Fill a Valid IRS 2553 Template

The IRS Form 2553 is a crucial document for small business owners looking to elect S corporation status for their entity. This form allows eligible corporations and limited liability companies (LLCs) to be taxed as S corporations, which can lead to significant tax savings by avoiding double taxation on corporate income. To qualify, businesses must meet specific requirements, including having no more than 100 shareholders and only one class of stock. The form requires detailed information, such as the entity's name, address, and the date of the election, and must be filed within a designated timeframe to ensure compliance. Understanding the implications of choosing S corporation status is essential, as it affects how income, losses, and tax credits are reported. Additionally, timely submission of Form 2553 is vital, as late elections can result in the loss of S corporation benefits for the tax year. By navigating this process effectively, business owners can optimize their tax situation and enhance their financial strategy.

Additional PDF Templates

Profits or Loss From Business - Partnerships and corporations do not use Schedule C, as it is exclusively for sole proprietors.

This document is often used in many transactions, and if you need a standardized approach, you can find a comprehensive Bill of Sale form that simplifies the process of recording the transfer of ownership and ensures that all necessary details are captured accurately.

What Documents Do I Need for Passport Renewal Australia - The photo dimensions should be between 35mm and 40mm in width and 45mm and 50mm in height.

Similar forms

The IRS Form 2553 is crucial for small businesses electing to be taxed as an S corporation. It has similarities with several other tax-related documents. Here’s a list of six documents that share characteristics with Form 2553:

- Form 1065: This is the U.S. Return of Partnership Income. Like Form 2553, it allows entities to choose how they want to be taxed. Both forms require detailed information about the business structure and ownership.

- Form 1120: This is the U.S. Corporation Income Tax Return. Similar to Form 2553, it is used by corporations to report income and expenses. Both forms involve decisions about tax status and require the disclosure of key financial information.

- Last Will and Testament: For proper estate planning, consider the reliable Last Will and Testament form resources to ensure your final wishes are respected and legally documented.

- Form 8832: This form allows entities to elect their classification for federal tax purposes. It is similar to Form 2553 in that both forms provide a way for businesses to select their tax treatment, impacting how they report income and pay taxes.

- Form 941: This is the Employer's Quarterly Federal Tax Return. While primarily focused on employment taxes, it shares a similar purpose of reporting and compliance. Both forms require accurate reporting and timely submission to avoid penalties.

- Schedule C (Form 1040): This is used by sole proprietors to report income and expenses. Like Form 2553, it is concerned with how a business is taxed, although it applies to different business structures.

- Form 1065-B: This is the U.S. Return of Income for Electing Large Partnerships. It shares similarities with Form 2553 in that it pertains to specific tax elections and requires detailed reporting of income and expenses, focusing on partnership structures.

Understanding these documents can help in navigating the complexities of business taxation and ensuring compliance with IRS regulations.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 2553 is used by small businesses to elect to be treated as an S corporation for tax purposes. |

| Eligibility | To qualify, a corporation must meet specific requirements, including having no more than 100 shareholders and only one class of stock. |

| Filing Deadline | The form must be filed within 75 days of the beginning of the tax year for which the election is to take effect. |

| State-Specific Forms | Some states require additional forms for S corporation status. For example, California uses Form 100S, governed by the California Revenue and Taxation Code. |

Things You Should Know About This Form

-

What is IRS Form 2553?

IRS Form 2553 is used by eligible small businesses to elect to be treated as an S corporation for federal tax purposes. This election allows the business to avoid double taxation, as income is passed through to shareholders and taxed at their individual tax rates.

-

Who can file Form 2553?

To file Form 2553, your business must meet specific criteria. It must be a domestic corporation, have no more than 100 shareholders, and all shareholders must be individuals, certain trusts, or estates. Additionally, the corporation can only have one class of stock.

-

When should Form 2553 be filed?

Form 2553 should be filed within 75 days of the beginning of the tax year for which the S corporation election is desired. If you miss this deadline, you may still be able to make the election by following specific late election procedures.

-

What information is required on Form 2553?

The form requires basic information about the corporation, including its name, address, and Employer Identification Number (EIN). It also asks for the number of shareholders and their consent to the S corporation election.

-

What are the benefits of electing S corporation status?

