Blank Iowa Quitclaim Deed Form

The Iowa Quitclaim Deed form serves as a crucial tool for property owners looking to transfer their interest in real estate. This form allows one party, known as the grantor, to convey their ownership rights to another party, the grantee, without making any promises about the property's title. It's important to note that a quitclaim deed does not guarantee that the title is free from claims or defects. Instead, it simply transfers whatever interest the grantor has at the time of the transfer. This makes it particularly useful in situations such as transferring property between family members or clearing up title issues. The form requires specific information, including the names of the parties involved, a legal description of the property, and the date of transfer. Additionally, the deed must be signed and notarized to be legally binding. Understanding these key aspects can help ensure a smooth transfer process and protect the interests of all parties involved.

Other Common Quitclaim Deed State Templates

Florida Quit Claim Deed Form Pdf - This deed can also be used to transfer rights in timeshare properties.

How to Get a Quit Claim Deed - Quitclaim deeds are simple and straightforward to complete.

Understanding the importance of an Operating Agreement is crucial for LLC members, as it lays the groundwork for governance and operational procedures. For further insights, visit this resource on the Operating Agreement's significance and implementation: key elements of an Operating Agreement.

Cost for Quit Claim Deed - This form can help simplify property management within families.

Similar forms

A Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without any warranties regarding the title. While it serves a specific purpose, several other documents share similarities in their function or intent. Here are eight documents that are comparable to a Quitclaim Deed:

- Warranty Deed: This document also transfers property ownership but provides guarantees about the title. The grantor assures the grantee that they hold clear title to the property, unlike the Quitclaim Deed, which offers no such assurances.

- Grant Deed: Similar to a Warranty Deed, a Grant Deed conveys property and includes certain guarantees, such as the assurance that the property has not been sold to anyone else. It is often used in California and other states.

- Deed of Trust: This document is used in real estate transactions to secure a loan. While it does not transfer ownership outright, it conveys an interest in the property as collateral, similar to how a Quitclaim Deed transfers interest without warranties.

- Lease Agreement: Though primarily a rental document, a Lease Agreement can grant rights to use a property. Like a Quitclaim Deed, it conveys a specific interest in the property but does not transfer ownership.

- Life Estate Deed: This type of deed allows a person to use and benefit from a property during their lifetime, with the property transferring to another party upon their death. It shares the aspect of transferring interests in property without full ownership changes.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. It can facilitate the transfer of property interests, much like a Quitclaim Deed, but does not itself convey ownership.

- Dirt Bike Bill of Sale: This form is used to validate the transfer of ownership of a dirt bike in New York, ensuring both parties are protected during the transaction. You can find more information for the document.

- Affidavit of Heirship: This document establishes the heirs of a deceased person and their rights to property. It can be used to transfer property interests, similar to how a Quitclaim Deed transfers ownership without guarantees.

- Assignment of Interest: This document allows one party to transfer their interest in a property or contract to another party. Like a Quitclaim Deed, it conveys rights but does not provide any warranties regarding the title.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any warranties or guarantees regarding the title. |

| Governing Law | The Iowa Quitclaim Deed is governed by the Iowa Code, specifically Section 557.1 to 557.6. |

| Use Cases | Commonly used among family members, in divorce settlements, or when transferring property between trusts. |

| Limitations | It does not protect the grantee against any claims or liens on the property; the grantee receives whatever interest the grantor has. |

Things You Should Know About This Form

-

What is a Quitclaim Deed?

A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another. Unlike other types of deeds, it does not guarantee that the grantor has clear title to the property. Instead, it simply transfers whatever interest the grantor has in the property, if any.

-

When is a Quitclaim Deed used?

Quitclaim deeds are often used in situations where property is transferred between family members, such as during a divorce or inheritance. They can also be used to clear up title issues or to add or remove someone from the title of a property.

-

How do I complete a Quitclaim Deed in Iowa?

To complete a quitclaim deed in Iowa, you will need to provide the following information:

- The names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- A legal description of the property being transferred.

- The date of the transfer.

Once you have filled out the form, both parties must sign it in the presence of a notary public. After notarization, the deed must be filed with the county recorder's office where the property is located.

-

Is a Quitclaim Deed the same as a Warranty Deed?

No, a quitclaim deed is not the same as a warranty deed. A warranty deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. In contrast, a quitclaim deed offers no such guarantees and only transfers the grantor's interest, if any.

-

Are there any risks associated with using a Quitclaim Deed?

Yes, there are risks. Because a quitclaim deed does not guarantee clear title, the grantee may inherit title issues or claims against the property. It is advisable to conduct a title search before accepting a quitclaim deed to ensure there are no outstanding liens or encumbrances.

-

Can I revoke a Quitclaim Deed?

Once a quitclaim deed is executed and recorded, it cannot be revoked unilaterally. However, the parties involved can agree to create a new deed to reverse the transaction. Legal advice may be necessary to navigate this process.

-

Do I need an attorney to create a Quitclaim Deed?

While it is not legally required to have an attorney to create a quitclaim deed, consulting one is often beneficial. An attorney can help ensure that the deed is completed correctly and that all legal requirements are met.

-

What is the cost to file a Quitclaim Deed in Iowa?

The cost to file a quitclaim deed varies by county in Iowa. Typically, there is a filing fee, which can range from $10 to $50. It is advisable to check with the local county recorder's office for specific fees and any additional costs that may apply.

-

Can a Quitclaim Deed be used for property in multiple states?

A quitclaim deed can be used for property in multiple states, but each state has its own laws and requirements for property transfers. It is important to follow the specific regulations of each state where the property is located.

Documents used along the form

When dealing with property transfers in Iowa, several other forms and documents may accompany the Quitclaim Deed. Each of these documents serves a specific purpose and helps ensure that the transaction is clear and legally sound.

- Property Transfer Statement: This document provides information about the property being transferred, including its assessed value and any existing liens. It is often required by local authorities for tax purposes.

- Warranty Deed: Unlike a quitclaim deed, a warranty deed offers guarantees about the title. It assures the buyer that the seller has the right to transfer ownership and that the property is free from claims.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and discloses any known issues. It helps protect the buyer by providing additional assurance regarding the title's status.

- Title Insurance Policy: This policy protects the buyer against potential disputes over property ownership. It covers legal fees and other costs if a claim arises regarding the title after the purchase.

- Real Estate Purchase Agreement: This contract outlines the terms of the sale, including the purchase price and any contingencies. It serves as a binding agreement between the buyer and seller.

- Notice of Transfer: This document notifies the local tax assessor's office of the property transfer. It ensures that the tax records are updated and reflects the new owner's information.

- Chick-fil-A Application for Employment: Potential employees can utilize this document to formally apply for positions at the franchise, ensuring they provide all necessary personal information, work experience, and availability. For those interested, you can find the application here: Chick-fil-A Application for Employment.

- Power of Attorney: If one party cannot be present for the signing, a power of attorney allows someone else to act on their behalf. This document must be properly executed to be valid.

- Closing Statement: This document summarizes the financial aspects of the transaction, including costs, fees, and the final amount due. It is typically reviewed and signed at the closing meeting.

These documents work together to facilitate a smooth property transfer process in Iowa. Understanding each one can help ensure that all necessary steps are taken and that both parties are protected throughout the transaction.

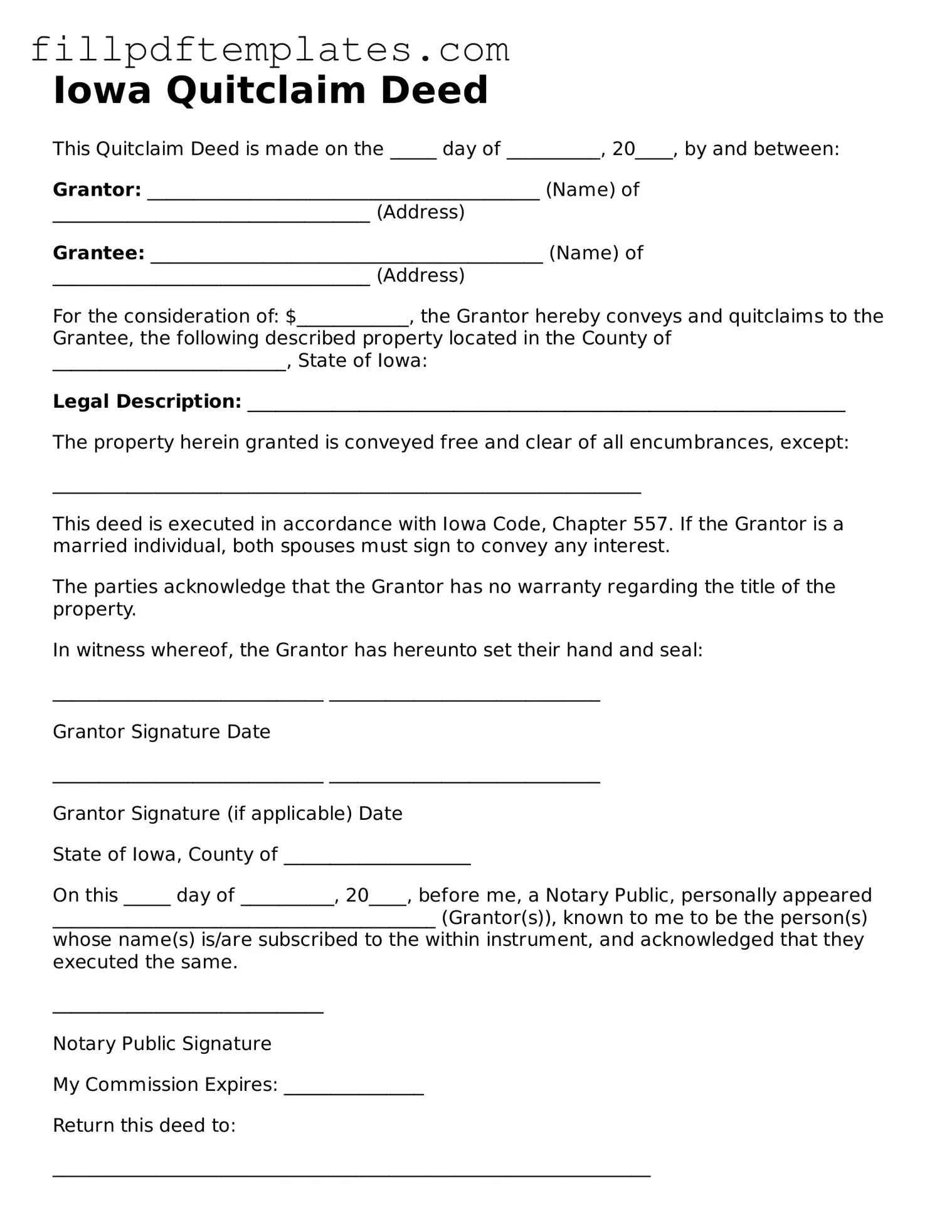

Iowa Quitclaim Deed Preview

Iowa Quitclaim Deed

This Quitclaim Deed is made on the _____ day of __________, 20____, by and between:

Grantor: __________________________________________ (Name) of __________________________________ (Address)

Grantee: __________________________________________ (Name) of __________________________________ (Address)

For the consideration of: $____________, the Grantor hereby conveys and quitclaims to the Grantee, the following described property located in the County of _________________________, State of Iowa:

Legal Description: ________________________________________________________________

The property herein granted is conveyed free and clear of all encumbrances, except:

_______________________________________________________________

This deed is executed in accordance with Iowa Code, Chapter 557. If the Grantor is a married individual, both spouses must sign to convey any interest.

The parties acknowledge that the Grantor has no warranty regarding the title of the property.

In witness whereof, the Grantor has hereunto set their hand and seal:

_____________________________ _____________________________

Grantor Signature Date

_____________________________ _____________________________

Grantor Signature (if applicable) Date

State of Iowa, County of ____________________

On this _____ day of __________, 20____, before me, a Notary Public, personally appeared _________________________________________ (Grantor(s)), known to me to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that they executed the same.

_____________________________

Notary Public Signature

My Commission Expires: _______________

Return this deed to:

________________________________________________________________

________________________________________________________________