Blank Illinois Loan Agreement Form

When entering into a loan agreement in Illinois, it is crucial to understand the various components that make up the Illinois Loan Agreement form. This document serves as a binding contract between the lender and the borrower, detailing essential terms such as the loan amount, interest rate, repayment schedule, and any collateral involved. Clear definitions of roles and responsibilities are outlined to protect both parties throughout the duration of the loan. Additionally, the form may include provisions for default, late fees, and dispute resolution, ensuring that all potential scenarios are addressed upfront. By carefully reviewing each section of the agreement, individuals can avoid misunderstandings and foster a transparent lending relationship. With the right knowledge, borrowers and lenders alike can navigate the complexities of the loan process with confidence and clarity.

Other Common Loan Agreement State Templates

Promissory Note Template Georgia - Having a written agreement solidifies the understanding of the loan terms.

California Promissory Note Template - Borrowers should retain a copy for their records.

Promissory Note Florida Pdf - The agreement outlines how disputes will be resolved.

A Recommendation Letter form is a document designed to collect and formalize feedback about an individual’s qualifications, skills, and character from a reliable source. These letters often serve as crucial endorsements for job applications, college admissions, or other opportunities. To create a professional recommendation letter, consider using templates available at legalpdfdocs.com. Ready to make your application stand out? Fill out the form by clicking the button below.

New York Promissory Note - Changes to the agreement must typically be in writing and agreed upon by both parties.

Similar forms

-

Promissory Note: A promissory note is a written promise to pay a specific amount of money at a designated time. Like a loan agreement, it outlines the terms of repayment, including interest rates and payment schedules. However, a promissory note is often simpler and may not include as many details about the loan's conditions.

-

Mortgage Agreement: A mortgage agreement is a specific type of loan agreement used for real estate transactions. It details the terms under which a borrower can secure a loan to purchase property. This document also includes provisions regarding collateral, typically the property itself, which the lender can claim if the borrower defaults.

- Articles of Incorporation: The Articles of Incorporation form is essential for establishing a corporation, outlining its name, purpose, and initial directors, thereby providing a legal framework for the business to operate in South Carolina.

-

Security Agreement: A security agreement establishes a legal claim on collateral that a borrower provides to secure a loan. Similar to a loan agreement, it specifies the terms of the loan but focuses more on the collateral's role in protecting the lender's interests in case of default.

-

Installment Agreement: An installment agreement is a contract that allows a borrower to pay back a loan in scheduled payments over time. Like a loan agreement, it outlines the payment terms, including the total amount borrowed, interest rates, and the timeline for repayment. It is often used for larger purchases or debts.

Document Properties

| Fact Name | Description |

|---|---|

| Purpose | The Illinois Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Illinois. |

| Parties Involved | The form requires the identification of both the lender and the borrower, including their legal names and contact information. |

| Loan Amount | The specific amount being loaned must be clearly stated in the agreement. |

| Interest Rate | The interest rate applicable to the loan should be included, along with whether it is fixed or variable. |

| Repayment Terms | The agreement outlines the repayment schedule, including the frequency of payments and due dates. |

| Default Conditions | Conditions under which the borrower would be considered in default are specified in the agreement. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

| Amendments | Any amendments to the agreement must be documented in writing and signed by both parties. |

Things You Should Know About This Form

-

What is an Illinois Loan Agreement form?

The Illinois Loan Agreement form is a legal document used to outline the terms and conditions of a loan between a lender and a borrower. It specifies details such as the loan amount, interest rate, repayment schedule, and any collateral involved.

-

Who needs to use a Loan Agreement?

Anyone who is lending or borrowing money in Illinois should consider using a Loan Agreement. This includes individuals, businesses, and organizations. A formal agreement helps protect both parties by clearly defining the terms of the loan.

-

What key elements should be included in the form?

- Loan amount

- Interest rate

- Repayment schedule

- Due dates

- Consequences of late payments

- Signatures of both parties

Including these elements ensures clarity and can prevent disputes in the future.

-

Is it necessary to have the Loan Agreement notarized?

While it is not always required to notarize a Loan Agreement in Illinois, doing so can add an extra layer of protection. A notarized document is generally considered more credible and can be helpful if a dispute arises.

