Valid Lady Bird Deed Form

The Lady Bird Deed, also known as an enhanced life estate deed, serves as a valuable estate planning tool for property owners in the United States. This unique form allows individuals to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime. One of its key features is the ability to avoid probate, which can simplify the transfer process and reduce associated costs. Additionally, the Lady Bird Deed offers flexibility, as the original owner can sell, mortgage, or change the beneficiaries at any time without the consent of the recipients. This deed can also provide certain tax benefits, as the property may receive a step-up in basis upon the owner's death, potentially lowering capital gains taxes for the heirs. Understanding the implications and advantages of this form can help individuals make informed decisions about their estate planning strategies.

Different Types of Lady Bird Deed Forms:

California Corrective Deed - A Corrective Deed can remedy typographical errors that could confuse buyers.

To complete the process of buying or selling a vehicle in Florida, it's essential to use the Florida Motor Vehicle Bill of Sale form, which acts as a legal proof of transaction. This document includes vital details about the agreement between the buyer and seller, ensuring that both parties' rights are safeguarded. For your convenience, you can download the form in pdf.

Title Companies and Transfer on Death Deeds - Information on executing and recording the deed is typically available online.

Similar forms

The Lady Bird Deed is a unique estate planning tool, but there are several other documents that serve similar purposes in managing property and transferring assets. Here’s a list of ten documents that share similarities with the Lady Bird Deed:

- Will: A will outlines how a person's assets will be distributed after their death. Like a Lady Bird Deed, it can specify beneficiaries but does not avoid probate.

- Trust: A trust allows for the management of assets during a person's lifetime and after death. It provides more control over how and when assets are distributed, similar to the Lady Bird Deed.

- Transfer on Death Deed (TOD): This deed allows property to pass directly to a beneficiary upon death, avoiding probate, much like a Lady Bird Deed.

- Life Estate Deed: A life estate deed grants someone the right to live in a property for their lifetime while allowing for a remainderman to inherit the property afterward, similar to the Lady Bird Deed's structure.

- Durable Power of Attorney: This document enables an individual to appoint someone to make decisions on their behalf when they are unable to do so. It shares the purpose of ensuring that one’s wishes are honored, much like the Lady Bird Deed. For more information and templates, visit arizonaformpdf.com/.

- Joint Tenancy Deed: This deed allows two or more people to own property together with rights of survivorship. Like the Lady Bird Deed, it can simplify the transfer of property upon death.

- Beneficiary Designation: This document is often used for financial accounts or insurance policies to designate who will receive assets upon death, similar to how a Lady Bird Deed designates beneficiaries.

- Power of Attorney: A power of attorney allows someone to manage another's affairs, including property decisions. While it does not transfer ownership, it provides control over property management, akin to the intent of a Lady Bird Deed.

- Quitclaim Deed: This deed transfers whatever interest a person has in a property without warranties. It can be used to gift property, similar to how a Lady Bird Deed can transfer property to heirs.

- Community Property Agreement: In some states, this agreement allows spouses to convert separate property into community property, which can simplify inheritance issues, much like the Lady Bird Deed.

- Deed of Trust: This document secures a loan with real estate. While its primary purpose is different, it involves property transfer and management, similar to the Lady Bird Deed's function in estate planning.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by state laws, primarily in Texas, Florida, and Michigan. |

| Retained Rights | Property owners maintain the right to sell, mortgage, or change the property without needing beneficiary consent. |

| Tax Benefits | Using a Lady Bird Deed can help avoid probate and may provide tax advantages for beneficiaries. |

| Medicaid Protection | The deed can protect the property from being counted as an asset for Medicaid eligibility, under certain conditions. |

| Revocability | Property owners can revoke or change the deed at any time before their death. |

| Beneficiaries | Beneficiaries can be individuals or entities, such as family members or trusts. |

| Transfer Process | Upon the owner's death, the property automatically transfers to the beneficiaries without going through probate. |

| State Variations | While popular in certain states, the specifics of the Lady Bird Deed can vary. Always check local laws. |

Things You Should Know About This Form

-

What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners to transfer their property to beneficiaries while retaining the right to use and control the property during their lifetime. This type of deed simplifies the transfer process upon the owner's death, avoiding the complexities of probate.

-

What are the benefits of using a Lady Bird Deed?

One of the primary benefits is that it allows the property owner to retain full control of the property while alive. Additionally, the property transfers automatically to the beneficiaries upon the owner's death, bypassing probate. This can save time and reduce costs associated with the estate settlement process.

-

Who can use a Lady Bird Deed?

Any property owner in states that recognize Lady Bird Deeds can use this form. It's particularly beneficial for individuals looking to ensure their property passes directly to their heirs without going through probate. However, it is advisable to consult with a legal professional to ensure it aligns with your specific situation.

-

Are there any limitations to a Lady Bird Deed?

While Lady Bird Deeds offer many advantages, they may not be suitable for all situations. For instance, if the property owner has outstanding debts or liens, creditors may still have claims against the property. Furthermore, not all states recognize this type of deed, so it's crucial to verify its legality in your state.

-

How do I create a Lady Bird Deed?

Creating a Lady Bird Deed typically involves drafting the deed form, which includes the property description, the owner's information, and the beneficiaries' details. It must be signed by the property owner and notarized. Once completed, the deed should be filed with the appropriate county office to ensure it is legally binding.

-

Can I change the beneficiaries after creating a Lady Bird Deed?

Yes, one of the advantages of a Lady Bird Deed is the ability to change beneficiaries at any time during the property owner's lifetime. This can be done by drafting a new deed that revokes the previous one or by modifying the existing deed, depending on state laws.

-

What happens if the property owner becomes incapacitated?

If the property owner becomes incapacitated, the Lady Bird Deed remains in effect. The owner still retains control over the property, and the beneficiaries do not have any rights until the owner's passing. However, if the owner has not designated a power of attorney, decisions regarding the property may require additional legal processes.

-

Is a Lady Bird Deed the same as a traditional life estate deed?

No, a Lady Bird Deed differs from a traditional life estate deed in significant ways. With a traditional life estate, the property owner cannot sell or mortgage the property without the consent of the remainderman (the beneficiary). In contrast, a Lady Bird Deed allows the owner to sell, mortgage, or change the property without needing consent from the beneficiaries.

Documents used along the form

A Lady Bird Deed is a useful tool for property owners who want to transfer their property to heirs while retaining control during their lifetime. When preparing this deed, you may also need several other forms and documents to ensure a smooth process. Below is a list of common documents that often accompany a Lady Bird Deed.

- Property Title Document: This document shows the current ownership of the property and is essential for verifying that the person transferring the property has the right to do so.

- Identification Documents: Valid identification, such as a driver’s license or passport, may be required to confirm the identity of the grantor and grantee.

- Affidavit of Heirship: This document can help establish the heirs of the property owner, particularly if the owner passes away without a will.

- Warranty Deed: This deed guarantees that the property title is clear of any liens or encumbrances, providing assurance to the new owner.

- Hold Harmless Agreement: This document is crucial for protecting individuals from liability during property transactions or service provisions. It's essential to understand its implications, similar to the Hold Harmless Agreement, which helps shift risk to another party, ensuring peace of mind in your estate planning efforts.

- Power of Attorney: If the property owner is unable to sign the Lady Bird Deed themselves, a power of attorney allows someone else to act on their behalf.

- Will: Having a will in place can complement the Lady Bird Deed by detailing the owner’s wishes for other assets and providing clarity for the heirs.

- Transfer Tax Form: Depending on the state, a transfer tax form may be necessary to report the transfer of property and ensure compliance with local laws.

Understanding these documents can help streamline the process of creating and executing a Lady Bird Deed. Having everything in order will make the transition smoother for you and your loved ones.

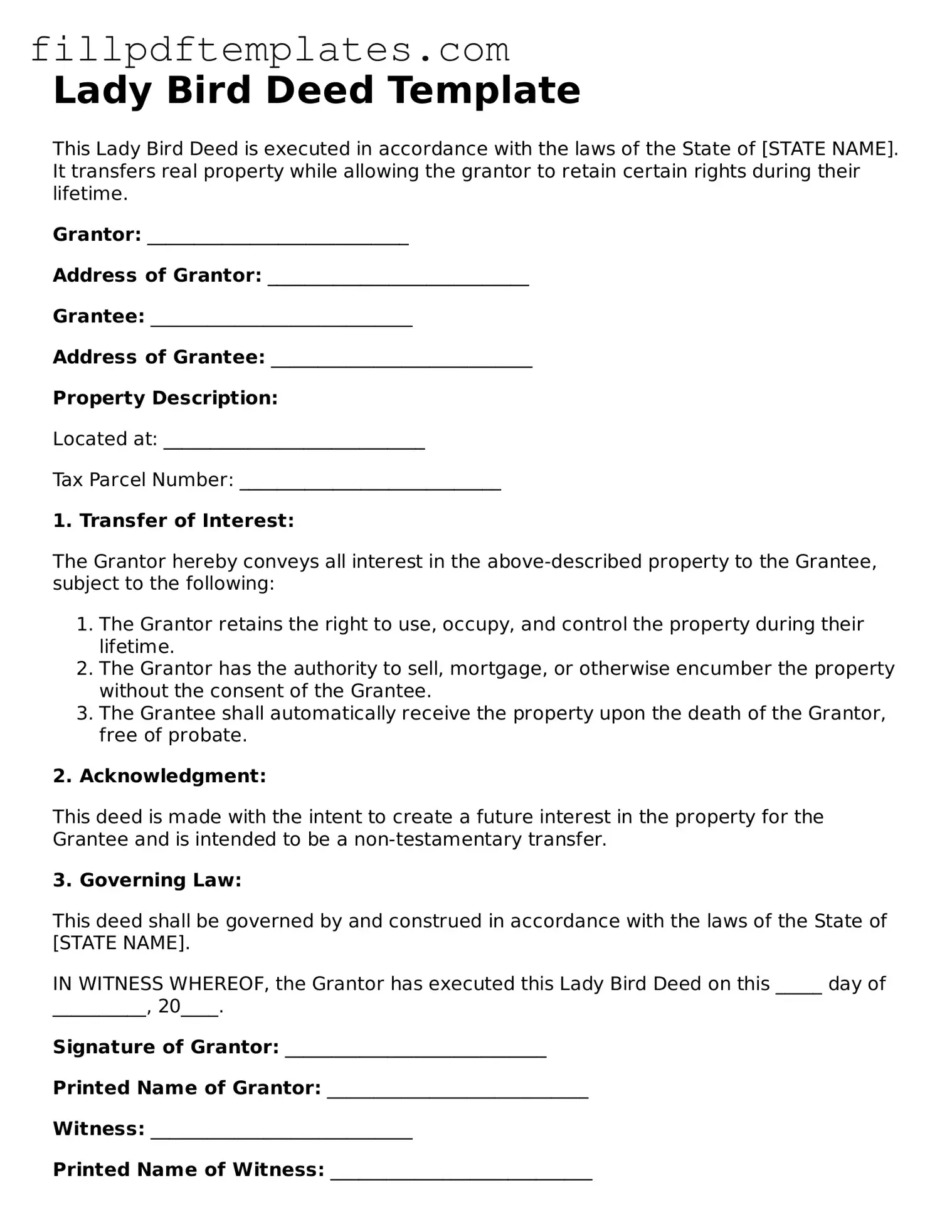

Lady Bird Deed Preview

Lady Bird Deed Template

This Lady Bird Deed is executed in accordance with the laws of the State of [STATE NAME]. It transfers real property while allowing the grantor to retain certain rights during their lifetime.

Grantor: ____________________________

Address of Grantor: ____________________________

Grantee: ____________________________

Address of Grantee: ____________________________

Property Description:

Located at: ____________________________

Tax Parcel Number: ____________________________

1. Transfer of Interest:

The Grantor hereby conveys all interest in the above-described property to the Grantee, subject to the following:

- The Grantor retains the right to use, occupy, and control the property during their lifetime.

- The Grantor has the authority to sell, mortgage, or otherwise encumber the property without the consent of the Grantee.

- The Grantee shall automatically receive the property upon the death of the Grantor, free of probate.

2. Acknowledgment:

This deed is made with the intent to create a future interest in the property for the Grantee and is intended to be a non-testamentary transfer.

3. Governing Law:

This deed shall be governed by and construed in accordance with the laws of the State of [STATE NAME].

IN WITNESS WHEREOF, the Grantor has executed this Lady Bird Deed on this _____ day of __________, 20____.

Signature of Grantor: ____________________________

Printed Name of Grantor: ____________________________

Witness: ____________________________

Printed Name of Witness: ____________________________

Notary Public: ____________________________

My Commission Expires: ____________________________