Blank Iowa Transfer-on-Death Deed Form

In the realm of estate planning, the Iowa Transfer-on-Death Deed offers a streamlined approach for property owners looking to ensure a smooth transition of their real estate assets upon their passing. This form allows individuals to designate beneficiaries who will automatically inherit their property without the need for probate, simplifying the process for loved ones during a difficult time. By completing this deed, property owners retain full control of their assets while alive, enabling them to sell, lease, or mortgage the property as they see fit. The deed becomes effective only upon the death of the owner, providing peace of mind that the designated beneficiaries will receive the property directly and efficiently. Additionally, the form must be properly executed and recorded to be valid, ensuring that the transfer is legally binding and recognized by the state. Understanding the nuances of this deed can empower property owners in Iowa to make informed decisions that reflect their wishes and protect their family's future.

Other Common Transfer-on-Death Deed State Templates

Where Can I Get a Tod Form - It may help expedite the transfer process for your beneficiaries, easing their burden during a difficult time.

Transfer on Death Deed Form Georgia - Property owners can retain control of their property during their lifetime with this deed option.

To further understand the implications of transferring liability, it is essential to review the details surrounding the Hold Harmless Agreement, which outlines the responsibilities and protections afforded to the parties involved. This legal instrument is particularly crucial in North Carolina, where businesses and individuals alike can benefit from a well-drafted agreement that clearly delineates risk management strategies.

Can a Transfer on Death Deed Be Contested - A Transfer-on-Death Deed is revocable, meaning the owner can change or cancel it at any time before death.

Similar forms

The Transfer-on-Death Deed (TOD) form is a useful tool for estate planning, allowing individuals to pass property directly to beneficiaries without going through probate. However, it shares similarities with several other legal documents. Here are four documents that are akin to the Transfer-on-Death Deed:

- Will: A will is a legal document that outlines how a person's assets should be distributed after their death. Like a TOD, it allows for the transfer of property, but a will typically requires probate, while a TOD bypasses this process.

- Lease Agreement: For a clear understanding of rental terms, refer to the comprehensive Lease Agreement form guide that outlines all essential details for landlords and tenants.

- Living Trust: A living trust is created during a person's lifetime and allows them to manage their assets. Similar to a TOD, a living trust can facilitate the transfer of property upon death without going through probate, providing privacy and efficiency.

- Beneficiary Designation: Certain assets, such as life insurance policies and retirement accounts, can have designated beneficiaries. This means that upon the account holder's death, the assets pass directly to the named beneficiaries, much like how a TOD deed operates.

- Joint Tenancy with Right of Survivorship: This arrangement allows two or more individuals to own property together. When one owner dies, their share automatically passes to the surviving owner(s), resembling the direct transfer feature of a TOD deed.

Understanding these similarities can help individuals make informed decisions about their estate planning strategies. Each document serves a unique purpose, yet they all aim to simplify the transfer of assets and ensure that loved ones receive what is intended for them.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | The Iowa Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Iowa Code § 557B, which outlines the requirements and procedures for its execution. |

| Eligibility | Any individual who owns real estate in Iowa can create a Transfer-on-Death Deed. |

| Execution Requirements | The deed must be signed by the property owner and acknowledged before a notary public. |

| Revocation | The property owner can revoke the deed at any time before their death by executing a new deed or a written revocation. |

| Beneficiary Designation | Multiple beneficiaries can be designated, and the property can be divided among them. |

| Filing Requirement | The deed must be recorded with the county recorder's office in the county where the property is located. |

| Tax Implications | The transfer of property through a Transfer-on-Death Deed does not trigger gift tax or estate tax until the owner's death. |

Things You Should Know About This Form

-

What is a Transfer-on-Death Deed in Iowa?

A Transfer-on-Death Deed (TODD) allows property owners in Iowa to transfer their real estate to a designated beneficiary upon their death. This deed does not take effect until the owner passes away, and it allows the property to avoid probate, making the transfer process simpler and faster for the beneficiary.

