Fill a Valid Intent To Lien Florida Template

The Intent To Lien Florida form serves as a crucial document for contractors and service providers who have not received payment for their work on a property. This notice is formally addressed to the property owner and includes essential details such as the owner's full legal name, mailing address, and a description of the property in question. It informs the property owner that the contractor, who has supplied labor, materials, or professional services, intends to file a Claim of Lien due to non-payment. The form stipulates that it must be sent at least 45 days before the lien is recorded, in accordance with Florida law. It also highlights the amount owed for the work performed, urging the property owner to respond within 30 days to avoid potential legal repercussions, including foreclosure and additional costs. The document emphasizes the importance of communication, encouraging the property owner to settle the matter promptly to prevent further action. Furthermore, a Certificate of Service is included to confirm that the notice has been properly delivered to the appropriate parties, ensuring compliance with legal requirements.

Additional PDF Templates

Employee Status Change Form Template - Ensure proper implementation of company policy changes.

A Hold Harmless Agreement form in Connecticut is a legal document where one party agrees not to hold the other legally responsible for any risks, liabilities, or losses. This agreement, often referred to as a Hold Harmless Agreement, is commonly used in scenarios where services are provided or during property use, to protect parties from legal actions stemming from unforeseen incidents. Understanding and properly executing this form is crucial to safeguarding the interests of all involved parties.

What Information Must Be Listed on a Job Application? - We look forward to reviewing your application soon.

Similar forms

The Intent to Lien Florida form serves a specific purpose in notifying property owners of an impending lien due to non-payment for services rendered. Several other documents share similarities with this form, each playing a crucial role in the construction and property management industries. Below is a list of eight documents that are similar to the Intent to Lien Florida form, highlighting their key characteristics.

- Notice of Lien: This document formally establishes a lien against a property, indicating that a creditor has a legal claim due to unpaid debts. Like the Intent to Lien, it serves to inform the property owner of the creditor's intent to secure payment through a lien.

- Preliminary Notice: Often required in many states, this notice alerts property owners and general contractors that a subcontractor or supplier is involved in a project. Similar to the Intent to Lien, it establishes a record of potential claims before they arise.

- Claim of Lien: This is the official document filed to enforce a lien after the Notice of Intent has been served. It details the amount owed and the nature of the work performed, paralleling the Intent to Lien in its focus on payment issues.

- Notice of Non-Payment: This document is sent when payment has not been received for services or materials. It serves as a warning similar to the Intent to Lien, emphasizing the need for prompt payment to avoid further action.

- Release of Lien: This document is used to formally remove a lien once payment has been made. While it serves a different purpose, it is closely related to the Intent to Lien, as both documents deal with the status of a lien on a property.

- Arizona Annual Report: A crucial document for utility companies that provides the Arizona Corporation Commission with essential operational and compliance information. Completing this form accurately is vital for maintaining good standing. For more details, visit https://arizonaformpdf.com/.

- Mechanic’s Lien: This legal claim is filed by contractors or subcontractors who have not been paid for their work. It is a specific type of lien similar to the Intent to Lien, focusing on labor and materials provided for property improvements.

- Notice of Intent to Foreclose: This document is issued when a creditor intends to take legal action to enforce a lien. Like the Intent to Lien, it serves as a warning to the property owner about potential legal consequences.

- Waiver of Lien Rights: This document is signed by a contractor or supplier to relinquish their right to file a lien. While it is a protective measure, it relates to the Intent to Lien by addressing the conditions under which a lien may be avoided.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Intent to Lien form notifies property owners of an impending lien due to non-payment for services or materials provided. |

| Legal Requirement | Under Florida Statutes §713.06(2)(a), this notice must be served at least 45 days before filing a Claim of Lien. |

| Response Time | Property owners have 30 days to respond to the notice. Failure to do so may lead to a lien being recorded. |

| Consequences | If a lien is filed, the property may face foreclosure, and the owner could incur additional costs, including attorney fees. |

Things You Should Know About This Form

-

What is the purpose of the Intent to Lien Florida form?

The Intent to Lien Florida form serves as a formal notification to property owners that a contractor, subcontractor, or supplier intends to file a lien against their property due to non-payment for services or materials provided. This notice is a critical step in the lien process, ensuring that the property owner is aware of the outstanding payment issue before any legal action is taken.

-

How long before filing a lien must the notice be sent?

According to Florida law, specifically Florida Statutes §713.06(2)(a), the notice must be sent at least 45 days before filing a Claim of Lien. This time frame allows the property owner to address the payment issue and potentially resolve it without the need for further legal action.

-

What happens if the property owner does not respond?

If the property owner fails to respond within 30 days of receiving the notice, the contractor or supplier may proceed to file a Claim of Lien. This could lead to foreclosure proceedings on the property. Additionally, the property owner may incur further costs, including attorney fees and court expenses.

-

Can the lien be avoided?

Yes, the lien can often be avoided if the property owner addresses the payment issue promptly. Communication with the contractor or supplier is crucial. By arranging payment or discussing the matter within the specified time frames, the property owner can potentially prevent the lien from being recorded.

Documents used along the form

The Intent to Lien form is an important document in Florida, particularly for contractors and suppliers who have not received payment for their services. Along with this form, several other documents may be used to ensure proper communication and legal compliance. Here are some commonly associated forms and documents.

