Blank Iowa Operating Agreement Form

The Iowa Operating Agreement form serves as a foundational document for limited liability companies (LLCs) operating within the state. This essential agreement outlines the management structure, operational procedures, and financial arrangements of the LLC, ensuring that all members are on the same page. It typically covers key aspects such as the roles and responsibilities of members, voting rights, profit distribution, and procedures for adding or removing members. Additionally, the form addresses how the company will be managed—whether by its members or designated managers—providing clarity on decision-making processes. By establishing guidelines for conflict resolution and outlining the procedures for dissolution, the Operating Agreement plays a crucial role in safeguarding the interests of the members and promoting a harmonious business environment. Understanding this document is vital for anyone looking to form an LLC in Iowa, as it not only helps prevent disputes but also enhances the credibility and professionalism of the business. In essence, the Iowa Operating Agreement form is more than just a legal requirement; it is a blueprint for successful collaboration among business partners.

Other Common Operating Agreement State Templates

How Do I Create an Operating Agreement for My Llc - A well-crafted agreement outlines the processes for adding or removing members.

How to Create an Operating Agreement - This document may specify how meetings will be held and conducted.

A Hold Harmless Agreement form in Indiana is a legal document that one party uses to protect themselves from liability, basically shifting the risk to another party. This form is frequently used in situations where services are provided or during the use of property, ensuring that the provider or owner is not held liable for damages or injuries. For more detailed information, refer to the Hold Harmless Agreement, which is an essential tool for managing risks in various transactions and activities.

Operating Agreement Llc California - It can establish guidelines for adding or removing members from the LLC.

Similar forms

- Bylaws: Similar to an Operating Agreement, bylaws outline the internal rules for managing a corporation. They cover governance, roles of officers, and meeting procedures.

- Partnership Agreement: This document details the terms of a partnership, including profit sharing, responsibilities, and dispute resolution, much like an Operating Agreement for an LLC.

-

Transfer-on-Death Deed: This legal document allows property owners to designate beneficiaries who will inherit their real estate upon death, streamlining the process and preventing complications. For more details, you can refer to https://todform.com/blank-arizona-transfer-on-death-deed/.

- Shareholder Agreement: This agreement governs the relationship between shareholders in a corporation. It addresses voting rights, share transfers, and management, paralleling the governance aspects of an Operating Agreement.

- Articles of Incorporation: While this document establishes a corporation's existence, it often includes basic governance information, similar to what is found in an Operating Agreement.

- LLC Membership Agreement: This is specific to LLCs and outlines the rights and responsibilities of members, akin to the provisions found in an Operating Agreement.

- Joint Venture Agreement: This document governs the relationship between parties in a joint venture. It details contributions, profit sharing, and management, similar to how an Operating Agreement functions for an LLC.

- Operating Procedures Manual: This manual outlines day-to-day operations and procedures for a business. While not as formal as an Operating Agreement, it serves a similar purpose in guiding operations.

- Non-Disclosure Agreement (NDA): While primarily focused on confidentiality, an NDA can include terms related to business operations and relationships, which can overlap with certain aspects of an Operating Agreement.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | The Iowa Operating Agreement form is a legal document used by limited liability companies (LLCs) to outline the management structure and operational guidelines of the company. |

| Governing Law | This form is governed by the Iowa Code, specifically Chapter 489, which pertains to the Iowa Uniform Limited Liability Company Act. |

| Purpose | The primary purpose of the Operating Agreement is to define the roles, responsibilities, and rights of the members and managers of the LLC. |

| Member Contributions | The agreement typically details the contributions of each member, including cash, property, and services, and how these contributions affect ownership percentages. |

| Profit Distribution | It specifies how profits and losses will be allocated among the members, which can differ from ownership percentages. |

| Management Structure | The document outlines whether the LLC will be member-managed or manager-managed, impacting decision-making processes. |

| Amendments | Procedures for amending the Operating Agreement are usually included, ensuring that all members can agree on future changes. |

| Dispute Resolution | The agreement may include provisions for resolving disputes among members, which can help avoid costly litigation. |

| Compliance | While not required by law, having an Operating Agreement helps ensure compliance with Iowa's LLC regulations and can protect members' personal assets. |

| Duration | The Operating Agreement can specify the duration of the LLC, whether it is perpetual or for a fixed term, which is crucial for long-term planning. |

Things You Should Know About This Form

-

What is an Iowa Operating Agreement?

An Iowa Operating Agreement is a crucial document for limited liability companies (LLCs) in Iowa. It outlines the management structure, operational procedures, and member responsibilities within the company. This agreement serves as a blueprint for how the LLC will function and helps prevent disputes among members by clearly defining roles and expectations.

-

Is an Operating Agreement required in Iowa?

While Iowa does not legally require LLCs to have an Operating Agreement, it is highly recommended. Having this document in place can protect your business interests and provide clarity in case of disagreements. It also demonstrates professionalism and can be beneficial when dealing with banks or investors.

-

Who should draft the Operating Agreement?

Any member of the LLC can draft the Operating Agreement. However, it is wise to involve all members in the process to ensure that everyone’s interests are represented. Consulting with a legal professional can also provide valuable insights and ensure that the agreement meets all necessary legal requirements.

-

What should be included in an Operating Agreement?

An effective Operating Agreement should cover several key elements, including:

- The name and purpose of the LLC

- The names and contributions of each member

- Management structure and voting rights

- Distribution of profits and losses

- Procedures for adding or removing members

- Dispute resolution methods

Including these components can help ensure that the LLC operates smoothly and that all members are on the same page.

-

How do I amend an Operating Agreement?

Amending an Operating Agreement is typically straightforward. Most agreements include a clause that outlines the process for making changes. Generally, amendments require the consent of all members or a majority vote, depending on what the agreement specifies. Always document any changes in writing to maintain clarity and avoid future disputes.

-

Can an Operating Agreement be verbal?

While a verbal agreement may be possible, it is not advisable. An Operating Agreement should be in writing to provide clear evidence of the terms agreed upon by the members. A written document reduces misunderstandings and can serve as a reference point in case of disputes.

-

What happens if we don’t have an Operating Agreement?

If an LLC operates without an Operating Agreement, it may face challenges. In the absence of this document, the default rules set by Iowa state law will apply. These default rules may not reflect the specific needs or intentions of the members, leading to potential conflicts and misunderstandings. Having an Operating Agreement can help prevent these issues and provide a clear framework for operation.

Documents used along the form

When forming a limited liability company (LLC) in Iowa, an Operating Agreement is a crucial document. However, it is often accompanied by other forms and documents that help establish and govern the LLC's operations. Below is a list of commonly used documents that can complement the Iowa Operating Agreement.

- Articles of Organization: This document is filed with the Iowa Secretary of State to officially create the LLC. It includes essential information such as the LLC's name, registered agent, and business address.

- Member Information Form: This form provides details about the LLC members, including their names, addresses, and ownership percentages. It helps clarify the structure of the company and the roles of its members.

- Bylaws: Although not required for LLCs, bylaws can outline the internal rules and procedures for the organization. They may cover topics such as meetings, voting rights, and the responsibilities of members.

- Durable Power of Attorney: This legal document is crucial for designating someone to make decisions on your behalf if you're unable to do so. For more information, you can visit https://arizonaformpdf.com/.

- Operating Procedures: This document details the day-to-day operational processes of the LLC. It may include guidelines on decision-making, financial management, and conflict resolution among members.

- Membership Certificates: These certificates serve as proof of ownership for each member in the LLC. They can be issued to reflect the percentage of ownership and may be important for record-keeping purposes.

- Tax Identification Number (TIN) Application: An LLC needs a TIN for tax purposes. This application is submitted to the IRS and is essential for opening a business bank account and filing taxes.

- Annual Reports: In Iowa, LLCs are required to file annual reports with the Secretary of State. These reports update the state on the LLC’s status and any changes in membership or business activities.

These documents work together to provide a comprehensive framework for managing an LLC. Ensuring that all necessary forms are completed and filed correctly can help establish a solid foundation for your business, paving the way for future success.

Iowa Operating Agreement Preview

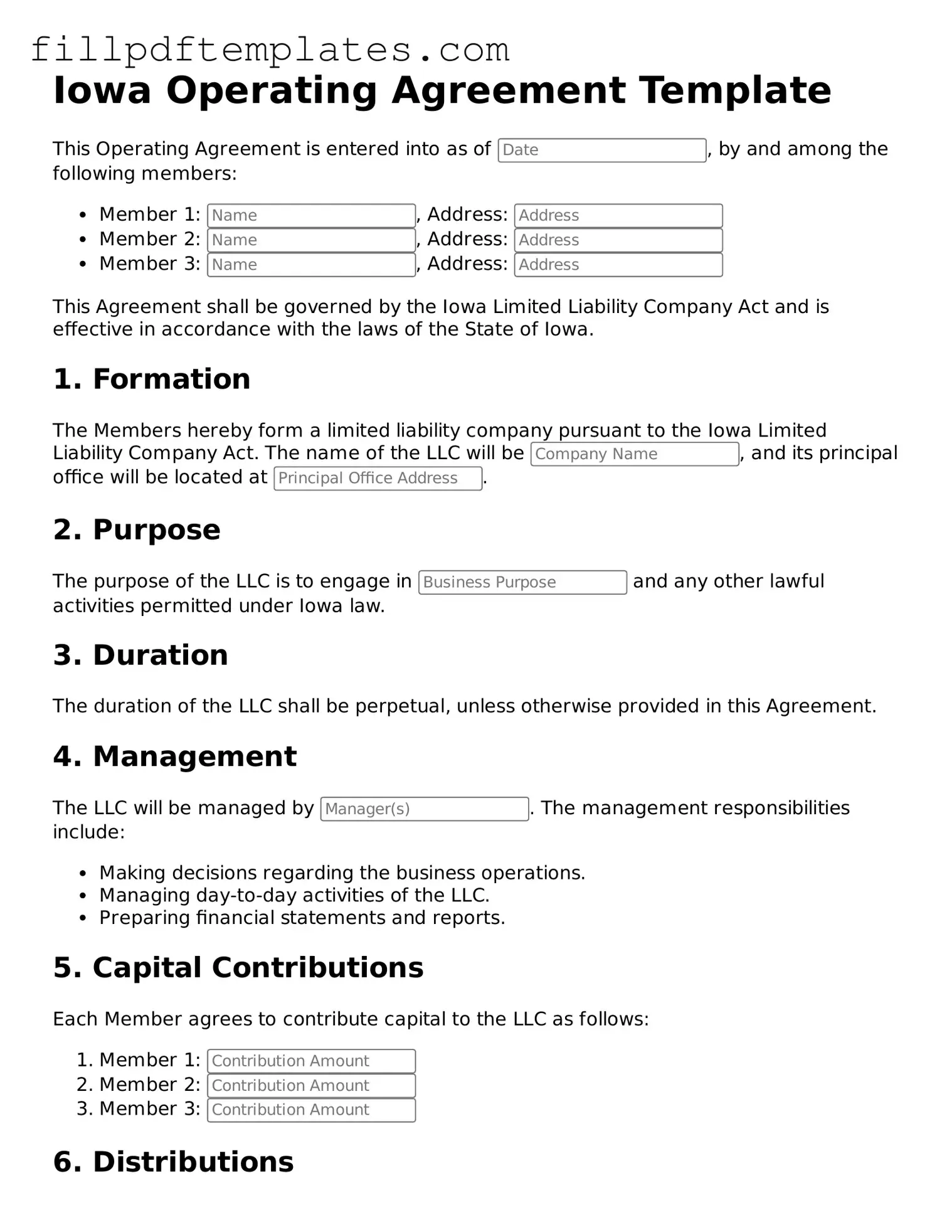

Iowa Operating Agreement Template

This Operating Agreement is entered into as of , by and among the following members:

- Member 1: , Address:

- Member 2: , Address:

- Member 3: , Address:

This Agreement shall be governed by the Iowa Limited Liability Company Act and is effective in accordance with the laws of the State of Iowa.

1. Formation

The Members hereby form a limited liability company pursuant to the Iowa Limited Liability Company Act. The name of the LLC will be , and its principal office will be located at .

2. Purpose

The purpose of the LLC is to engage in and any other lawful activities permitted under Iowa law.

3. Duration

The duration of the LLC shall be perpetual, unless otherwise provided in this Agreement.

4. Management

The LLC will be managed by . The management responsibilities include:

- Making decisions regarding the business operations.

- Managing day-to-day activities of the LLC.

- Preparing financial statements and reports.

5. Capital Contributions

Each Member agrees to contribute capital to the LLC as follows:

- Member 1:

- Member 2:

- Member 3:

6. Distributions

Distributions of profits and losses shall be allocated among Members in accordance with their respective ownership interests, as follows:

- Member 1: %

- Member 2: %

- Member 3: %

7. Indemnification

The LLC shall indemnify any Member or Manager against any losses, costs, or expenses incurred in connection with the LLC, except in cases of willful misconduct or gross negligence.

8. Amendments

This Agreement may be amended only by a written agreement signed by all Members.

9. Miscellaneous

This Agreement constitutes the entire understanding among the Members regarding the LLC. If any provision of this Agreement is found to be invalid, the remaining provisions shall continue in full force and effect.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement on the date first written above.