Blank Illinois Transfer-on-Death Deed Form

The Illinois Transfer-on-Death Deed form is a valuable tool for property owners looking to streamline the transfer of their real estate upon death. This form allows individuals to designate one or more beneficiaries who will automatically inherit the property without the need for probate. By using this deed, you can maintain full control over your property during your lifetime, while ensuring a smooth transition to your chosen heirs after you pass away. It’s important to note that the deed must be properly executed and recorded to be effective. Additionally, the form can be revoked or altered at any time, giving you flexibility as your circumstances change. Understanding the ins and outs of the Transfer-on-Death Deed can empower you to make informed decisions about your estate planning, providing peace of mind for both you and your loved ones.

Other Common Transfer-on-Death Deed State Templates

Can a Transfer on Death Deed Be Contested - This deed is typically used for homes, land, and other types of real estate holdings.

The Arizona Hold Harmless Agreement form is a legal document designed to release one party from potential legal liabilities at the hands of another. This contract usually pertains to protection from lawsuits or claims that arise during a transaction or activity. Businesses and individuals in Arizona often use it to minimize risks associated with various agreements, and more information can be found at the Hold Harmless Agreement page.

Transfer on Death Deed California Common Questions - The deed must be signed, notarized, and recorded to be valid under state law.

Transfer on Death Deed Iowa Form - Complete your estate plan with a Transfer-on-Death Deed to ensure your real estate transitions smoothly to your heirs.

Transfer on Death Deed Form Georgia - The form needs to be executed in a manner compliant with state-specific witness and notarization requirements.

Similar forms

- Will: A will specifies how a person's assets should be distributed upon their death. Like a Transfer-on-Death Deed, it allows individuals to designate beneficiaries for their property, but it must go through probate.

- Living Trust: A living trust allows individuals to place their assets into a trust during their lifetime. Similar to a Transfer-on-Death Deed, it can help avoid probate and allows for direct transfer of assets to beneficiaries upon death.

- Payable-on-Death (POD) Account: A POD account allows individuals to designate a beneficiary who will receive the funds in the account upon the account holder's death. This is similar to a Transfer-on-Death Deed in that it facilitates direct transfer without going through probate.

- Transfer-on-Death Deed: This deed enables the direct transfer of real estate to designated beneficiaries upon the owner's death, bypassing the probate process, as outlined at transferondeathdeedform.com/north-carolina-transfer-on-death-deed/, ensuring a smooth transition of property.

- Joint Tenancy with Right of Survivorship: This form of ownership allows two or more people to own property together. When one owner dies, the property automatically transfers to the surviving owner, similar to how a Transfer-on-Death Deed functions.

- Life Estate Deed: A life estate deed allows a person to retain the right to use a property during their lifetime while transferring ownership to another party upon their death. This is akin to a Transfer-on-Death Deed in its intent to transfer property at death.

- Beneficiary Designation on Retirement Accounts: Many retirement accounts allow account holders to name beneficiaries. Upon the account holder's death, the assets transfer directly to the named beneficiaries, similar to the process of a Transfer-on-Death Deed.

- Transfer-on-Death Registration for Vehicles: Certain states allow vehicle owners to designate a beneficiary for their vehicle. This ensures that the vehicle transfers directly to the beneficiary upon the owner’s death, much like a Transfer-on-Death Deed for real estate.

- Community Property with Right of Survivorship: In some states, couples can hold property as community property with right of survivorship. This means that upon the death of one spouse, the property automatically passes to the surviving spouse, paralleling the Transfer-on-Death Deed's function.

Document Properties

| Fact Name | Details |

|---|---|

| Purpose | The Illinois Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Revocation | Property owners can revoke the Transfer-on-Death Deed at any time before their death by filing a new deed or a revocation form. |

| Beneficiary Designation | Multiple beneficiaries can be designated, and the property can be divided among them as specified in the deed. |

| Eligibility | Only real estate can be transferred using this deed. Personal property or financial assets are not eligible. |

Things You Should Know About This Form

-

What is a Transfer-on-Death Deed in Illinois?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Illinois to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This means that the property can pass directly to the beneficiaries, simplifying the process and potentially saving time and costs associated with probate proceedings.

