Blank Michigan Deed Form

The Michigan Deed form plays a crucial role in real estate transactions across the state. When transferring property ownership, this legal document ensures that the transfer is recorded and recognized by the state. It includes essential information such as the names of the grantor (the person selling or transferring the property) and the grantee (the person receiving the property), as well as a detailed description of the property being conveyed. Additionally, the form requires the inclusion of the property's tax identification number and the consideration amount, which is the price paid for the property. The Michigan Deed form can vary in type, with options like warranty deeds, quitclaim deeds, and others, each serving different purposes and offering varying levels of protection to the parties involved. Properly completing and filing this form is vital, as it not only formalizes the transfer but also helps prevent disputes over property ownership in the future. Understanding the nuances of this document can significantly impact the success of a real estate transaction in Michigan.

Other Common Deed State Templates

New Jersey Deed Transfer Form - A deed may be executed in person or remotely, depending on state law.

Iowa Records Online - Acts as a basis for property taxes and assessments.

The process of forming a corporation in Wisconsin begins with the completion of the necessary documentation, including the essential Articles of Incorporation, which outlines the key aspects of the corporation's structure and purpose, setting a solid foundation for future business operations.

Quit Claim Deed Georgia - Deeds must comply with state-specific laws to ensure proper execution.

Similar forms

The Deed form is a crucial document in real estate and legal transactions. It shares similarities with several other documents, each serving specific purposes. Below is a list of ten documents that are similar to the Deed form, along with explanations of how they are alike.

- Title Insurance Policy: Like a Deed, this document provides evidence of property ownership and protects against potential claims on the property.

- Texas Motor Vehicle Power of Attorney: This form allows you to authorize someone to handle vehicle-related tasks for you, such as title transfers and registration. For more information, visit https://legalpdfdocs.com/.

- Bill of Sale: This document transfers ownership of personal property, similar to how a Deed transfers ownership of real estate.

- Lease Agreement: A Lease Agreement outlines the terms under which a tenant may occupy a property, much like a Deed outlines ownership rights.

- Trust Agreement: This document establishes a trust and outlines the management of property, similar to how a Deed conveys property interests.

- Quitclaim Deed: This is a specific type of Deed that transfers whatever interest the grantor has in the property, akin to a standard Deed but with fewer guarantees.

- Mortgage Agreement: This document secures a loan with the property as collateral, paralleling how a Deed establishes ownership rights tied to the property.

- Power of Attorney: This document allows someone to act on another's behalf in legal matters, including property transactions, similar to how a Deed conveys authority over property.

- Settlement Statement: This document outlines the financial aspects of a real estate transaction, similar to how a Deed finalizes the transfer of ownership.

- Affidavit of Title: This sworn statement confirms the ownership of a property and any claims against it, much like a Deed asserts ownership rights.

- Warranty Deed: This type of Deed guarantees that the grantor holds clear title to the property, similar to a standard Deed but with additional protections for the buyer.

Understanding these documents can help clarify their roles in property transactions and ensure that all parties are adequately informed about their rights and responsibilities.

Document Properties

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Deed form is used to legally transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Warranty Deed, Quit Claim Deed, and Special Warranty Deed. |

| Governing Law | The form is governed by the Michigan Compiled Laws, specifically Act 59 of 1915. |

| Signature Requirements | All parties involved must sign the deed in the presence of a notary public. |

| Recording | The completed deed must be recorded with the county register of deeds to ensure public notice. |

| Tax Implications | Transfer taxes may apply, and it's important to check local regulations for specific rates. |

Things You Should Know About This Form

-

What is a Michigan Deed form?

A Michigan Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Michigan. It outlines the details of the property being transferred, including the names of the parties involved, the legal description of the property, and any conditions or restrictions related to the transfer.

-

What types of deeds are available in Michigan?

Michigan offers several types of deeds, each serving different purposes. The most common types include:

- Warranty Deed: This type guarantees that the seller has clear title to the property and has the right to sell it. It also protects the buyer from any claims against the property.

- Quit Claim Deed: This deed transfers whatever interest the seller has in the property without any guarantees. It is often used between family members or in divorce settlements.

- Grant Deed: Similar to a warranty deed, this type provides some assurances to the buyer but may not guarantee against all claims.

-

How do I fill out a Michigan Deed form?

Filling out a Michigan Deed form requires attention to detail. Start by clearly stating the names of the grantor (the seller) and the grantee (the buyer). Next, include the legal description of the property, which can often be found on the property's tax records. Ensure you also include the date of transfer and any specific conditions that apply. After completing the form, both parties must sign it in the presence of a notary public to make it legally binding.

-

Do I need to record the deed after it is signed?

Yes, it is essential to record the deed with the local county register of deeds office. Recording the deed provides public notice of the ownership change and protects the buyer's rights to the property. Failure to record the deed could lead to disputes over property ownership in the future.

Documents used along the form

When completing a property transfer in Michigan, several forms and documents may accompany the Michigan Deed form. Each of these documents serves a specific purpose in ensuring a smooth and legally compliant transaction. Below is a list of commonly used documents.

- Property Transfer Affidavit: This document provides information about the property being transferred, including its assessed value and any changes in ownership. It is typically filed with the local assessor's office.

- Transfer-on-Death Deed: This legal document allows property owners to transfer their real estate to beneficiaries upon their death, avoiding probate. For more information, visit transferondeathdeedform.com/new-jersey-transfer-on-death-deed/.

- Affidavit of Title: This form confirms the seller's legal ownership of the property and asserts that there are no outstanding liens or claims against it. It helps protect the buyer from potential legal issues.

- Closing Statement: Also known as a HUD-1 or settlement statement, this document outlines all financial aspects of the transaction, including the purchase price, closing costs, and any adjustments made. It provides transparency for both parties.

- Transfer Tax Form: This form is used to calculate and report the state and local transfer taxes due upon the sale of the property. It ensures compliance with tax regulations and is typically submitted at closing.

These documents, when used in conjunction with the Michigan Deed form, help facilitate a clear and legally binding property transfer. It is important to ensure that all necessary forms are completed accurately to avoid complications in the transaction process.

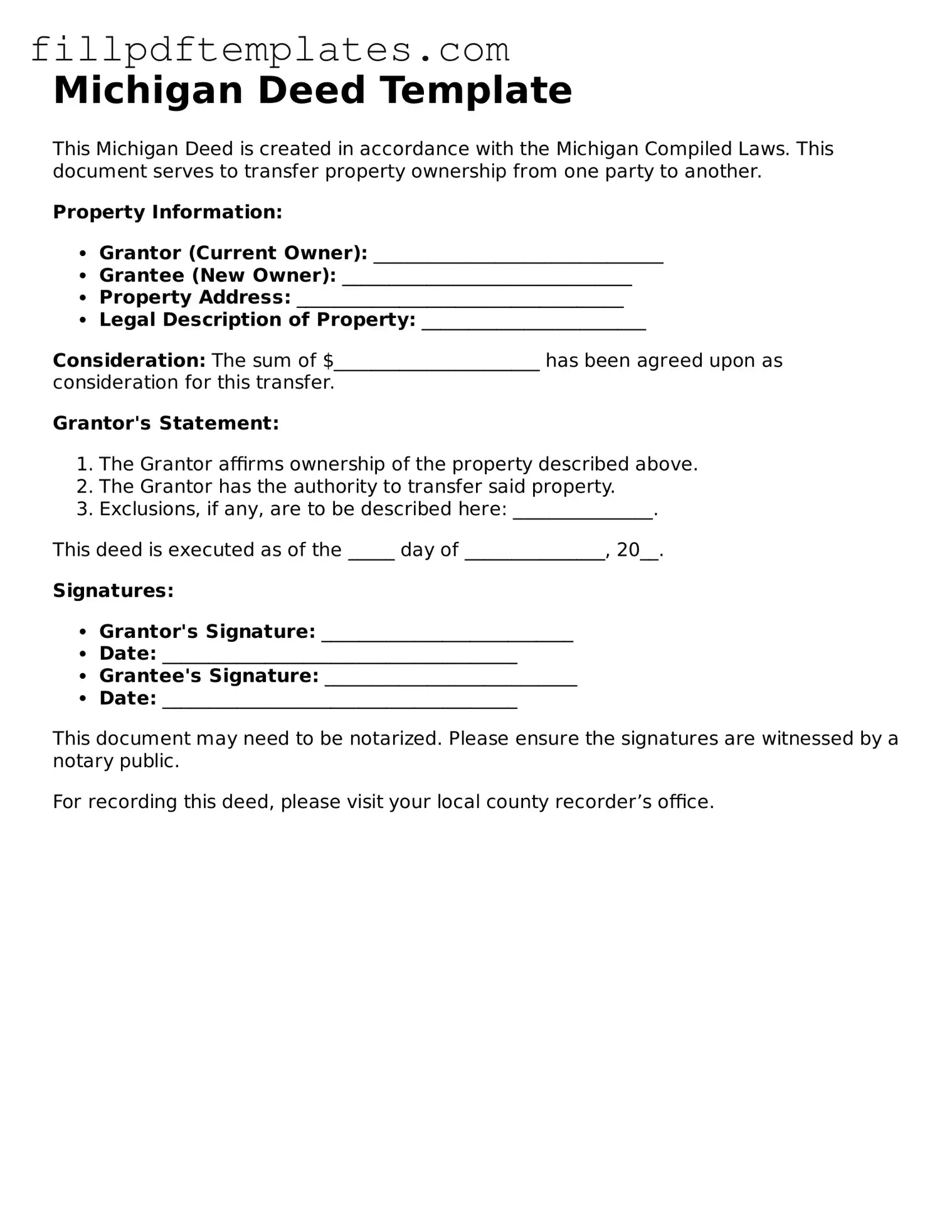

Michigan Deed Preview

Michigan Deed Template

This Michigan Deed is created in accordance with the Michigan Compiled Laws. This document serves to transfer property ownership from one party to another.

Property Information:

- Grantor (Current Owner): _______________________________

- Grantee (New Owner): _______________________________

- Property Address: ___________________________________

- Legal Description of Property: ________________________

Consideration: The sum of $______________________ has been agreed upon as consideration for this transfer.

Grantor's Statement:

- The Grantor affirms ownership of the property described above.

- The Grantor has the authority to transfer said property.

- Exclusions, if any, are to be described here: _______________.

This deed is executed as of the _____ day of _______________, 20__.

Signatures:

- Grantor's Signature: ___________________________

- Date: ______________________________________

- Grantee's Signature: ___________________________

- Date: ______________________________________

This document may need to be notarized. Please ensure the signatures are witnessed by a notary public.

For recording this deed, please visit your local county recorder’s office.