Blank Illinois Quitclaim Deed Form

In the realm of real estate transactions, the Illinois Quitclaim Deed form serves as a vital tool for property owners looking to transfer their interest in a property without the complexities often associated with other types of deeds. This form allows an individual, known as the grantor, to convey their rights to a property to another party, called the grantee, effectively relinquishing any claim they may have. Unlike warranty deeds, which provide guarantees about the title's validity, a quitclaim deed offers no such assurances, making it essential for both parties to understand what is being transferred. The simplicity of the quitclaim deed lies in its straightforward nature; it requires minimal information, such as the names of the parties involved, a description of the property, and the signature of the grantor. Additionally, it is important to note that this form must be properly executed and may need to be recorded with the county clerk or recorder’s office to ensure the transfer is legally recognized. Understanding the nuances of the Illinois Quitclaim Deed form can empower property owners to navigate their real estate transactions with confidence, whether they are transferring property to a family member, friend, or even themselves in a different capacity.

Other Common Quitclaim Deed State Templates

How to Get a Quit Claim Deed - There is no standard form; states may have different requirements.

Kalamazoo Register of Deeds - A quitclaim deed does not involve any warranties or guarantees regarding the property’s condition.

The Massachusetts Transfer-on-Death Deed form is a valuable instrument for estate planning, allowing property owners to facilitate the seamless transfer of real estate to their chosen beneficiaries upon death. By adopting this method, individuals can effectively avoid the complexities of the probate process, ensuring that their property is distributed according to their intentions. For those interested in this straightforward approach, further details can be found at https://todform.com/blank-massachusetts-transfer-on-death-deed/, which provides comprehensive guidance on filling out the necessary form.

Quick Deed - Be sure to keep a copy of the Quitclaim Deed for personal records after it is executed.

Similar forms

- Warranty Deed: This document transfers property ownership with a guarantee that the title is clear. Unlike a quitclaim deed, it offers more protection to the buyer.

- Grant Deed: Similar to a warranty deed, a grant deed conveys property ownership but provides limited warranties about the title. It assures that the seller has not transferred the property to anyone else.

- Special Purpose Deed: This type of deed is used for specific transactions, such as transferring property between family members or in a divorce. It may have limited warranties similar to a quitclaim deed.

- Trustee's Deed: Used when property is transferred from a trust, this deed can be similar to a quitclaim deed in that it may not provide full warranties about the title.

- Hold Harmless Agreement: This form serves to release one party from legal liability under specific conditions, ensuring that involved parties agree that one will not hold the other accountable for any injuries or damages that may arise. You can learn more about it at Hold Harmless Agreement.

- Personal Representative's Deed: This document is utilized by an executor to transfer property from an estate. It often lacks warranties, resembling the quitclaim deed's simplicity.

- Deed of Bargain and Sale: This deed conveys property but typically does not include any warranties. It is often used in real estate transactions where the seller wants to limit liability.

- Affidavit of Title: While not a deed, this document asserts that the seller holds the title and there are no claims against it. It is often used alongside quitclaim deeds to clarify ownership.

- Bill of Sale: Although primarily used for personal property, a bill of sale can serve a similar purpose in transferring ownership. It does not guarantee a clear title like a warranty deed.

- Leasehold Deed: This document grants the right to use property for a specified period. While it does not transfer ownership, it can be similar in that it outlines the rights of the parties involved.

Document Properties

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any warranties. |

| Governing Law | The Illinois Quitclaim Deed is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Parties Involved | The deed involves two parties: the grantor (seller) and the grantee (buyer). |

| Consideration | While a nominal consideration is often stated, it is not required for the deed to be valid. |

| Form Requirements | The deed must be in writing, signed by the grantor, and should be notarized to be enforceable. |

| Recording | To provide public notice of the transfer, the quitclaim deed should be recorded with the county recorder's office. |

| Use Cases | Commonly used among family members, in divorce settlements, or to clear up title issues. |

| Limitations | It does not guarantee that the grantor has clear title to the property; it simply conveys whatever interest the grantor has. |

| Tax Implications | Transfer taxes may apply depending on the county and the value of the property transferred. |

| Legal Advice | Consulting with an attorney is advisable to ensure proper execution and understanding of rights and responsibilities. |

Things You Should Know About This Form

-

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. It conveys whatever interest the grantor has in the property, without guaranteeing that the title is clear. This means the grantor is not liable for any claims against the property.

