Bird Deed, but it can be more complex to set up and manage.

- General Power of Attorney: This document allows someone to act on behalf of another in financial matters. While it does not directly transfer property, it can be used in conjunction with a Lady Bird Deed to manage property interests effectively.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | The Michigan Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by Michigan Compiled Laws, specifically MCL 565.25a. |

| Benefits | It helps avoid probate, allowing for a smoother transfer of property upon the owner's death. |

| Revocation | The grantor can revoke the deed at any time before their death, maintaining flexibility. |

| Tax Implications | There are no immediate tax consequences for the grantor when using a Lady Bird Deed. |

| Requirements | The deed must be signed, dated, and recorded with the county register of deeds to be valid. |

Things You Should Know About This Form

-

What is a Lady Bird Deed?

A Lady Bird Deed is a type of property deed that allows a property owner to transfer their property to a beneficiary while retaining the right to live in and control the property during their lifetime. This deed can help avoid probate and may provide tax benefits.

-

How does a Lady Bird Deed work in Michigan?

In Michigan, a Lady Bird Deed allows the property owner to name a beneficiary who will automatically receive the property upon the owner’s death. The owner maintains full control over the property during their lifetime, including the ability to sell or mortgage it without the beneficiary's consent.

-

What are the benefits of using a Lady Bird Deed?

- Avoiding probate: The property transfers automatically, bypassing the probate process.

- Retaining control: The owner keeps the right to use and manage the property.

- Tax advantages: The property may receive a step-up in basis, potentially reducing capital gains taxes for the beneficiary.

-

Who can be named as a beneficiary in a Lady Bird Deed?

Any individual or entity can be named as a beneficiary in a Lady Bird Deed. Common choices include family members, friends, or trusts. It is essential to choose someone you trust to manage the property after your passing.

-

Can a Lady Bird Deed be revoked or changed?

Yes, the property owner can revoke or change a Lady Bird Deed at any time during their lifetime. This flexibility allows the owner to adjust beneficiaries or modify terms as needed.

-

What happens if the beneficiary predeceases the property owner?

If the beneficiary named in the Lady Bird Deed passes away before the property owner, the property will not automatically transfer to that beneficiary's heirs. Instead, the owner may need to update the deed to name a new beneficiary or the property will pass according to the owner's will or state law.

-

Is legal assistance required to create a Lady Bird Deed?

While it is possible to create a Lady Bird Deed without legal assistance, it is highly recommended to consult with a legal professional. This ensures that the deed is properly executed and complies with Michigan law, minimizing potential issues in the future.

-

What is the cost associated with creating a Lady Bird Deed?

The cost of creating a Lady Bird Deed can vary depending on whether you choose to do it yourself or hire an attorney. If you opt for legal assistance, fees may range from a few hundred to several hundred dollars, depending on the complexity of your situation.

-

Where should a Lady Bird Deed be filed?

A Lady Bird Deed should be filed with the county register of deeds in the county where the property is located. Proper filing ensures that the deed is publicly recorded and legally recognized.

Documents used along the form

The Michigan Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. When preparing to use this deed, several other forms and documents may be relevant to ensure a comprehensive approach to property transfer and estate management. Below is a list of commonly used documents that often accompany the Lady Bird Deed.

- Warranty Deed: This document guarantees that the grantor holds clear title to the property and has the right to transfer it. It provides assurance to the buyer about the ownership and condition of the property.

- Quit Claim Deed: This type of deed transfers whatever interest the grantor has in the property without making any guarantees about the title. It is often used between family members or in situations where the parties know each other well.

- Transfer-on-Death Deed: This form allows property owners to designate beneficiaries who will receive their real estate upon their death, avoiding the lengthy probate process. For additional details, visit todform.com/blank-arizona-transfer-on-death-deed.

- Power of Attorney: A legal document that allows one person to act on behalf of another in legal or financial matters. This can be useful if the property owner becomes incapacitated and needs someone to manage their affairs.

- Trust Document: If the property owner has established a trust, this document outlines the terms and conditions of the trust, including how the property should be managed and distributed after the owner's death.

- Will: A legal document that specifies how a person's assets should be distributed upon their death. It may include provisions for the property covered by the Lady Bird Deed and can work in conjunction with it.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person. It can simplify the transfer of property by confirming the rightful heirs without the need for a lengthy probate process.

- Property Tax Exemption Form: This form may be necessary to ensure that the property remains eligible for certain tax exemptions after the transfer of ownership, especially if it is being transferred to a family member.

Understanding these documents can help individuals navigate the complexities of property transfer and estate planning. Each form plays a specific role in ensuring that the wishes of the property owner are honored and that the transfer process is as smooth as possible.

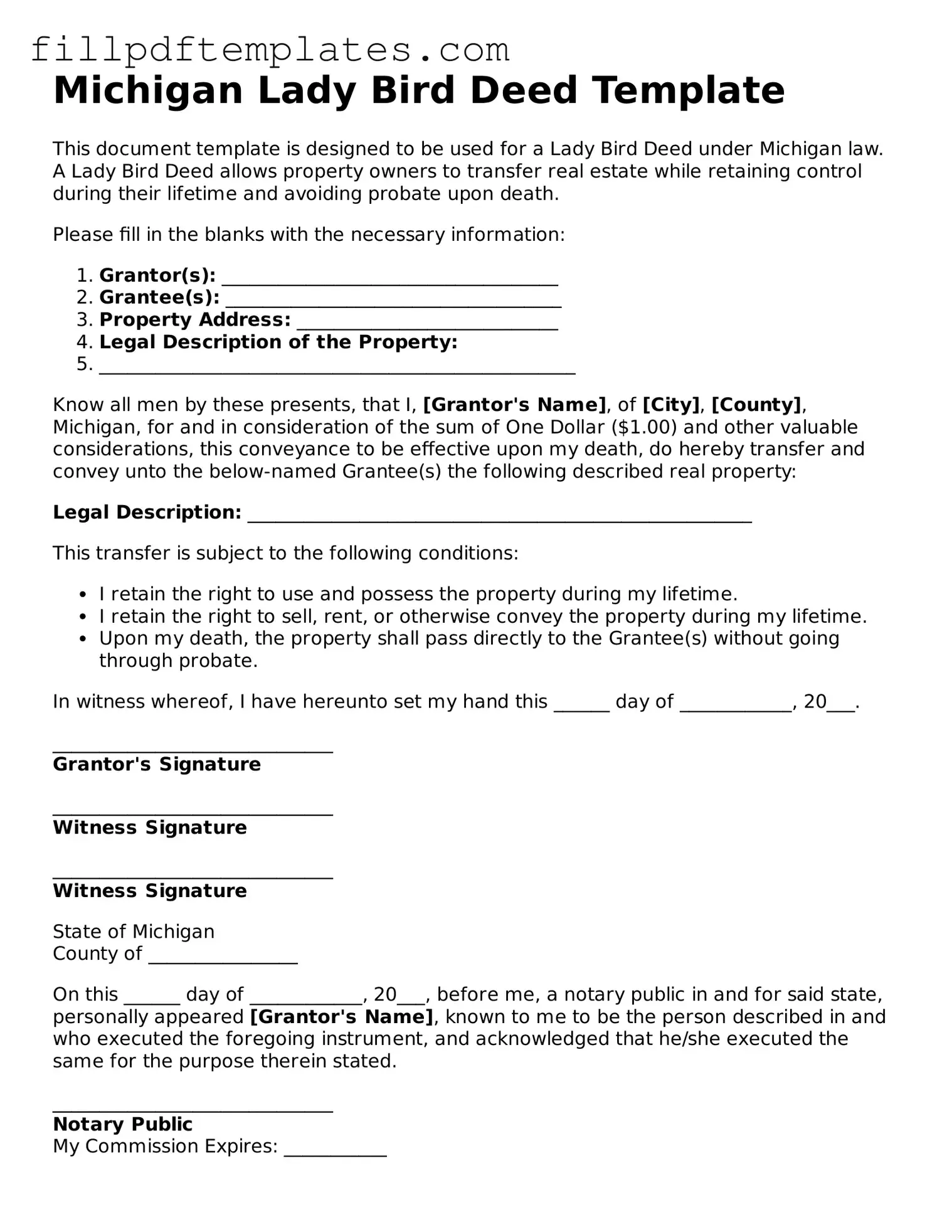

Michigan Lady Bird Deed Preview

Michigan Lady Bird Deed Template

This document template is designed to be used for a Lady Bird Deed under Michigan law. A Lady Bird Deed allows property owners to transfer real estate while retaining control during their lifetime and avoiding probate upon death.

Please fill in the blanks with the necessary information:

- Grantor(s): ____________________________________

- Grantee(s): ____________________________________

- Property Address: ____________________________

- Legal Description of the Property:

- ___________________________________________________

Know all men by these presents, that I, [Grantor's Name], of [City], [County], Michigan, for and in consideration of the sum of One Dollar ($1.00) and other valuable considerations, this conveyance to be effective upon my death, do hereby transfer and convey unto the below-named Grantee(s) the following described real property:

Legal Description: ______________________________________________________

This transfer is subject to the following conditions:

- I retain the right to use and possess the property during my lifetime.

- I retain the right to sell, rent, or otherwise convey the property during my lifetime.

- Upon my death, the property shall pass directly to the Grantee(s) without going through probate.

In witness whereof, I have hereunto set my hand this ______ day of ____________, 20___.

______________________________

Grantor's Signature

______________________________

Witness Signature

______________________________

Witness Signature

State of Michigan

County of ________________

On this ______ day of ____________, 20___, before me, a notary public in and for said state, personally appeared [Grantor's Name], known to me to be the person described in and who executed the foregoing instrument, and acknowledged that he/she executed the same for the purpose therein stated.

______________________________

Notary Public

My Commission Expires: ___________