Blank Illinois Deed Form

When it comes to transferring property ownership in Illinois, the Illinois Deed form plays a crucial role in ensuring a smooth and legally binding transaction. This document serves as the official record of the transfer, detailing essential information such as the names of the grantor (the person selling the property) and the grantee (the person buying the property), as well as a clear description of the property being transferred. The form not only outlines the rights and responsibilities of both parties but also includes important elements like the consideration—the amount paid for the property. Additionally, the Illinois Deed must be signed by the grantor and often requires notarization to validate the transfer. Understanding the nuances of this form is vital for anyone involved in a real estate transaction, as it helps protect the interests of both buyers and sellers while ensuring compliance with state laws. Whether you are a first-time homebuyer or a seasoned investor, grasping the key aspects of the Illinois Deed form can make a significant difference in your property dealings.

Other Common Deed State Templates

Iowa Records Online - Establishes the relationship between the grantor and grantee.

The Massachusetts Transfer-on-Death Deed form allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This tool can simplify the process of passing on property and help avoid potential legal complications. Understanding how to properly utilize this form is essential for anyone looking to secure their estate for future generations. For more detailed information, you can visit https://transferondeathdeedform.com/massachusetts-transfer-on-death-deed.

New Jersey Deed Transfer Form - A deed establishes legal proof of ownership to third parties.

Similar forms

The Deed form serves a specific purpose in the realm of property and legal transactions. However, there are several other documents that share similarities with the Deed form. Below is a list of five such documents, along with a brief explanation of how they are alike:

- Title Transfer Document: This document is used to officially transfer ownership of property from one party to another, much like a Deed. Both documents establish a legal record of the change in ownership.

- Lease Agreement: A Lease Agreement outlines the terms under which one party rents property from another. Similar to a Deed, it creates a legal relationship regarding the use and rights associated with the property.

- Mortgage Agreement: This document details the terms of a loan secured by real estate. Like a Deed, it is essential for establishing rights and responsibilities related to property ownership and financing.

- Bill of Sale: A Bill of Sale is used to transfer ownership of personal property. It shares similarities with a Deed in that both documents serve to officially record the transfer of ownership and the details of the transaction.

-

Articles of Incorporation: Essential for starting a business in Washington State, this form formally registers the corporation and includes critical details such as the name, purpose, and initial directors. To learn more, visit Articles of Incorporation.

- Power of Attorney: This document grants one person the authority to act on behalf of another in legal matters. While it does not directly transfer property, it can be used in conjunction with a Deed to facilitate property transactions when the owner is unable to sign.

Understanding these documents can help individuals navigate the complexities of property transactions with greater confidence.

Document Properties

| Fact Name | Description |

|---|---|

| Governing Law | The Illinois Deed form is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005/1. |

| Types of Deeds | In Illinois, common types of deeds include warranty deeds, quitclaim deeds, and special warranty deeds. |

| Transfer of Ownership | A deed is used to transfer ownership of real property from one party to another. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property) to be valid. |

| Notarization | Illinois law requires that the deed be notarized to ensure its authenticity. |

| Recording | To protect the interests of the new owner, the deed should be recorded with the county recorder's office. |

| Legal Description | The deed must include a legal description of the property being transferred, which precisely identifies it. |

Things You Should Know About This Form

-

What is an Illinois Deed form?

An Illinois Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Illinois. It serves as proof of the transfer and outlines the rights and responsibilities of the parties involved. There are various types of deeds, including warranty deeds and quitclaim deeds, each serving different purposes based on the nature of the transaction.

-

What information is required on an Illinois Deed form?

To complete an Illinois Deed form, several key pieces of information must be included:

- The names and addresses of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- A legal description of the property, which details its boundaries and location.

- The date of the transaction.

- Any applicable consideration, or the value exchanged for the property.

- Signatures of the grantor and any necessary witnesses or notaries, depending on the type of deed.

-

How do I file an Illinois Deed form?

Filing an Illinois Deed form involves submitting the completed document to the appropriate county recorder's office where the property is located. It’s important to ensure that the deed is properly executed, meaning it must be signed and notarized as required. After filing, the recorder will return a stamped copy of the deed, which serves as proof of the recorded transfer.

-

Are there any fees associated with filing an Illinois Deed form?

Yes, there are typically fees associated with filing a deed in Illinois. These fees can vary by county and are usually based on the number of pages in the document. Additionally, there may be transfer taxes that apply to the transaction. It is advisable to check with the local recorder’s office for the specific fee schedule and any potential exemptions.

-

Can I use a template for an Illinois Deed form?

While it is possible to use a template for an Illinois Deed form, it is crucial to ensure that the template complies with state laws and includes all necessary information. Using a generic template may lead to errors or omissions that could affect the validity of the deed. For this reason, many individuals choose to consult with a legal professional to ensure that their deed is correctly prepared.

Documents used along the form

When transferring property in Illinois, several forms and documents may accompany the Illinois Deed form. Each of these documents serves a unique purpose and helps ensure a smooth and legally compliant transfer of ownership. Understanding these forms can help you navigate the process with confidence.

- Title Search Report: This document provides a history of the property’s ownership and any claims or liens against it. It helps verify that the seller has the legal right to transfer the property.

- Sample Tax Return Transcript: Essential for verifying income and preparing for financial transactions, you can find a template at https://legalpdfdocs.com/.

- Property Transfer Tax Declaration: Required by the state, this form documents the sale price and calculates any applicable transfer taxes. It must be filed with the deed at the time of recording.

- Affidavit of Title: This sworn statement from the seller confirms their ownership of the property and discloses any encumbrances. It assures the buyer that the title is clear.

