Blank Illinois Last Will and Testament Form

The Illinois Last Will and Testament form serves as a crucial legal document that outlines an individual's wishes regarding the distribution of their assets after death. This form allows a testator, or the person making the will, to specify beneficiaries, appoint an executor, and provide instructions for handling debts and taxes. It is essential to ensure that the will is signed and witnessed according to Illinois law to be deemed valid. Additionally, the form can include provisions for guardianship of minor children, ensuring their care is entrusted to a chosen individual. Understanding the structure and requirements of the Illinois Last Will and Testament form is vital for anyone looking to secure their estate and provide clear directives for their loved ones. Properly executed, this document not only reflects personal wishes but also helps to minimize potential disputes among heirs and streamline the probate process.

Other Common Last Will and Testament State Templates

Simple Will Template Georgia - Can help you manage your estate's tax liabilities more effectively.

For those looking to secure their final wishes, completing a basic Last Will and Testament form is crucial. This document specifies how your assets should be distributed and can designate guardians for dependents. To learn more about the process and access resources, visit guidelines for creating a Last Will and Testament.

Free Will Template California - A vital document that provides peace of mind regarding future uncertainties for the individual and their loved ones.

Similar forms

-

Living Will: A living will outlines an individual’s preferences regarding medical treatment in the event they become incapacitated. Like a Last Will and Testament, it expresses the individual's wishes, but focuses on health care decisions rather than the distribution of assets after death.

-

Power of Attorney: This document allows someone to make financial or legal decisions on behalf of another person. While a Last Will and Testament takes effect after death, a power of attorney is effective during a person’s lifetime, providing a way to manage affairs if they are unable to do so.

-

Trust Document: A trust document establishes a legal entity that holds assets for the benefit of certain individuals. Similar to a Last Will and Testament, it dictates how assets are distributed, but a trust can take effect during the grantor's lifetime, potentially offering more control and privacy over asset management.

- Transfer-on-Death Deed: This form allows for the direct transfer of real estate to beneficiaries after death, avoiding probate. It ensures that your property is passed on according to your wishes, providing ease in estate planning. For more information, visit todform.com/blank-massachusetts-transfer-on-death-deed.

-

Codicil: A codicil is an amendment to an existing will. It allows individuals to make changes or updates without creating an entirely new Last Will and Testament. This document maintains the original will's validity while reflecting new intentions or circumstances.

Document Properties

| Fact Name | Description |

|---|---|

| Governing Law | The Illinois Last Will and Testament is governed by the Illinois Probate Act. |

| Age Requirement | Testators must be at least 18 years old to create a valid will in Illinois. |

| Witness Requirement | At least two witnesses are required to sign the will in the presence of the testator. |

| Holographic Wills | Illinois recognizes holographic wills, which are handwritten and signed by the testator, but they must still meet certain criteria. |

| Revocation | A will can be revoked by a subsequent will or by physically destroying the original document. |

| Self-Proving Wills | Illinois allows for self-proving wills, which streamline the probate process by including a notarized affidavit from the witnesses. |

| Distribution of Assets | Assets are distributed according to the terms outlined in the will, provided it is valid. |

| Spousal Rights | Illinois law protects the rights of spouses, allowing them to claim a portion of the estate regardless of the will's terms. |

| Executor Appointment | The testator can appoint an executor in the will, who will be responsible for managing the estate after death. |

| Filing Requirement | Once a will is executed, it must be filed with the probate court upon the testator's death to initiate the probate process. |

Things You Should Know About This Form

-

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. It allows individuals to specify their wishes regarding the distribution of their property, the care of any minor children, and the appointment of an executor to manage the estate.

-

Who can create a Last Will and Testament in Illinois?

In Illinois, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. This means that the individual must understand the nature of the document and the consequences of their decisions.

-

What are the requirements for a valid will in Illinois?

To be valid in Illinois, a Last Will and Testament must be:

- Written, either by hand or typed.

- Signed by the testator (the person making the will) in the presence of at least two witnesses.

- Witnessed by individuals who are at least 18 years old and not beneficiaries of the will.

-

Can I change my will after it is created?

Yes, you can change your will at any time while you are still alive. This can be done by creating a new will or by making a codicil, which is an amendment to the existing will. However, ensure that any changes meet the same legal requirements as the original will.

-

What happens if I die without a will in Illinois?

If you die without a will, your estate will be distributed according to Illinois intestacy laws. This means that the state will determine how your assets are divided, which may not align with your wishes. It is always advisable to have a will to ensure your preferences are honored.

-

Can I write my own will in Illinois?

Yes, you can write your own will in Illinois. However, it is important to ensure that it complies with all legal requirements to avoid any disputes or challenges later. Using a template or consulting with a legal professional can help ensure that your will is valid.

-

What is an executor, and how do I choose one?

An executor is the person responsible for managing your estate after your death. This includes settling debts, distributing assets, and ensuring that your wishes are carried out. When choosing an executor, consider someone who is trustworthy, organized, and willing to take on the responsibilities involved.

-

How do I revoke my existing will?

You can revoke your existing will by creating a new will that states your intention to revoke the previous one. Additionally, you can physically destroy the old will or mark it with a statement indicating that it is revoked. Always ensure that the revocation is clear to avoid confusion.

-

Is it necessary to have a lawyer to create a will in Illinois?

While it is not legally required to have a lawyer to create a will in Illinois, consulting one is highly recommended. A lawyer can provide guidance on complex issues, help ensure that your will is valid, and advise you on how to best protect your assets and loved ones.

Documents used along the form

When creating an estate plan in Illinois, the Last Will and Testament is a crucial document. However, several other forms and documents often complement it to ensure a comprehensive approach to managing your assets and wishes. Below are some essential documents you might consider alongside your will.

- Durable Power of Attorney: This document allows you to appoint someone to make financial and legal decisions on your behalf if you become incapacitated. It provides peace of mind knowing that your affairs will be managed by a trusted individual.

- Hold Harmless Agreement: This agreement serves to protect parties from legal liability, ensuring that in specific transactions, one party will not hold the other responsible for any injuries or damages that may occur. For more detailed information, you can refer to the Hold Harmless Agreement.

- Healthcare Power of Attorney: Similar to the durable power of attorney, this form designates someone to make medical decisions for you when you are unable to do so. It ensures that your healthcare preferences are respected, even if you cannot communicate them.

- Living Will: A living will outlines your preferences regarding medical treatment in situations where you cannot express your wishes. This document is particularly important for end-of-life care, as it guides healthcare providers and your loved ones in making decisions that align with your values.

- Revocable Trust: A revocable trust allows you to place your assets into a trust during your lifetime. You can modify or revoke it as needed. Upon your passing, the assets in the trust can be distributed to your beneficiaries without going through probate, which can save time and costs.

By considering these additional documents, you can create a more robust estate plan that addresses various aspects of your financial and healthcare wishes. Each document serves a unique purpose and helps ensure that your intentions are honored, even in challenging circumstances.

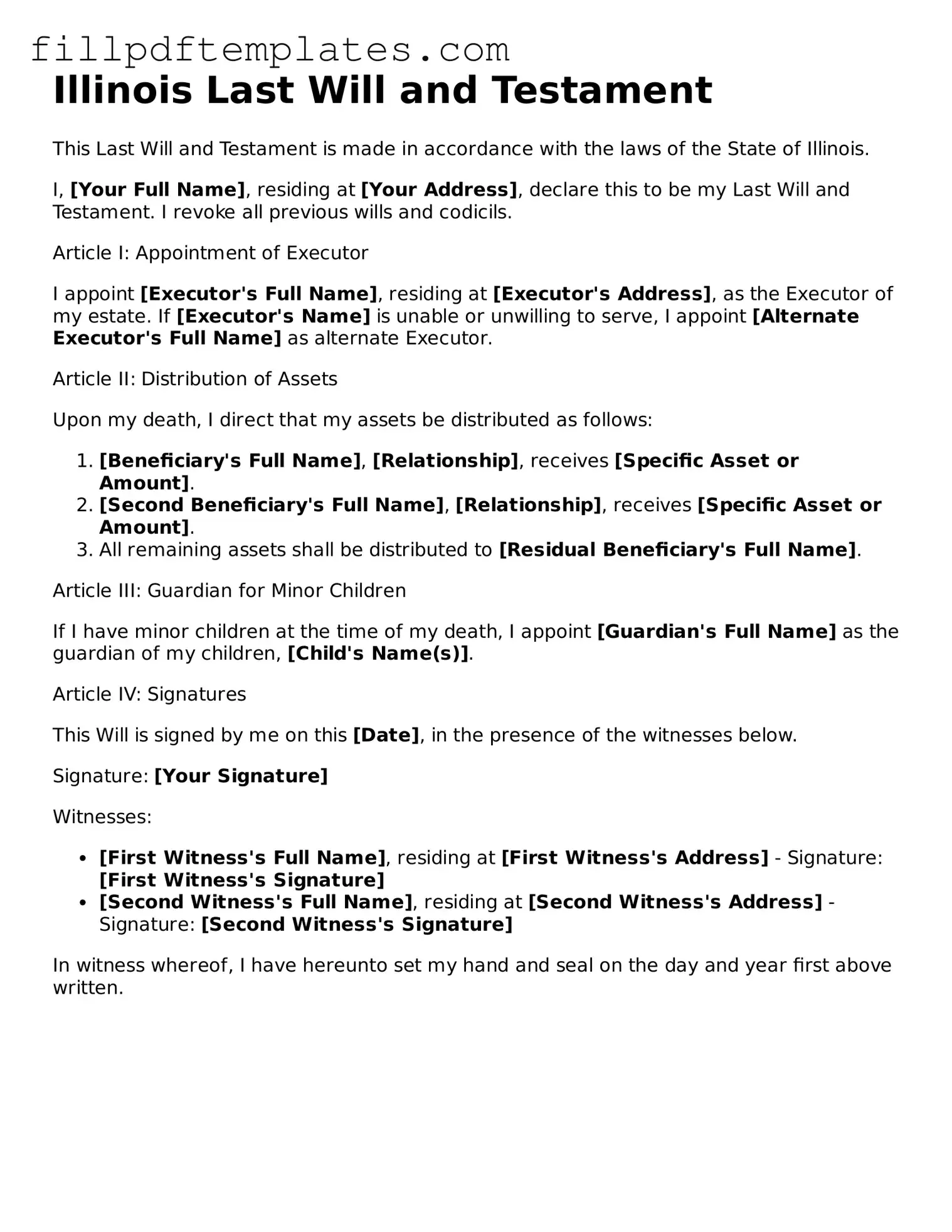

Illinois Last Will and Testament Preview

Illinois Last Will and Testament

This Last Will and Testament is made in accordance with the laws of the State of Illinois.

I, [Your Full Name], residing at [Your Address], declare this to be my Last Will and Testament. I revoke all previous wills and codicils.

Article I: Appointment of Executor

I appoint [Executor's Full Name], residing at [Executor's Address], as the Executor of my estate. If [Executor's Name] is unable or unwilling to serve, I appoint [Alternate Executor's Full Name] as alternate Executor.

Article II: Distribution of Assets

Upon my death, I direct that my assets be distributed as follows:

- [Beneficiary's Full Name], [Relationship], receives [Specific Asset or Amount].

- [Second Beneficiary's Full Name], [Relationship], receives [Specific Asset or Amount].

- All remaining assets shall be distributed to [Residual Beneficiary's Full Name].

Article III: Guardian for Minor Children

If I have minor children at the time of my death, I appoint [Guardian's Full Name] as the guardian of my children, [Child's Name(s)].

Article IV: Signatures

This Will is signed by me on this [Date], in the presence of the witnesses below.

Signature: [Your Signature]

Witnesses:

- [First Witness's Full Name], residing at [First Witness's Address] - Signature: [First Witness's Signature]

- [Second Witness's Full Name], residing at [Second Witness's Address] - Signature: [Second Witness's Signature]

In witness whereof, I have hereunto set my hand and seal on the day and year first above written.