- Claim of Lien: This document is filed with the county clerk to formally assert a lien against the property for unpaid work or materials. It must be filed within a specific timeframe after the work is completed.

- Notice to Owner: This notice informs the property owner that a contractor or supplier is working on their property. It serves to protect the rights of those who may not have a direct contract with the owner.

- Waiver of Lien: This document is used to relinquish the right to file a lien after payment has been received. It can be conditional or unconditional, depending on the circumstances.

- Release of Lien: Similar to a waiver, this document confirms that a previously filed lien has been satisfied and is no longer valid. It is important for clearing title to the property.

- Notice of Non-Payment: This document notifies the property owner or general contractor that payment has not been received, emphasizing the potential for a lien if the issue is not resolved.

- Subcontractor's Affidavit: This affidavit is often required by the owner or general contractor to confirm that all subcontractors have been paid, helping to prevent future lien claims.

- Construction Contract: This is the agreement between the property owner and the contractor outlining the scope of work, payment terms, and other essential details of the project.

- Transfer-on-Death Deed: This form allows property owners to designate beneficiaries for their real estate, facilitating direct transfer upon death and avoiding probate, much like the details found at transferondeathdeedform.com/oklahoma-transfer-on-death-deed.

- Payment Application: This document is submitted by contractors to request payment for work completed. It provides a breakdown of the work done and the amount owed.

Understanding these documents can help both property owners and contractors navigate the complexities of construction projects and payment issues. Proper use of these forms can prevent misunderstandings and protect rights related to property and payments.

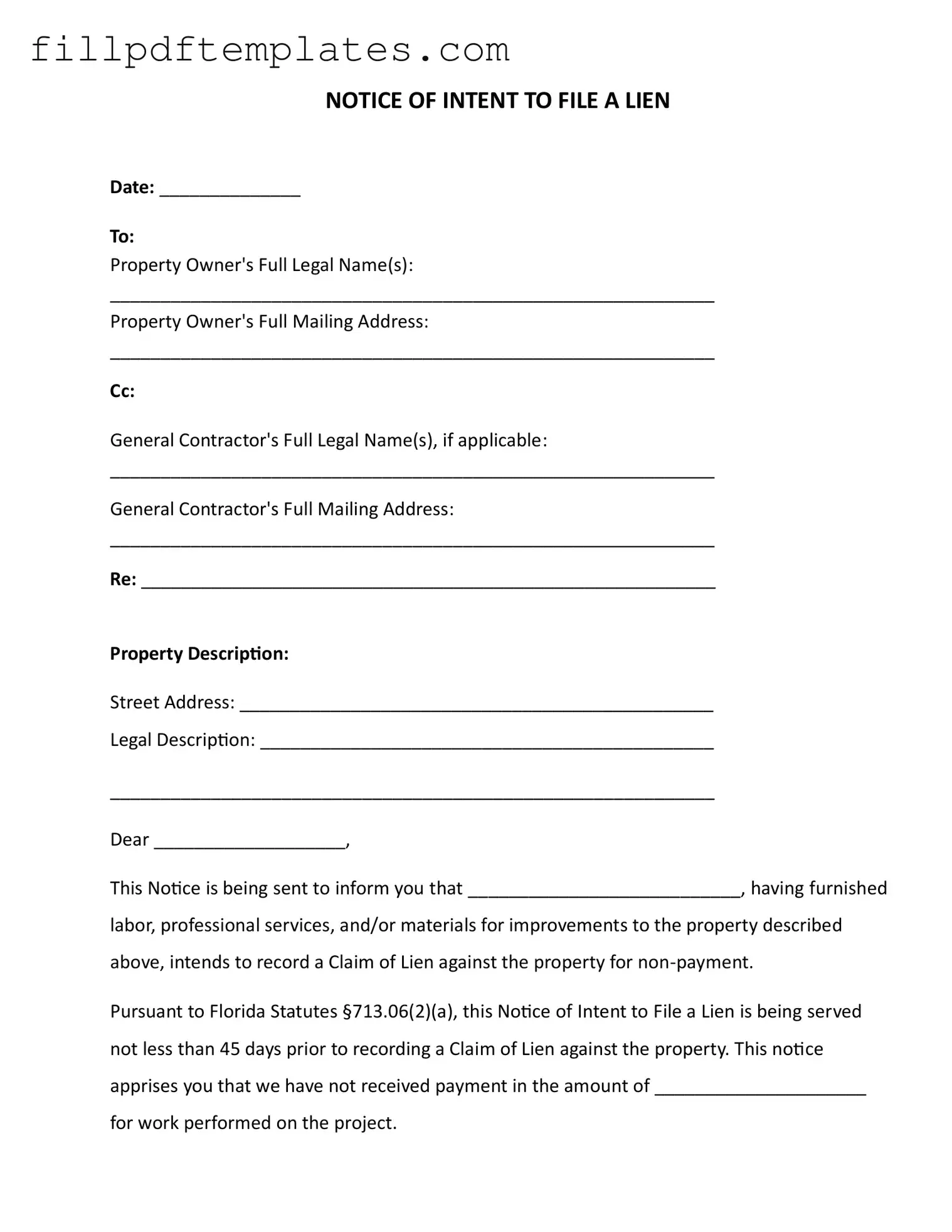

Intent To Lien Florida Preview

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |