Blank Illinois Promissory Note Form

In the realm of personal and business finance, the Illinois Promissory Note form stands out as a vital tool for establishing clear, enforceable agreements between lenders and borrowers. This document outlines the borrower's promise to repay a specified sum of money to the lender, detailing essential components such as the loan amount, interest rate, repayment schedule, and any applicable late fees. By including these key elements, the form not only fosters transparency but also protects the interests of both parties involved. Additionally, the Illinois Promissory Note can be tailored to fit various situations, whether it’s for a personal loan between friends or a more formal arrangement between businesses. Understanding this form is crucial, as it serves as a legal record that can be referenced in case of disputes or misunderstandings. With the right knowledge, individuals can navigate the lending landscape confidently, ensuring that their financial agreements are solid and secure.

Other Common Promissory Note State Templates

Promissory Note Template Georgia - Establishes the terms of repayment for a debt obligation.

Promissory Notes for Personal Loans - Formalizes an agreement for borrowing and lending money.

The formation of a corporation in Washington State necessitates the completion of the Washington Articles of Incorporation form, which serves as a foundational document in this process. This form not only legally establishes the corporation but also includes vital details such as the corporation's name, purpose, and the identities of its initial directors. In order to gain legal recognition and commence operations, it is essential to file this document with the Secretary of State. For further details, you can refer to the Articles of Incorporation.

California Promissory Note Requirements - Willingness to negotiate terms can lead to more favorable conditions for repayment.

Similar forms

A Promissory Note is a crucial financial document that outlines a borrower's promise to repay a loan under specified terms. However, it shares similarities with several other documents in the financial and legal landscape. Here are eight documents that resemble a Promissory Note:

- Loan Agreement: Like a Promissory Note, a Loan Agreement details the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. However, it often includes more comprehensive terms and conditions.

- Mortgage: A Mortgage is similar in that it involves borrowing money, typically for real estate. It secures the loan with the property itself, while a Promissory Note serves as the borrower's promise to repay.

- Installment Agreement: This document outlines a plan for repaying a debt in fixed amounts over time. Similar to a Promissory Note, it emphasizes the repayment schedule but often involves multiple payments over a longer period.

- Rental Application Form: To initiate the rental process, complete the legalpdfdocs.com/ which collects essential information about your financial background and rental history.

- Credit Agreement: A Credit Agreement governs the terms of a line of credit. It shares the promise to repay, but it typically allows for borrowing up to a certain limit rather than a fixed amount.

- Loan Proposal: A Loan Proposal outlines the terms under which a borrower seeks a loan. While it may not be a binding agreement, it often includes similar elements such as the loan amount and repayment terms.

- Debt Acknowledgment: This document serves as a formal recognition of a debt owed. It shares the essence of a Promissory Note in that it acknowledges the obligation to repay, though it may not detail repayment terms.

- Security Agreement: A Security Agreement provides collateral for a loan. It is similar to a Promissory Note in that both involve a promise to repay, but the Security Agreement specifies the assets pledged as security.

- Letter of Credit: This document guarantees payment to a third party. While it differs in purpose, it shares the underlying concept of a financial promise, ensuring that a payment will be made under specified conditions.

Understanding these documents can help clarify the obligations and rights involved in borrowing and lending situations. Each serves a unique purpose but shares common elements with a Promissory Note.

Document Properties

| Fact Name | Details |

|---|---|

| Definition | An Illinois Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Illinois Promissory Note is governed by the Illinois Uniform Commercial Code (UCC) Article 3. |

| Parties Involved | The document involves two primary parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be specified in the note and must comply with Illinois usury laws. |

| Payment Terms | Payment terms should clearly outline the due date, amount, and method of payment. |

| Signature Requirement | The promissory note must be signed by the borrower to be legally binding. |

| Amendments | Any amendments to the note should be made in writing and signed by both parties. |

| Enforceability | In Illinois, a properly executed promissory note is enforceable in a court of law. |

Things You Should Know About This Form

-

What is a Promissory Note?

