Valid Letter of Intent to Purchase Business Form

When considering the acquisition of a business, a Letter of Intent (LOI) to Purchase Business serves as a crucial first step in the negotiation process. This document outlines the preliminary understanding between the buyer and seller, detailing key terms and conditions that will guide the eventual purchase agreement. It typically includes the purchase price, payment structure, and any contingencies that must be satisfied before the sale can proceed. Additionally, the LOI may address confidentiality agreements, due diligence timelines, and any conditions related to financing. While it is not legally binding in most cases, this letter sets the tone for the transaction and demonstrates the seriousness of the buyer’s intent. By clearly articulating the main points of agreement, both parties can work towards a smoother negotiation process, paving the way for a successful business transfer.

Different Types of Letter of Intent to Purchase Business Forms:

Lease Proposal Letter of Intent - Sets a positive tone for the future landlord-tenant relationship.

The Alaska Homeschool Letter of Intent form is a document that parents or guardians must submit to officially notify the state of their decision to homeschool their children. This form serves as a crucial step in ensuring compliance with Alaska's educational regulations. Parents can find the necessary information and access the form by visiting the Homeschool Intent Letter, allowing families to embark on their homeschooling journey with clarity and purpose.

Intent to Marry - A Letter of Intent to Marry shows your commitment to your partner.

Intent to Homeschool Letter - A notification to inform local education authorities of homeschooling intentions.

Similar forms

The Letter of Intent to Purchase Business serves as an important preliminary document in business transactions. Several other documents share similarities with it, often serving related purposes in the negotiation and agreement processes. Here are eight such documents:

- Memorandum of Understanding (MOU): Like the Letter of Intent, an MOU outlines the intentions of parties to collaborate or enter into an agreement, though it may not be legally binding.

- Investment Letter of Intent - This form serves as a preliminary commitment to invest, outlining critical terms before finalizing the deal. For those pursuing investment opportunities, our essential Investment Letter of Intent form guide details the steps necessary for a successful agreement.

- Term Sheet: A term sheet summarizes the key terms and conditions of a proposed deal, similar to how a Letter of Intent lays out the foundational elements of a business purchase.

- Non-Disclosure Agreement (NDA): This document protects sensitive information shared during negotiations, just as the Letter of Intent may include confidentiality clauses to safeguard proprietary details.

- Purchase Agreement: While the Letter of Intent indicates a desire to purchase, a purchase agreement formalizes the terms of the sale and is legally binding.

- Sales Proposal: A sales proposal outlines the specifics of a product or service offering, akin to how a Letter of Intent details the intentions and expectations of the purchasing parties.

- Due Diligence Checklist: This document lists the necessary investigations and evaluations before finalizing a deal, similar to the preliminary assessments often referenced in a Letter of Intent.

- Engagement Letter: An engagement letter establishes the relationship between parties and outlines the services to be provided, similar to how a Letter of Intent sets the stage for future collaboration.

- Binding Letter of Intent: Unlike a standard Letter of Intent, this document includes specific commitments that can be enforced, blurring the line between intent and obligation.

Understanding these documents can help clarify the negotiation process and ensure that all parties are aligned in their intentions and expectations.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Letter of Intent (LOI) outlines the preliminary understanding between parties intending to purchase a business. |

| Purpose | It serves to clarify the intentions of both buyer and seller before a formal agreement is drafted. |

| Binding Nature | Generally, an LOI is non-binding, meaning it does not legally obligate either party to complete the transaction. |

| Key Components | Typical components include purchase price, terms of payment, and timelines for due diligence. |

| State-Specific Forms | Some states may have specific requirements or forms for LOIs, governed by local business laws. |

| Confidentiality Clause | Many LOIs include a confidentiality clause to protect sensitive information shared during negotiations. |

| Legal Advice | It is advisable to seek legal counsel when drafting or signing an LOI to ensure all interests are protected. |

Things You Should Know About This Form

-

What is a Letter of Intent to Purchase a Business?

A Letter of Intent (LOI) to purchase a business is a document that outlines the preliminary understanding between a buyer and a seller regarding the potential sale of a business. It serves as a starting point for negotiations and typically includes key terms such as the purchase price, payment structure, and any conditions that must be met before the sale can be finalized.

-

Is a Letter of Intent legally binding?

Generally, a Letter of Intent is not legally binding, meaning that either party can walk away from the deal without legal consequences. However, certain sections of the LOI, such as confidentiality agreements or exclusivity clauses, may be binding. It's essential to clarify which parts of the document are intended to be enforceable.

-

Why should I use a Letter of Intent?

Using a Letter of Intent can help both parties clarify their intentions and expectations before entering into a more formal agreement. It can also save time and resources by identifying potential deal-breakers early in the process. Additionally, it demonstrates a serious commitment to the transaction.

-

What should be included in a Letter of Intent?

A well-crafted Letter of Intent typically includes:

- Identification of the parties involved

- Description of the business being sold

- Proposed purchase price and payment terms

- Timeline for due diligence and closing

- Any contingencies or conditions that must be met

- Confidentiality provisions

- Exclusivity period, if applicable

-

How long does it take to negotiate a Letter of Intent?

The time it takes to negotiate a Letter of Intent can vary widely depending on the complexity of the deal and the responsiveness of both parties. In some cases, a simple LOI can be drafted and agreed upon within a few days. More complex transactions may require several weeks of back-and-forth discussions.

-

Can I change my mind after signing a Letter of Intent?

Yes, you can change your mind after signing a Letter of Intent, as it is typically non-binding. However, if you have agreed to any binding provisions, such as confidentiality or exclusivity, you must adhere to those terms. It’s always wise to consult with a legal professional before making any decisions.

-

Do I need a lawyer to draft a Letter of Intent?

While it is not legally required to have a lawyer draft a Letter of Intent, it is highly advisable. A legal professional can help ensure that the document accurately reflects your intentions and protects your interests. They can also provide guidance on any specific legal implications related to your situation.

-

What happens after the Letter of Intent is signed?

After signing the Letter of Intent, both parties typically move forward with due diligence. This process involves a thorough examination of the business’s financials, operations, and any potential liabilities. If all goes well, the parties will proceed to negotiate a formal purchase agreement.

-

Can a Letter of Intent be used for other types of transactions?

Yes, a Letter of Intent can be used for various types of transactions beyond business purchases. It is commonly employed in real estate deals, mergers and acquisitions, and joint ventures. The format and content may vary depending on the specific transaction, but the purpose remains the same: to outline the intentions of the parties involved.

-

What should I do if I receive a Letter of Intent?

If you receive a Letter of Intent, take the time to review it carefully. Consider consulting with a lawyer to understand the implications and ensure your interests are protected. If you have questions or concerns about specific terms, don’t hesitate to discuss them with the other party before signing.

Documents used along the form

When preparing to purchase a business, several key documents often accompany the Letter of Intent to Purchase Business. Each of these forms plays a crucial role in ensuring a smooth transaction. Below is a list of commonly used documents in this process.

- Purchase Agreement: This is the main contract that outlines the terms and conditions of the sale, including the purchase price and payment terms.

- Confidentiality Agreement: Also known as a non-disclosure agreement (NDA), this document protects sensitive information shared during negotiations.

- Due Diligence Checklist: This is a list of items to review before finalizing the purchase, such as financial statements and legal documents.

- Asset Purchase Agreement: If the buyer is acquiring specific assets rather than the entire business, this document details which assets are included in the sale.

- Homeschool Letter of Intent: To properly inform the state about your decision to educate your children at home, you can utilize the https://homeschoolintent.com/editable-arizona-homeschool-letter-of-intent/ as a reference to complete this necessary document.

- Bill of Sale: This document serves as proof of the transfer of ownership of the business or its assets from the seller to the buyer.

- Financing Agreement: If the buyer requires financing, this document outlines the terms of the loan or financing arrangement.

- Employment Agreements: If the buyer plans to retain existing employees, these agreements outline the terms of their employment post-sale.

- Non-Compete Agreement: This document prevents the seller from starting a competing business for a specified period after the sale.

- Closing Statement: This document summarizes the financial aspects of the transaction and is prepared for the closing meeting.

Understanding these documents can help buyers and sellers navigate the complexities of a business purchase. Each form serves a specific purpose, contributing to a successful transaction.

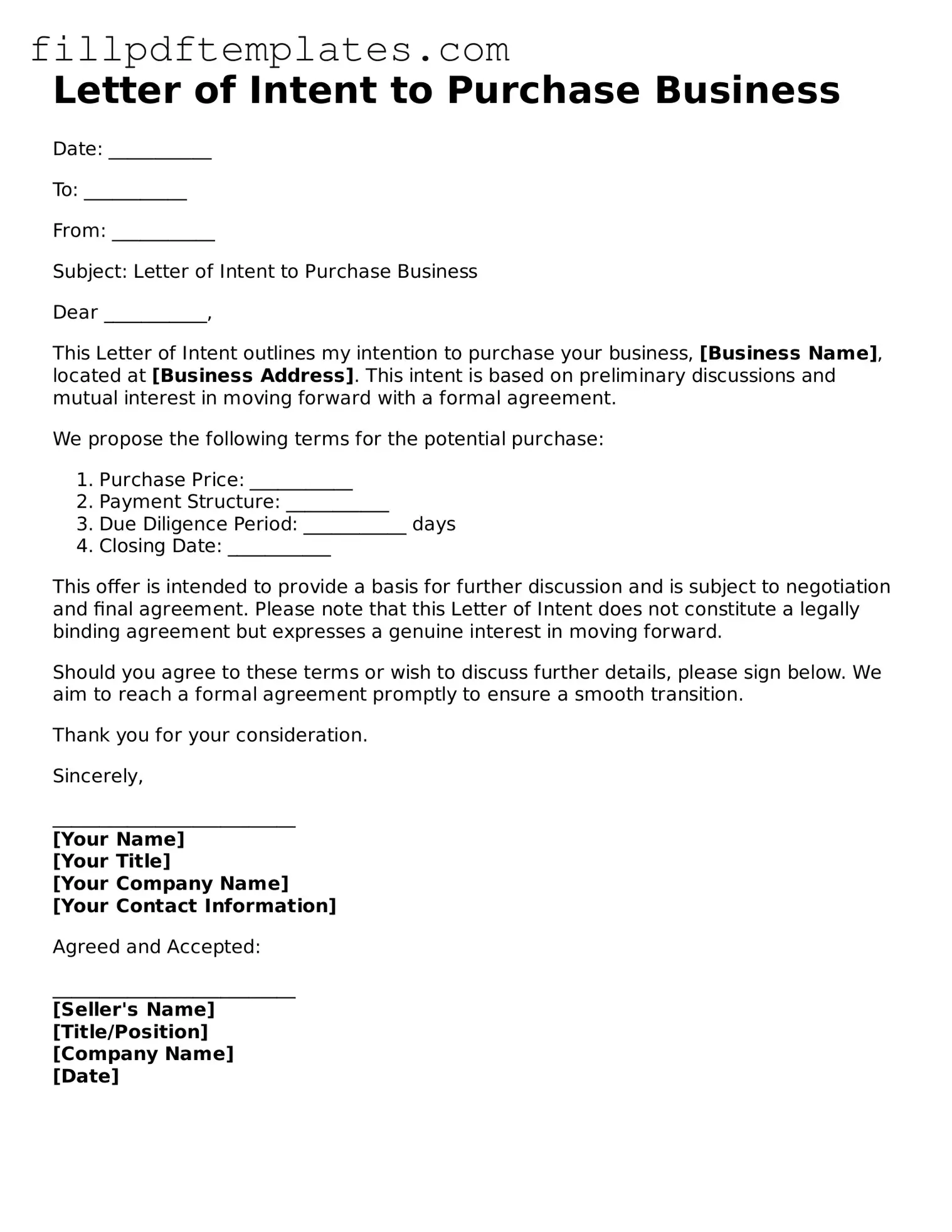

Letter of Intent to Purchase Business Preview

Letter of Intent to Purchase Business

Date: ___________

To: ___________

From: ___________

Subject: Letter of Intent to Purchase Business

Dear ___________,

This Letter of Intent outlines my intention to purchase your business, [Business Name], located at [Business Address]. This intent is based on preliminary discussions and mutual interest in moving forward with a formal agreement.

We propose the following terms for the potential purchase:

- Purchase Price: ___________

- Payment Structure: ___________

- Due Diligence Period: ___________ days

- Closing Date: ___________

This offer is intended to provide a basis for further discussion and is subject to negotiation and final agreement. Please note that this Letter of Intent does not constitute a legally binding agreement but expresses a genuine interest in moving forward.

Should you agree to these terms or wish to discuss further details, please sign below. We aim to reach a formal agreement promptly to ensure a smooth transition.

Thank you for your consideration.

Sincerely,

__________________________

[Your Name]

[Your Title]

[Your Company Name]

[Your Contact Information]

Agreed and Accepted:

__________________________

[Seller's Name]

[Title/Position]

[Company Name]

[Date]