Electing S corporation status can provide several benefits, including avoidance of double taxation on corporate income and potential savings on self-employment taxes. Shareholders report their share of income, losses, and deductions on their personal tax returns.

-

What happens if Form 2553 is not approved?

If the IRS does not approve your Form 2553, your corporation will be treated as a C corporation for tax purposes. This means the corporation will be subject to corporate income tax, and dividends distributed to shareholders may be taxed again on their personal returns.

-

Can Form 2553 be revoked?

Yes, an S corporation election can be revoked. The corporation must file a statement of revocation with the IRS, and all shareholders must consent to the revocation. Once revoked, the corporation will revert to C corporation status.

-

Is there a filing fee for Form 2553?

No, there is no fee to file Form 2553. However, you may incur costs if you seek assistance from a tax professional to complete the form.

-

What should I do if I need to make changes to Form 2553 after filing?

If you need to make changes to your Form 2553 after it has been filed, you can submit a new Form 2553 with the correct information. Clearly indicate that it is a correction. The IRS will process the most recent version of the form.

-

Where can I find Form 2553?

You can download IRS Form 2553 directly from the IRS website. It is available in PDF format, along with instructions for completing the form. Ensure you are using the most current version to avoid any issues.

Documents used along the form

The IRS Form 2553 is crucial for small businesses electing to be taxed as an S Corporation. When filing this form, several other documents may be necessary to ensure compliance with IRS requirements and to support the election process. Below is a list of commonly associated forms and documents.

- IRS Form 1120S: This is the annual tax return for S Corporations. After the S Corporation election is approved, the business must file this form each year to report income, deductions, and credits.

- IRS Form 941: This form is used to report payroll taxes withheld from employees' paychecks. S Corporations must file Form 941 quarterly to report federal income tax, Social Security tax, and Medicare tax.

- IRS Form SS-4: This form is used to apply for an Employer Identification Number (EIN). An EIN is necessary for tax purposes and is required when filing Form 2553.

- Operating Agreement: While not a formal IRS document, this internal document outlines the management structure and operational guidelines of the S Corporation. It is important for clarifying roles and responsibilities among shareholders.

- ATV Bill of Sale: This essential document can be downloaded from Top Document Templates to ensure proper recording of the sale of an all-terrain vehicle in California.

- State-specific forms: Depending on the state where the business operates, additional forms may be required for state tax purposes or to comply with local regulations regarding S Corporations.

Understanding these forms and documents can facilitate a smoother process when electing S Corporation status. Proper preparation and timely filing are essential to maintain compliance and to benefit from the tax advantages associated with this election.

IRS 2553 Preview

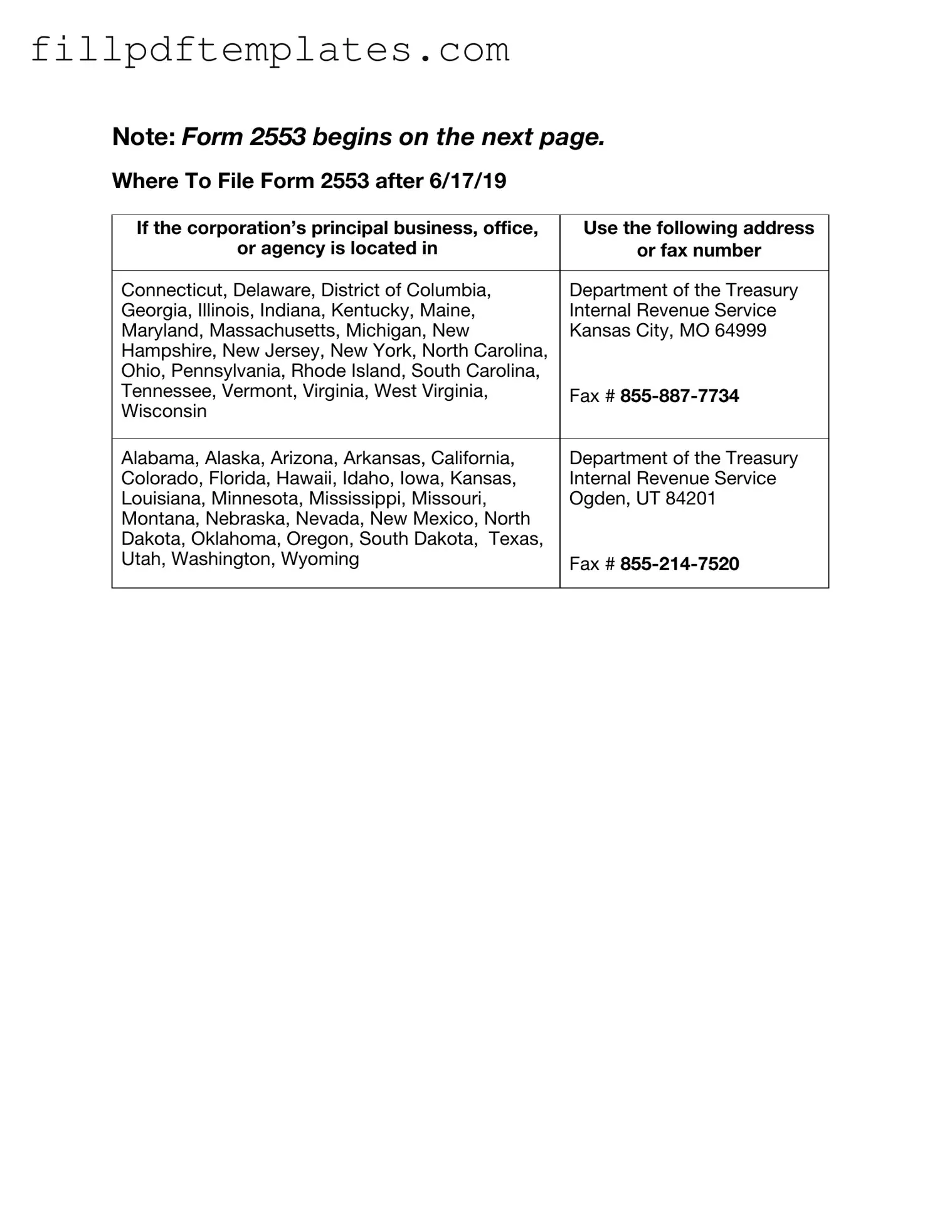

Note: Form 2553 begins on the next page.

Where To File Form 2553 after 6/17/19

If the corporation’s principal business, office, |

Use the following address |

or agency is located in |

or fax number |

|

|

Connecticut, Delaware, District of Columbia, |

Department of the Treasury |

Georgia, Illinois, Indiana, Kentucky, Maine, |

Internal Revenue Service |

Maryland, Massachusetts, Michigan, New |

Kansas City, MO 64999 |

Hampshire, New Jersey, New York, North Carolina, |

|

Ohio, Pennsylvania, Rhode Island, South Carolina, |

|

Tennessee, Vermont, Virginia, West Virginia, |

Fax # |

Wisconsin |

|

|

|

Alabama, Alaska, Arizona, Arkansas, California, |

Department of the Treasury |

Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, |

Internal Revenue Service |

Louisiana, Minnesota, Mississippi, Missouri, |

Ogden, UT 84201 |

Montana, Nebraska, Nevada, New Mexico, North |

|

Dakota, Oklahoma, Oregon, South Dakota, Texas, |

|

Utah, Washington, Wyoming |

Fax # |

|

|

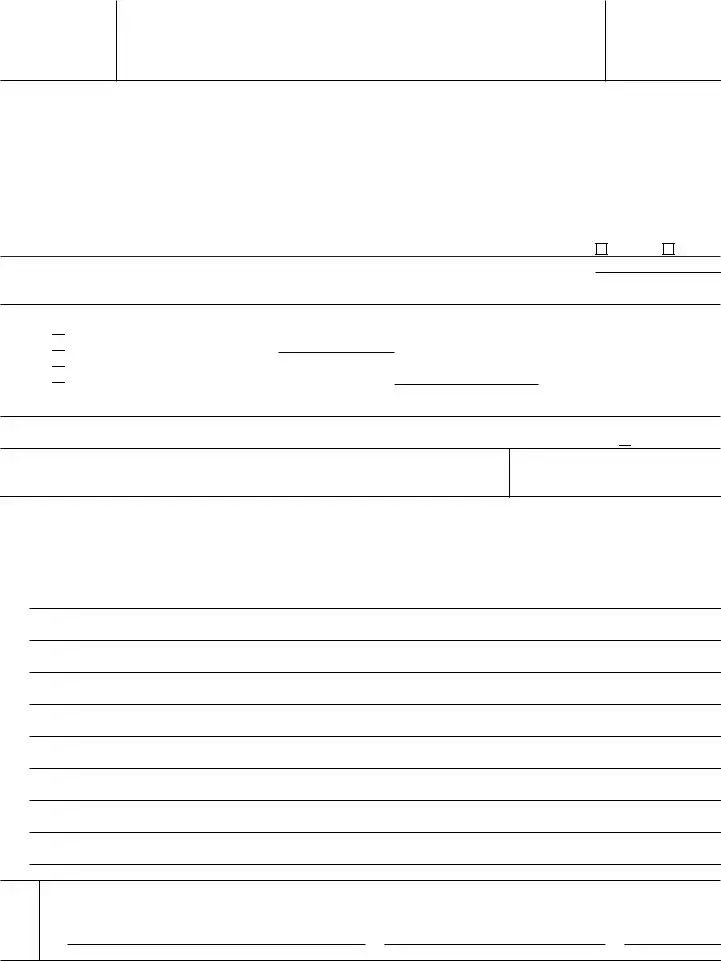

Form 2553

(Rev. December 2017)

Department of the Treasury Internal Revenue Service

Election by a Small Business Corporation

(Under section 1362 of the Internal Revenue Code)

(Including a late election filed pursuant to Rev. Proc.

▶You can fax this form to the IRS. See separate instructions.

▶Go to www.irs.gov/Form2553 for instructions and the latest information.

OMB No.

Note: This election to be an S corporation can be accepted only if all the tests are met under Who May Elect in the instructions, all shareholders have signed the consent statement, an officer has signed below, and the exact name and address of the corporation (entity) and other required form information have been provided.

Part I |

|

Election Information |

|

|

|

|

|

|

|

Name (see instructions) |

A Employer identification number |

||

Type |

|

|

|

|

|

|

|

Number, street, and room or suite no. If a P.O. box, see instructions. |

B Date incorporated |

|

|||

or |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

City or town, state or province, country, and ZIP or foreign postal code |

C State of incorporation |

|

|||

|

|

|

|

|||

|

|

|

|

|

|

|

D |

Check |

the applicable box(es) if the corporation (entity), after applying for the EIN shown in A above, changed its |

name or |

address |

||

EElection is to be effective for tax year beginning (month, day, year) (see instructions) . . . . . . ▶

Caution: A corporation (entity) making the election for its first tax year in existence will usually enter the beginning date of a short tax year that begins on a date other than January 1.

FSelected tax year:

(1) Calendar year

Calendar year

(2) Fiscal year ending (month and day) ▶

Fiscal year ending (month and day) ▶

(3)

(4)

If box (2) or (4) is checked, complete Part II.

GIf more than 100 shareholders are listed for item J (see page 2), check this box if treating members of a family as one shareholder results in no more than 100 shareholders (see test 2 under Who May Elect in the instructions) ▶

HName and title of officer or legal representative whom the IRS may call for more information

Telephone number of officer or legal representative

IIf this S corporation election is being filed late, I declare I had reasonable cause for not filing Form 2553 timely. If this late election is being made by an entity eligible to elect to be treated as a corporation, I declare I also had reasonable cause for not filing an entity classification election timely and the representations listed in Part IV are true. See below for my explanation of the reasons the election or elections were not made on time and a description of my diligent actions to correct the mistake upon its discovery. See instructions.

|

Under penalties of perjury, I declare that I have examined this election, including accompanying documents, and, to the best of my |

||

Sign knowledge and belief, the election contains all the relevant facts relating to the election, and such facts are true, correct, and complete. |