-

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, you must fill out the appropriate form, which includes details such as the property description, the names of the beneficiaries, and your signature. It is essential that the deed is signed in the presence of a notary public. After signing, you must record the deed with the county recorder’s office where the property is located. This ensures that the deed is legally recognized and enforceable.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TOD Deed at any time while you are alive. To do this, you must create a new deed that explicitly revokes the previous one or simply record a revocation document. It is crucial to ensure that any changes are properly executed and recorded to avoid confusion for your beneficiaries later on.

-

What happens if I sell the property after creating a Transfer-on-Death Deed?

If you sell the property after creating a TOD Deed, the deed becomes void. The transfer of property through a TOD Deed only takes effect upon your death. Therefore, selling the property means that it will no longer be transferred to the designated beneficiaries under that deed.

-

Are there any limitations to using a Transfer-on-Death Deed?

Yes, there are some limitations. For instance, a TOD Deed cannot be used for certain types of property, such as personal property or property held in a trust. Additionally, if you have outstanding debts or liens on the property, those may need to be addressed before the transfer can occur. It is advisable to consult with a legal professional to understand all implications and ensure that a TOD Deed is the right choice for your situation.

Documents used along the form

The Illinois Transfer-on-Death Deed form allows property owners to transfer their real estate to beneficiaries upon their death without the need for probate. When utilizing this form, several other documents may be relevant to ensure a smooth transfer of property and to address any related legal matters. Below is a list of commonly used forms and documents that often accompany the Illinois Transfer-on-Death Deed.

- Will: A legal document that outlines how a person's assets, including real estate, should be distributed after their death. It may also name guardians for minor children.

- Living Trust: An arrangement where a trustee holds legal title to property on behalf of beneficiaries. This document can help avoid probate and provide more control over asset distribution.

- Affidavit of Heirship: A sworn statement that identifies the heirs of a deceased person. This document may be used to clarify ownership of property when no will exists.

- California Motor Vehicle Bill of Sale: This form serves as a legal document that records the sale and purchase of a motor vehicle in California. It is essential to have this document properly filled out and may be important to download a blank form for your transaction.

- Death Certificate: An official document that certifies a person's death. It is often required to process the transfer of property and to settle the deceased's estate.

- Property Deed: The legal document that conveys ownership of real estate. It is essential to have the current deed on file to ensure the transfer is valid.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, such as bank accounts or retirement funds, upon the account holder's death. They can work alongside the Transfer-on-Death Deed.

Utilizing these documents in conjunction with the Illinois Transfer-on-Death Deed can facilitate a more efficient transfer of property and ensure that the wishes of the property owner are honored. It is advisable to consult with a legal professional to ensure all necessary forms are completed accurately and in compliance with state laws.

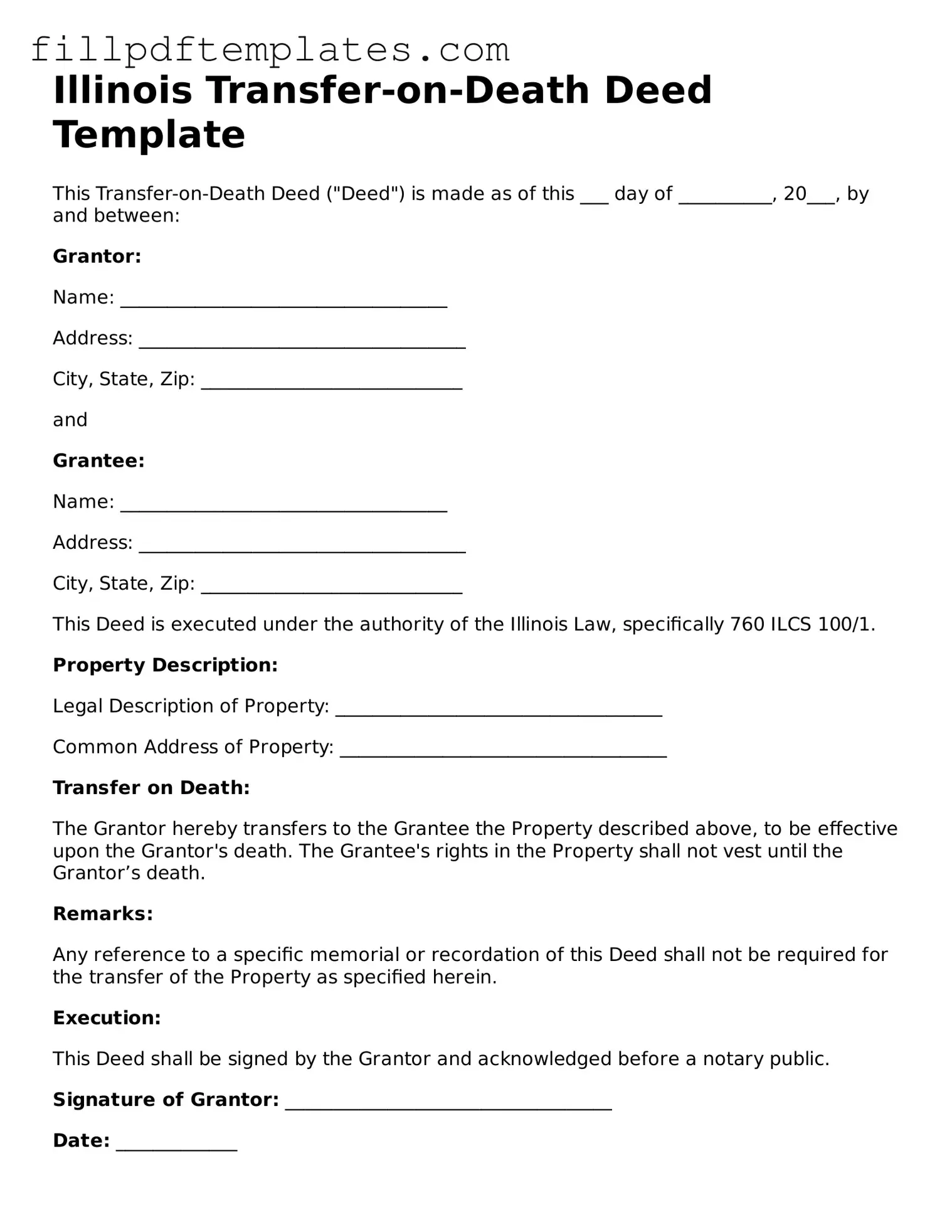

Illinois Transfer-on-Death Deed Preview

Illinois Transfer-on-Death Deed Template

This Transfer-on-Death Deed ("Deed") is made as of this ___ day of __________, 20___, by and between:

Grantor:

Name: ___________________________________

Address: ___________________________________

City, State, Zip: ____________________________

and

Grantee:

Name: ___________________________________

Address: ___________________________________

City, State, Zip: ____________________________

This Deed is executed under the authority of the Illinois Law, specifically 760 ILCS 100/1.

Property Description:

Legal Description of Property: ___________________________________

Common Address of Property: ___________________________________

Transfer on Death:

The Grantor hereby transfers to the Grantee the Property described above, to be effective upon the Grantor's death. The Grantee's rights in the Property shall not vest until the Grantor’s death.

Remarks:

Any reference to a specific memorial or recordation of this Deed shall not be required for the transfer of the Property as specified herein.

Execution:

This Deed shall be signed by the Grantor and acknowledged before a notary public.

Signature of Grantor: ___________________________________

Date: _____________

Notary Public:

State of Illinois

County of _____________________

Subscribed and sworn before me on this ___ day of __________, 20___.

Signature of Notary Public: ___________________________________

My Commission Expires: ____________