-

Who can be named as a beneficiary in a Transfer-on-Death Deed?

Any individual or entity can be named as a beneficiary in a Transfer-on-Death Deed. This includes family members, friends, or organizations. However, it is important to ensure that the beneficiary is legally capable of receiving the property.

-

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed in Iowa, you must complete the appropriate form, which includes details about the property and the beneficiary. After filling out the form, it must be signed in the presence of a notary public. Finally, the deed must be recorded with the county recorder's office where the property is located.

-

Can I revoke a Transfer-on-Death Deed?

Yes, you can revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed that explicitly states the revocation or record a written notice of revocation with the county recorder's office.

-

What happens if I sell the property after creating a Transfer-on-Death Deed?

If you sell the property after creating a Transfer-on-Death Deed, the deed becomes void. The new owner will not be affected by the original deed, and the property will not transfer to the designated beneficiary.

-

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when you create a Transfer-on-Death Deed. However, the beneficiary may be subject to property taxes and potential capital gains taxes when they sell the property. It is advisable to consult a tax professional for specific guidance.

Documents used along the form

When dealing with property transfer in Iowa, the Transfer-on-Death Deed is a key document. However, several other forms and documents may be necessary to ensure a smooth process. Below is a list of these important documents, each serving a unique purpose in the property transfer process.

- Property Deed: This is the foundational document that establishes ownership of the property. It includes details such as the legal description of the property and the names of the current owners.

- Will: A will outlines how a person wishes their assets, including real estate, to be distributed after their death. It can complement the Transfer-on-Death Deed by providing additional instructions.

- : This legal document allows for the transfer of real estate to beneficiaries upon death without going through probate, which can simplify estate planning—more details can be found at todform.com/blank-massachusetts-transfer-on-death-deed.

- Affidavit of Death: This document serves as proof of the property owner’s death. It may be required to activate the Transfer-on-Death Deed and facilitate the transfer of ownership.

- Title Search Report: A title search verifies the current ownership and any liens or encumbrances on the property. This report ensures that the property can be transferred without legal complications.

- Beneficiary Designation Form: This form allows property owners to designate beneficiaries for their assets. It can be used alongside the Transfer-on-Death Deed to clarify intentions.

- Real Estate Purchase Agreement: If the property is being sold, this agreement outlines the terms of the sale, including price and conditions. It is essential for documenting the transaction.

- Power of Attorney: This document grants someone the authority to act on behalf of the property owner. It can be useful in managing property affairs if the owner is unable to do so themselves.

- Estate Inventory: This document lists all assets owned by the deceased, including real estate. It helps in the administration of the estate and ensures that all assets are accounted for.

- Transfer Tax Statement: This form may be required to report the transfer of property and calculate any applicable taxes. It ensures compliance with state tax regulations.

Understanding these documents can significantly ease the property transfer process in Iowa. Each plays a vital role in ensuring that ownership is transferred smoothly and in accordance with the owner's wishes.