|||

Here |

▲Signature of officer |

|

|

|

Title |

Date |

|

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 18629R |

Form 2553 (Rev. |

|

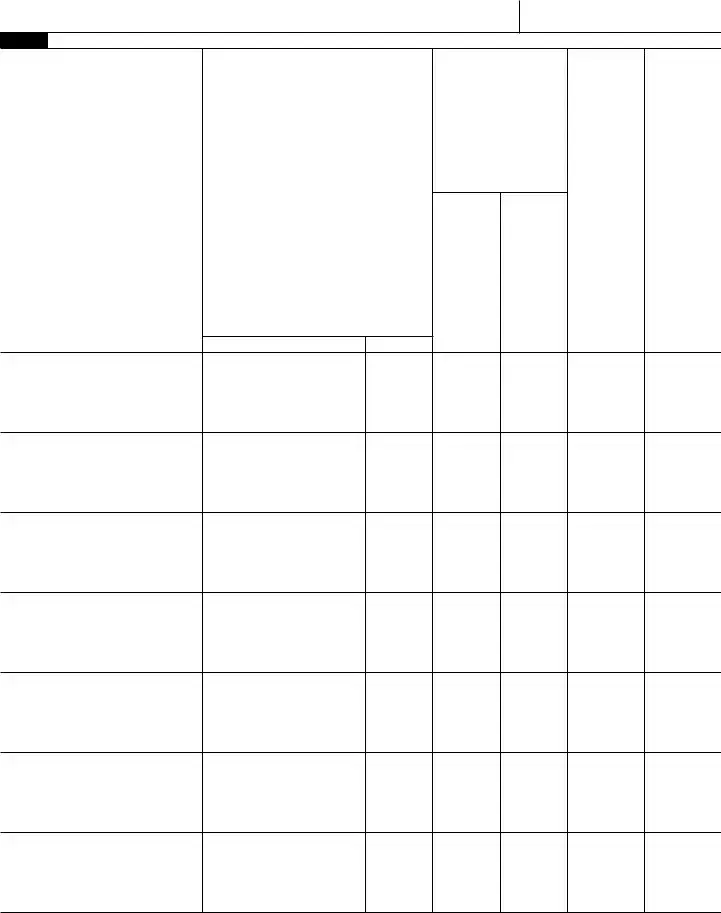

Form 2553 (Rev. |

Page 2 |

Name |

Employer identification number |

Part I Election Information (continued) Note: If you need more rows, use additional copies of page 2.

J

Name and address of each

shareholder or former shareholder required to consent to the election.

(see instructions)

K

Shareholder’s Consent Statement

Under penalties of perjury, I declare that I consent to the election of the

Signature |

Date |

L

Stock owned or

percentage of ownership

(see instructions)

Number of |

|

shares or |

|

percentage |

Date(s) |

of ownership |

acquired |

M |

|

Social security |

|

number or |

N |

employer |

Shareholder’s |

identification |

tax year ends |

number (see |

(month and |

instructions) |

day) |

Form 2553 (Rev.

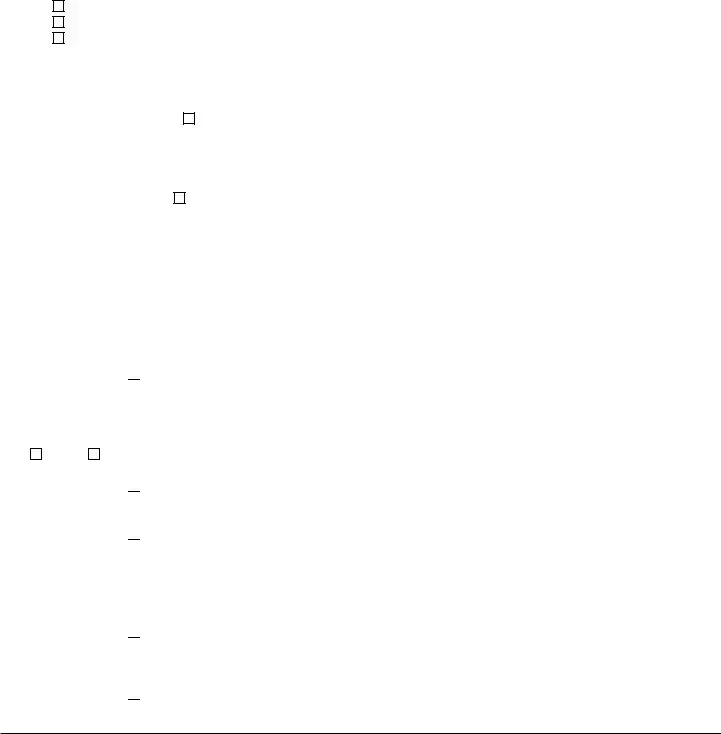

Form 2553 (Rev. |

Page 3 |

|

Name |

|

Employer identification number |

|

|

|

Part II |

Selection of Fiscal Tax Year (see instructions) |

|

Note: All corporations using this part must complete item O and item P, Q, or R. |

|

|

O Check the applicable box to indicate whether the corporation is: |

|

|

1. |

A new corporation adopting the tax year entered in item F, Part I. |

|

2. |

An existing corporation retaining the tax year entered in item F, Part I. |

|

3. |

An existing corporation changing to the tax year entered in item F, Part I. |

|

PComplete item P if the corporation is using the automatic approval provisions of Rev. Proc.

1. Natural Business Year ▶ |

I represent that the corporation is adopting, retaining, or changing to a tax year that qualifies |

as its natural business year (as defined in section 5.07 of Rev. Proc.

2. Ownership Tax Year ▶ |

I represent that shareholders (as described in section 5.08 of Rev. Proc. |

than half of the shares of the stock (as of the first day of the tax year to which the request relates) of the corporation have the same tax year or are concurrently changing to the tax year that the corporation adopts, retains, or changes to per item F, Part I, and that such tax year satisfies the requirement of section 4.01(3) of Rev. Proc.

Note: If you do not use item P and the corporation wants a fiscal tax year, complete either item Q or R below. Item Q is used to request a fiscal tax year based on a business purpose and to make a

QBusiness

1. Check here ▶  if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

if the fiscal year entered in item F, Part I, is requested under the prior approval provisions of Rev. Proc.

Yes |

No |

2.Check here ▶

to show that the corporation intends to make a

to show that the corporation intends to make a

3.Check here ▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event (1) the corporation’s business purpose request is not approved and the corporation makes a

RSection 444

1.Check here ▶

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, and either attach it to Form 2553 or file it separately.

to show that the corporation will make, if qualified, a section 444 election to have the fiscal tax year shown in item F, Part I. To make the election, you must complete Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, and either attach it to Form 2553 or file it separately.

2.Check here ▶

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

to show that the corporation agrees to adopt or change to a tax year ending December 31 if necessary for the IRS to accept this election for S corporation status in the event the corporation is ultimately not qualified to make a section 444 election.

Form 2553 (Rev.

Form 2553 (Rev. |

Page 4 |

Name |

Employer identification number |

Part III Qualified Subchapter S Trust (QSST) Election Under Section 1361(d)(2)* Note: If you are making more than

one QSST election, use additional copies of page 4.

Income beneficiary’s name and address

Social security number

Trust’s name and address

Employer identification number

Date on which stock of the corporation was transferred to the trust (month, day, year) . . . . . . . . ▶

In order for the trust named above to be a QSST and thus a qualifying shareholder of the S corporation for which this Form 2553 is filed, I hereby make the election under section 1361(d)(2). Under penalties of perjury, I certify that the trust meets the definitional requirements of section 1361(d)(3) and that all other information provided in Part III is true, correct, and complete.

Signature of income beneficiary or signature and title of legal representative or other qualified person making the election |

|

Date |

*Use Part III to make the QSST election only if stock of the corporation has been transferred to the trust on or before the date on which the corporation makes its election to be an S corporation. The QSST election must be made and filed separately if stock of the corporation is transferred to the trust after the date on which the corporation makes the S election.

Part IV Late Corporate Classification Election Representations (see instructions)

If a late entity classification election was intended to be effective on the same date that the S corporation election was intended to be effective, relief for a late S corporation election must also include the following representations.

1The requesting entity is an eligible entity as defined in Regulations section

2The requesting entity intended to be classified as a corporation as of the effective date of the S corporation status;

3The requesting entity fails to qualify as a corporation solely because Form 8832, Entity Classification Election, was not timely filed under Regulations section

4The requesting entity fails to qualify as an S corporation on the effective date of the S corporation status solely because the S corporation election was not timely filed pursuant to section 1362(b); and

5a The requesting entity timely filed all required federal tax returns and information returns consistent with its requested classification as an S corporation for all of the years the entity intended to be an S corporation and no inconsistent tax or information returns have been filed by or with respect to the entity during any of the tax years, or

bThe requesting entity has not filed a federal tax or information return for the first year in which the election was intended to be effective because the due date has not passed for that year’s federal tax or information return.

Form 2553 (Rev.