Blank Iowa Promissory Note Form

The Iowa Promissory Note form is an essential financial document that facilitates the borrowing and lending process between individuals or entities. This form outlines the borrower's promise to repay a specified amount of money, along with any agreed-upon interest, within a defined timeframe. Key components of the note include the principal amount, interest rate, repayment schedule, and any late fees that may apply. Additionally, the form may include provisions for prepayment and default, ensuring that both parties understand their rights and obligations. This straightforward yet crucial document not only serves as a legal record of the loan but also fosters trust and transparency between the lender and borrower. Understanding the details of the Iowa Promissory Note can help individuals navigate their financial agreements with confidence, ensuring that all terms are clear and agreed upon before any funds are exchanged.

Other Common Promissory Note State Templates

California Promissory Note Requirements - A signed Promissory Note becomes enforceable once both parties agree to its terms.

Basic Promissory Note - A Promissory Note effectively memorializes the duty to repay and can prevent future disagreements.

Promissory Notes for Personal Loans - Encourages responsible borrowing practices.

The Massachusetts Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This tool can simplify the process of passing on property and help avoid potential legal complications. For more information on how to properly utilize this form, you can visit transferondeathdeedform.com/massachusetts-transfer-on-death-deed, which is essential for anyone looking to secure their estate for future generations.

Promissory Note Template Florida Pdf - This document outlines the borrower's commitment to repay a loan, including terms and conditions of the repayment.

Similar forms

A Promissory Note is a financial document that outlines a promise to pay a specific amount of money to a designated person or entity under agreed-upon terms. Several other documents serve similar purposes in financial transactions. Here are four documents that share similarities with a Promissory Note:

- Loan Agreement: This document outlines the terms and conditions of a loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. Like a Promissory Note, it establishes the borrower's obligation to repay the loan.

- Tax Return Transcript: A Tax Return Transcript is essential for verifying income and it's similar to a Promissory Note in that it documents financial obligations. For more insights, visit legalpdfdocs.com.

- Mortgage Agreement: A Mortgage Agreement is a specific type of loan agreement used for real estate transactions. It details the loan amount, interest rate, and repayment terms, while also specifying that the property serves as collateral. This agreement, like a Promissory Note, creates a legal obligation for repayment.

- Installment Agreement: This document outlines the terms under which a borrower agrees to repay a debt in installments over time. Similar to a Promissory Note, it specifies the total amount owed, the payment schedule, and any applicable interest rates, thereby formalizing the repayment commitment.

- IOU (I Owe You): An IOU is a simple acknowledgment of a debt, stating that one party owes money to another. While less formal than a Promissory Note, it serves a similar purpose by documenting the debt and the amount owed, although it may lack detailed repayment terms.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated party at a defined time. |

| Governing Law | The Iowa Uniform Commercial Code (UCC) governs promissory notes in Iowa. |

| Parties Involved | Typically, there are two parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The note may specify an interest rate, which can be fixed or variable. |

| Payment Terms | Payment terms must be clear, detailing the due date and method of payment. |

| Default Clause | Many notes include a default clause, outlining consequences if payments are missed. |

| Signatures Required | The note must be signed by the maker to be enforceable. |

| Record Keeping | Both parties should keep a copy of the signed note for their records. |

Things You Should Know About This Form

-

What is a Promissory Note?

A promissory note is a legal document in which one party promises to pay a specific amount of money to another party at a designated time or on demand. It serves as a written record of a loan agreement and outlines the terms, including the amount borrowed, interest rate, and repayment schedule.

-

Why would I need an Iowa Promissory Note form?

If you are lending or borrowing money in Iowa, having a promissory note is essential. It protects both parties by clearly defining the terms of the loan. This document can help prevent misunderstandings and provide legal recourse if the borrower fails to repay the loan as agreed.

-

What information is typically included in the Iowa Promissory Note form?

The form generally includes:

- The names and addresses of the borrower and lender.

- The principal amount of the loan.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any late fees or penalties for missed payments.

- Signatures of both parties.

-

Is it necessary to have the Promissory Note notarized?

While notarization is not always required, it is highly recommended. Having the document notarized adds an extra layer of authenticity and can be beneficial if legal action is needed in the future. It helps verify the identities of both parties and the voluntary nature of the agreement.

-

Can I modify the terms of the Promissory Note after it has been signed?

Yes, modifications can be made, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement to avoid future disputes.

-

What happens if the borrower fails to repay the loan?

If the borrower does not repay the loan as specified in the promissory note, the lender may take legal action to recover the owed amount. This could involve filing a lawsuit or seeking a judgment against the borrower. Having a well-drafted promissory note strengthens the lender's position in such cases.

-

Are there any specific laws governing Promissory Notes in Iowa?

Yes, promissory notes in Iowa are governed by state laws. It’s important to ensure that your note complies with Iowa's legal requirements. Consulting with a legal professional can help ensure that the document is enforceable and meets all necessary regulations.

-

Where can I obtain an Iowa Promissory Note form?

Iowa Promissory Note forms can be obtained from various sources, including legal stationery stores, online legal document providers, or local attorneys. Make sure to choose a reliable source to ensure that the form meets Iowa's legal standards.

Documents used along the form

The Iowa Promissory Note is a crucial document in the realm of lending and borrowing, serving as a written promise to repay a specified amount of money under agreed-upon terms. However, it is often accompanied by several other forms and documents that help clarify the terms of the loan and protect the interests of both parties involved. Below is a list of related documents commonly used alongside the Iowa Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide to the expectations of both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets pledged as security. It defines the lender's rights in the event of default.

- Disclosure Statement: This document provides borrowers with important information about the loan, including fees, interest rates, and total repayment costs. It ensures that borrowers are fully informed before signing.

- Personal Guarantee: A personal guarantee may be required if the borrower is a business entity. This document holds an individual personally responsible for the loan, providing additional assurance to the lender.

- Amortization Schedule: This schedule breaks down the repayment of the loan into manageable installments, detailing how much of each payment goes toward principal and interest over the loan's term.

- Incorporation Documents: Essential for starting a corporation, the filing of the Articles of Incorporation is crucial for legal recognition and operational commencement in Washington State.

- Default Notice: In the event of a missed payment, a default notice serves as a formal communication from the lender to the borrower, outlining the consequences of default and potential remedies.

- Release of Lien: Once the loan is fully repaid, this document releases any claims the lender had against the collateral, signifying that the borrower has fulfilled their obligations.

These documents work together to create a clear framework for the lending process, ensuring that both parties understand their rights and responsibilities. Proper documentation can prevent misunderstandings and disputes, fostering a more secure lending environment.

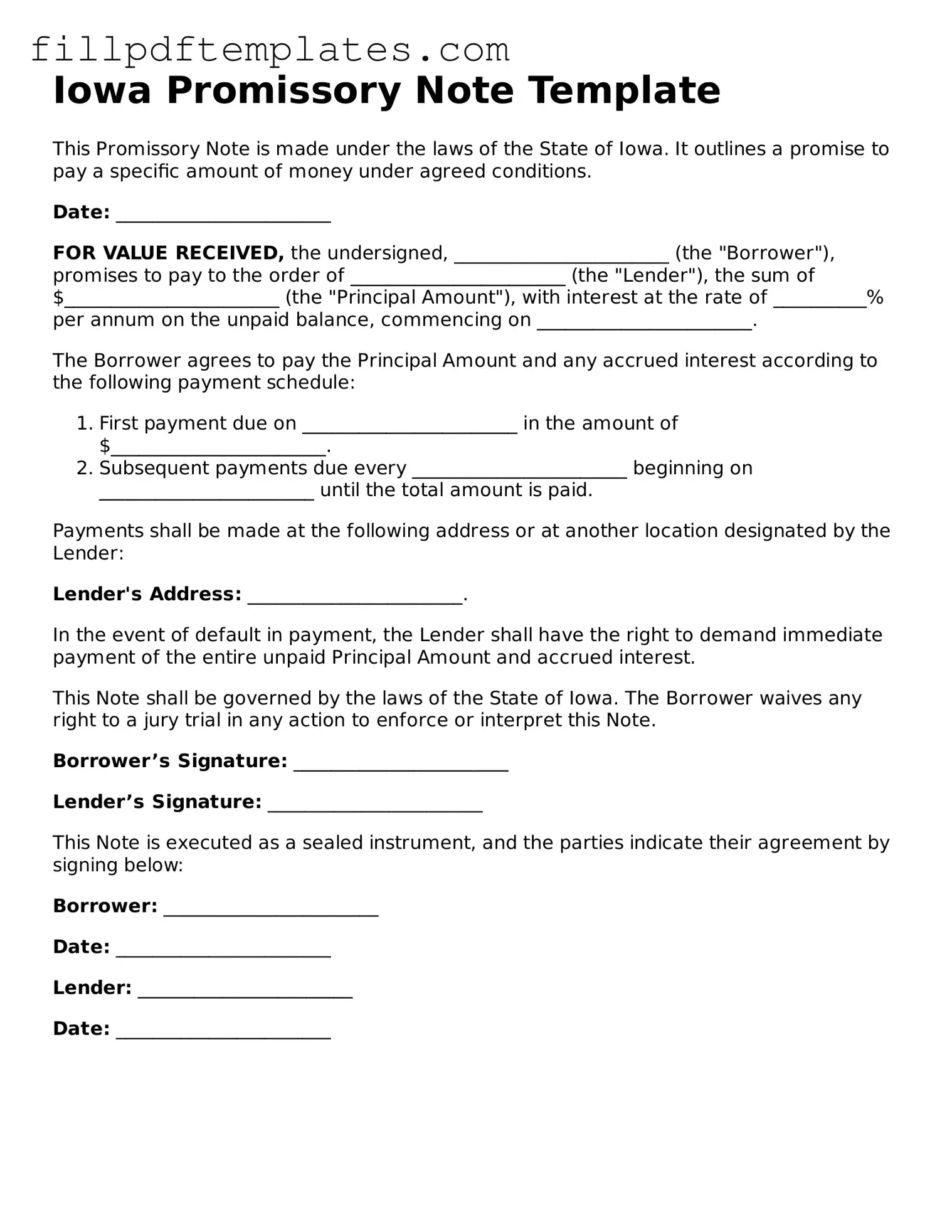

Iowa Promissory Note Preview

Iowa Promissory Note Template

This Promissory Note is made under the laws of the State of Iowa. It outlines a promise to pay a specific amount of money under agreed conditions.

Date: _______________________

FOR VALUE RECEIVED, the undersigned, _______________________ (the "Borrower"), promises to pay to the order of _______________________ (the "Lender"), the sum of $_______________________ (the "Principal Amount"), with interest at the rate of __________% per annum on the unpaid balance, commencing on _______________________.

The Borrower agrees to pay the Principal Amount and any accrued interest according to the following payment schedule:

- First payment due on _______________________ in the amount of $_______________________.

- Subsequent payments due every _______________________ beginning on _______________________ until the total amount is paid.

Payments shall be made at the following address or at another location designated by the Lender:

Lender's Address: _______________________.

In the event of default in payment, the Lender shall have the right to demand immediate payment of the entire unpaid Principal Amount and accrued interest.

This Note shall be governed by the laws of the State of Iowa. The Borrower waives any right to a jury trial in any action to enforce or interpret this Note.

Borrower’s Signature: _______________________

Lender’s Signature: _______________________

This Note is executed as a sealed instrument, and the parties indicate their agreement by signing below:

Borrower: _______________________

Date: _______________________

Lender: _______________________

Date: _______________________