Valid Loan Agreement Form

When individuals or businesses seek financial assistance, a Loan Agreement form serves as a crucial document that outlines the terms and conditions of the loan. This form typically includes essential information such as the loan amount, interest rate, repayment schedule, and the duration of the loan. Additionally, it specifies the rights and obligations of both the lender and the borrower, ensuring clarity and protection for both parties involved. Key aspects like collateral requirements, late payment penalties, and default consequences are also addressed within the agreement. By detailing these elements, the Loan Agreement form helps to prevent misunderstandings and disputes, fostering a transparent relationship between the lender and borrower. Understanding the significance of this document can empower individuals and businesses to navigate their financial commitments with confidence.

Loan Agreement - Customized for Each State

Loan Agreement Form Subtypes

Fill out More Documents

How to Fix My Birth Certificate in California - An affidavit used to affirm the identity and origins of a child.

In the state of Georgia, having a General Power of Attorney form is crucial for ensuring that your preferred representative can manage financial and legal affairs on your behalf, especially in situations where you may be unable to do so yourself. This legal document not only provides flexibility but also grants peace of mind by outlining the powers you wish to delegate to your agent, making it an essential part of effective personal and financial planning.

Unconditional Waiver - Allows contractors to maintain good relationships with clients by confirming payments.

Similar forms

- Promissory Note: This document outlines the borrower's promise to repay the loan under specific terms. Like a loan agreement, it includes the loan amount, interest rate, and repayment schedule.

- Mortgage Agreement: If the loan is secured by property, this document details the terms of the mortgage. It shares similarities with a loan agreement by specifying the collateral and the consequences of default.

- Hold Harmless Agreement: This legal document protects one party from legal responsibility for any injuries or damages incurred by another party during an activity. It is particularly important when using another's property or services. For more information, refer to the Hold Harmless Agreement.

- Credit Agreement: This is often used for revolving credit, such as credit cards. It includes terms similar to those in a loan agreement, like interest rates and repayment terms, but is typically more flexible.

- Lease Agreement: While primarily for renting property, a lease agreement can resemble a loan agreement in that it outlines payment terms, duration, and obligations of both parties.

- Personal Guarantee: This document may accompany a loan agreement, where a third party agrees to be responsible for the debt if the borrower defaults. It emphasizes the borrower's obligations, similar to the loan agreement.

- Business Loan Agreement: Tailored for business financing, this document includes terms like interest rates and repayment schedules. It functions similarly to a personal loan agreement but focuses on business-related terms.

- Lines of Credit Agreement: This document outlines the terms under which a borrower can draw funds. Similar to a loan agreement, it specifies limits, interest rates, and repayment terms.

- Debt Settlement Agreement: This document is used when negotiating a reduced payoff amount for a debt. It shares the goal of resolving financial obligations, much like a loan agreement.

- Security Agreement: This document provides details on collateral for a loan. It is similar to a loan agreement in that it outlines obligations and rights related to the secured asset.

Document Properties

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement form outlines the terms under which one party borrows money from another, ensuring both parties understand their rights and obligations. |

| Parties Involved | The agreement typically involves a lender (who provides the funds) and a borrower (who receives the funds). |

| Loan Amount | The specific amount of money being borrowed is clearly stated in the agreement, providing clarity to both parties. |

| Interest Rate | The form specifies the interest rate applied to the loan, which can be fixed or variable, depending on the agreement. |

| Repayment Terms | Details about how and when the loan will be repaid are included, such as monthly payments and the total repayment period. |

| Governing Law | The agreement is governed by the laws of the state where the loan is executed, which can vary by state. For example, California laws may apply for loans executed in California. |

| Default Clause | This clause outlines what happens if the borrower fails to repay the loan, including potential penalties or legal action. |

| Collateral | If applicable, the agreement may specify collateral that secures the loan, providing the lender with a form of protection. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties to be valid. |

| Signatures | Both the lender and borrower must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

Things You Should Know About This Form

-

What is a Loan Agreement?

A Loan Agreement is a legal document that outlines the terms of a loan between a lender and a borrower. It includes details such as the amount of the loan, interest rate, repayment schedule, and any collateral involved. This document serves to protect both parties by clearly stating their rights and responsibilities.

-

Who needs a Loan Agreement?

Anyone who is borrowing or lending money should consider using a Loan Agreement. This includes individuals, businesses, or organizations. Having a written agreement helps prevent misunderstandings and provides a reference point if disputes arise.

-

What information is included in a Loan Agreement?

A typical Loan Agreement includes:

- The names and contact information of both the lender and borrower.

- The loan amount and currency.

- The interest rate and how it is calculated.

- The repayment schedule, including due dates and payment methods.

- Any collateral or security for the loan.

- Consequences of late payments or default.

-

Is a Loan Agreement legally binding?

Yes, a Loan Agreement is legally binding as long as it meets certain requirements. Both parties must agree to the terms and sign the document. It is advisable to have the agreement witnessed or notarized to strengthen its enforceability.

-

What happens if the borrower cannot repay the loan?

If the borrower fails to repay the loan as agreed, the lender may take legal action to recover the owed amount. This could include filing a lawsuit or pursuing collection efforts. The specific consequences should be detailed in the Loan Agreement.

-

Can the terms of a Loan Agreement be changed?

Yes, the terms can be changed if both parties agree to the new terms. It is important to document any changes in writing and have both parties sign the amended agreement. This helps ensure clarity and mutual understanding.

-

Do I need a lawyer to create a Loan Agreement?

While it is not strictly necessary to hire a lawyer, it can be beneficial. A legal professional can help ensure that the agreement complies with local laws and adequately protects your interests. If you feel confident, you can also create a Loan Agreement using templates or guides.

-

Where can I find a Loan Agreement template?

Loan Agreement templates are available online. Many legal websites offer free or paid templates that you can customize to fit your needs. Make sure to choose a template that is appropriate for your situation and jurisdiction.

Documents used along the form

A Loan Agreement is a crucial document that outlines the terms and conditions of a loan between a lender and a borrower. However, it is often accompanied by several other forms and documents that help clarify the agreement and protect the interests of both parties. Below is a list of commonly used documents that may accompany a Loan Agreement.

- Promissory Note: This document is a written promise from the borrower to repay the loan amount, including any interest, by a specified date. It serves as evidence of the borrower's commitment.

- Security Agreement: If the loan is secured by collateral, this agreement outlines the specific assets that the borrower pledges as security for the loan. It details the rights of the lender in case of default.

- Operating Agreement: To formalize your business operations, consider utilizing the essential Operating Agreement form template to clearly define ownership and procedures.

- Personal Guarantee: In some cases, a lender may require a personal guarantee from the borrower or a third party. This document holds the guarantor personally responsible for repaying the loan if the borrower defaults.

- Disclosure Statement: This document provides important information about the loan terms, including interest rates, fees, and repayment schedules. It ensures that the borrower understands the costs associated with the loan.

- Loan Application: This form collects information about the borrower’s financial status, credit history, and purpose for the loan. It helps the lender assess the risk involved in granting the loan.

- Amortization Schedule: This schedule outlines the repayment plan for the loan, showing how much of each payment goes toward principal and interest over time. It helps borrowers understand their payment obligations.

- Loan Closing Statement: This document summarizes the final terms of the loan and includes details about any closing costs. It is presented at the end of the loan process to ensure transparency.

Understanding these additional documents is essential for both borrowers and lenders. They provide clarity, outline responsibilities, and help prevent misunderstandings throughout the lending process. Each document plays a unique role in ensuring a smooth transaction and protecting the rights of all parties involved.

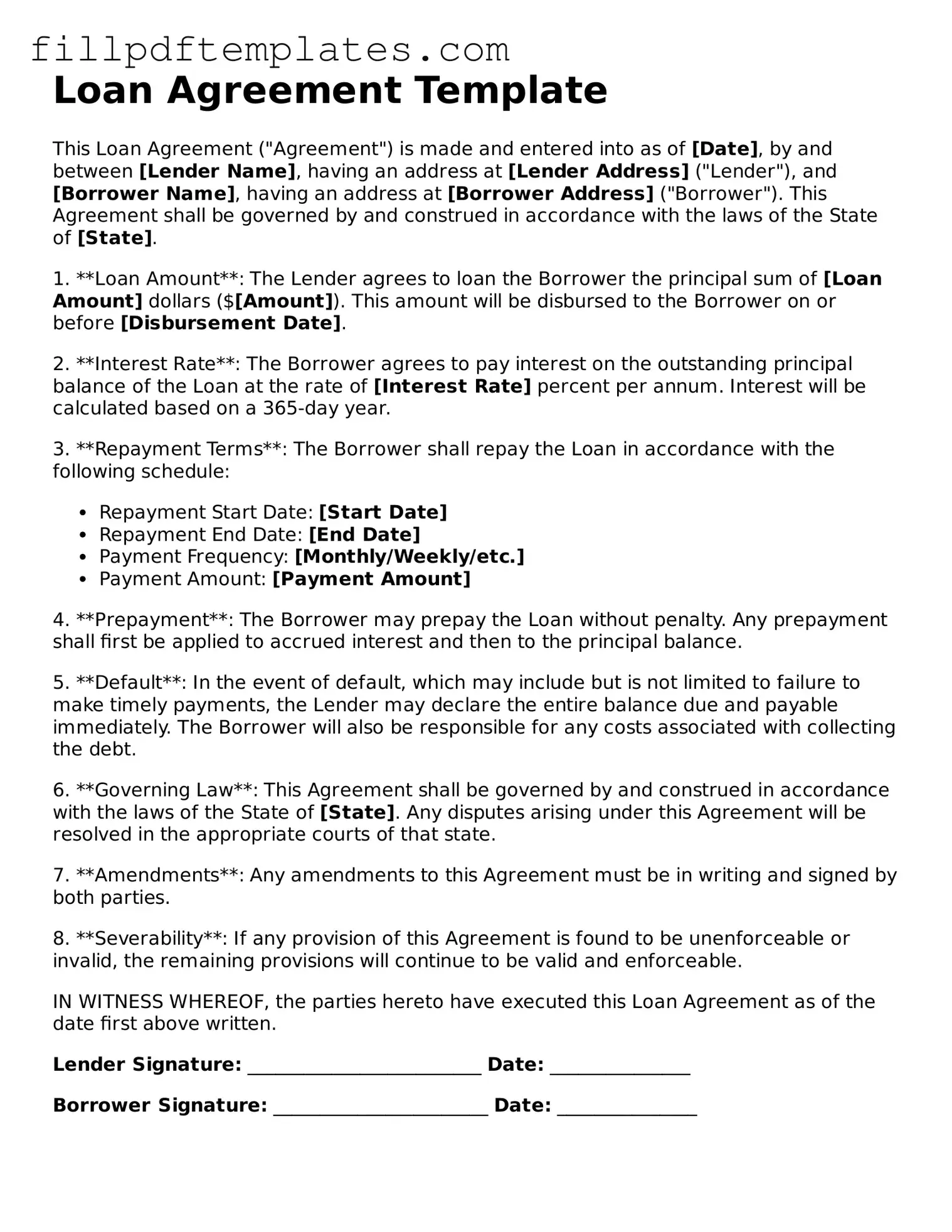

Loan Agreement Preview

Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into as of [Date], by and between [Lender Name], having an address at [Lender Address] ("Lender"), and [Borrower Name], having an address at [Borrower Address] ("Borrower"). This Agreement shall be governed by and construed in accordance with the laws of the State of [State].

1. **Loan Amount**: The Lender agrees to loan the Borrower the principal sum of [Loan Amount] dollars ($[Amount]). This amount will be disbursed to the Borrower on or before [Disbursement Date].

2. **Interest Rate**: The Borrower agrees to pay interest on the outstanding principal balance of the Loan at the rate of [Interest Rate] percent per annum. Interest will be calculated based on a 365-day year.

3. **Repayment Terms**: The Borrower shall repay the Loan in accordance with the following schedule:

- Repayment Start Date: [Start Date]

- Repayment End Date: [End Date]

- Payment Frequency: [Monthly/Weekly/etc.]

- Payment Amount: [Payment Amount]

4. **Prepayment**: The Borrower may prepay the Loan without penalty. Any prepayment shall first be applied to accrued interest and then to the principal balance.

5. **Default**: In the event of default, which may include but is not limited to failure to make timely payments, the Lender may declare the entire balance due and payable immediately. The Borrower will also be responsible for any costs associated with collecting the debt.

6. **Governing Law**: This Agreement shall be governed by and construed in accordance with the laws of the State of [State]. Any disputes arising under this Agreement will be resolved in the appropriate courts of that state.

7. **Amendments**: Any amendments to this Agreement must be in writing and signed by both parties.

8. **Severability**: If any provision of this Agreement is found to be unenforceable or invalid, the remaining provisions will continue to be valid and enforceable.

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement as of the date first above written.

Lender Signature: _________________________ Date: _______________

Borrower Signature: _______________________ Date: _______________