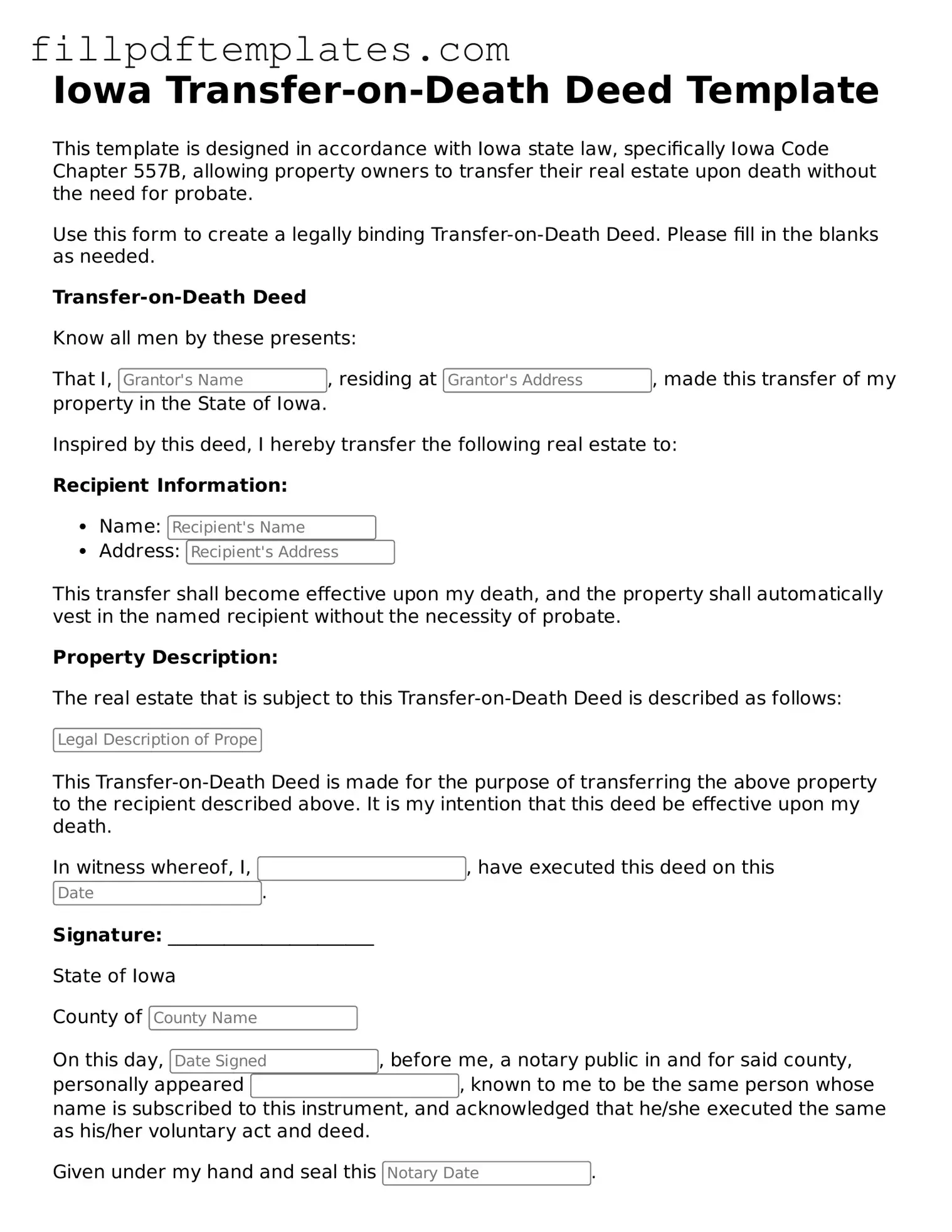

Iowa Transfer-on-Death Deed Preview

Iowa Transfer-on-Death Deed Template

This template is designed in accordance with Iowa state law, specifically Iowa Code Chapter 557B, allowing property owners to transfer their real estate upon death without the need for probate.

Use this form to create a legally binding Transfer-on-Death Deed. Please fill in the blanks as needed.

Transfer-on-Death Deed

Know all men by these presents:

That I, , residing at , made this transfer of my property in the State of Iowa.

Inspired by this deed, I hereby transfer the following real estate to:

Recipient Information:

- Name:

- Address:

This transfer shall become effective upon my death, and the property shall automatically vest in the named recipient without the necessity of probate.

Property Description:

The real estate that is subject to this Transfer-on-Death Deed is described as follows:

This Transfer-on-Death Deed is made for the purpose of transferring the above property to the recipient described above. It is my intention that this deed be effective upon my death.

In witness whereof, I, , have executed this deed on this .

Signature: ______________________

State of Iowa

County of

On this day, , before me, a notary public in and for said county, personally appeared , known to me to be the same person whose name is subscribed to this instrument, and acknowledged that he/she executed the same as his/her voluntary act and deed.

Given under my hand and seal this .

Notary Public Signature: ______________________

Notary Public Name:

My Commission Expires: