Fill a Valid Louisiana act of donation Template

The Louisiana act of donation form is a crucial legal document that facilitates the transfer of property or assets from one individual to another without the expectation of payment. This form is primarily used for donations of movable and immovable property, allowing donors to express their intent clearly and formally. It includes essential details such as the names and addresses of both the donor and the recipient, a description of the property being donated, and any conditions attached to the donation. Additionally, the form may require signatures from witnesses to validate the transaction, ensuring that the donor's intentions are documented and legally recognized. Understanding the components and requirements of this form is vital for both donors and recipients to navigate the donation process effectively while complying with Louisiana state laws.

Additional PDF Templates

Verizon Claims Department - Make sure to review the F-017-08 MEN before submission for accuracy.

Skin Assessment Shower Sheets for Cna - The form gathers important data that can inform staff training needs.

To facilitate a thorough tenant evaluation process, landlords often require prospective renters to complete a detailed rental application. This form plays a pivotal role in assessing the applicant's financial stability, rental background, and overall suitability for tenancy.

Panel Load Calculation - Territorial considerations apply when completing this form for different locales.

Similar forms

-

Quitclaim Deed: Similar to the Louisiana act of donation, a quitclaim deed transfers ownership of property without guaranteeing that the title is clear. It’s often used between family members or in situations where the grantor does not want to make any warranties about the property’s title.

-

Gift Deed: A gift deed is a document used to transfer property as a gift, without any payment involved. Like the act of donation, it signifies the donor's intention to give the property to another person, often without the expectation of receiving anything in return.

-

Warranty Deed: While a warranty deed provides a guarantee of clear title to the buyer, it shares similarities with the act of donation in that both involve the transfer of property ownership. However, the warranty deed offers more legal protection to the recipient.

- Hold Harmless Agreement: This document serves to protect parties from potential liabilities during various transactions, similar to how the Louisiana Act of Donation clarifies property transfers. For more information, visit the Hold Harmless Agreement page.

-

Power of Attorney: A power of attorney allows one person to act on behalf of another in legal matters, including property transactions. This document can be used in conjunction with the act of donation when someone is unable to sign the donation form themselves.

-

Bill of Sale: A bill of sale is used to transfer ownership of personal property. While the act of donation pertains to real estate, both documents serve to officially document the transfer of ownership from one party to another.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Louisiana Act of Donation form is used to legally transfer ownership of property or assets from one person to another without compensation. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1466-1485, which outline the requirements for donations. |

| Requirements | The form must be executed in writing and signed by both the donor and the donee, and it may require notarization to be enforceable. |

| Types of Donations | Donations can be inter vivos (between living persons) or mortis causa (in anticipation of death), each with specific legal implications. |

Things You Should Know About This Form

-

What is the Louisiana Act of Donation form?

The Louisiana Act of Donation form is a legal document used to formally transfer ownership of property or assets from one individual (the donor) to another (the donee) without any exchange of money. This form is often used for gifts of real estate, personal property, or other assets, and it helps ensure that the transfer is recognized under Louisiana law.

-

Who can use the Act of Donation form?

Any individual who wishes to donate property to another person can use this form. This includes family members, friends, or even charitable organizations. However, both the donor and the donee must be legally competent to enter into a contract.

-

What types of property can be donated using this form?

The Act of Donation form can be used for various types of property, including:

- Real estate, such as land or buildings

- Personal property, such as vehicles, jewelry, or artwork

- Financial assets, such as stocks or bonds

It is important to specify the type of property being donated in the form to avoid any confusion.

-

Is the Act of Donation form legally binding?

Yes, once properly executed, the Act of Donation form is legally binding. To ensure its validity, the document should be signed by both the donor and the donee, and it may also need to be notarized or recorded with the appropriate governmental authority, especially in the case of real estate.

-

Are there any tax implications for the donor or donee?

Yes, there may be tax implications associated with donations. The donor could be subject to gift taxes if the value of the donated property exceeds a certain threshold. The donee may also need to consider how the donation affects their tax situation. It is advisable to consult a tax professional for specific guidance.

-

Can the donor place conditions on the donation?

Yes, the donor can specify certain conditions in the Act of Donation form. For example, the donor may wish to include stipulations regarding the use of the property or set up a trust for the benefit of the donee. These conditions must be clearly outlined in the document to be enforceable.

-

What happens if the donor changes their mind?

Once the Act of Donation is executed and the property is transferred, the donor typically cannot revoke the donation unless specific conditions for revocation are included in the document. If the donation was made under duress or fraud, legal recourse may be available.

-

How should the Act of Donation form be filled out?

The form should include the following information:

- The names and addresses of both the donor and donee

- A detailed description of the property being donated

- Any conditions or restrictions on the donation

- The date of the donation

It is essential to ensure that all information is accurate and complete to avoid potential disputes in the future.

-

Where can I obtain a Louisiana Act of Donation form?

Louisiana Act of Donation forms can typically be obtained from legal stationery stores, online legal form providers, or through an attorney who specializes in estate planning or property law. It is crucial to use a form that complies with Louisiana law to ensure its validity.

-

Is legal advice recommended when using this form?

While it is possible to complete the Act of Donation form without legal assistance, seeking advice from an attorney is highly recommended. An attorney can provide guidance on the implications of the donation, ensure that the form is filled out correctly, and help navigate any potential tax issues.

Documents used along the form

The Louisiana Act of Donation form is a legal document used to transfer ownership of property from one person to another without any compensation. Several other forms and documents may accompany this form to ensure a smooth transaction and proper documentation of the donation process. Below is a list of commonly used documents in conjunction with the Louisiana Act of Donation form.

- Property Deed: This document serves as the official record of property ownership. It details the description of the property and the names of the grantor (donor) and grantee (recipient). A property deed is essential for transferring title and should be recorded with the local parish clerk.

- Transfer-on-Death Deed: This legal document allows property owners in North Carolina to designate beneficiaries who will receive the property after the owner's death, thereby circumventing the probate process. For more information, visit transferondeathdeedform.com/north-carolina-transfer-on-death-deed/.

- Affidavit of Identity: This form verifies the identity of the parties involved in the donation. It may be required to confirm that the individuals signing the Act of Donation are indeed who they claim to be, helping to prevent fraud.

- Gift Tax Return (Form 709): This federal form is used to report gifts made during the year. If the value of the donated property exceeds the annual exclusion limit, the donor may need to file this return to comply with tax regulations.

- Notarized Statement: A notarized statement may be used to affirm the donor's intent to make the gift. This document adds an extra layer of authenticity and may be required by some institutions or for certain types of property.

These documents play an important role in the donation process, providing clarity and legal protection for both the donor and the recipient. Ensuring all relevant paperwork is completed can facilitate a successful transfer of property ownership.

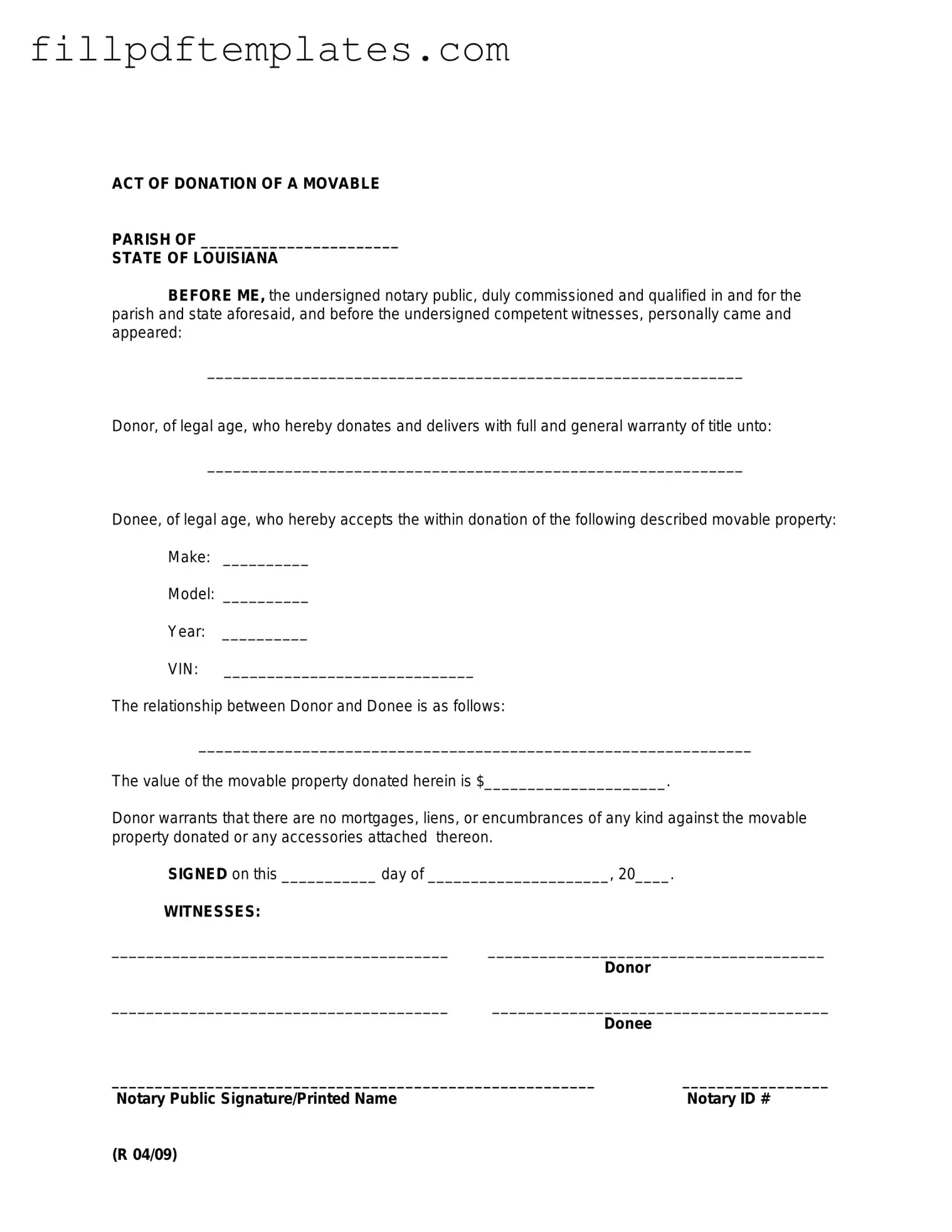

Louisiana act of donation Preview

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)