Fill a Valid Independent Contractor Pay Stub Template

The Independent Contractor Pay Stub form serves as a crucial document for both contractors and businesses, ensuring transparency and clarity in financial transactions. This form typically includes essential details such as the contractor's name, the services rendered, and the total amount earned for a specific pay period. It may also outline deductions, if applicable, which can include taxes or other withholdings. By providing a clear breakdown of earnings and deductions, the pay stub fosters a better understanding of compensation and helps contractors track their income for tax purposes. Additionally, it can serve as a record for businesses to maintain compliance with labor regulations. Understanding the components of this form is vital for independent contractors to ensure they receive fair payment and for businesses to uphold their financial obligations. Overall, the Independent Contractor Pay Stub form plays a significant role in the financial relationship between independent contractors and the companies that hire them.

Additional PDF Templates

Welder Qualification Record - The qualifications recorded are a testament to a welder's experience and skill level.

Understanding the importance of a Hold Harmless Agreement is essential for anyone operating in Montana, particularly when it comes to protecting oneself from unforeseen liabilities. For those looking to delve deeper into how these agreements function, the Hold Harmless Agreement provides comprehensive insights into the protective measures available and the legal implications that accompany such documents.

Spanish Job Application Template - Applicants should fill out the form in clear print.

Similar forms

W-2 Form: This document is issued by employers to report wages paid to employees and the taxes withheld. Like the Independent Contractor Pay Stub, it provides a summary of earnings and deductions, but it is specifically for employees rather than independent contractors.

1099-MISC Form: This form is used to report payments made to independent contractors. Similar to the Independent Contractor Pay Stub, it outlines total earnings for the year but does not detail deductions like a pay stub would.

Employment Verification Form: To confirm the employment status of workers, utilize the employment verification form to validate employment details efficiently.

Invoice: An invoice is a request for payment sent by independent contractors to clients. Both documents detail services rendered and payment amounts, but an invoice is typically issued prior to payment, whereas a pay stub is provided after payment has been made.

Payroll Summary Report: This report summarizes all payroll transactions for a specific period. It shares similarities with the Independent Contractor Pay Stub in that both provide a breakdown of earnings, but the payroll summary is more comprehensive, covering multiple employees or contractors.

Expense Report: An expense report is used to document costs incurred while performing work. While the Independent Contractor Pay Stub focuses on earnings, both documents serve to provide financial transparency regarding a contractor's compensation and related expenses.

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Independent Contractor Pay Stub form provides a detailed record of payments made to independent contractors for services rendered. |

| Components | Typically includes contractor's name, payment date, payment amount, and any deductions or taxes withheld. |

| Legal Requirement | While not always mandated, providing pay stubs is a best practice to maintain transparency and accurate record-keeping. |

| Governing Law | In California, Labor Code Section 226 requires employers to provide itemized wage statements, which can include independent contractors. |

| Tax Implications | Independent contractors are responsible for their own taxes; however, accurate pay stubs can assist in tax preparation. |

| Payment Frequency | Pay stubs can be issued weekly, bi-weekly, or monthly, depending on the agreement between the contractor and the hiring entity. |

| Record Keeping | Both the contractor and the hiring entity should keep copies of pay stubs for at least three years for tax and legal purposes. |

| Format | Pay stubs can be provided in paper or electronic format, but must be easily accessible to the contractor. |

| Confidentiality | Pay stubs contain sensitive information; therefore, they should be handled with care to protect the contractor's privacy. |

| Dispute Resolution | In case of payment disputes, pay stubs serve as crucial evidence to clarify payment terms and amounts. |

Things You Should Know About This Form

-

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the earnings of a contractor for a specific period. It serves as a record of payment and includes details such as the contractor's name, the amount earned, deductions (if any), and the payment date. This form helps contractors keep track of their income and can be used for tax purposes.

-

Why is it important for independent contractors to have a pay stub?

Having a pay stub is crucial for independent contractors for several reasons. First, it provides a clear record of income, which is essential for accurate tax reporting. Second, it can help in managing finances by detailing earnings and any deductions. Lastly, a pay stub can serve as proof of income when applying for loans or other financial services, making it a valuable document for contractors.

-

What information should be included on an Independent Contractor Pay Stub?

A comprehensive Independent Contractor Pay Stub should include the following information:

- The contractor's full name and contact information

- The pay period covered by the stub

- The total amount earned during that period

- Any deductions, such as taxes or fees

- The net amount paid to the contractor

- The date of payment

This information helps ensure clarity and transparency regarding earnings.

-

How can independent contractors obtain a pay stub?

Independent contractors can obtain a pay stub in several ways. Many companies provide pay stubs as part of their payment process. If a contractor is not receiving one, they can request it directly from the company they are working with. Additionally, there are online templates and software available that allow contractors to create their own pay stubs. Using these resources can help ensure that all necessary information is included and formatted correctly.

Documents used along the form

When engaging independent contractors, it's important to have a variety of documents that support the business relationship. These forms not only help in maintaining clear communication but also ensure compliance with various regulations. Here’s a list of essential documents that are often used alongside the Independent Contractor Pay Stub form.

- Independent Contractor Agreement: This contract outlines the terms of the relationship between the contractor and the hiring party, including payment terms, project scope, and deadlines.