-

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in situations where property is transferred between family members, such as during a divorce or inheritance. They are also useful for clearing up title issues, like adding or removing a name from the property title.

-

How do I complete an Illinois Quitclaim Deed?

To complete the form, you will need to fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property). Include a legal description of the property, which can be found on the current deed or tax records. Ensure that the document is signed in front of a notary public.

-

Is a Quitclaim Deed the same as a Warranty Deed?

No, they are not the same. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such guarantees. If you're unsure about the title, a Warranty Deed may be a better option.

-

Do I need to have the Quitclaim Deed notarized?

Yes, in Illinois, the Quitclaim Deed must be signed in front of a notary public. This step is crucial for the document to be legally valid and enforceable.

-

How do I record a Quitclaim Deed in Illinois?

After completing and notarizing the Quitclaim Deed, you need to file it with the Recorder of Deeds in the county where the property is located. There may be a small fee for recording the document.

-

Are there any tax implications when using a Quitclaim Deed?

Yes, transferring property can have tax implications. In Illinois, you may need to pay transfer taxes. It's advisable to consult with a tax professional to understand any potential tax consequences related to your specific situation.

-

Can I revoke a Quitclaim Deed?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. If you need to reverse the transfer, you would typically need to create a new deed to transfer the property back to the original owner.

-

Where can I find a Quitclaim Deed form for Illinois?

Quitclaim Deed forms can be obtained from various sources, including legal stationery stores, online legal form providers, or your local Recorder of Deeds office. Ensure that the form you choose complies with Illinois laws.

Documents used along the form

When transferring property in Illinois, the Quitclaim Deed is a crucial document, but it is often accompanied by several other forms and documents that facilitate the process. Understanding these additional documents can help ensure a smooth transaction and protect the interests of all parties involved.

- Property Transfer Tax Declaration: This form is required to disclose the amount of tax due on the transfer of real estate. It helps local authorities assess the value of the property and collect the appropriate taxes.

- Affidavit of Title: This document provides a sworn statement about the ownership of the property. It assures the buyer that the seller has the legal right to transfer the property and that there are no undisclosed claims or liens against it.

- Last Will and Testament Form: To ensure your final wishes are honored, consider using our comprehensive Last Will and Testament guide to navigate the necessary legal documentation.

- Title Insurance Policy: This policy protects the buyer against any future claims or disputes regarding ownership. It is a safeguard that can prevent financial loss due to title defects that may arise after the purchase.

- Real Estate Purchase Agreement: This contract outlines the terms and conditions of the property sale. It details the purchase price, contingencies, and responsibilities of both the buyer and seller, serving as a roadmap for the transaction.

- Illinois Residential Real Property Disclosure Report: This report requires sellers to disclose known issues with the property, such as structural problems or environmental hazards. It promotes transparency and allows buyers to make informed decisions.

- Power of Attorney: In some cases, a seller may not be able to be present for the transaction. A Power of Attorney allows another person to act on their behalf, ensuring that the deed can be signed and the transfer completed.

- Settlement Statement (HUD-1): This document itemizes all costs and fees associated with the closing of the real estate transaction. It provides a clear breakdown of what each party is responsible for, ensuring that there are no surprises at closing.

- Certificate of Good Standing: For corporate sellers, this certificate verifies that the entity is legally registered and authorized to conduct business in Illinois. It assures buyers that they are dealing with a legitimate entity.

By familiarizing oneself with these additional forms and documents, individuals can navigate the property transfer process with greater confidence. Each document plays a vital role in ensuring that the transaction is legally sound and that the rights of all parties are protected throughout the process.

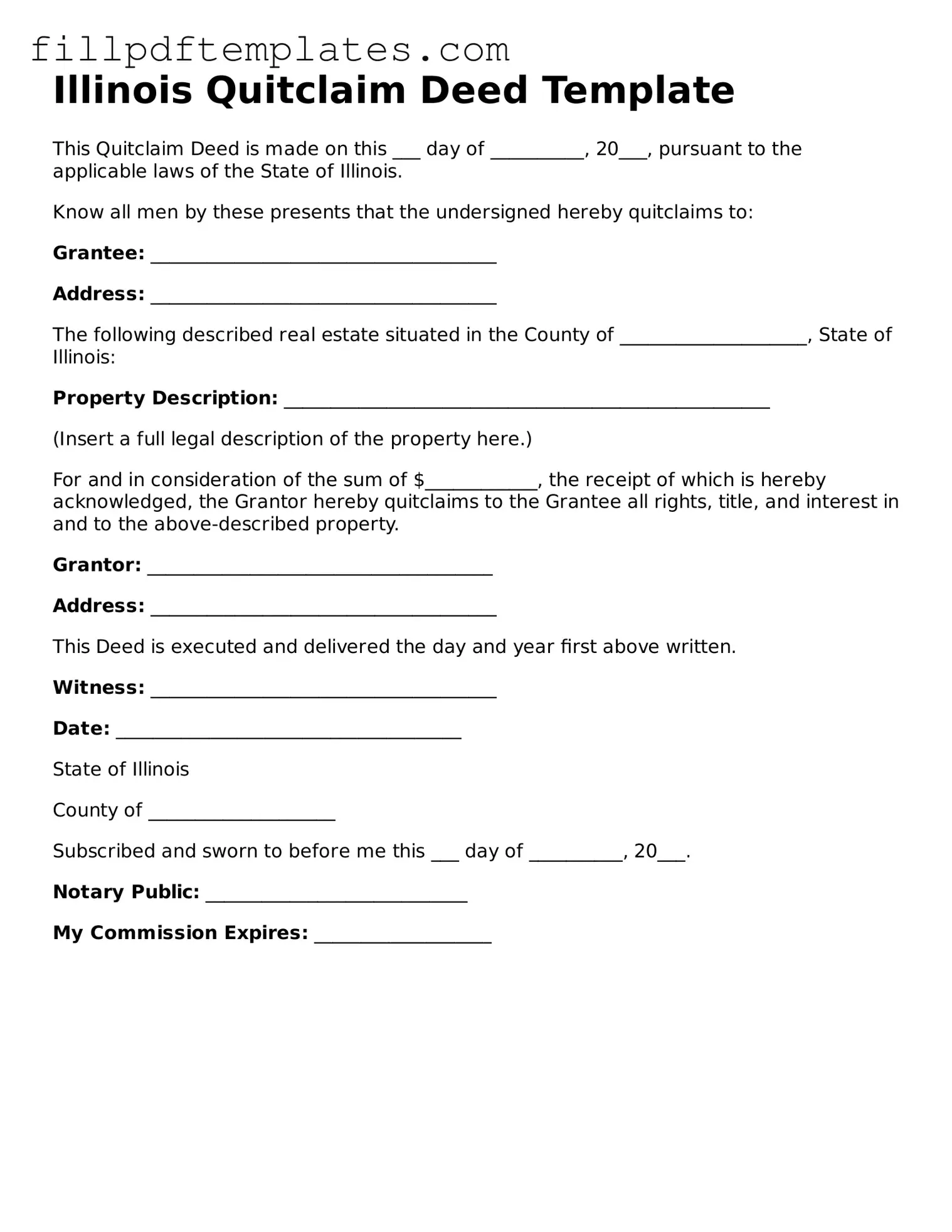

Illinois Quitclaim Deed Preview

Illinois Quitclaim Deed Template

This Quitclaim Deed is made on this ___ day of __________, 20___, pursuant to the applicable laws of the State of Illinois.

Know all men by these presents that the undersigned hereby quitclaims to:

Grantee: _____________________________________

Address: _____________________________________

The following described real estate situated in the County of ____________________, State of Illinois:

Property Description: ____________________________________________________

(Insert a full legal description of the property here.)

For and in consideration of the sum of $____________, the receipt of which is hereby acknowledged, the Grantor hereby quitclaims to the Grantee all rights, title, and interest in and to the above-described property.

Grantor: _____________________________________

Address: _____________________________________

This Deed is executed and delivered the day and year first above written.

Witness: _____________________________________

Date: _____________________________________

State of Illinois

County of ____________________

Subscribed and sworn to before me this ___ day of __________, 20___.

Notary Public: ____________________________

My Commission Expires: ___________________