- Closing Statement: This document outlines the financial details of the transaction, including costs, fees, and the final amount due. It serves as a summary of the closing process.

- Bill of Sale: If personal property is included in the sale, a bill of sale transfers ownership of those items. It details what is included in the transaction.

- Power of Attorney: In some cases, a seller may appoint someone else to act on their behalf during the transaction. This document grants that authority and must be properly executed.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide information about rules, fees, and regulations that govern the community.

- Disclosure Statements: Sellers are often required to disclose any known issues with the property, such as structural problems or environmental hazards. This protects buyers from unexpected surprises.

- Mortgage Documents: If the buyer is financing the purchase, various mortgage documents will be involved, including the loan agreement and promissory note.

- Deed of Trust: This document secures the mortgage loan by placing a lien on the property. It outlines the responsibilities of the borrower and lender.

By familiarizing yourself with these documents, you can approach the property transfer process with greater clarity. Each form plays a vital role in ensuring that your transaction is legally sound and that your rights as a buyer or seller are protected. Always consider consulting with a professional if you have questions or need assistance.

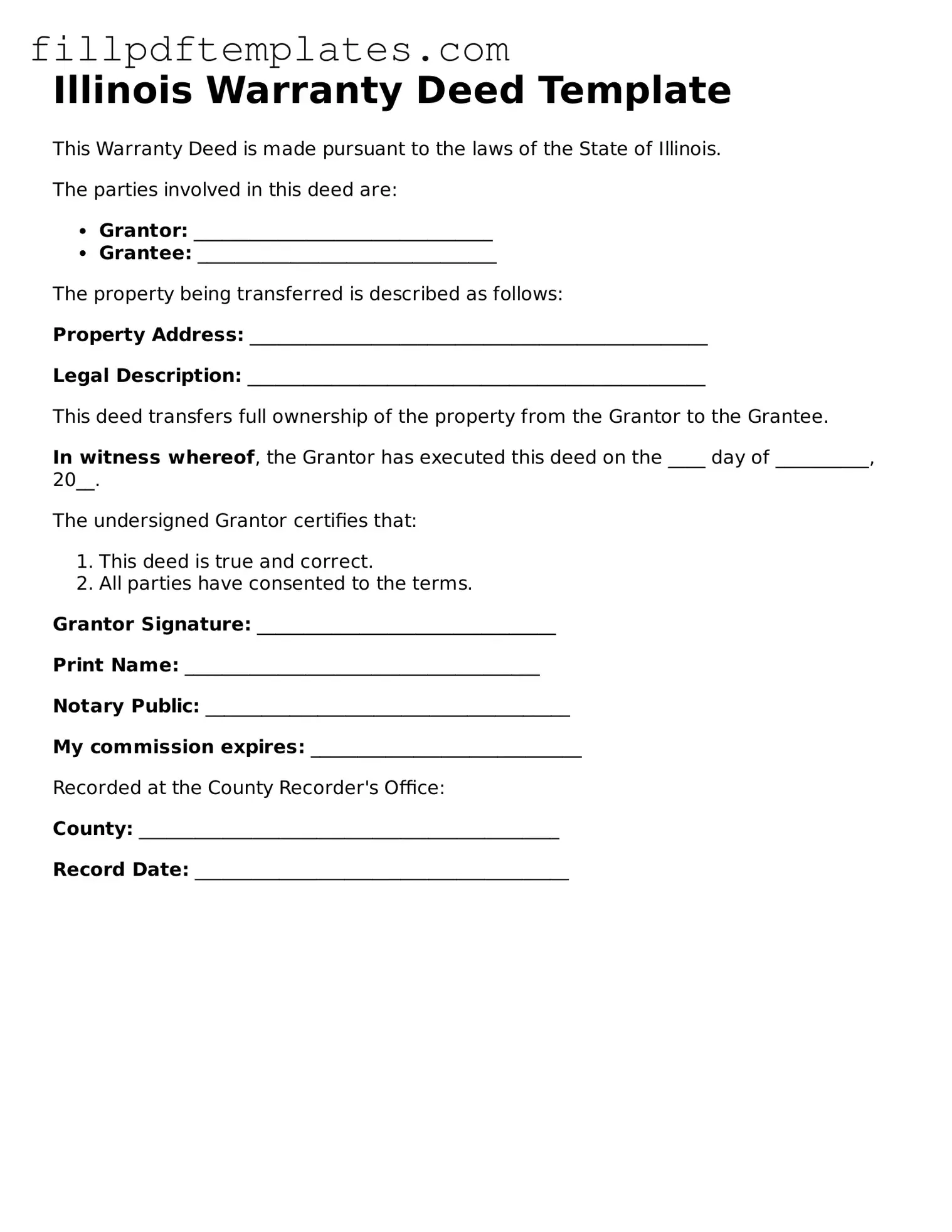

Illinois Deed Preview

Illinois Warranty Deed Template

This Warranty Deed is made pursuant to the laws of the State of Illinois.

The parties involved in this deed are:

- Grantor: ________________________________

- Grantee: ________________________________

The property being transferred is described as follows:

Property Address: _________________________________________________

Legal Description: _________________________________________________

This deed transfers full ownership of the property from the Grantor to the Grantee.

In witness whereof, the Grantor has executed this deed on the ____ day of __________, 20__.

The undersigned Grantor certifies that:

- This deed is true and correct.

- All parties have consented to the terms.

Grantor Signature: ________________________________

Print Name: ______________________________________

Notary Public: _______________________________________

My commission expires: _____________________________

Recorded at the County Recorder's Office:

County: _____________________________________________

Record Date: ________________________________________