-

Can the terms of the Loan Agreement be changed?

Yes, the terms can be changed, but both parties must agree to the modifications. It is best to document any changes in writing and have both parties sign the revised agreement.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender may have the right to take legal action to recover the owed amount. The specific consequences should be outlined in the Loan Agreement. Common actions include seeking repayment through court or seizing collateral if applicable.

-

Is there a specific format for the Loan Agreement?

While there is no strict format, the Loan Agreement should be clear and organized. It should include all necessary details and be easy to read. Templates are available online, but it’s wise to customize them to fit your specific situation.

-

Can I use a Loan Agreement for business loans?

Absolutely! A Loan Agreement can be used for personal loans, business loans, or even loans between family members. Just ensure that all terms are clearly defined to avoid misunderstandings.

-

Where can I find an Illinois Loan Agreement template?

Templates for Illinois Loan Agreements can be found online through legal websites, or you may consult with a legal professional for a customized document. Make sure the template is relevant to Illinois law.

Documents used along the form

When entering into a loan agreement in Illinois, several other forms and documents may be necessary to ensure clarity and legal compliance. These documents help outline the terms of the loan, protect the rights of both parties, and facilitate the loan process. Below is a list of commonly used forms alongside the Illinois Loan Agreement form.

- Promissory Note: This document serves as a written promise by the borrower to repay the loan amount under specified terms. It includes details such as interest rates, repayment schedule, and consequences of default.

- Loan Application: A formal request submitted by the borrower to obtain a loan. This document typically includes personal and financial information to assess creditworthiness.

- Transfer-on-Death Deed: This legal document allows property owners in Massachusetts to designate beneficiaries to receive their real estate upon death, streamlining the transfer process without probate. For more information, visit https://transferondeathdeedform.com/massachusetts-transfer-on-death-deed.

- Disclosure Statement: This document provides essential information about the loan, including fees, interest rates, and other costs. It ensures that the borrower is fully informed before agreeing to the loan.

- Security Agreement: If the loan is secured, this document outlines the collateral that the borrower offers to the lender. It details the lender's rights to the collateral in case of default.

- Personal Guarantee: A document in which an individual agrees to be personally responsible for the loan if the borrowing entity defaults. This adds an extra layer of security for the lender.

- Amortization Schedule: This schedule breaks down the repayment of the loan into regular installments, showing how much of each payment goes towards principal and interest over time.

- Loan Closing Statement: This document summarizes the final terms of the loan agreement and any closing costs. It is typically reviewed and signed at the closing of the loan.

- Title Insurance Policy: If real estate is involved, this policy protects the lender against any claims or issues with the title of the property used as collateral.

- Financial Statements: Borrowers may be required to provide personal or business financial statements to demonstrate their ability to repay the loan. These documents provide insight into the borrower's financial health.

Each of these documents plays a vital role in the loan process, helping to protect both the lender and the borrower. It is advisable to review each document carefully and seek professional guidance if needed to ensure that all terms are understood and agreed upon.

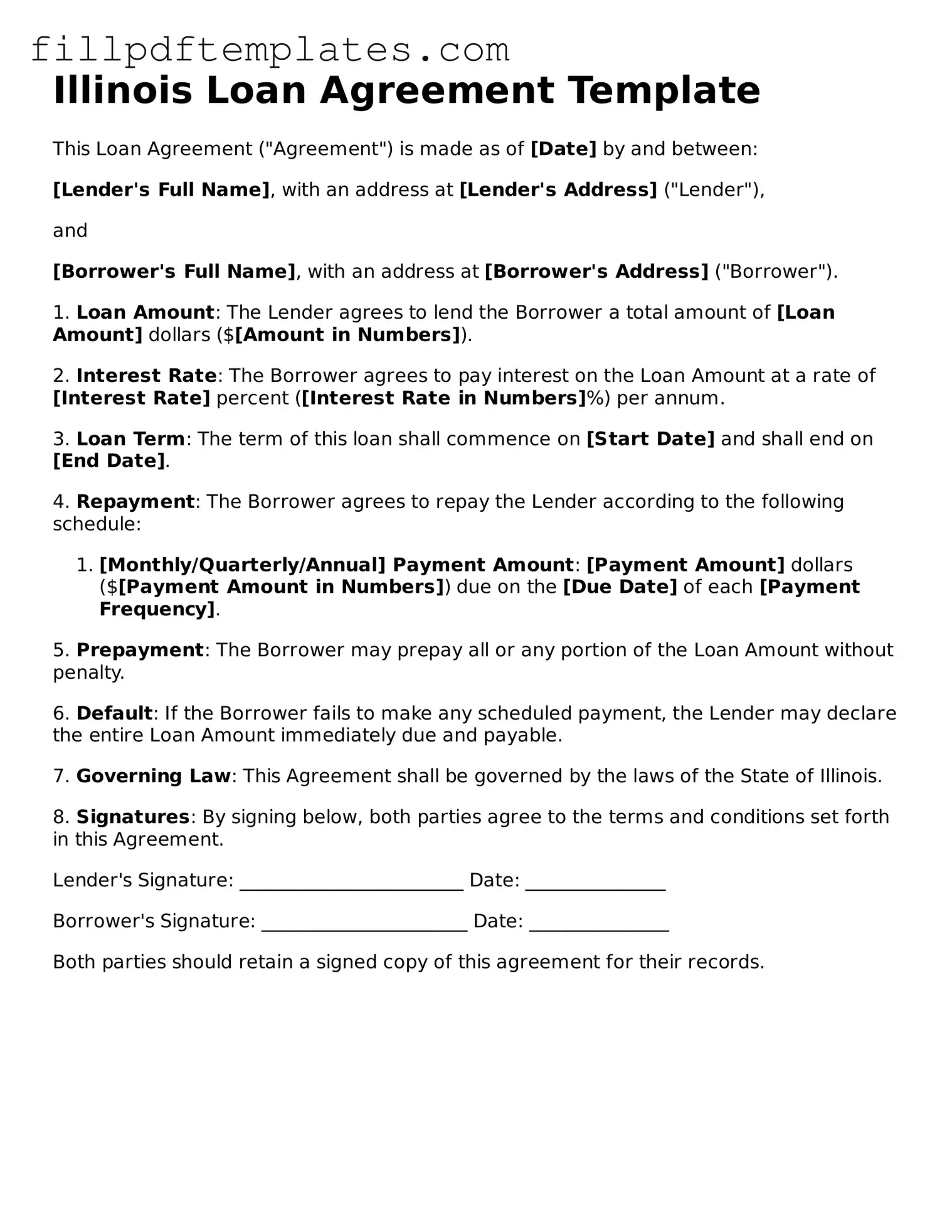

Illinois Loan Agreement Preview

Illinois Loan Agreement Template

This Loan Agreement ("Agreement") is made as of [Date] by and between:

[Lender's Full Name], with an address at [Lender's Address] ("Lender"),

and

[Borrower's Full Name], with an address at [Borrower's Address] ("Borrower").

1. Loan Amount: The Lender agrees to lend the Borrower a total amount of [Loan Amount] dollars ($[Amount in Numbers]).

2. Interest Rate: The Borrower agrees to pay interest on the Loan Amount at a rate of [Interest Rate] percent ([Interest Rate in Numbers]%) per annum.

3. Loan Term: The term of this loan shall commence on [Start Date] and shall end on [End Date].

4. Repayment: The Borrower agrees to repay the Lender according to the following schedule:

- [Monthly/Quarterly/Annual] Payment Amount: [Payment Amount] dollars ($[Payment Amount in Numbers]) due on the [Due Date] of each [Payment Frequency].

5. Prepayment: The Borrower may prepay all or any portion of the Loan Amount without penalty.

6. Default: If the Borrower fails to make any scheduled payment, the Lender may declare the entire Loan Amount immediately due and payable.

7. Governing Law: This Agreement shall be governed by the laws of the State of Illinois.

8. Signatures: By signing below, both parties agree to the terms and conditions set forth in this Agreement.

Lender's Signature: ________________________ Date: _______________

Borrower's Signature: ______________________ Date: _______________

Both parties should retain a signed copy of this agreement for their records.