A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It serves as a legal document that outlines the terms of a loan or credit agreement.

-

What are the key components of an Illinois Promissory Note?

The key components typically include:

- The names and addresses of the borrower and lender.

- The principal amount of the loan.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Any collateral that secures the loan.

- Signatures of both parties.

-

Is it necessary to have a lawyer review my Promissory Note?

While it is not legally required, having a lawyer review your promissory note can be beneficial. A legal professional can ensure that the terms are clear, enforceable, and compliant with Illinois law.

-

Can a Promissory Note be modified after it is signed?

Yes, a promissory note can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement.

-

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or pursuing collection efforts, depending on the terms outlined in the note.

-

Is a Promissory Note enforceable in Illinois?

Yes, a properly executed promissory note is generally enforceable in Illinois, provided it meets the legal requirements and contains all necessary elements.

-

Do I need to notarize my Promissory Note?

Notarization is not required for a promissory note to be valid in Illinois. However, having it notarized can add an extra layer of authenticity and may help in case of disputes.

-

What is the difference between a secured and an unsecured Promissory Note?

A secured promissory note is backed by collateral, meaning the lender can claim specific assets if the borrower defaults. An unsecured note does not have collateral backing it, making it riskier for the lender.

-

Can I use a Promissory Note for personal loans?

Yes, promissory notes are commonly used for personal loans between individuals, such as family or friends. They help clarify the terms and expectations of repayment.

-

Where can I find an Illinois Promissory Note form?

You can find templates for Illinois promissory notes online, or you may consult with a lawyer to draft a custom document that meets your specific needs.

Documents used along the form

When dealing with a promissory note in Illinois, there are several other documents that can be important for ensuring clarity and legal protection for both parties involved. Here’s a list of some common forms and documents that often accompany a promissory note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets that back the loan. It establishes the lender's rights to the collateral in case of default.

- Personal Guarantee: In some cases, a personal guarantee may be required. This document holds an individual personally responsible for repaying the loan if the borrowing entity fails to do so.

- Disclosure Statement: This document provides important information about the loan, including any fees, interest rates, and terms. It ensures that the borrower fully understands their obligations before signing the promissory note.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components. It helps the borrower understand how their payments will reduce the loan balance over time.

- Boat Bill of Sale: This form is essential for documenting the transfer of ownership of a boat in California, providing necessary details about the transaction; click here to get the document.

- Default Notice: Should the borrower fail to meet the terms of the promissory note, this notice outlines the consequences and actions the lender may take. It serves as a formal communication regarding the default.

- Release of Liability: Once the loan is fully paid, this document releases the borrower from any further obligations. It provides proof that the loan has been satisfied and protects the borrower from future claims.

These documents work together to create a clear understanding between the lender and borrower. Having them in place can help prevent misunderstandings and protect both parties’ interests throughout the loan process.

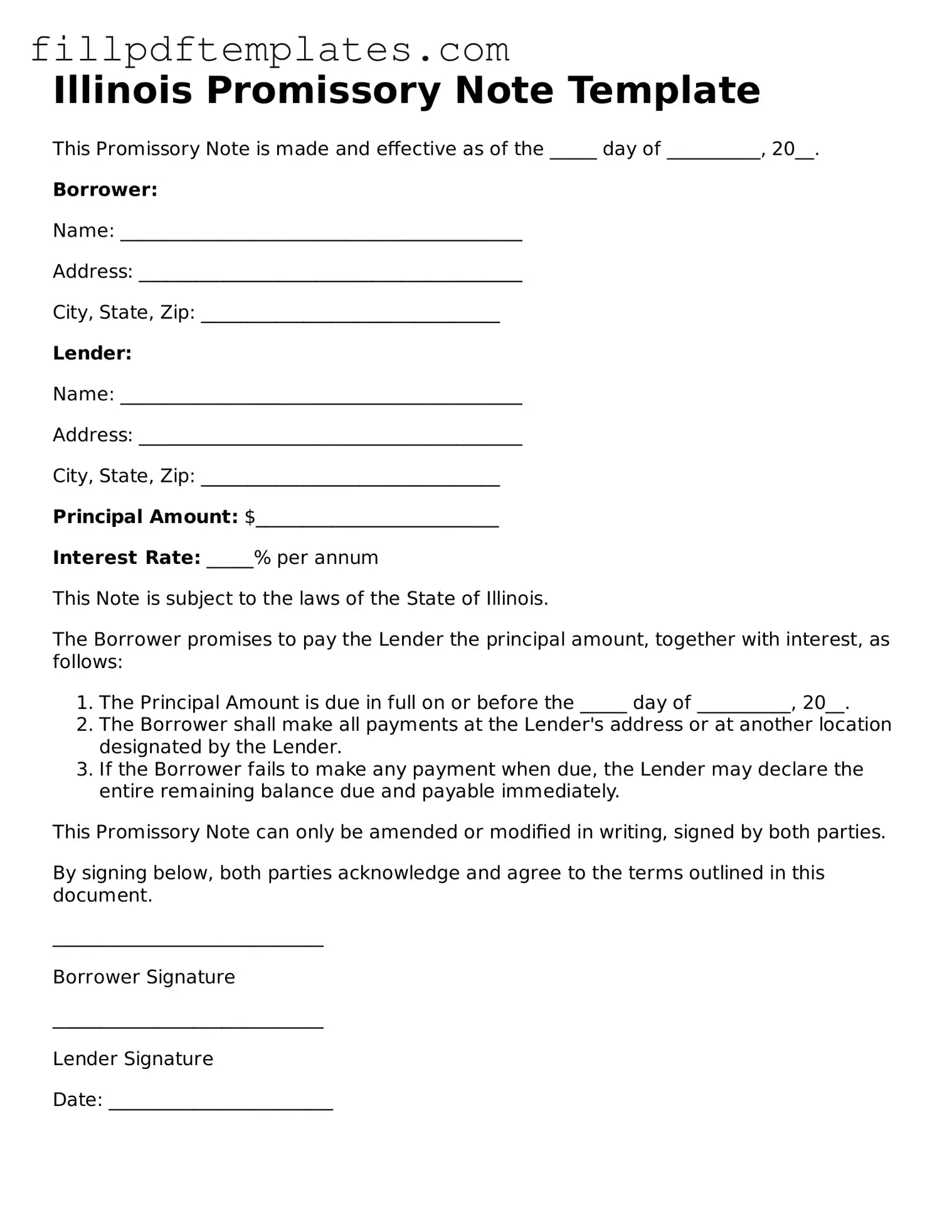

Illinois Promissory Note Preview

Illinois Promissory Note Template

This Promissory Note is made and effective as of the _____ day of __________, 20__.

Borrower:

Name: ___________________________________________

Address: _________________________________________

City, State, Zip: ________________________________

Lender:

Name: ___________________________________________

Address: _________________________________________

City, State, Zip: ________________________________

Principal Amount: $__________________________

Interest Rate: _____% per annum

This Note is subject to the laws of the State of Illinois.

The Borrower promises to pay the Lender the principal amount, together with interest, as follows:

- The Principal Amount is due in full on or before the _____ day of __________, 20__.

- The Borrower shall make all payments at the Lender's address or at another location designated by the Lender.

- If the Borrower fails to make any payment when due, the Lender may declare the entire remaining balance due and payable immediately.

This Promissory Note can only be amended or modified in writing, signed by both parties.

By signing below, both parties acknowledge and agree to the terms outlined in this document.

_____________________________

Borrower Signature

_____________________________

Lender Signature

Date: ________________________