- W-9 Form: This tax form is used to collect the contractor's taxpayer identification number. It's essential for reporting payments to the IRS at the end of the year.

- Invoices: Contractors typically submit invoices to request payment for their services. These documents detail the work completed and the amount owed.

- Time Sheets: These records track the hours worked by the contractor, providing a basis for payment calculations and ensuring transparency in billing.

- Confidentiality Agreement: Also known as a Non-Disclosure Agreement (NDA), this document protects sensitive information shared between the contractor and the hiring party.

- Scope of Work Document: This outlines the specific tasks and responsibilities expected from the contractor, helping to clarify expectations and prevent misunderstandings.

- Payment Authorization Form: This form authorizes the payment to the contractor and may include details about the payment method and schedule.

- Tax Compliance Certificates: These documents confirm that the contractor is compliant with local tax regulations, which can be crucial for legal and financial reasons.

- Divorce Settlement Agreement: This form outlines the terms agreed upon in a divorce, addressing asset division, custody arrangements, and more, ensuring compliance with Colorado's legal standards. For additional information, refer to Colorado PDF Forms.

- Termination Notice: If the relationship needs to be ended, this document formally communicates the termination of the contract, outlining any final obligations.

Having these documents in place not only streamlines the process of working with independent contractors but also helps in avoiding potential disputes. By ensuring that all parties understand their rights and responsibilities, you can foster a professional and productive working environment.

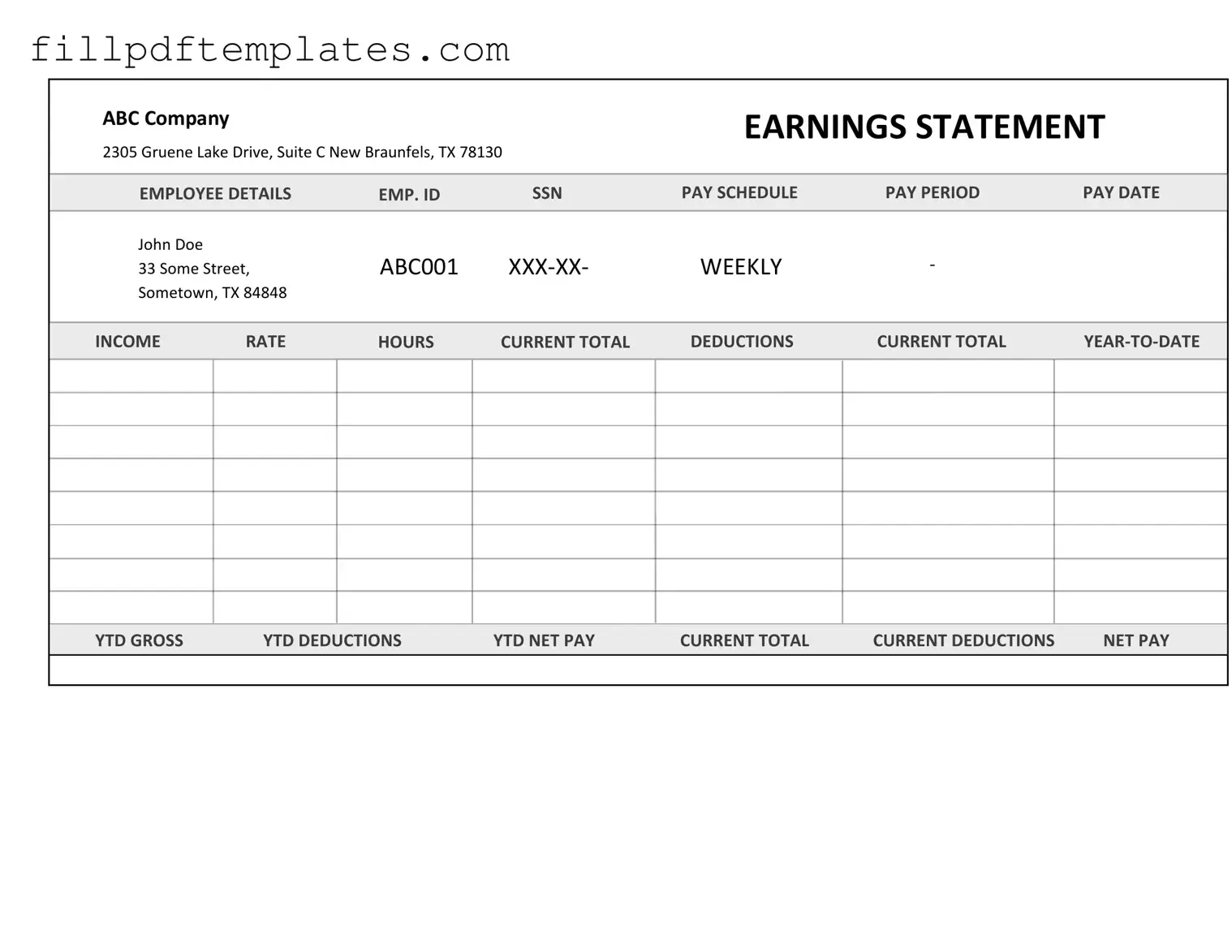

Independent Contractor Pay Stub Preview

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |